Recent Content

Scaling Low-Carbon Design and Construction with Concrete: Enabling the Path to Net Zero for Buildings and Infrastructure

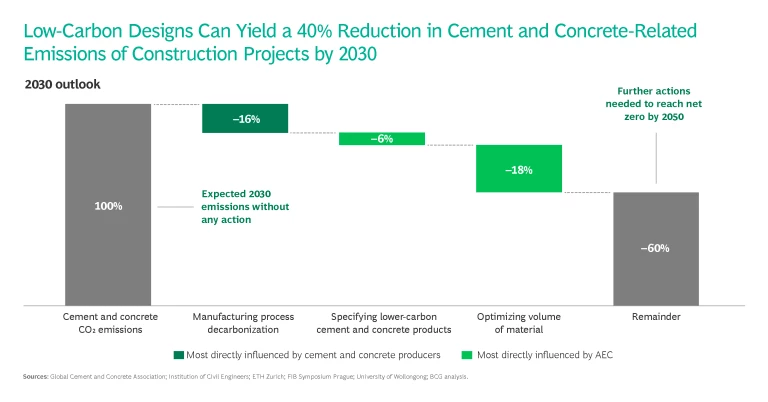

Cement is a hard-to-abate sector, one that requires breakthrough technology—including large-scale deployment of carbon capture, utilization, and storage—to achieve net zero. However, substantial reductions in cement and concrete emissions can be achieved in the near term through the use of existing technologies, lower-carbon cement blends, and design techniques that minimize structures’ carbon footprints.

Unfortunately, systemic challenges across the construction value chain are preventing the scaled deployment of such low-carbon design practices. Unlocking this opportunity will require action not only from cement and concrete producers but also from design and construction firms, real estate developers and investors, corporations, and governments.

BCG, the World Economic Forum, and the Global Cement and Concrete Association have collaborated on a report that provides a framework for scaling low-carbon design and reducing emissions from concrete. While the report focuses on concrete, many of its takeaways can be applied to other materials and to construction more broadly.

Key insights from the report:

- Cement emissions from construction projects can be reduced by up to 40% by 2030 using low-carbon materials and design techniques

- Life-cycle carbon assessments for construction projects are not done consistently today—but they are necessary to inform responsible design decisions and to measure progress

- Enhanced collaboration is needed between design and construction firms and material producers to facilitate use of low-carbon materials and designs

- Private- and public-project owners can spur the rest of the value chain to action by incorporating carbon abatement into their project requirements and goals

- Building standards should be updated to support the use of low-carbon materials; to help make that happen, design and construction firms and materials producers must increase their piloting of—and engagement with—industry committees

Green Public Procurement: Catalyzing the Net-Zero Economy

Every year, governments around the world spend about $11 trillion to buy defense and security equipment, waste management services, fuel, electricity, construction materials, and other goods and services that they need to operate. And every year, all that activity produces about 7.5 billion tons of direct and indirect greenhouse gas (GHG) emissions, roughly 15% of the world’s total.

The sheer size of public procurement’s carbon footprint makes its potential contribution to global decarbonization central to the fight against climate change. However, reducing public procurement’s emissions to net zero will require the combined efforts of governments and their suppliers alike. The enormous amount of money that governments spend—about 13% of global GDP—should give them a considerable amount of influence over the carbon footprint of those suppliers.

BCG and the World Economic Forum collaborated to copublish a comprehensive report that analyzes the benefits and challenges of green public procurement. It also provides guidance on how officials can ensure that procurement activities contribute to achieving net-zero goals.

Five key findings from the report

- Public procurement’s GHG emissions are heavily concentrated in six industries.

- Governments should look to exert their influence on industries that are heavily dependent on public spending.

- Pursuing net-zero goals in public procurement will boost the green economy.

- A considerable proportion of public procurement’s GHG emissions can be abated at a reasonable cost. We expect that greener procurement activities will raise costs by just 3% to 6% through 2050.

- Public procurement is also complex and highly decentralized, making it difficult to devise coherent decarbonization strategies.

A Procurement Strategy for Low-Carbon Concrete and Construction

Demand for cement—the key ingredient in concrete—is soaring on the wings of a global infrastructure and building boom that is driven by the expansion of developing and developed economies alike. But cement manufacturing poses multiple challenges. Namely, it will not be possible to meet climate change goals unless steps are taken to reduce the CO₂ emissions that result from cement manufacturing, which is responsible for approximately 7% of the global total.

Attempts to address this looming concern must begin with the public sector. Governments and agencies at the national, regional, and local levels are responsible for 40% to 60% of concrete sales and 20% to 30% of the construction industry’s revenues. The public sector can lead the transition toward low-carbon concrete by shifting more rapidly to green procurement policies. Governments can develop regulations and business environments that encourage and, at times, mandate the procurement of low-carbon concrete and the adoption of low-carbon construction methods.

A new report explores the activities of six countries (Sweden, Germany, France, the Netherlands, UK, and US) that are leading the charge to develop rules for low-carbon concrete and construction procurement. This report—a joint effort by the World Economic Forum, the Global Cement and Concrete Association, and Boston Consulting Group—is based on interviews with construction and procurement experts from the public and private sectors in the countries we studied. The report examines the tools and regulations that have been adopted to support the shift to low-carbon concrete.

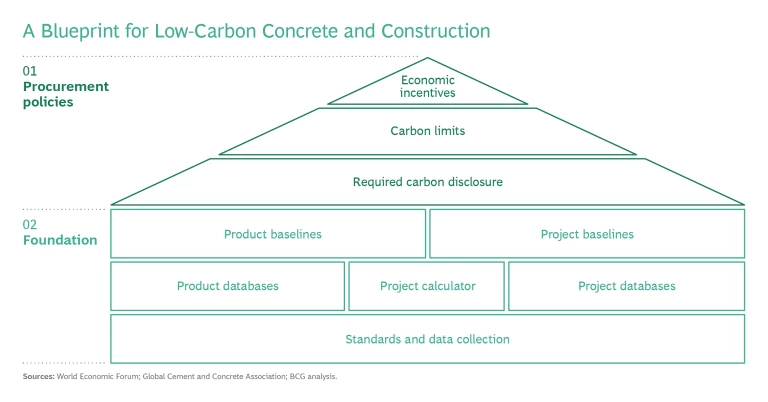

Our analysis suggests a blueprint for low-carbon concrete and construction that is focused on a carbon reduction foundation and procurement policies.

- The foundation is a set of common standards for assessing the carbon emissions of concrete, other building products, and completed projects. It generally includes a product database for collecting and storing carbon emissions information and baselines. Similar databases and baselines can also be established for whole projects.

- Procurement policies determine rules for the disclosure of carbon in concrete products and projects, which are essential for data collection in the foundation stage. In addition, procurement policies are needed to set targets for carbon emissions reduction. To meet these targets, mandates and incentives should be adopted.

The report describes the primary issues that policymakers, procurement leaders, and the private sector must address to design and implement low-carbon-concrete standards, tools, and policies. Among these issues is the need to measure carbon impacts across the life of a project, even after its completion. We also explore the obstacles in scaling green concrete and construction globally.

Procurement programs should be measured and refined over time, becoming more ambitious as the technology advances for carbon capture and carbon emissions measurement, among other things. Ideally, these improvements to procurement programs should align with the targets set forth in the Paris Agreement. In addition, programs must be tailored for developing markets, where much of the future demand for concrete and infrastructure will lie. International collaboration is necessary to accelerate progress and ensure that minimum shared guidelines are adopted. These guidelines should emphasize the disclosure of embodied and operational carbon in concrete and construction projects, set ambitious and credible targets, and incentivize low-carbon design.

Paving the Way for a Better Future: Cement Decarbonization in Emerging Markets

Emerging Markets Play an Important Role in Global Cement Demand

Emerging markets around the world consume 30%–40% of total global cement (excluding China). With this figure expected to continue rising as these markets grow and invest in infrastructure, it is crucial that these economies take action now to decarbonize their cement and concrete sectors.

The Way Cement Is Used Has Meaningful Implications for Decarbonization

While cement decarbonization levers such as CCUS and alternative fuels can be deployed in the production process are immaterial in terms of how that cement is used, other levers such as efficiency in design and construction have a direct impact. The ways cement is utilized influences the decision makers who need to be educated, the types of policies the government must consider, and how manufacturers must produce and distribute their products in order to decarbonize.

A Clear Picture of Cement Use in Emerging Markets Was Needed for Decarbonization to Progress

The challenge in tailoring emerging market decarbonization roadmaps to their use of cement is the limited amount of data that has been available historically. To better understand cement use in emerging markets (and the implications it has on decarbonization), BCG collaborated with the Mission Possible Partnership’s Concrete Action for Climate initiative, co-led by the World Economic Forum and Global Cement and Concrete Association, to conduct an analysis of cement use in four emerging markets from around the world that consume high volumes of cement: India, Indonesia, Brazil, and Egypt.

Three Key Considerations for Cement Decarbonization in Emerging Markets

Meet the Project Advisors

The Full BCG Team