This article is a companion to the report A Guaranteed Opportunity in Programmatic Advertising , BCG Focus, February 2018, which assesses the worldwide market for the automated digital advertising process commonly known as “programmatic guaranteed.” Here we focus on the impact of programmatic guaranteed on buyers and sellers in the dynamic and fast-growing Asia-Pacific markets.

Programmatic advertising has been on a tear—for good reason. As more and more ad spending has moved online, the automated, or programmatic, processing of ad sales and execution has continued to gain share versus traditional methods because of the effectiveness and efficiency of programmatic models. The Asia-Pacific region, or APAC, is no exception. For the five markets we studied for this article (Australia, China, India, Japan, and a group of predominantly southeast Asian countries that use Singapore as a buying and selling hub), we estimate that the total digital display and video ad market will increase from $14.5 billion in 2017 to $19.0 billion in 2020 and that programmatic’s share will rise from 19% to 36% over this period.

The Power of Programmatic—Guaranteed

A fast-rising driver of this growth, which is commonly known as “programmatic guaranteed,” effectively replaces the manual execution processes involved in the premium inventory segment that is regularly used by brand campaigns. As with other programmatic processes, programmatic guaranteed is both more efficient and more effective than manual tag-based reservations. Advertisers, agencies, and publishers that are ahead of the curve are realizing big benefits, but full implementation of programmatic guaranteed requires a rethinking of the organization and its operations and systems.

Programmatic guaranteed brings the power of automation to direct reservations. Advertisers and agencies benefit from access to premium guaranteed inventory (as they do with traditional reservations)—and they can optimize for multiple campaigns, as well as manage frequency across programmatic and guaranteed reservation inventory. Publishers can lock in revenue through advance reservations, automatically update their forecasts, and automate billing and collections (saving time, for example, by not having to issue invoices and chase payments). In our study, which included 23 advertisers, agencies, and publishers from APAC, we found that the programmatic guaranteed process was more than 50% more efficient than traditional approaches for publishers and almost 30% more efficient for advertiser and agency buying teams. (See the sidebar, “About This Article.”)

About This Article

This article focuses on the differences in the digital advertising market between traditional direct reservations and the automated buying and selling process commonly known as “programmatic guaranteed.” By direct reservations, we mean the traditional process in which inventory is bought at fixed prices directly from media owners using offline insertion orders and manual methods to book and run campaigns. By programmatic guaranteed, we refer to guaranteed inventory that is bought at fixed prices directly from media owners, but in a process that uses programmatic software to execute transactions and deliver campaigns.

BCG has conducted several examinations of the benefits and challenges of the programmatic market for both buyers and sellers of digital advertising and of the effectiveness with which this marketplace functions. (See The Programmatic Path to Profit for Publishers, BCG Focus, July 2015; Efficiency and Effectiveness in Digital Advertising, BCG Focus, May 2013; and Improving Engagement and Performance in Digital Advertising, BCG Focus, September 2014.)

For this article, our research included 23 advertisers, agencies, and publishers in the APAC region. The participants had various levels of experience using programmatic guaranteed. Our research in APAC included 12 workshops and 12 telephone interviews among 17 agencies/advertisers and 7 publishers.

We used the lean-management method of value stream mapping to visualize and measure processes with 11 of the APAC participants. We considered the entire workflow, including deal setup (request for proposal, finalizing contracts and insertion orders, and campaign setup) and ongoing campaign management (reporting, optimization, and billing).

The research was commissioned by Google, and the findings were discussed with Google executives, but BCG is solely responsible for the analysis and conclusions.

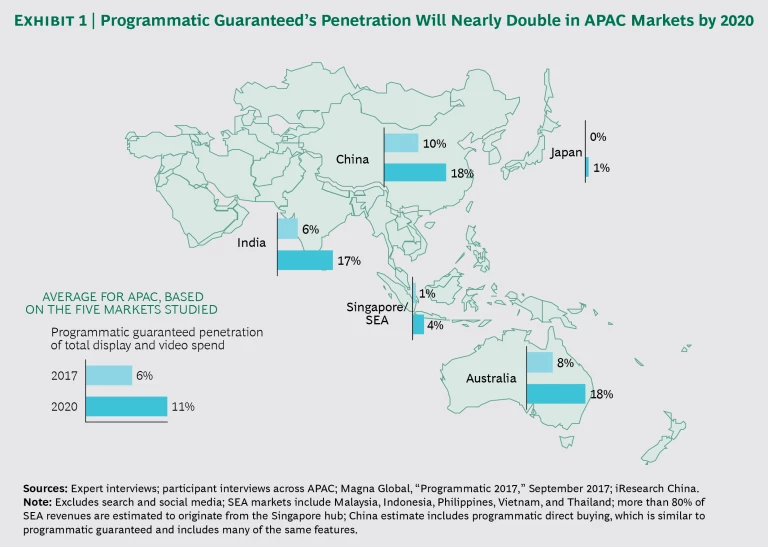

The diverse mix of countries in APAC means that programmatic guaranteed is playing out in different ways based on market dynamics, cultural factors, and technical expertise. Local advertisers, agencies, and publishers—as well as global players—face different challenges in each market as they look to take advantage of the latest developments in digital advertising technology. Overall, we estimate that the penetration of programmatic guaranteed in digital display and video ad activity across the APAC markets we studied will increase from 6% in 2017 to 11% in 2020. (See Exhibit 1.)

Looking forward, we see a number of factors that will affect the uptake of programmatic guaranteed:

- Markets with relatively high levels of programmatic expertise and familiarity with programmatic models of trading, such as China, are likely to see greater penetration and realize more benefits from consolidation of activity and the ability to optimize across campaigns.

- Markets in which buyers value control and transparency in ad placement, or where there is an undersupply of some segments (such as premium video in Australia), are more likely to consider programmatic guaranteed over other programmatic models.

- In countries where direct reservation processes are currently cumbersome and painful (such as payments in India or the lack of third-party ad serving in China), programmatic guaranteed may leapfrog the direct reservations approach to establish itself as the norm.

- Some markets need time to mature. In countries such as Indonesia and Malaysia, access to premium inventory, control, and transparency are seen as significant benefits. But lack of market education and a dearth of available partners on both the buy side (advertisers and agencies) and the sell side (publishers) are significant barriers in the near term.

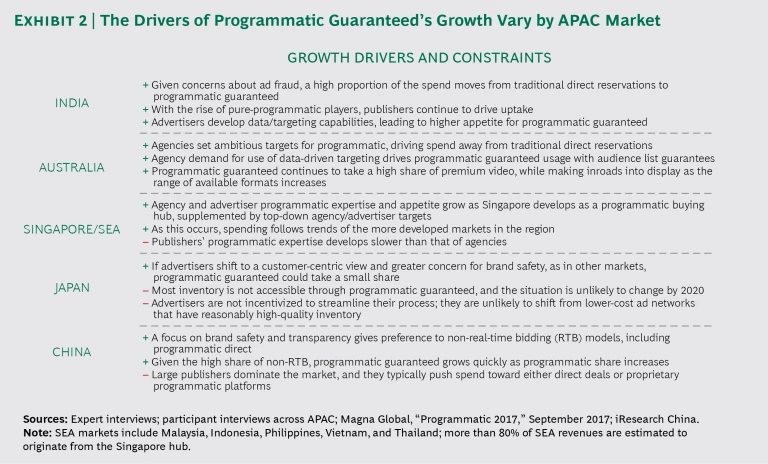

The following sections and Exhibit 2 give a market-by-market rundown of the current state of programmatic guaranteed, the factors affecting its penetration, and the implications for advertisers, agencies, and publishers.

Australia: Leading the Way

Australia, one of the most advanced programmatic markets in the world, is the clear leader in programmatic uptake among the APAC markets, with penetration of 53%. Australia is often used by global tech players as a test market. A significant undersupply of premium video inventory—some publishers are selling out a year in advance—draws attention to programmatic guaranteed. “In Australia, demand for video is greater than supply,” said an executive from Wavemaker, a media, content, and technology agency. “We want to ensure that we have a decent supply of quality media for our clients, so we use programmatic guaranteed to secure it in advance.”

Agencies and advertisers in Australia have set ambitious targets for increasing the share of programmatic and driving spending away from direct reservations, and we expect programmatic guaranteed’s share of the total digital display and video market (excluding search and social media) to increase from roughly 8% in 2017 to about 18% in 2020. “Programmatic will grow significantly and take share from direct, but the share held by programmatic guaranteed within programmatic will also grow,” said an agency executive.

Rising agency and advertiser demand for data-driven targeting is a primary driver of programmatic guaranteed usage. Programmatic guaranteed continues to hold a high share of video—undersupply makes the ability to secure inventory in advance more important—while making inroads into display as the range of available formats increases. This situation suggests that publishers should consider producing more content according to where advertising sells best (using a “pull” model as opposed to a “push” model). As one publisher observed, “Demand for ads on our sports pages is always higher than what we have available.” Given the current lack of supply, publishers should be looking for a way to create more premium video ad content.

Agencies and publishers now using programmatic guaranteed in Australia, where we conducted nine workshops, saw a 30% reduction in the time spent on campaign setup and execution, which is similar to the results achieved in other developed markets. Efficiency gains tend to have a greater impact in Australia than in other APAC markets because of the country’s relatively high labor costs.

At the same time, Australia’s media industry is highly consolidated and dominated by “old world” print and digital titles with legacy structures and processes, which impede players from realizing efficiency gains. Given the advanced state of the market in general and competition from digital natives, the traditional agencies, advertisers, and publishers need to tackle their legacy complexity.

China: A Seller’s Market

China’s large, traditional advertisers tend to focus more on brand and reach than on yield, so they see a guarantee of inventory as highly valuable. Large publishers, particularly the BAT trio (Baidu, Alibaba, and Tencent), dominate the market and typically push spending toward either direct deals or proprietary programmatic platforms. One result is that traditional reservations still hold a 75% share; programmatic holds 25%. Even within programmatic markets, non-real-time bidding models—used primarily by small and medium-size advertisers as a self-service platform for accessing publisher inventory directly—tend to predominate.

Another result has been the rise of uniquely Chinese hybrid solutions. One example is programmatic direct buying (PDB), which allows buyers to algorithmically select which impressions to run, within the normal definition of a guaranteed buy. We estimate that PDB has built a 10% share of market, mostly among small and medium-size advertisers. Their strong focus on brand safety and transparency means that advertisers favor non-real-time bidding models, as do publishers, for pricing reasons and to ensure that no inappropriate ads occupy the premium slots. Programmatic guaranteed should grow quickly as programmatic’s overall share increases. We expect programmatic guaranteed’s share of the total digital video and display market to increase from roughly 10% in 2017 to about 18% in 2020.

One of the big challenges for publishers in China is determining how to compete against the strong market position and data and analytics advantages of the BAT players. Agencies and advertisers need to ensure that they maintain access to high-quality inventory by working closely with the BAT platforms and building strong relationships with other publishers. They can also push publishers to deliver more transparency (by enabling third-party ad serving, for example, and the use of metrics such as viewability).

As more advertisers move to programmatic guaranteed, competition for premium content will heat up, driving up prices and reducing availability. Because a large proportion of growth will come from mobile, accessing premium-quality mobile inventories will be an especially hot battle. Advertisers need to ensure that they stay ahead of the game and maintain strong relationships with publishers. They also need to increase their data and tech capabilities, either in house or by working with reliable partners, especially as the BAT trio moves toward more data- and tech-driven operating models.

India: Potential to Leapfrog?

India is a study in contrasts. On the one hand, while programmatic has built a 41% share, adoption of basic ad tech (such as ad serving and the use of third-party trackers) is low. On the other, some players are pushing advanced techniques and appear to be leapfrogging directly to sophisticated models such as programmatic guaranteed. Although the barriers are high, early positive results by a few prominent companies could lead to a snowball effect.

Publishers are driving uptake. One company already sells 20% of its inventory through programmatic guaranteed, and the rest through other automated processes. Because it operates without legacy restrictions, the company saw significant efficiency gains. “Not that many media partners have gotten into programmatic yet,” observed a publisher executive, “but they’re increasingly open to it.”

Overall, programmatic guaranteed’s share in India should increase from about 6% in 2017 to about 17% in 2020. Among publishers, we see some programmatic-only players emerging, but the scarcity of high-quality user data, combined with minimal user attribution (owing in part to high mobile versus desktop usage), remains a significant barrier. Advertisers and publishers need to invest in improved data capabilities to fully benefit from the data-driven targeting that is made easier with programmatic guaranteed. As advertisers and their agencies develop better data and targeting capabilities, the appetite for programmatic guaranteed will grow. Moreover, as spending moves away from direct, many participants will move to programmatic guaranteed because of concerns about ad fraud and their lack of experience with other programmatic types.

Programmatic expertise varies widely in India, and advanced users could speed market development by bringing their partners along on the journey. “The barrier is talent,” an agency executive told us. “You need people to explain to media owners how programmatic works.” Programmatic execution teams should invest in (or bring over from the direct ranks) expertise to help with the additional troubleshooting that is often involved in richer media and video, particularly in the early stages. As the premium video market grows (in terms of the diversity of media owners that supply it), we expect a significant undersupply at first. Publishers should look for ways to hasten the transition from display to video.

Japan: Low Penetration

Programmatic guaranteed has low penetration in Japan for several reasons. Advertisers focus heavily on the number of clicks ads generate and on last-click attribution as key metrics. They put less weight on viewability or brand awareness. In addition, four publishers control an estimated 70% of the direct reservations market, and they do not make their inventory accessible via programmatic guaranteed, a situation that is unlikely to change without significant pressure from advertisers. But advertisers are unlikely to shift from lower-cost ad networks that have reasonably high-quality inventory.

One global advertiser summarized the Japanese market this way: “The benefits of programmatic guaranteed overseas do not apply in Japan. Although there is a lot of prime traditional reservations inventory overseas, there is not much good inventory in Japan.” We expect only slight penetration—to 1% or 2% of the market—by programmatic guaranteed over the next few years. Programmatic generally has only a 20% share.

Still, advertisers need to shift their focus from a bottom-of-the-funnel retargeting toward the use of digital media for more of their premium and branding campaigns. They could become more sophisticated in their use of audience data to deliver targeted campaigns across the customer journey, as opposed to going purely for last-click conversion. They could also become more sophisticated in their choice of KPIs. (Does it make sense for their brand to focus purely on clicks or cost per click, for example? What about awareness, ad recall, and reach-based metrics?) Advertisers should consider whether their current approach gives them sufficient control over brand safety. Publishers should consider how to better monetize their sites. Premium display and video inventory today is limited.

Singapore and Southeast Asia: Room to Grow

Singapore is an established regional hub of programmatic activity for a group of nations that includes Malaysia, Indonesia, the Philippines, Thailand, and Vietnam. The Interactive Advertising Bureau, among other entities, offers training for Asia-based advertising professionals there, and Singapore itself provides tax incentives to encourage businesses to centralize their regional ad buying in the city-state.

Most agencies in the countries served by the Singapore hub are building their capabilities, as advertisers slowly but surely move toward programmatic buying. We have seen programmatic maturity increase in Malaysia, and Indonesia and Thailand will follow. The Philippines and Vietnam are so far the least developed. Overall, programmatic has a 15% share in these markets.

We expect that the programmatic appetite and expertise of agencies and advertisers will grow as Singapore develops further as a hub. “We see a lot of room for programmatic guaranteed to grow,” said one agency executive, “as soon as we can educate publishers on why they would benefit from moving inventory to programmatic guaranteed.” We expect market penetration for programmatic guaranteed, which averaged about 1% in 2017 across the five countries, to reach about 4% in 2020.

Singapore’s role as a hub is driving initial adoption of programmatic guaranteed. However, for the process to scale up more significantly, the local markets need to develop capabilities and drive adoption as well. Given the low penetration of digital advertising generally in these countries (15% internet advertising versus 47% print, according to Magna), advertisers should consider whether there’s potential to follow the trend seen elsewhere.

The opportunity is huge. The ASEAN (Association of Southeast Asian Nations) countries have a combined population of about 700 million, 50% of which are younger than 25. People are rapidly adopting smartphones and mobile data, providing a very fertile ground for digital marketing. There is also potential for a massive leapfrog effect—more than 100 million people going directly from no digital access to smartphone digital usage. The ASEAN countries also have some of the highest social media usage rates in the world.

Publishers, advertisers, and agencies should prepare for this shift by building their programmatic expertise. Agencies and publishers can also consider programmatic guaranteed as an opportunity for advertisers that are reluctant to use other forms of programmatic, such as open auctions.

As it is in the rest of the world, programmatic guaranteed is developing quickly in APAC. Growth rates in several of the APAC markets could easily accelerate with a push from publishers or advertisers. As these markets develop, the efficiency and effectiveness gains that advertisers, agencies, and publishers elsewhere have achieved will become more apparent and fuel growth in APAC. Although we expect growth to be driven primarily by Australia, China, and India, there is significant potential for programmatic guaranteed across the region, and advertisers and publishers in all markets can help shape the industry’s evolution.