There has been plenty of uncertainty in the automotive industry, even before the collapse in manufacturing and sales as a result of the COVID-19 pandemic, much of it centered on battery electric vehicles (BEVs) and how quickly they will gain widespread acceptance.

Although it is difficult to predict future sales figures for BEVs precisely, one thing is clear: a combination of increasing demand for more environmentally friendly vehicles and government-mandated reductions in automakers’ fleet-wide average emissions will compel OEMs to increase their share of BEV production to at least some degree.

But often lost in the enthusiasm and anticipation surrounding the emergence of BEVs is the potentially profound impact this product shift will have on the operations of automakers and suppliers—and, by extension, on global employment patterns in the auto industry. Without a full understanding of the repercussions of the transformation from internal-combustion-engine vehicles (ICEVs) to BEVs, automakers will be unable to produce a coherent plan for navigating this consequential shift. In particular, workforce deployment will be a critical facet of this transition. To help automakers and suppliers better manage this period of uncertainty and understand what the future may hold, BCG conducted a study on how electromobility (e-mobility) will alter automotive production, with a specific focus on shifts in labor requirements.

How ICEVs and BEVs Differ

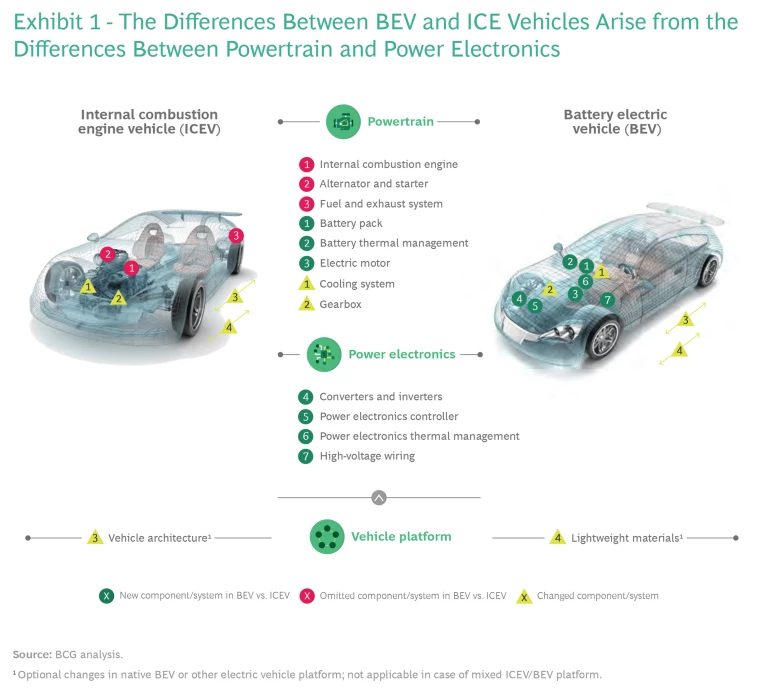

The differences in composition between BEVs and ICEVs will ultimately determine production requirements. These differences can be separated into two categories: powertrain and power electronics. (See Exhibit 1.)

- Powertrain. The main components of an internal-combustion-engine (ICE) powertrain—the engine and auxiliary systems, such as the alternator, starter, and fuel and exhaust systems—are unnecessary in a BEV. They are instead replaced by a battery pack and an electric motor. The battery pack consists of modules that contain battery cells, a battery management system that monitors performance, a thermal management system to cool the battery, interconnects, and housing. In addition, the multispeed gearboxes used in ICEVs are virtually always swapped out for a single-speed transmission in BEVs because the power output of electric motors is efficient and consistent across a much broader range of RPMs than conventional ICEs.

- Power Electronics. This covers all the equipment essential for running BEVs and electric hybrids but doesn’t exist in pure ICEVs. Included, among other things, are DC/DC and DC/AC converters and power electronics controllers.

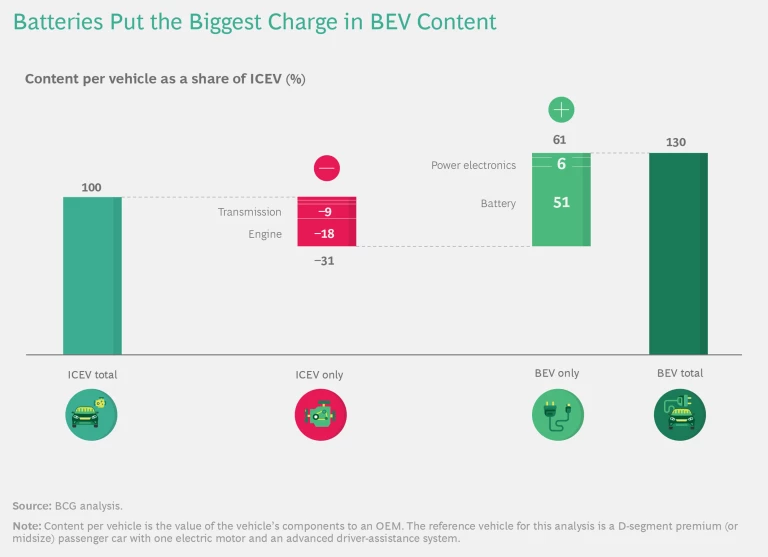

Primarily because of their more complex powertrains, ICEVs include many more components than electric cars. An ICE powertrain may have more than 1,000 components, while a BEV powertrain generally has only a few hundred (not counting each individual battery cell separately). Nevertheless, the content per vehicle of BEVs is actually about 30% higher than that of ICEVs, primarily because of the cost of batteries. (See “How BEV and ICEVs Differ in Content.”)

How BEV and ICEVs Differ in Content

How BEV and ICEVs Differ in Content

In ICEVs, the engine and transmission, as well as some auxiliary parts, account for about 31% of CPV. And while those would be eliminated in a BEV, they would be replaced by battery cells, modules, and packs, which are far more costly than an ICEV powertrain. Indeed, the battery system amounts to about one-third of the total BEV CPV and one-half of the total CPV relative to an ICEV. This high price tag is mainly rooted in materials, which make up as much as 60% of the BEV battery cost.

On top of the price of batteries, the power electronics in a BEV add another 6 percentage points to CPV. Other BEV-specific parts, such as high-voltage wiring, drive up CPV by another 4 percentage points. All told, BEV specific components increase CPV to 130% compared with an ICEV. However, electric vehicle battery costs are declining fast because of improvements in scale, factory automation, and efficiency. (See the 2018 BCG report The Future of Battery Production for Electric Vehicles.) As a result, this large CPV gap between ICEVs and BEVs is likely to diminish significantly before too long.

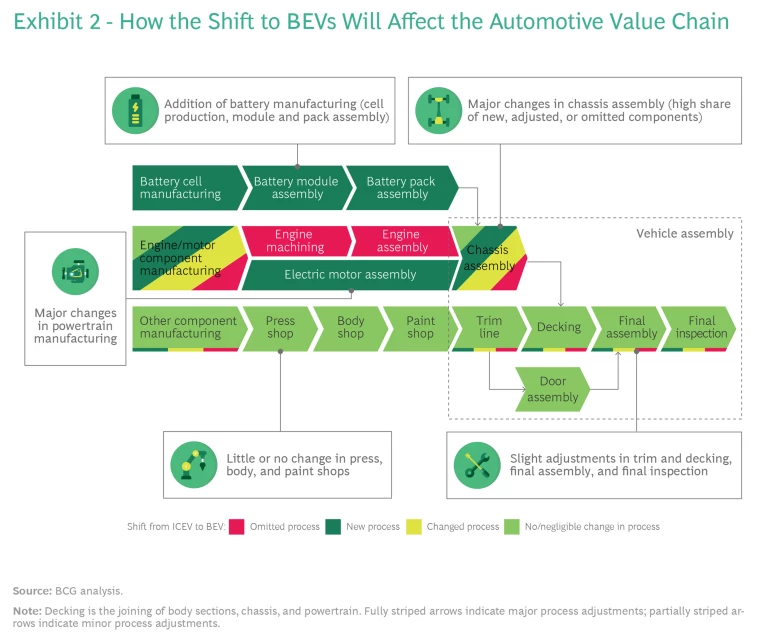

How What’s Under the Hood Affects the Way It’s Built

The most important difference between ICEVs and BEVs from a manufacturing perspective is the replacement of the traditional engine with an electric motor. (See Exhibit 2.) This frees automakers from the complex and labor-intensive assembly of ICEs and allows them to focus instead on relatively simple electric motors. Indeed, because electric motors have fewer parts with difficult-to-handle flexible materials, such as hoses or gaskets, automakers can generally deploy more automated equipment to build them. Still, by switching over to BEV production, automakers will have to master new manufacturing processes, such as coiling, impregnation or sealing of wiring, and quality control for more complex electrical systems. This is a significant change for an industry that has spent more than 100 years developing and improving engine manufacturing and vehicle assembly to the highest degrees of efficiency.

Assembly isn’t the only area where production of ICEV engines and BEV motors differs. There are also significant differences in the manufacture of their components. Instead of the elaborate casting and machining processes necessary to make crankcases, cylinders, camshafts, and rods for ICEs, smaller and less complex machining methods can be used to manufacture and install components for electric motors, which include rotor hubs, stator hubs, magnets, and bearings. In this sense, the switch to BEV production affects not only OEMs and their suppliers but also producers of machinery and automation equipment for engine-related parts.

The other distinct difference in powertrain production is the integration of battery packs. Automakers often assemble battery packs in-house by piecing together battery modules. However, the cells that go into the battery modules are typically produced by specialized suppliers, often from the consumer electronics industry and headquartered in Asia. Delivery of those battery cells to automakers requires a well-functioning supply chain, since automakers cannot store large inventories of battery modules, because of the potential fire hazard and the degradation of batteries over time. As a result, automakers must create a seamless just-in-time production process for that aspect of BEV manufacturing.

Manufacturing distinctions exist in other functions as well. While reducing vehicle weight to help meet tightening fuel economy requirements is an ongoing process in the auto industry overall, BEV manufacturers are especially focused on this issue because the multiple battery packs in their vehicles are extremely heavy, which reduces range between charges. For example, the battery pack alone of the Tesla Model S weighs more than half a ton. To counteract the extra weight, Model S bodies (as well as those for the Model X) are made chiefly with aluminum, which is lighter and stronger than steel. However, aluminum is trickier to work with in a factory. For instance, in the press shop, fine dimensional control of design cutouts is difficult because aluminum alloys are relatively soft compared with steel and can exhibit poor ductility. Additionally, joining aluminum vehicle body parts in the body shop is problematic because of an oxide layer that builds on their surface during welding. This results in the need to shore up weak joints with both adhesive and spot welding.

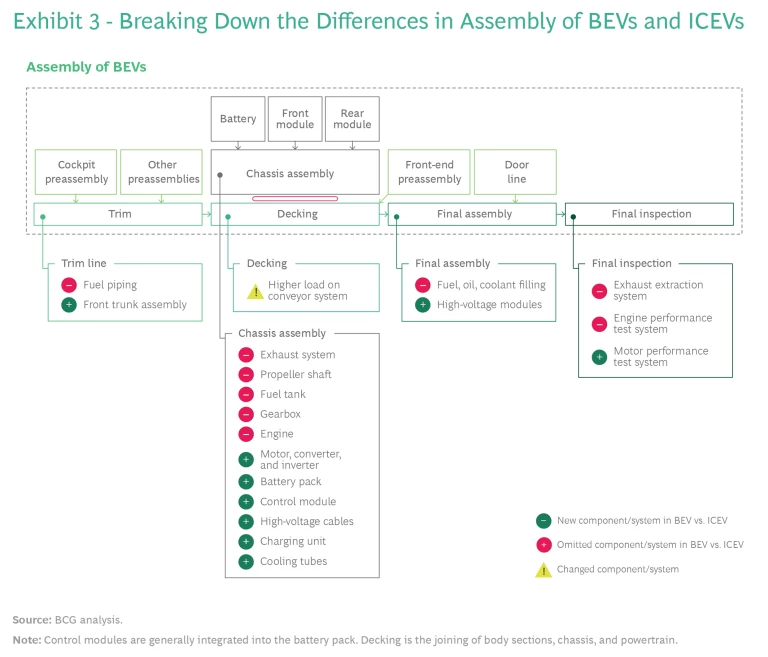

The common wisdom that BEVs are less labor intensive in assembly stages than traditional vehicles is inaccurate.

The common wisdom that BEVs are less labor intensive in assembly stages than traditional vehicles is inaccurate. (See Exhibit 3.) In fact, the labor requirements for assembling BEVs and ICEVs are comparable. Though BEVs require no assembly of fuel piping or an exhaust system, they do require manufacturing high-voltage wiring converters and inverters, installing motor-charging units, and connecting battery cooling tubes (BEVs have three thermal systems; ICEVs have two). Also, some BEVs have an additional front trunk, which involves the extra step of assembling interior lining that’s not necessary in ICEV production. Moreover, some parts of the BEV manufacturing process require greater attention to quality control, thus adding more complexity to the effort. For example, additional quality checks are necessary to make sure that no nuts, bolts, or other small parts are mistakenly left in the battery pack, which could cause it to overheat and catch fire.

Factory infrastructures differ as well. For example, plants dedicated solely to BEV manufacturing do not require vehicle exhaust extraction systems in the final inspection area. But that savings is offset by the special equipment needed to handle the added weight of the batteries. This includes the machines necessary to ferry battery modules and packs around the factory and the reinforced chassis conveyor or other transport systems required to move the assembled vehicles at the end of the line. These infrastructure changes can make the conversion of brownfield manufacturing sites into BEV assembly facilities difficult to do without expensive retrofitting.

Two Manufacturing Options

Most automakers that are beginning to integrate BEVs into their manufacturing mix are deciding between two vehicle production strategies: a native setup exclusively dedicated to producing BEVs, or a mixed setup, which can make both BEVs and ICEVs. VW’s Audi unit has already built a BEV-only factory in Brussels for the e-tron, whereas BMW is producing its i3 in a mixed setup in Leipzig. Native production setups require high-volume output to amortize the investment in a timely way—which essentially amounts to making a big bet on BEVs at a time when future demand is still uncertain. However, the native setup allows automakers that are bullish on BEVs to optimize their production, running these factories at very high efficiency because of relatively low product variance.

By contrast, mixed assembly lines can be wildly inefficient. Running a higher variety of products on a single line often results in production inefficiencies because of different cycle times and the need for separate assembly stations for parts unique to ICEVs or BEVs. This, in turn, leads to a reduction in workforce and equipment utilization. In addition, in shared assembly areas, there is the added logistics headache of having to deliver on time to the assembly line many different types of parts and materials.

In weighing the pros and cons of the two production strategies, companies that plan to manufacture BEVs in high volumes can often make a strong profitability case for a native setup. At this point, low-volume BEV producers typically find mixed-production setups most attractive, because they avoid the significant upfront investments and lengthy amortization periods for native setups and also maintain flexibility to react to fluctuations in demand.

Companies that plan to manufacture BEVs in high volume can often make a strong profitability case for a native setup.

But there is a way to combine native and mixed production setups, which could be a better option currently for BEV manufacturing, particularly since the shift into high-volume manufacturing of electric vehicles is likely to evolve slowly for many companies. Flexible-cell manufacturing (FCM) replaces the conveyor belts that move one car after another along the same assembly line with automated guided vehicles (AGVs) that transport car bodies individually to the assembly workstations appropriate for that specific model of vehicle. These modular workstations, called flexible manufacturing cells, are not interconnected as they are on traditional assembly lines. Rather than following a standardized direction of movement for all vehicles, each type of automobile has its own assembly itinerary in the factory. With FCM, multiple vehicle varieties can be made in the same factory without the substantial disadvantages in cost efficiency that crop up when a single line has to handle vehicles that vary greatly.

One common misperception about FCM is that it needs to be implemented throughout the entire automotive plant. At least one European automaker has proven that that isn’t true. This company makes both ICEVs and BEVs in the same factory but has set up flexible manufacturing cells only at the decking stations, as they are known, where the body sections and chassis are joined. After the trim and chassis stations, vehicles are transported by AGVs to decking stations dedicated to either ICEVs or BEVs. The biggest difference between the two is that the BEV decking station is more highly automated than its ICEV counterpart. All told, this results in improved efficiency and more productive use of labor hours. In fact, in a simulation of flexible-cell manufacturing, BCG found that worker utilization increased by 12%, which in turn can lead to a similar reduction in labor cost per vehicle.

The Difference in Manufacturing Value Added for ICEVs and BEVs

Understanding all the ways that ICEV and BEV production diverge is essential because this generates a sharper picture of the differences in the value added during the manufacturing processes for each vehicle. Manufacturing value added comprises the costs involved in converting raw material into a finished vehicle. A central component of the added value is direct and indirect labor hours per vehicle.

Understanding all the ways that ICEV and BEV production diverge is essential to generating a sharper picture of the differences in the value added during manufacturing.

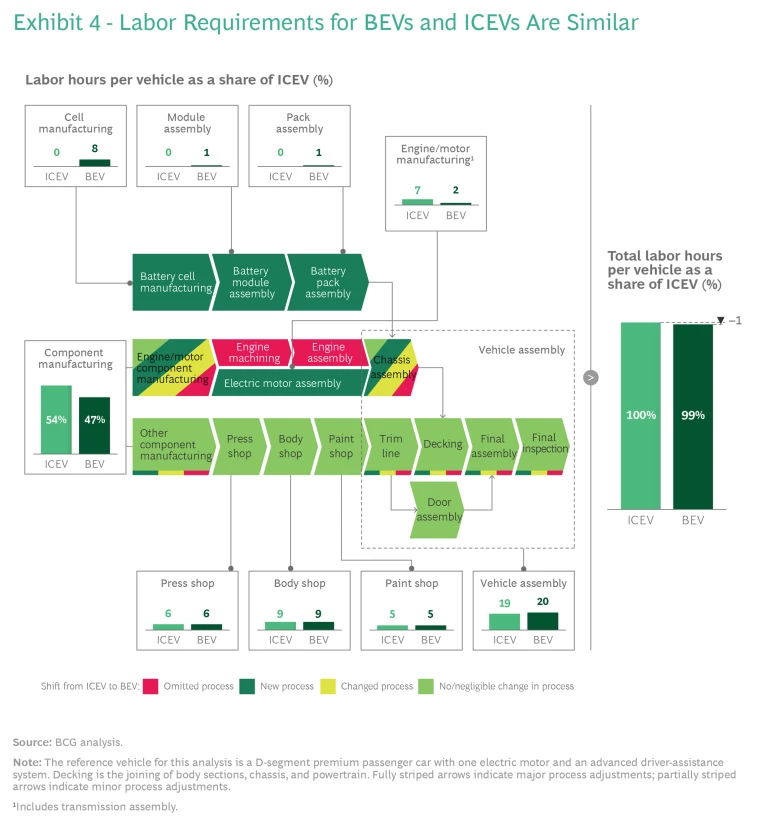

To analyze and compare the total labor hours required to build an ICEV and a BEV as well as the distribution of labor value across the automotive value chain for both types of vehicles, we began by calculating the combined production activities of automakers and tier one suppliers for a single reference vehicle, a D-segment car. (This is the European classification for a premium passenger car. In the US, these vehicles are generally described as midsize.) We modeled the labor hours assuming a similar level of efficiency for ICEV and BEV production. We considered the time spent by direct manufacturing workers—assemblers, machine operators, and the like—and by workers involved in indirect manufacturing functions, including those in quality control and maintenance. (See Exhibit 4.) Here is a breakdown of the major differences between ICEVs and BEVs in the primary facets of vehicle manufacturing:

- Components. Because electric motors have fewer parts than traditional engines they require less casting and machining. Also, BEVs are often equipped with single-speed transmissions, which require fewer components, and exhaust and fuel systems are unnecessary. Therefore, component manufacturing currently accounts for 47% of vehicle labor hours for a BEV, compared with 54% for an ICEV. (All BEV calculations assumed an ICEV total vehicle labor level of 100% as a baseline.) Though the percentage allocated to component manufacturing may seem high, it includes highly manual processes, such as making wiring harnesses, an extremely labor-intensive effort that alone requires about ten hours of manual work versus only about three hours to assemble an engine.

- Engine, Motor, and Transmission Assembly and Installation. Since it takes relatively little time to build and install an electric motor, only about 2% of BEV labor hours are related to this task (assuming that the car has only one electric motor) compared with 7% in an ICEV. Similarly, single-speed BEV transmissions cut labor needs for transmission assembly and installation by more than 50% compared with the labor required for multispeed gearboxes in ICEVs.

- Battery Manufacturing. This category includes cell production and module and battery pack assembly—and, of course, is intrinsic to BEVs, so has no bearing on ICEV labor calculations. Although cell manufacturing plants are heavily automated, a significant amount of indirect labor is involved in operating machinery and equipment, controlling the production process, and quality inspection. Cell manufacturing alone adds about 8 percentage points in vehicle hours per BEV, relative to the ICEV baseline today.

- Press, Body, and Paint Shops. Activities in these stages are mostly independent from powertrain and power electronics, so per-vehicle labor hour requirements are about the same for both BEVs and ICEVs.

- Vehicle Assembly. There are several distinct differences between the two types of cars in this stage. The additional labor required in BEV assembly, including the installation of the charging unit and additional wiring as well as battery loading and alignment, slightly outweighs the ICEV processes that are eliminated, such as installing fuel tanks, gear shifter cables, and engine wiring. Some automakers expect an increase in vehicle assembly labor hours of as much as 8% for BEVs compared with ICEV baselines, assuming a similar level of automation.

Taking all of these per-vehicle labor figures into consideration, current BEV labor requirements are about 1% less than those for ICEVs. While we compared pure ICEVs and BEVs in the analysis, it should be noted that there are also hybrid forms between the two. Because they include both an engine and an electric motor, these hybrids have higher manufacturing value added than ICEVs and BEVs. Accordingly, their per-vehicle labor figures are higher than those for pure ICEV or BEVs.

It may come as a surprise to some that the total added value is about the same for BEVs and ICEVs, but this similarity masks a significant change already underway in the automotive added-value equation. That change is intrinsic to the second part of our added-value analysis—the distribution of labor value across the automotive value chain. Simply put, as BEVs take hold in the market, the value added in automotive manufacturing will shift from automakers to tier one suppliers, particularly battery cell makers, when automakers choose not to build their own batteries. The implications of this shift on Western automotive companies is enormous because virtually all of the dominant battery cell producers are Asian companies, although some Western players, such as Sweden’s Northvolt, are in the process of gearing up production facilities.

Currently, OEMs source battery cells because they are outside of their areas of expertise—more in the realm of consumer electronics than auto manufacturing. Still, OEMs often manufacture battery modules, battery packs, and electric motors in-house. For battery packs, these components are customized for each vehicle model and assembled near the vehicle plant, since transporting them is a specialized and expensive process. By contrast, OEMs often buy power electronics from suppliers, who have begun to add value to these components with design innovations such as the use of silicon carbide-based semiconductors and improvements in cooling circuit integration. And no clear picture emerges for BEV transmissions; some OEMs produce them in-house, while others outsource them.

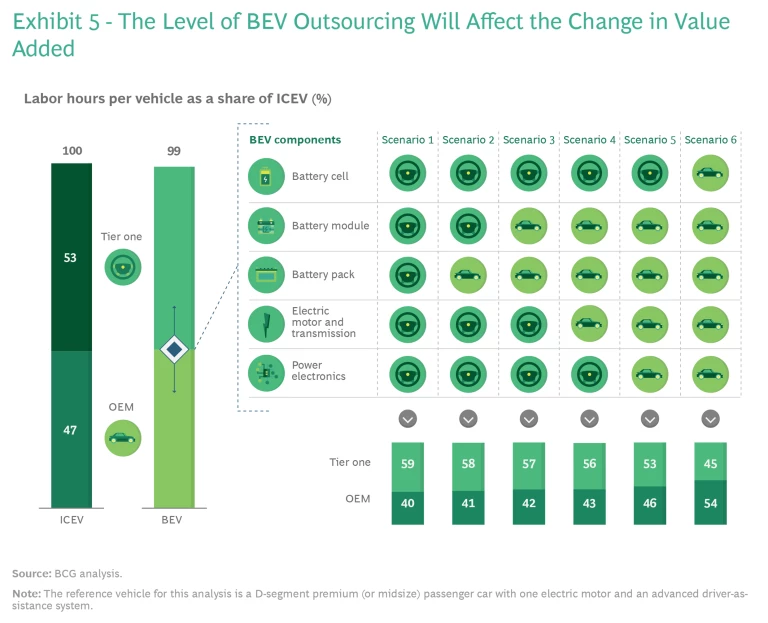

To model the impact of different OEM production and sourcing strategies on the value added by OEM versus supplier, we analyzed six possible scenarios, ranging from an OEM outsourcing all BEV powertrain components and power electronics to producing all of this equipment in-house. (See Exhibit 5.) We assumed one baseline element taken from the prior analysis: BEV manufacturing requires about 1% less labor per vehicle than traditional vehicle production. And when comparing the BEV supplier-OEM labor distribution against current automotive manufacturing figures, the total labor hours for an ICEV today tilt slightly toward suppliers—53% for suppliers versus 47% for OEMs.

Our findings could serve as a useful guide for automotive companies to explore their labor needs and how they can best respond to this transition through strategic workforce planning. The highlights of our analysis are:

- If OEMs were to outsource all powertrain and power electronic components, they would see a reduction in labor hours per vehicle of 7 percentage points. General Motors has taken this approach, outsourcing most powertrain and power electronic components for the Chevy Bolt to Korean electronics company LG.

- On the other hand, if OEMs produce all powertrain and power electronics components in-house, including battery cells, they could increase their labor hours per vehicle by 7 percentage points. Very few OEMs are taking this approach today, although Tesla is moving in this direction as it builds its capacity to produce battery cells in-house.

- The most common scenario for OEMs today—outsourcing battery cells and power electronics but producing battery modules, battery packs, and electric motors in-house (scenario 4 in Exhibit 5)—lowers labor hours per vehicle by 4 percentage points.

This analysis shows clearly that the labor needs of manufacturers will shrink over the long term as the industry moves toward pure BEV production. However, during this transition process, many automakers are increasing the share of hybrid electric vehicles in their product mix, which might lead to a rise in labor hours in the medium term. This increase in labor needs will be temporary, however, and automakers will need to use this transition to BEV production to plan strategically to either in-source or downsize their workforces.

Preparing for the BEV Future

BCG’s analysis of the ICEV and BEV production environments—how they differ and how those differences will affect labor needs across the automotive value chain as BEV adoption increases—shows the need for automotive companies to reevaluate their operations. They will need to make three crucial decisions:

What to Produce. Our study shows that, despite the elimination of engine manufacturing in BEV production, total labor hours across the automotive value chain to assemble an electric vehicle will be on par with ICEV manufacturing, primarily because of the requirements of battery cell manufacturing. That will shift much of the value of BEVs to large Asian players already dominant in the area of battery cell manufacturing.

Established OEMs may find it difficult to overcome the high entry barriers to battery cell manufacturing, such as the need for expensive equipment and chemical skill sets that automakers do not have. But they must begin considering their response to the value-added shift that the addition of batteries represents, including revised make-or-buy strategies, joint ventures, and strategic workforce planning.

Workforce deployment will be a critical facet of this transition. As labor needs change along with shifts in production and supply chains, automotive companies will have to conduct extensive strategic workforce planning to evaluate the impact of the shift to BEVs on their workforce and to identify which employees can be requalified to stay at their current or similar jobs, internally transferred, or let go. For example, retraining may be required for autoworkers who lack the skills for handling potentially hazardous high-voltage BEV parts. In addition, if labor reductions are required, automotive firms will have to decide how to implement them—through attrition, severance packages, or early retirement buyouts. There is a huge wave of change ahead in many industrialized nations as automation, digital manufacturing, new factory processes, and new types of products and materials increasingly play a bigger role. For automakers, leveraging and balancing those elements smartly will be key to mastering the transition.

Where to Produce. With the emergence of BEVs, OEMs and suppliers will need to make consequential decisions about their global factory footprints, taking labor costs, logistics expenses, time constraints, and local regulations into account. Some elements of BEV production will almost certainly require a greater number of localized production networks. For instance, an OEM that decides to assemble battery packs in-house will need to set up this activity near the automobile assembly plant because of the logistics headaches of moving heavy batteries full of potentially hazardous chemicals.

To a large degree, suppliers’ footprints will depend on where OEMs establish their BEV factories. Not only is it more efficient for suppliers to locate their plants close to their customers, but with global regulators and the auto industry increasingly focused on reducing cradle-to-grave emissions—that is the total emissions generated by a vehicle from manufacturing through disposal—producing battery cells using the least amount of energy for assembly and logistics will be a priority.

How to Produce. Faced with a transformation in their product lines unlike any they have seen in recent history, automotive companies must devise strategies enabling them to continue producing ICEVs and parts in the short term, while preparing for a massive changeover to BEVs in the near future. OEMs have to decide whether to integrate BEVs on the same assembly lines as ICEVs or build BEV-only production setups—a decision that rests on, among other things, expected volume. While BEV volume growth remains uncertain, flexible cell manufacturing, could be a promising approach to improve flexibility and resilience because it eliminates time losses even as product variance increases.

The shift to BEV production will require new investments in manufacturing and, hence, is an opportunity to also integrate the latest factory of the future principles, including increased use of automation and artificial intelligence . For example, when retrofitting its Zwickau, Germany, plant for BEV production, Volkswagen increased the automation on its assembly line from 17% to 28%.

As BEV volumes grow, automotive companies should continuously reevaluate their operations strategy, including workforce management, manufacturing footprint, and technology investment. While transformation is always risky, the emergence of the electric car may be just what OEMs and suppliers need in order to shake off complacency and explore avenues that could provide real gains.

About BCG’s Innovation Center for Operations

BCG’s Innovation Center for Operations

is an ecosystem for exploring the factory of the future. The ICO’s objective is to support all operational functions, including manufacturing, engineering, and supply chain management. We offer a variety of resources, facilities, and expertise in support of Industry 4.0 implementation. Among these resources is a network of Industry 4.0 model factories in multiple locations. The model factories, which BCG makes available in collaboration with best-in-class partners, allow clients to experiment and assess Industry 4.0 solutions—such as collaborative robots, 3D printing, augmented reality, and big data—with real assembly and production lines and machines that demonstrate new technologies. Additionally, BCG experts can bring the ICO’s mobile labs directly to client sites to demonstrate potential impact and opportunities. The ICO seeks to improve companies’ competitive advantage by helping them realize benefits in productivity, quality, flexibility, and speed. The center reinforces our commitment to innovation, Industry 4.0, and the use of advanced technologies in operations.