BCG’s Approach to Sustainable Finance and Investing

BCG helps banks, asset managers, and other financial institutions create competitive advantage in sustainable finance and investing. Here are just some of the ways we help clients:

- Unlock business value through enterprise-wide sustainable investment strategies.

- Set ESG and sustainable finance targets, conduct benchmarking and scenario planning, and implement ESG and sustainable finance roadmaps.

- Develop social and sustainable finance frameworks and sustainable finance strategies.

- Identify and pursue high-impact sustainable investing opportunities that capture market share across environmental and social categories.

- Identify and quantify the relationship between valuation multiples and ESG scores.

- Unlock the potential of carbon markets.

- Set net-zero targets for greenhouse gas emissions across portfolios and financial activities using CO2 FI, BCG’s proprietary measurement tool for financial institutions.

- Build forward-thinking ESG data and reporting capabilities, and effectively respond to demands from regulators, standard setters, and other stakeholders.

- Establish a target operating model to deliver on sustainable finance and investing ambitions.

- Tailor sustainable finance solutions to corporations to help CFOs steer the sustainability journey and adapt to sustainable investing trends.

Our Clients’ Success in Sustainable Finance and Investing

A global bank set an ambition to become a leader in sustainable finance and investing by 2025. BCG identified and sized commercial opportunities, developed a sustainable finance framework and strategy, and created a two-year roadmap for execution. The bank doubled the size of its original sustainable finance and investing ambition and is on track to become a market leader in sustainability.

One of the biggest asset management companies in the world set a three-year goal to integrate ESG into all of its investment decisions. BCG identified the capabilities needed to become an ESG leader, designed a methodology framework for net zero, and set up a project management office to run 12 workstreams. The company translated its ESG ambitions into concrete, quantified ESG commitments and implemented a set of robust net-zero targets.

A global bank committed to reducing emissions from its lending and investment portfolios to achieve net zero by 2050. BCG established climate transition frameworks for high-emitting sectors, developed a methodology for facilitated emissions, and shaped the bank’s roadmap to net zero. The bank announced an ambitious net-zero strategy, including commitments to reduce financed and facilitated emissions, and is now a leader in climate and sustainability.

Our Insights on Sustainable Finance and Investing

Video

November 4, 2025

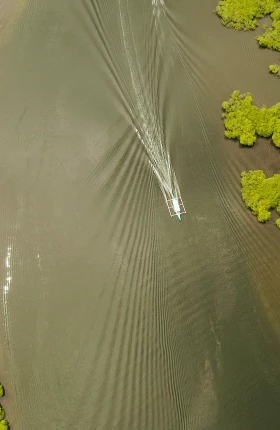

Mobilizing Private Equity is Key to Closing the Climate Finance Gap

Wendy Woods and Carbon Equity’s Saskia Bruysten explore how democratizing investment in private markets can funnel investment into much needed climate tech and innovation.

Video

October 30, 2025

How Banks are Addressing Physical Climate Risk in Financial Decisions

Amine Benayad and Quantis’s Natalie Benz reveal how banks can integrate climate scenarios to better evaluate their risk exposure and capture future opportunities.

Video

October 14, 2025

How to Fund Sustainable Growth

At a time when catalytic forms of capital are needed, BCG’s Veronica Chau says that financial institutions, corporate strategic investors, and family offices are stepping up.

Video

September 25, 2025

Development Finance Is Commercially Viable

Lori Kerr of FinDev Canada and BCG’s Qahir Dhanani discuss what it will take to bring more private investors into emerging markets.

Article

September 23, 2025

Headlines may suggest climate investing is dead, but a confluence of tailwinds is creating opportunities in low-carbon technologies as well as in circularity, adaptation, and resilience solutions.

Article

September 18, 2025

Governments and businesses can take steps that collectively create the enabling environment needed to attract investment, scale solutions, and drive lasting change.

Meet Our Sustainable Finance Consulting Leadership Team

BCG’s sustainable finance consulting team has deep expertise in sustainable investing and sustainable and social finance. Here are some of our experts in sustainable investing consulting.

Explore Related Services

Industry

Sustainability in Private Equity

Capability

Corporate Finance and Strategy

Capability