Green Logistics Innovation for Emerging Markets: Driving Competitiveness and Shared Value

The global logistics sector is a strategic enabler of trade and development, projected to reach nearly $8 trillion in value by 2028. Maritime transport remains the backbone of global freight, while road and rail transport are expanding rapidly, driven by supply chain reconfiguration, surging e-commerce, and the adoption of digital and low-carbon technologies. The sector also plays a vital role in inclusive growth, supporting 10% of global employment.

But logistics carries a substantial environmental footprint, contributing 11% of global emissions. In addition to the mounting pressure to decarbonize, the industry faces other challenges:

- Geopolitical Disruptions and Rising Costs. Trade tensions, export controls, and regional conflicts can disrupt supply chains and increase logistics costs.

- Infrastructure Gaps and Inefficiencies. Aging, underdeveloped, and overstretched infrastructure can hamper efficiency and increase congestion and delays.

- Climate Risk. Companies must adapt to the increasing incidence of extreme weather events.

- Labor Shortages and Skills Mismatches. The industry is confronting the dual challenge of attracting new talent and upskilling the existing workforce in new technologies.

- Rising Consumer Expectations. Consumers increasingly demand services that are faster and more flexible, reliable, and transparent.

These vulnerabilities highlight the need for sustainable, resilient solutions. Green logistics offers a pathway, harnessing technology and innovative business models to improve efficiency, reduce emissions, and align practices with evolving regulations and societal expectations. Emerging economies, despite varying levels of readiness, are making progress and demonstrating that green logistics is both feasible and economically viable.

Research by the World Economic Forum and BCG draws on leading practices to showcase innovative levers and case examples that illustrate scalable pathways for transformation. The research identifies 15 levers for systemic change across four themes:

- Green fuel production and use

- Green vehicle and propulsion adoption

- Green infrastructure construction

- Digital and green operational enhancement

These must work in combination to unlock systemwide decarbonization and efficiency. However, scaling requires overcoming systemic barriers in emerging markets, such as policy and regulatory fragmentation, limited resources, skills gaps, data fragmentation, and lack of ecosystem-wide alignment.

To address these, the WEF and BCG offer a practical playbook:

- Build an integrated policy and regulatory framework.

- Mobilize green finance, including transition finance.

- Upskill the workforce.

- Cultivate ecosystem collaboration.

Scaling green logistics cannot be achieved by any single actor. It demands a shared agenda and coordinated action by multiple players:

- Governments can establish coherent regulation, mobilize capital through incentives, nurture industry development, and encourage global collaboration.

- Industry can engage in multistakeholder dialogue, upskill workforces, and scale solutions through alliances and PPPs.

- Shippers and cargo owners can secure long-term agreements and aggregate demand to reduce risk.

- Financial institutions can expand blended financing to unlock large-scale investment.

- Academia and civil society can build talent pipelines, translate research into application and provide knowledge support.

From Scarcity to Solutions: Food-Water Innovation in Asia and the Middle East

The world’s freshwater systems are buckling under unprecedented pressures: global freshwater demand is predicted to exceed supply by 40% by 2030, with the hydrological cycle—nature’s replenishment mechanism—increasingly disrupted by climate change, pollution, and over-extraction.

By 2050, this imbalance will intensify as water demand is expected to grow by 30% and food availability will need to increase by 60%. Agriculture, which already consumes 70% of freshwater withdrawals, faces shrinking rivers, erratic rainfall, and depleted aquifers. This convergence of scarcity and urgent demand places the food-water nexus at the epicenter of global leadership imperatives, demanding immediate action to rebalance humanity’s relationship with water.

Emerging economies are suffering disproportionate burdens, as growing stresses in food and water systems intersect with rapid development needs. Yet they are also proving that innovation can turn constraints into catalysts. The food-water tech market in Asia Pacific and the Middle East is projected to reach $209 billion by 2030, accounting for nearly 45% of the global total. Despite inherent challenges, China and the Middle East offer a blueprint for scalable, market-driven solutions, providing valuable inspiration for other developing countries navigating food-water transitions.

China: Driving Efficiency and Self-Reliance

Despite having just 6% of the world’s freshwater supply and 9% of its arable land, China sustains 20% of the global population with self-sufficient staple foods. Breakthroughs in precision agriculture, blockchain traceability, and closed-loop circularity have driven a 10-time income rise for farmers since 2000. An integrated system from policy to implementation emphasizes high-standard farmland development, R&D in bio-breeding, and smart irrigation. These efforts secure the country’s staple grain self-sufficiency and optimize agricultural water use efficiency, strengthening the sector’s resilience and efficiency.

Middle East: Testing Solutions for Arid Climate Futures

In a region where 14 countries face extreme water stress, innovation has turned deserts into breadbaskets. The Middle East accounts for 40% of global desalination output, with growing use of solar technologies and public-private partnership (PPP) models. Breakthroughs in salt-tolerant crops and soil bio-engineering now enable sustainable yields in marginalized environments.

Transforming Food and Water Systems

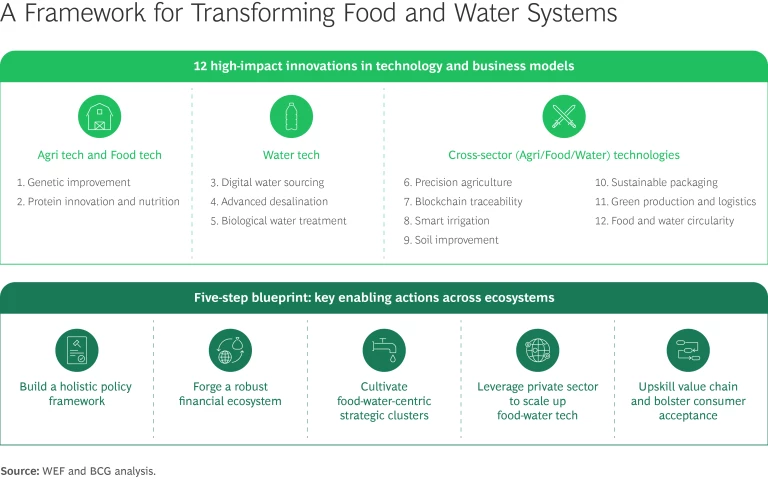

The transformation of global food and water systems requires innovations in technology and business models across multiple sectors, silos, and ecosystems. Research by the World Economic Forum and BCG proposes a holistic framework that encompasses innovation in areas that span the value chain and a blueprint for actions that can turn innovations into systemic resilience.

A Path Forward

The work on systemic transformation has only just begun. Across emerging markets and especially in China and the Middle East, this five-step blueprint offers a pathway to dismantle silos, align stakeholders, and embed innovation into the fabric of food-water systems.

Collaborative approaches are needed to bridge the disparate domains of policy, finance, skills training, and grassroots implementation. Only through public-private action at scale will it be possible to transition from fragmented pilots toward unlocking the full potential of food-water systems to act as engines of economic growth, sustainability, and resilience.

Toward Green Building Value Chains: China and Beyond

Accounting for 50% of the world’s new construction every year, China is the largest building market in the world. This fact is even more significant when juxtaposed with this one—buildings are responsible for 37% of global carbon emissions. As the world experiences a surge in construction, the need to transition to green buildings will become urgent.

China, home to more than half of the global production capacity for several building materials, is central to decarbonization efforts. The building industry’s value chain involves multiple public and private entities, several of which are in hard-to-abate sectors. The green transition of China’s building value chain will not only create value and new business opportunities for industry players in the country, but also boost the development and adoption of green building products and services globally.

A building’s environmental impact extends across its life cycle, from material production to demolition. Building materials come from sectors such as steel and cement, which emit carbon at every stage: production, transportation, installation, and demolition. Building operations consume large amounts of energy for heating, cooling, lighting, and other functions. Planning for a fully green transition of buildings must take this whole value chain into account.

This report by the World Economic Forum and BCG offers a comprehensive analysis of the building value chain, market opportunities, and barriers to the green building transition. It identifies 11 levers that offer abatement potential of approximately 80% if implemented well. (See the exhibit.) Together, they are expected to generate $1.8 trillion in value by 2030 for a range of stakeholders resulting from rent premiums/brown discounts, new market growth, differentiated value propositions, and enhanced talent attraction.

To make the most of this opportunity, early movers in the building value chain need to act promptly. Promoting green buildings in China, where most of the largest building material producers, constructors, and real estate developers operate, will have a significant impact on both the domestic and the global building market. Achieving the goal of planning, building, and operating green, sustainable buildings depends on the collective, consistent action of stakeholders along the value chain—starting now.

Greening the Renewable Value Chain: China’s Experience

China accounts for almost 60% of the new renewable capacity expected to become operational globally by 2028, according to the International Energy Agency. Around 80% of the world’s solar panel modules, 70% of wind turbines, and 80% of lithium batteries are manufactured in China.

At COP28, more than 130 governments committed to tripling their renewable capacity by 2030. While a welcome move, renewables themselves have a significant incremental carbon impact. By 2050, if the life cycle carbon intensities of all power sources remain at current levels, about 90% of electricity generation will come from renewables, but renewables’ share of carbon emissions in the energy sector will reach nearly 60%, up from just 2% in 2020.1

The successful green transition of China’s renewable value chain can pave the way for other countries to follow suit.

The renewable value chain is complex and involves multiple players—materials suppliers, equipment manufacturers and OEMs; project developers and owners; engineering, procurement, and construction contractors; operators; technology providers; end users; and recyclers. Making the transition to renewables that come from greener value chains requires all participants to pursue a common goal.

The World Economic Forum and BCG have identified seven levers that can help industry on this journey. Collectively, these levers have the potential to achieve about 70% abatement over the renewable value chain and generate global market value worth $2 trillion by 2030, unlocking numerous green opportunities for stakeholders. Tomorrow’s renewables will provide clean energy that the industry will manufacture, operate, and handle sustainably. To achieve this promise, stakeholders along the value chain must plan, align, and take collaborative action today.

Note

1. The number is based on the development of renewables under a net-zero scenario forecast. The life cycle carbon emission is calculated, included embodied and operational carbon emission. The life cycle carbon emission intensities used are from the National Renewable Energy Laboratory (NREL) in the US: https://www.nrel.gov/analysis/life-cycle-assessment.html.

Meet the Project Advisors

Related Project Content