Carbon capture, utilization and storage (CCUS) has had a banner few months in Canada. In June, the five major oil sand producers announced the Oil Sands Net Zero Alliance that will include a carbon capture hub in Fort McMurray and Cold Lake. A week later, TC Energy and Pembina announced the Alberta Carbon Grid, a pipeline network that will transport CO2 from points of emission to sequestration. More recently, TC Energy and Irving Oil announced plans to explore joint development of decarbonization opportunities in Atlantic Canada, including a carbon capture and sequestration network. And back in April, the federal government announced an upcoming investment tax credit for CCUS.

With three projects already up and running - Boundary Dam (2014), Quest (2015) and Alberta Carbon Trunk Line (2020) – we’ve been a world leader for a while. In fact, we’re second to only the US in operational projects to date. Yet, these facilities capture about 7 Mt annually, roughly 1% of total emissions. And up until recently, unlike Norway, the UK and others, we didn’t have any major projects in the pipeline. It’s good news that momentum is returning in Canada.

CCUS collects carbon dioxide emissions from fuel combustion sources, then pipes or ships them to a place where it can be stored or reused. For some of the heaviest industrial emitters, it is the only way to reduce emissions steeply enough, fast enough to achieve our climate targets.

CCUS plays a big role in any serious climate model that gets the world to Net Zero. In 2019, Canada produced 730 megatonnes (Mt) of carbon dioxide. To meet our most recent obligations under the Paris Agreement, we need to cut this volume by 40-45% over the next nine years. CCUS will be integral. Current policies are projected to reduce emissions by ~30%, and CCUS is one of many levers driving this reduction. Strategic investments in large-scale CCUS projects could play a major role in closing the remaining 10-15% gap.

As importantly, expanding our CCUS capabilities would boost our national competitiveness, spurring growth in fields that have significant long-term potential such as low-carbon “blue” hydrogen, which can be used domestically and exported abroad as a fossil fuel substitute and as an feedstock in industrial processes. CCUS will also ensure long-term competitiveness of existing industries such as oil and gas and fertilizer in a world of rising carbon prices, border carbon adjustments, and premiums for low-carbon products.

The good news is Canada already has strong advantages in CCUS – many large industrial emitters clustered in proximity to each other and to abundant geologic storage, as well as industry expertise and strong transport and storage regulatory regimes.

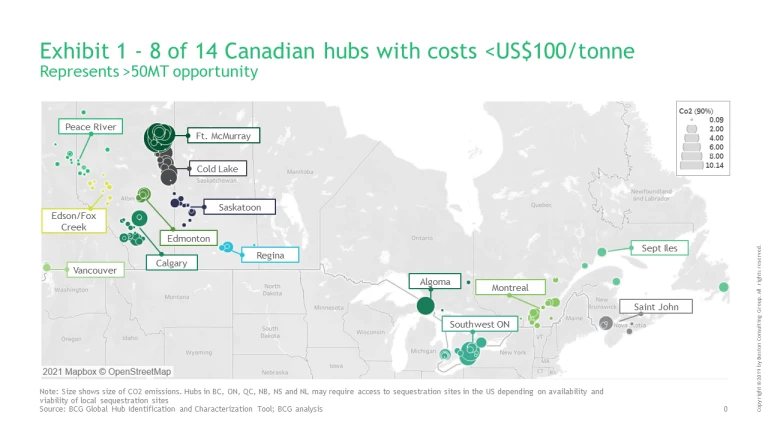

Over the last year, BCG has worked with public and private sector institutions to identify how to make CCUS deployment technically and economically feasible. A key lever is hubs where participants share transmission and storage infrastructure. Through network-design analysis, we’ve identified 14 potential hubs in Canada. (See the Exhibit.) If actualized, these hubs would span the country and serve multiple industries, including energy, steel, cement, and refining. Eight could capture carbon for less than US$100 per tonne, although some may require access to storage aquifers in the US. With a potential capacity of more than 50 Mt, these eight hubs could close half of our gap to our Paris target.

CCUS hubs are large, complex capital projects that require new business models and an ecosystem of stakeholders (e.g., industrial emitters, midstream companies, clean-tech firms, multiple levels of government) to succeed. Scaling-up capacity will require close public and private sector cooperation. The costs and risks for a CCUS hub are heavily front-loaded, while policy supports such as carbon taxes and fuel standards won’t fully kick in until later in the decade. To spark investment, governments must provide financial incentives and supports, such as an investment tax credit, grants, or a production tax credit like 45Q in the U.S. Other policies such as loss-absorbing capital, counterparty risk guarantees, and streamlined government approval processes are also important.

For emitters, the most important thing is to act. These projects take years, so feasibility studies need to start today to have an impact by 2030. In a hub model, emitters will also need to collaborate closely with each other and convene the right stakeholders with the necessary expertise. Finally, emitters can partner with technology firms on demonstration plants to help bring down costs.

It’s not often that business and society are presented with an opportunity for such significant, collective payoff from bold infrastructure investments. But this is one of them. We have the ambition, we have the talent and the know-how as well as world-class carbon sequestration assets. We need to build on the momentum and seize this opportunity.