This article is part of a series of publications offering practical guidance on business ecosystems. Other installments address more key questions: “ Do You Need a Business Ecosystem? ” “ How Do You Design a Business Ecosystem? ” “ How Do You Manage a Business Ecosystem? ” “ How Do You Succeed as a Business Ecosystem Contributor? ”

We are in the midst of a paradigm shift in the way businesses are organized. The traditional model of the integrated firm with its hierarchical supply chain is increasingly being replaced by business ecosystems, dynamic groups of largely independent partners that work together to deliver integrated products and services.

Most of today’s business ecosystems are built around digital platforms . Our smartphones, smart cars, and smart homes are powered by ecosystems of hardware suppliers and application developers; we increasingly order our food, transportation, and accommodation on digital marketplaces; and industrial companies are revolutionizing the way they collaborate by moving to IoT platforms.

Such collaborative networks are also playing an increasing role in addressing the world’s biggest challenges. This was impressively demonstrated during the early days of the COVID-19 crisis, when scores of new ecosystems emerged to coordinate health care services and balance utilization, to offer 3D printing capacity to produce medical equipment, to develop smartphone applications for virus tracking and protection, and more.

There are good reasons for the success of the ecosystem model: in an ecosystem’s startup phase, this model can quickly provide access to capabilities that may be too expensive or time-consuming to build within a single firm. Once launched, ecosystems can scale much faster than an individual business because their modular structure makes it easy to add partners. Moreover, ecosystems are very flexible and resilient; their modularity enables both high variety and a high capacity to evolve. Given all these advantages, it is no surprise that startups and established companies are rushing to build their own platforms and ecosystems .

However, there is a hidden and inconvenient truth: most business ecosystems fail. Research by the BCG Henderson Institute found that fewer than 15% were sustainable in the long run. If we want to harness the power of the ecosystem model, we need to understand not only the reasons for success but also the reasons for failure.

If we want to harness the power of the ecosystem model, we need to understand not only the reasons for success but also the reasons for failure.

The stakes are high. According to data from Preqin, in recent years $100 billion has been invested annually in venture capital funds. Based on an analysis of individual financing rounds above $250 million, we estimate that 60% of these investments went into digital platforms and ecosystem business models. If we assume a failure rate of 85% for these ecosystem investments, more than $50 billion of capital is lost every year. And this does not include the failed investments of incumbents that try to emulate the ecosystem model.

To understand how to improve the odds of success, we studied more than 100 failed ecosystems in a variety of industries and compared them with their more successful industry peers, using a systematic quantitative and qualitative analysis. We identified an ecosystem as a failure if it was dissolved, shrank to an insignificant market share, or was acquired for an amount substantially below its initial funding. Our database contains B2C, C2C, and B2B ecosystems and includes social networks, marketplaces, and software solutions as well as payment, mobility, entertainment, and health care services. On average, the ecosystems we studied had existed for 6.8 years and had raised funding of $185 million.

Here we summarize the findings and conclusions from our analysis, answering the following questions:

- Why are successful ecosystems so rare?

- How do ecosystems fail?

- When do ecosystems fail?

- What can you do about it?

Why Are Successful Ecosystems So Rare?

Ecosystems and digital platforms challenge traditional ways of thinking about strategy. Boundaries between industries are dissolving as ecosystems span sectors and incumbents are attacked by tech players and platforms that they had never considered competitors before. Boundaries between companies are dissolving, too, as the value the ecosystem creates must be shared among multiple partners and physical assets are increasingly separated from value capture.

Being successful in such a world requires a new mindset. Organizations need to move from controlling internal resources to orchestrating external resources, from erecting competitive barriers to engaging vibrant communities, and from hierarchical control to collaboration and persuasion.

Conventional management education does not prepare us well for success in ecosystems, and experience with traditional business models may be outright misleading.

Conventional management education does not prepare us well for success in ecosystems, and experience with traditional business models may be outright misleading. Designing a successful business ecosystem poses multiple challenges . For example, it is not enough to design the value creation and delivery model; the design must also explicitly consider value distribution among ecosystem members, and this requires a systems perspective. At the same time, ecosystems cannot be entirely planned and designed; they also emerge and continuously evolve. This adaptability is one of their major strengths. So ecosystem design must ensure that the basics are in place and strategic blunders are avoided, but it must also leave room for creativity, serendipitous discoveries, and emerging customer needs. Ecosystems that are successful in the long run need to be ready to modify their design in anticipation of shifts in markets, technologies, regulations, and public sentiment.

Managing a business ecosystem also presents distinct strategic challenges: solving the chicken-or-egg problem of building supply or demand during launch; preventing the explosion of costs during scale-up, which can be very fast when network effects kick in; protecting quality during fast growth; and defending against competitors that use the low entry barriers of many digital platform models to copy and improve your model and encourage your complementors or users to multihome or even fully switch their allegiance.

The failure of ecosystem-based business models tends to be particularly costly.

The stakes are high because the failure of ecosystem-based business models tends to be particularly costly. Many ecosystems are driven by strong direct or indirect network effects and have winner-takes-all characteristics. They may require substantial upfront investments to build the platform and attract a critical mass of suppliers and customers, but once they take off, they can scale very fast and at low marginal cost. Focusing on scale before focusing on profitability, then, can be justified, but this means that failure becomes apparent only after a significant delay. According to PitchBook, out of the more than 100 companies worth more than $1 billion that have gone public since 2010, 64% were unprofitable at the time of listing, including ecosystems such as Uber, Lyft, Snapchat, and Spotify.

These challenges are exacerbated by the current hype around ecosystems. Herd behavior fosters shallow imitation and the transfer of successful models to locations or domains where they do not apply. And the abundance of cheap venture capital has perhaps supported some questionable investments in zombie businesses that have no inherent right to survive.

Given all these factors, it is no surprise that most ecosystems fail, destroying much value along the way. To address these challenges, we need to learn from failure, better understand its root causes, and identify the traps.

How Do Ecosystems Fail?

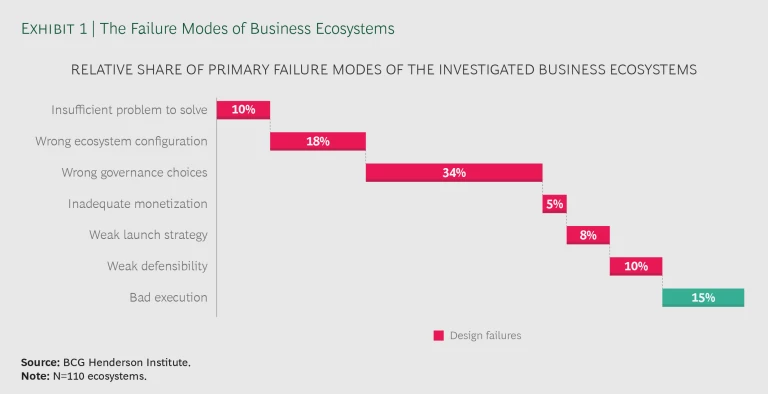

Of course, business failure is always the consequence of a multitude of external circumstances and internal decisions. When we analyzed in detail the failed ecosystems in our database, we could identify patterns that allowed us to assign a primary root cause to each failure. In this way, we uncovered seven fundamental failure modes. (See Exhibit 1.)

Remarkably, six of the seven failure modes—and 85% of observed failures—related to weaknesses in ecosystem design, while only 15% were attributable to bad execution. Occasionally, the design failures were strategic blunders in the initial design of the business ecosystem. But more frequently, they were due to insufficient adaptation of ecosystem design as technological or market conditions changed.

The failure mode strongly depends on the context of the given business ecosystem, such as its industry, ecosystem type, or stage in the life cycle. To elucidate these factors, we will discuss the seven failure modes in turn.

Failure Mode 1: Insufficient Problem to Solve

Among the ecosystems in our database, 10% failed because they did not address a problem that was substantial enough to justify the high upfront investment and to convince partners and customers to join the ecosystem. An ecosystem’s value proposition is a function of the size of the market friction it addresses, the share of the friction that can be eliminated by the ecosystem solution, and the willingness of customers to pay for it.

Many ecosystems that were shipwrecked by this failure mode were B2B platforms that failed in the early 2000s. Encouraged by the success of B2C marketplaces like eBay and Amazon, many companies tried to transfer this model to the B2B space, building marketplaces for automotive parts, paper, chemicals, and other supplies. However, most failed because they did not realize that the underlying problem of high transaction costs in B2C was not as pronounced in B2B transactions. Most industrial buyers knew their more limited range of potential suppliers very well and had optimized their relationships with them. The new B2B marketplaces did not add much value to the transaction, but only shifted value from suppliers to buyers because of increased transparency and competition, reducing the incentive of suppliers to join the platforms and leading to their demise.

We currently observe a resurgence of B2B marketplace models, such as XOM Materials, CheMondis, and Convictional, that focus on more-substantial problems in B2B transactions: supply chain coordination, data analytics, and other advanced value-added services.

Failure Mode 2: Wrong Ecosystem Configuration

Assuming that an ecosystem has found a substantial problem to solve, the next challenge is to configure the ecosystem to deliver the targeted value proposition. This involves defining the required activities and partners, their responsibilities, and the links among them, and assigning roles to various partners—in particular, the role of orchestrator, which coordinates members, defines standards and rules, and arbitrates conflict. The initial configuration should focus on the core value proposition and incorporate the minimum number of partner types required for its delivery.

Among the ecosystems in our database, 18% stumbled at this stage. Most were solution ecosystems that involved multiple suppliers and complementors that needed to work together to develop and provide complex products or services. They failed mainly because they could not align all required innovations or because they could not convince all required contributors to join the ecosystem.

An example is the Sony e-reader, which came to market earlier than Amazon’s Kindle but never managed to establish a successful ecosystem. Sony built a complex blueprint that required customers to purchase e-books online and manually upload them to the e-reader. Because of the open upload mechanism, publishers worried about copyright infringement and hesitated to join the ecosystem. By contrast, Kindle established an integrated ecosystem configuration that allowed users to automatically load content from Amazon and precluded the transfer of books to any other device or to a printer. Sony left the e-reader market in 2014, while Amazon became the market leader.

Failure Mode 3: Wrong Governance Choices

The most prevalent failure mode in our database—responsible for more than a third of the ecosystem failures we studied—was wrong governance choices. The governance model is a critical design choice for an ecosystem because it replaces the hierarchical forms of control in traditional vertical supply chains with indirect forms of control appropriate to the complexity and dynamism of an ecosystem. Governance establishes the standards, rules, and processes that define an ecosystem’s formal or informal constitution. Specifically, it needs to regulate access (Who can become a member of the ecosystem and under what conditions?), participation (How are decision rights distributed among ecosystem partners?), and commitment (What level of ecosystem-specific investments and cospecialization is required?).

The biggest challenge in ecosystem governance is finding the right level of openness.

According to our analysis, the biggest challenge in ecosystem governance is finding the right level of openness. More-open ecosystems can benefit from faster growth, particularly around launch. They enable a greater diversity of participants and variety of offerings and encourage decentralized innovation. However, they are difficult to control. In the case of high failure cost, and a corresponding need to limit the downside, more-closed ecosystem governance may be the better choice because it allows for a more deliberate design of the ecosystem and for closer control of partners and of the quality of the offering.

We found that social networks were particularly prone to missing the right level of openness. Most of them failed because they opted for a high degree of openness in an attempt to quickly increase the number of users. They tended to underestimate the wisdom of a more closed approach, which can increase the quality of interactions and the perceived value of the network. Facebook got this right by starting with a very strict governance model that allowed users to view only people who went to the same school. Only after the network had established itself as a valuable ecosystem did it gradually increase its openness.

We also found an especially high rate of governance failure among ecosystems that tried to emulate successful models or transfer them to other domains or locations. Competitive pressure frequently forced these copycat ecosystems to differentiate from existing solutions. For example, Google made several attempts to establish a social network, as a latecomer to this market. Google+ used an asymmetric following model similar to Twitter’s, in which one party can unilaterally establish a relationship to another. Initially, this led to strong growth, but user interactions were not considered very valuable, and users left the platform. Similarly, Orkut was designed very openly, with features that let you know when other people visited your profile. Users did not appreciate this lack of privacy, and the network went offline in 2014.

Failure Mode 4: Inadequate Monetization

Ecosystem monetization strategy defines what to charge and whom to charge. The orchestrator must balance the three competing objectives of increasing the overall size of the pie, enabling all important groups of ecosystem partners to earn a decent profit to ensure their ongoing contribution, and capturing its own fair share of the value. Effective monetization encourages and incentivizes participation by, for example, subsidizing the side of the market that is less willing to participate, charging for transactions rather than access, or offering rebates for increased usage.

Although inadequate monetization strategies were the primary reason for failure in only 5% of the investigated cases, this failure mode was particularly prevalent among B2C marketplaces. For example, eBay closed its operations in China in 2006 after realizing that charging for transactions, a model that served the company well in the US and Europe, was not accepted by Chinese consumers, who could benefit from cost-free transactions on the competing Taobao platform, which was financed by advertisements. Similarly, Table8, a platform for last-minute reservations in sold-out restaurants, failed because it charged customers, while competitors like OpenTable, Quandoo, and Bookatable succeeded by charging only restaurants for their reservation service.

Failure Mode 5: Weak Launch Strategy

A strategic challenge for many business ecosystems during launch is to solve the chicken-or-egg problem of securing enough participation from both buyers and suppliers. The goal is to achieve a critical mass for network and data flywheel effects to kick in, whereby scale begets further scale. Success factors include focusing first on the core value proposition and building a minimum viable ecosystem around it that can be expanded over time; emphasizing building a dense network rather than a large network in order to improve the quality of interactions; and focusing investments on the side of the market that is more difficult to convince to join the ecosystem (most ecosystems we observed were initially supply-constrained).

More than two thirds of the failed ecosystems we investigated struggled with solving the chicken-or-egg problem. However, as previously discussed, there can be many reasons for this, such as the wrong configuration or governance or monetization model. In 8% of the cases, a weak launch strategy was the primary reason for failure. This failure mode is particularly prevalent among solution ecosystems that require large investments from members, and among transaction ecosystems with only limited barriers to entry or high numbers of existing competitors.

An example of a failed solution ecosystem is the HD-DVD platform (an ecosystem led by Toshiba, Microsoft, and others), which lost the standards war of high-definition DVD players to the Blu-ray platform (backed by Sony, Apple, and others). Neither standard was technically superior to the other, and the HD-DVD ecosystem won the battle to sell more DVD players to consumers. However, Blu-ray ultimately prevailed because it secured the exclusive support of large film studios such as Warner Brothers and Fox Searchlight Pictures.

Uber China is an example of a transaction ecosystem that failed because it could not solve the chicken-or-egg problem in the highly contested Chinese ride-hailing market. The company managed to lure drivers and riders to its platform, but only at the cost of permanently subsidizing both sides of the market, resulting in substantial losses. Uber was not embedded enough in the Chinese mobile app landscape to achieve critical mass and finally sold its Chinese business to its competitor Didi.

Failure Mode 6: Weak Defensibility

Ecosystems that solve the chicken-or-egg problem frequently enjoy winner-takes-all effects. Once they have achieved a dominant market position, strong barriers to entry can result from network effects and scale advantages on costs and data. However, we still identified 10% of ecosystems in our database that went down because they did not build effective defenses into their design.

The failed ecosystems suffered from one or several of the following five basic mechanisms of attack: multihoming (suppliers or customers participate in multiple competing ecosystems at the same time or easily switch between ecosystems), disintermediation (partners from two sides of a transaction ecosystem bypass the matching platform and connect directly), differentiation (a subset of users has distinctive needs or tastes that can support a separate ecosystem that takes away market share from the dominant player), ecosystem carryover (a successful business ecosystem expands into a neighboring domain), and backlash (from incumbents, consumers, suppliers, or regulators that challenge the business model or practices of the ecosystem). Successful ecosystems respond to these threats by designing user lock-in into their models, incentivizing customer and supplier loyalty, increasing switching costs, and designing their ecosystems not only for legal compliance but also for long-term social acceptance.

We found weak defensibility as a primary failure mode to be particularly prevalent within highly regulated industries and among ecosystems with a high incentive to multihome. For example, from 1974 to 2006, Bankcard was the leading credit card ecosystem in Australia and New Zealand, managed by a joint venture of Australia’s leading banks. However, once MasterCard and Visa entered the Australian market, Bankcard was not able to defend its leading position because of its purely local footprint. Similarly, StudiVZ was the leading social network in German-speaking countries, with more than 15 million members in 2009, but did not manage to defend its position when Facebook entered the European market with a superior value proposition and a global footprint.

Failure Mode 7: Bad Execution

We were surprised to find that only 15% of ecosystems failed because of execution issues. In some cases, the problems were operational, as in the case of Canvas Networks, a social network that allowed users to share and play with images and had to close because members of the community lost access to their artwork after a hacker attack. In other instances, failure could be attributed to management action, as in the case of Wikimart, a heavily funded marketplace that aspired to become the Russian version of eBay but went down after a series of questionable acquisitions of unprofitable retailers. Sometimes outright fraud contributed to demise, as in the case of Auctionata, a popular online auction platform that was among the first to develop the concept of livestream auctions but had to shut down after allegations that the company supported shill bidding on selected items.

A final source of bad execution that we uncovered was complacency. An example is Microsoft’s Internet Explorer, widely considered to have won the browser war after capturing close to 95% market share in 2004. With no serious competitor left, Microsoft underinvested in further development of the browser and its underlying ecosystem, which allowed Firefox and Chrome to enter and eventually dominate the market.

When Do Ecosystems Fail?

The nature of many ecosystems—with their highly attractive winner-takes-all characteristics based on strong network effects that justify persistent investments and loss-making to achieve a dominant position—implies that failure may become apparent only late in the ecosystem’s life cycle and can thus be very costly.

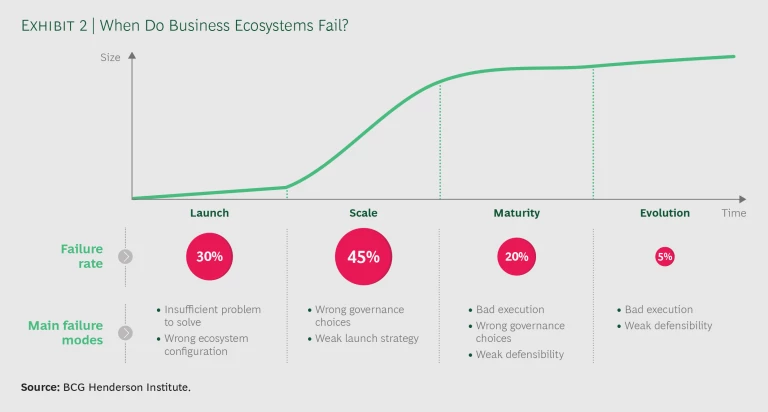

The typical life cycle of an ecosystem can be divided into four phases with specific jobs to be done and corresponding success factors:

- The launch phase, with a focus on developing a strong value proposition for all participants and on finding the right initial ecosystem design.

- The scale phase, with a focus on increasing the number and intensity of interactions in order to grow toward a dominant market position.

- The maturity phase, with a focus on increasing the loyalty of customers and suppliers, and on erecting barriers to entry for competitors.

- The evolution phase, with a focus on expanding the offering and on continuous innovation to thrive and survive in the long term.

Our analyses confirm the assumption that ecosystems tend to fail late: seven out of ten failed ecosystems in our database made it into the scale phase before flaws in their design materialized and led to their demise. (See Exhibit 2.) And even those 30% of ecosystems that failed during launch achieved a median survival time of 3.5 years while burning $16 million of investors’ money. Most of them failed because they could not address a large enough problem or establish an effective configuration (failure modes 1 and 2).

Of the ecosystems in our study, 45% failed during the scale phase, most of them because they could not solve the chicken-or-egg problem of bringing a critical mass of all required sides of the market to their platform. Detailed analyses revealed that this was mainly due to the wrong level of openness in their governance or a weak launch strategy (failure modes 3 and 5).

The maturity phase was the point of downfall for 20% of the ecosystems in our database. At the point of failure, they had received a median amount of $79 million in funding and survived for five years. The most prevalent root cause of failure was execution issues (failure mode 7), but design flaws in governance and defense also explain half of the downfalls (failure modes 3 and 6).

Finally, only 5% of ecosystems failed in the evolution phase, after successfully establishing and defending their leading position for an extended period, with a median survival time of 25 years. However, they neglected to continuously adapt, advance, and reinvent the ecosystem and failed because of execution issues or because they did not adjust their defense mechanisms to the changing environment (failure modes 6 and 7).

What Can You Do About It?

Business ecosystems, in particular those built on digital platforms, are a relatively new phenomenon. Traditional management concepts of industry analysis and value chains are insufficient if we want to master the ecosystem model. Many founders, managers, and investors had to learn this the hard way. Their experience should humble us and make us realize the limits of our understanding. However, we should also learn from their failures.

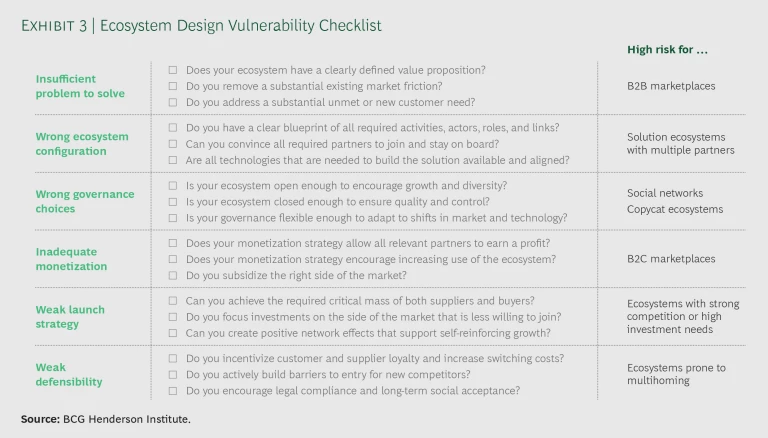

If you are a founder, manager, or investor and are considering building or joining a business ecosystem, you can learn from these insights and increase the odds of success. Our checklist can help you assess the vulnerability of your ecosystem design. (See Exhibit 3.)

Of course, business ecosystems cannot be entirely planned and designed in advance. The only way to succeed in the long run is to be adaptable and modify the design in anticipation of shifts in markets, technologies, regulations, and public sentiment. Nevertheless, our list of questions can help you regularly challenge the viability of your model. If not all answers are positive, you may need to adapt the design of your ecosystem—or accept that it is time to pull the plug rather than burn more money.