In these unprecedented times, companies have had to shift their entire sales force practically overnight to working remotely. Gone are face-to-face meetings, client dinners, and the entire social element of sales. Demand is down, in some sectors massively, except for a few areas in which the new environment has created a sudden surge.

To find out what it’s like to be in sales right now, BCG and the Strategic Account Management Organization fielded a survey of more than 100 account executives in health care, technology, industrial goods, and other sectors. We asked them about their experiences in the market today and their expectations for the future. We also asked what their organizations are doing to survive and thrive; in particular, we were interested in whether they are implementing some of the pricing and sales best practices provided in BCG’s COVID Readiness Assessment, which helps organizations understand how well they are configured to weather the current storm.

The Current Perspective

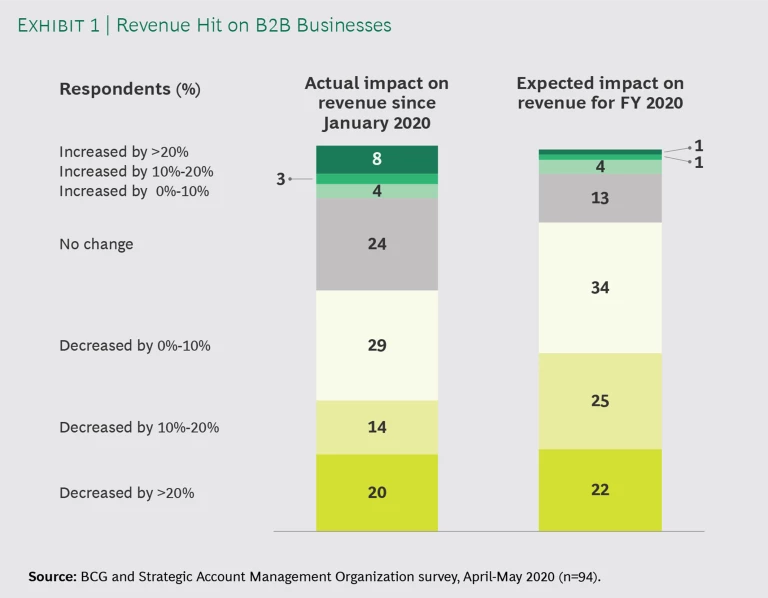

It’s no surprise that 63% of account executives have seen revenue decline since January and that 81% expect 2020 to be down relative to last year. (See Exhibit 1.) The latest Congressional Budget Office projection is for a 5.6% decline in US GDP in 2020, so the fact that most sellers are pessimistic about their business growth for the year is to be expected. But note that 19% see flat or growing revenue—a useful reminder that the economic impacts are uneven and it may be possible to find pockets of growth.

How long will the effects of COVID-19 last? At least seven months, according to 83% of our respondents and at least a year according to 48%. (See Exhibit 2.) When asked about the recovery, the majority said it will be U-shaped, a prediction that squares with the results of a recent BCG survey of CFOs.

Surprisingly, the current environment is causing some, but by no means all, customers to ask for concessions: 36% of respondents said customers have asked for delayed payments, and 29% said they have asked for reductions in volume. Only 22% have had customers try to negotiate lower prices. Most respondents (51%) said they are having internal supply challenges in delivering to customers.

How Are Companies Coping?

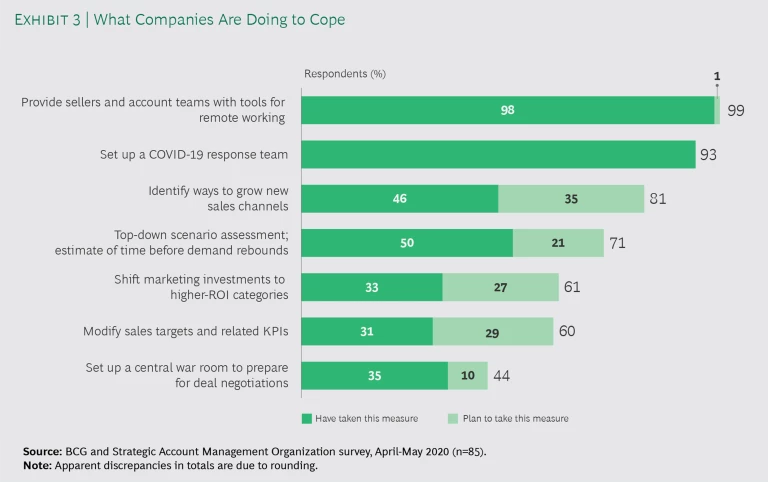

As might be expected, nearly all the account managers in our survey (98%) have provided their sellers with the tools they need to work remotely, and 93% have set up some sort of COVID response team. (See Exhibit 3.) Less common is a systematic approach to planning and managing the day-to-day tactical response. Only 35% of respondents have set up a dedicated war room. Half respond to customer requests for concessions at their standard sales meetings or outside of any regular forum. And half have done no strategic planning at the account level regarding the expected impacts on pricing, volume, and churn.

Sales and Pricing Best Practices

Drawing on our decades of work in sales effectiveness and pricing strategy, we have a few suggestions for sales teams in the current economic environment. These techniques apply during any demand shock but are especially applicable now, given the uncertainty still facing customers and suppliers.

Set up a digital war room. Discussing COVID response issues in your regular sales meetings is a start, but that often leads to decisions based on anecdote or on whatever happened in the last deal. Better to establish a dedicated digital war room for collecting a concise set of real-time (or at least daily) dashboards showing key metrics on volume, price realization, and wins/losses cut by your most important customer segments. Then hold weekly strategy sessions to review market trends, plan upcoming deals, and discuss recently won or lost deals in the context of the dashboard data. It’s amazing how quickly the discussion becomes more realistic and relevant when participants are looking at actual data.

Create a COVID response strategy by segment and key account. A key feature of the current environment is the dramatic difference in impact on different customer segments. Ahead of any negotiation, it’s critical to have a clear idea of whether a customer is truly in dire straits or simply opportunistically fishing for a discount. Develop a game plan for every segment and large account, taking into consideration their respective economic, market, and competitive pictures. Use these game plans in the war room to prepare your sellers for upcoming negotiations and revise them in real time as your team gathers more market intelligence.

Establish preapproved flexibility options. Some customers that are really struggling will ask for concessions, whether one-time discounts, reductions in units, or outright cancellations. We saw some of this early in the crisis and, as depressed demand continues, we are likely to see more. Be ready with predefined and preapproved flexibility options that can help your customers get through the downturn but that don’t lock in lower prices. Deferred payments, short-term expiring discounts, or temporary licenses to enable remote work are all examples of high-value concessions that let you return to normal pricing once the crisis ends.

Implement deal escalation and pricing controls. Above all, don’t panic! Be sure to have appropriate controls in place to prevent irrational pricing decisions by your sellers or business unit leaders. Set clear discounting guardrails and ensure strict but rapid escalation processes. You may need to approve some ugly deals right now, but don’t let your sellers run every deal to the ground and start a price war on top of everything else.

Plan a rebound strategy. This, too, shall pass. Have a plan for the rebound. What market opportunities can you capture today that will pay dividends when demand returns? Software companies are aggressively pushing freemium or trial offers, or they are switching to consumption-based pricing as a way to offer lower entry points when customers are price sensitive but scale up when demand returns.

You can bring our pricing and sales best practices, codified for the COVID crisis, to your sales organization. Take our free

COVID Readiness Assessment

to learn what more your organization can do to survive the crisis and thrive in the rebound.