How BCG Supports Successful Mergers and Acquisitions

BCG’s mergers and acquisitions consultants bring a strategic, value-creating perspective to every engagement to deliver fresh insights via an efficient, results-oriented process.

We also help you avoid some all-too-common traps for M&A. For example:

Reason for Failure

- Inadequate integration concept

- Wrong business logic or fit

- Wrong acquisition candidate

- High price but low synergies

How BCG Adds Value

- Prepare integration well before day one

- Develop and validate strategic rationale

- Assess strategic fit and synergies for each M&A target

- Help you negotiate on the basis of key value drivers

BCG tailors your merger and acquisition strategy through an iterative, highly collaborative approach. Our mergers and acquisitions consultants serve as partners for senior management, drawing on our global network and cross-industry perspectives, supported by proprietary methodologies and digital tools.

We help you pursue buy-side mergers and acquisitions and create or enhance replicable mergers and acquisitions processes in-house.

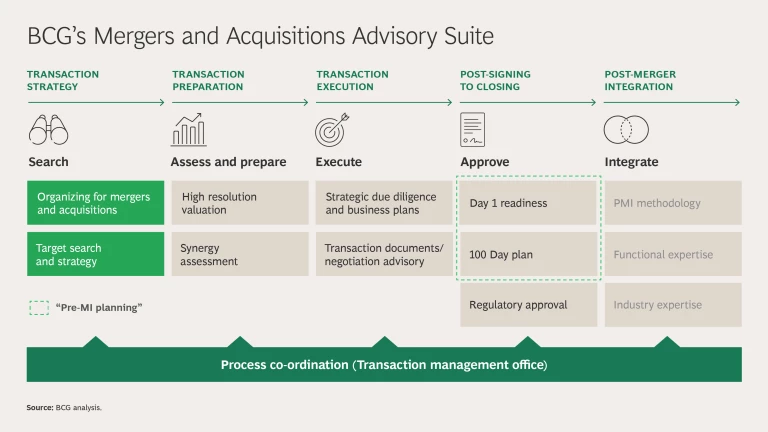

Because BCG views value creation in mergers and acquisitions as a continuum, we’re also prepared to support you at every stage, from transaction strategy to post-merger integration. M&A target identification typically takes about 3 months and is the first step in a process that can last up to 18 months.

Our M&A transaction services combine our extensive expertise in all types of M&A-related processes, such as due diligence, with our industry-specific expertise, such as consumer M&A and health care M&A.

Explore our Mergers and Acquisitions Brochures for More

BCG’s Five Steps for Initiating an M&A Target Search

- Generate ideas. Apply different lenses to develop a long list of potentially attractive industries and segments: consider different classification approaches, database and IP screening, and the relevance of such megatrends as climate change and shifts in international trade.

- Prioritize the long list of industries and segments. Carry out an initial assessment of structural attractiveness. Generate about 200 candidates.

- Create and categorize the short list. Develop common-sense exclusion criteria for segments and targets. Pare down to 20 to 30 companies. Profile and analyze from multiple angles, including risks. Check availability.

- Refine the short list. Further evaluate segments and companies. Reduce to fewer than ten targets

- Launch a deep dive into the M&A target. Thoroughly explore feasibility, financing, risks, and other vital dimensions—and prepare for initial due diligence.

M&A Activity by Year: The BCG M&A Report Collection

Our Insights on Mergers and Acquisitions