Our Approach to Divestiture Consulting

BCG has a record of successful divestitures in every major industry, and our clients find that involving us can unlock substantial value. Our divestiture consultants understand how to identify prospective buyers and assess businesses beyond the obvious metrics, which can shift your targets and maximize what they’re willing to pay. And by working shoulder-to-shoulder with clients, we free you to focus on what matters most: your core business.

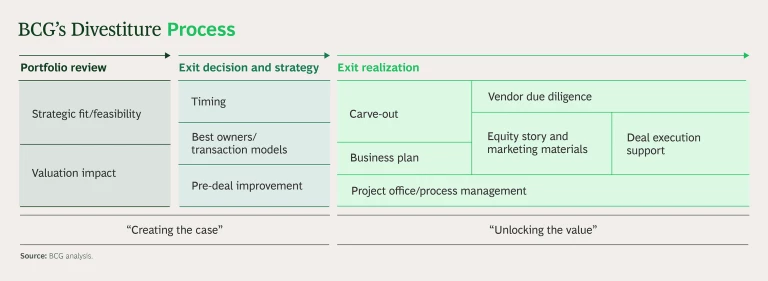

Our highly tailored approach is the antithesis of a corporate divestiture checklist. We deliver end-to-end support for the corporate divestiture process and deal execution in two broad categories: creating the case for a divestiture and unlocking value during the exit process.

Creating the Case

Phase 1 of our divestiture process covers everything from a portfolio review of ripe prospects to the creation of an exit strategy, including operating upgrades to boost the value of the assets being sold.

Unlocking the Value

Phase 2 involves preparing for and conducting the actual sale. A corporate divestiture usually starts with a carve-out, or surgical separation of the unit from its parent. Too often an afterthought, carve-outs require careful oversight to avoid costly value leakage.

In this phase, BCG also helps build two key elements: an equity story with a compelling investment rationale and a detailed, substantiated business plan tightly linked to targeted high-value operational improvements.

In the case of a trade sale, we conduct intensive vendor due diligence to deliver an independent assessment that can guide prospective bidders’ decisions. Our objective, highly reputable opinion of a unit’s value and prospects raises the confidence of would-be buyers—and often the price they’re willing to pay.

Finally, we support you throughout the divestiture agreement process and interaction with bidders to close the optimal deal.

M&A Activity by Year: The BCG M&A Report Collection

Our Insights on Divestitures

Meet Our Divestiture Consultants