Australia faced the unprecedented crisis of COVID-19 with a clear and collaborative response on all fronts, putting us in a better position than many other countries. While the health challenges are flattened for now, different sectors of the economy are experiencing vastly different impacts. As of today, our governments, businesses and the community face a future that is uncertain but also one that presents opportunity.

BCG has analysed the impact of the crisis on different sectors of the Australian economy. The result: all is not equal. The economic impacts vary significantly by sector, as will the shape of recovery. While macroeconomic reform and collaboration at a national level can underpin Australia’s economic growth for another 30 years, the most tangible message that emerges from our analysis is that, even within an individual sector, companies can take specific actions in response to COVID-19 that will see them outperform their peers.

AUSTRALIA HAS RESPONDED WELL TO THE CRISIS SO FAR

Australia has come through the initial wave of the virus better than many countries, thanks to some strong policy decisions, compliance with social distancing measures, and some geographic good fortune. However, our recovery will be linked to global fortunes given the proportion of trade and tourism in Australia’s economy.

The political and social response to the crisis was fast. The National Cabinet was formed quickly and first met on 15 March. From then on, the PM worked closely with the State Premiers and Territory Chief Ministers, and together they took some smart early decisions to close borders, restrict movement, put medical experts at the centre of the response, roll out widespread testing, and deploy contact tracing through mechanisms such as the COVIDSafe app. Our social cohesion, and trust in each other and in government, meant compliance with and respect for social distancing measures has been excellent and it is clearly working.

Australia’s robust universal health system grants citizens the ability to seek medical help without entering financial hardship. Strong public health capabilities at the state level, and the tracing and tracking component of our early response, were also significant factors. Australia could also draw on its history of public health responses and past success at limiting the spread of disease in Australia, from localised measles outbreaks to Ross River virus, and our effectiveness at managing the HIV/AIDS pandemic.

Australia also responded quickly on the economic front, with unprecedented government–business collaboration to support economic and social recovery: the Treasury established a business liaison unit; leaders of peak business and employee groups worked with relevant Ministers and senior government officials, business sector working groups supported the national emergency management process; and the Prime Minister established a National COVID-19 Coordination Commission (NCCC) to look at issues critical to response and recovery.

The Government was also quick to announce significant stimulus to accelerate the speed and depth of economic recovery. The JobKeeper and JobSeeker programs aimed to alleviate pressure on businesses and employees, and the JobMaker program will continue collaboration between government and industry groups to seize this once-in-a-generation opportunity for positive economic and social reform.

WE HAVE THE BASIS TO RECOVER, BUT THERE’S NO TIME FOR COMPLACENCY

Australia’s economy has some clear assets that should set it up to recover faster and more strongly than the rest of the world. As the country begins to re-open, the number of active COVID-19 cases per million people is lower than most other developed countries in the world, and transmission rates are also low. Restrictions are starting to loosen, and consumer confidence is rising faster than in other geographies with tighter social distancing measures.

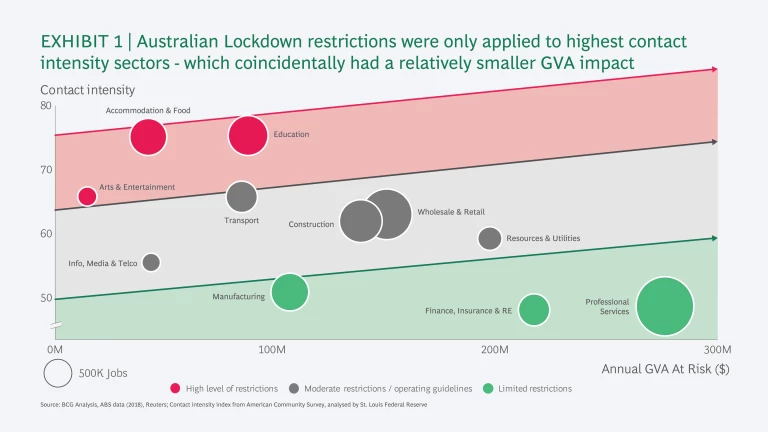

Australia’s lockdown only applied in full to a few sectors, such as Accommodation & Food, Education, Arts & Entertainment and, even then, not in all states. Other sectors were subject to additional operating guidelines. In contrast, many jurisdictions (e.g., New Zealand, most of Europe) imposed much stricter lockdown restrictions that affected all sectors.

In construction and mining, two sectors that represent almost 15% of Australia’s country Gross Value Added (GVA) per year, government guidelines allowed for companies in these sectors to continue operating without sacrificing health and safety outcomes. While social distancing appears to have reduced productivity, especially in more physically constrained construction sites, the continued operation of these industries has been a significant benefit to the nation’s economic health during the worst of the crisis. In other countries where these sectors also represent a large share of GVA, the sectors faced stricter lockdown impacts and these economies were hit harder as a result.

Australia’s strong ties with Asia are also a strength. Most Asian countries have fought the disease well and are in more advanced stages of restart than the rest of the world. There are chances that an earlier and more dynamic recovery in Asia would also fuel Australia’s growth, given our close trade ties and the historically higher growth rates of those regions.

But securing a bright future for Australia will rely on more. Beyond Asia, Australia is tightly integrated in the global economy and dependent on the rest of the world for a full recovery. With our growth fuelled by exports of materials and services, the shape of Australia’s economic recovery is likely to be heavily influenced by the shape of the global economic recovery, our ability to avoid or contain future waves of the virus, and whether Australia and its trading partners can resist the lure of protectionism.

Three decades of growth have masked rising structural impediments to productivity and innovation, which are potential barriers to the next three decades of growth and prosperity. Businesses, industries and government are at a critical cross-road – if we make the wrong choices, and don’t act now, the chance for economic rebound could be lost to Australia.

ECONOMIC REFORM WILL SET AUSTRALIA UP FOR THE NEXT ERA OF PROSPERITY

This crisis is an opportunity to look at the root causes of these impediments and take actions that will both accelerate Australia’s recovery and unblock the barriers to our longer-term potential. Economic policy reform that focuses on higher productivity growth will support a return to low unemployment, improve industry competitiveness, secure Australia’s ability to attract foreign investment, invest in areas of comparative advantage, cultivate innovation and commercialisation, develop workforce capabilities, and make it easier for companies to do business. Changes to regulation, taxation, industrial relations and education will be needed to deliver these outcomes.

Digital and physical infrastructure investment will also help to pave the pathway to recovery. Public stimulus can be used for investments that will enhance productivity, encourage innovation and rebuild in ways that shift us towards a carbon-neutral future. As COVID-19 changes how we work, infrastructure investments can be balanced between digital connectivity, traditional modes of transport (such as road and rail), and infrastructure that increases local mobility (such as cycling, walking) to create more liveable cities as Australians find themselves working more remotely in the post-crisis world.

V, U OR L? HOW DIFFERENT SECTORS OF THE AUSTRALIAN ECONOMY WILL RECOVER

Looking beyond the macro level to how individual sectors will rebound, our analysis shows that some sectors will rebound fast, while others will face a much slower and more difficult recovery.

In Australia, social distancing measures have necessarily had the highest impact on sectors with high contact intensities, but these sectors also contribute lower to Gross Value Added (GVA). Exhibit 1 shows that there is an inverse correlation between the level of contact intensity in a sector and the GVA at risk from that sector. Critically though, many low GVA sectors employ large numbers of people, and a negative impact on the labour market in these sectors can have long-lasting and far-reaching consequences for the nation.

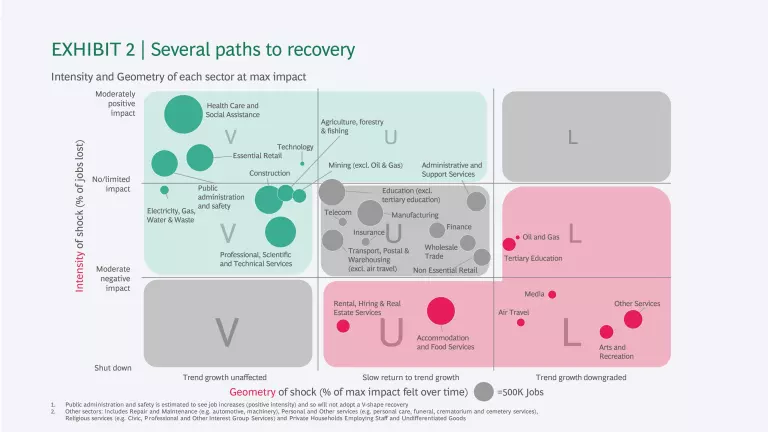

To consider how sectors are likely to recover, and whether they experience a V, U, or L-shaped recovery, we considered the contact intensity of each sector, as well as the broader set of conditions (e.g., customer demand impact from domestic and international perspectives; contribution to GVA; GVA per employee by sector level).

From there, we derived the intensity (job losses at the peak of the first wave of the crisis) and the geometry for each sector.

- In a V-shaped recovery, the sector experiences a fairly quick return to its original path

- In a U-shaped recovery, the sector experiences some permanent loss of output after the initial shock

- In an L-shaped recovery, the sector experiences structural damage with a significant impact on growth

Peak unemployment in Australia could reach around 13% in 2020. To explore this at the sector level, Exhibit 2 shows the intensity and the geometry of the shock for each sector in Australia.

Overall, we estimate that 50% of the working population are employed in sectors that will experience a V-shaped recovery (a fairly quick return). Around 32% of the working population are employed in sectors that will experience a U-shaped recovery (slow return and some permanent loss of output). Around 18% of the working population are employed in sectors that will experience a deeper U-shape recovery (very intense initial peak and some permanent loss) or an L-shaped recovery (deep structural damage). This includes Arts and Recreation Services, Media, Airlines, Tertiary Education, Accommodation and Food services. We assume JobKeeper aids economic recovery and it (or an alternative) continues if required in certain slow-recovering sectors to avoid a ‘second wave’ of unemployment.

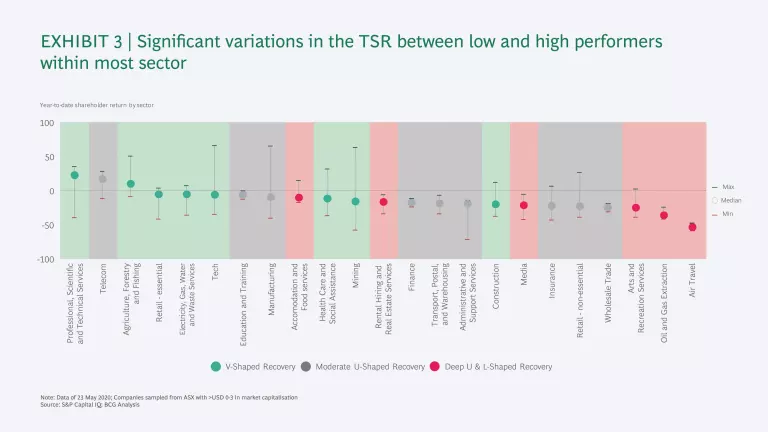

We also assessed how companies are performing using Total Shareholder Return (TSR) analysis. Exhibit 3 shows that companies in sectors that will experience a V-shaped recovery have an average TSR of -5%. Companies in sectors that will experience a U-shape recovery have an average TSR of -11%. Companies in sectors that will experience a deeper U-shape or L-shape recovery have an average TSR of -26%.

The analysis also shows significant variations in TSR between the low and high performers in most sectors (i.e., within a sector, some companies are performing well while others are not). This shows that a company’s performance is not necessarily dependant on how its sector recovers, and that other factors contribute to company-level TSR performance.

WHAT CAN COMPANIES DO TO RECOVER FASTER THAN THEIR PEERS?

If the crisis is affecting each sector differently, and sector recovery shapes differ as a consequence, then companies will need to respond with specific actions based on whether their sector is experiencing a V, U or L-shaped recovery.

In sectors with an L-shape recovery…aim for survival and resilience.

- Manage cash and liquidity: Identify liquidity risks. Set-up a liquidity war-room. Implement liquidity planning and reporting. Extend payment terms. Review and plan new Capex rigorously.

- Reduce costs: Look for continuous improvement for operational excellence to lower breakeven points.

- Re-invent your business model: Look at the sector to understand the fundamental business model re-invention and innovation needs.

Example: Qantas quickly raised $1 billion of funding to navigate fallout from the crisis. It entered a partnership with Woolworths to provide 5,000 of its 25,000 employees it had to stand down with work at the retailer. It also flagged $19 Jetstar fares between Sydney and Melbourne to stimulate passenger demand once domestic travel restrictions ease, along with its Fly Well program to provide passengers with peace of mind before flights and once they are on-board.

In sectors with a U-shape recovery…build a strong organisational immune system to deal with sustained cost pressure.

- Revamp your organisation: Prepare teams and people for work in the new normal. Get teams working productively with new policies and by engaging people. Empower managers to lead virtually. Shift to agile ways of working.

- Accelerate digital and technology transformations: Redesign processes and customer journeys by taking a customer view and with an emphasis on digital interactions. Build the technology platforms to support them. Identify new ways to meet changes in demand.

- Drive security and customer trust: Track and assess changes in customer behaviour. Adapt and transform channels (e-commerce), sales, marketing spend, pricing, and support in response.

- Capture value from rapid market shifts: Ramp up commercial efforts and strong digital capabilities.

Example: BCG’s REBEX survey measures the impact of COVID-19 on retail banking consumer behaviour in Australia. It found that after the crisis 25-30% of Australians expect to use digital banking channels more, and 15-20% expect to use physical channels less. This will force banks to accelerate their digital transformations and consider the mix of physical and remote support.

In sectors with a V-shape recovery...create an advantage.

- Increase vitality: Build the ability to innovate and explore new ideas. Re-invent your corporate strategy to focus on sustainable long-term growth. Seek out promising markets and concepts. Redesign development processes to get new ideas to market quickly.

- Adjust organisational resources: Plan and build workforce capabilities. Embed Agile working models to move faster and capture new opportunities.

- Consider M&A opportunities: Take advantage of low-valuation opportunities, particularly where liquidity distress could catalyse a transaction

Example: Grocery retailers around the world have experienced a well-publicised surge in sales during COVID-19, with a very significant spike in online demand. In Australia, both Coles and Woolworths have made significant investments in facilities, labour and partnerships to ramp-up their online capacity during COVID-19. Some measures are temporary, but others are likely to endure as both retailers recognise the importance of online to their competitive advantage. WooliesX online chief Amanda Bardwell stated recently that Woolworths now has a highly flexible and scalable way to meet the needs of many more online customers.

BUILDING A BETTER AUSTRALIA CALLS FOR COLLABORATION ACROSS ALL LEVELS

Today in Australia, we need to keep embracing this a once-in-a generation opportunity to drive reform and economic prosperity by changing how government and industry work together.

Already inside government, the slow-moving Council of Australian Governments (COAG) has been replaced by the National Cabinet that worked swiftly and effectively to make critical decisions during the crisis.

New, rapidly formed working groups extend outside government as well, where government and industry are coming together to solve problems and implement rapid solutions at a pace not seen before (e.g. joint tables between business and government, commissions, governmental coaches helping businesses to navigate between departments). These actions have facilitated the fast domestic production of critical medical and personal protective equipment, the alignment of safe work operating procedures, and ground-breaking industry and union collaboration in the recently announced JobMaker program. There are many more examples.

As a nation, we should look for ways to make this joint government and industry collaboration part of the new normal for how Australia succeeds in the decades to come.

Acknowledgments

The authors would like to acknowledge the many contributions to the research, writing and production of this report, including Eliza Spring, Jasmine Aurora, Cole Brown, Marissa Lynch, and Debbie Spears.

The authors would like to acknowledge the many contributions to the research, writing and production of this report, including Eliza Spring, Jasmine Aurora, Cole Brown, Marissa Lynch, and Debbie Spears.

The authors would like to acknowledge the many contributions to the research, writing and production of this report, including Eliza Spring, Jasmine Aurora, Cole Brown, Marissa Lynch, and Debbie Spears.