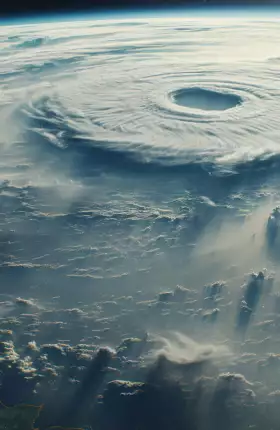

Each year, the UN convenes a Conference of Parties (COP), bringing together public and private sector leaders to catalyze action and deliver climate progress. From November 11 to November 22, the COP Presidency of Azerbaijan hosted COP29 in Baku, with a program focused on advancing the targets set forth in the Paris Agreement and designing an inclusive energy transition.

Every COP represents a critical moment in international progress and cooperation—an opportunity to align and forge collective action around a shared purpose. But each also acts as a reminder that time is running out to combat the worst effects of climate change. The objective of COP29 was focusing on the need to “invest today to save tomorrow.”

In Baku, BCG’s delegation convened clients across industries to explore pathways for green growth, reducing climate risks, and accelerating decarbonization. Our engagements at COP29 reinforced that, while much work remains—especially in delivering government-level cooperation worldwide-public and private sector organizations play a pivotal role in aligning net-zero goals with value creation to drive impactful progress.

Insights from COP29 and Beyond

Climate Finance — BCG is committed to helping organizations unlock climate financing and innovation by mobilizing funding across the investment and venture ecosystem.

The Sustainable Advantage: Insights on Creating Competitive Advantage Through Sustainability

Our Latest Thinking from BCG Climate Experts

Meet Our Climate and Sustainability Experts