As guardians of the balance sheet, treasuries have the potential to deliver extraordinary returns on banks’ digital investments, generating significant competitive and financial advantages for years to come. Superior data management and process automation can give treasuries an initial boost, while machine learning (ML) and artificial intelligence (AI) will generate the biggest benefits over time, allowing treasuries to operate more efficiently and effectively.

All told, BCG research and benchmarking data finds that digitization can reduce treasury operating costs by an average of 20% to 30% and increase average net interest income (NII) contributions by 10% to 15%. Banking executives could benefit from understanding the types of treasury use cases digitization is enabling and what it takes to accelerate digital maturity and begin reaping the benefits.

Digitization can reduce treasury operating costs by an average of 20% to 30% and increase average NII contributions by 10% to 15%.

Treasury Digitization Has Been Overlooked

For most of the past decade, banks have been understandably preoccupied with catching up and slimming down—catching up in creating sleek customer front ends to compete with peers, fintechs, and other rivals and streamlining to improve the customer experience and relieve pressures from margin erosion. That survival mindset guided where and how banks channeled their digital investments. But it also obscured a significant opportunity—the ability to use digital tools and capabilities to unlock value within the treasury function.

In the time since the global financial crisis, the treasury mandate has grown markedly in scope and strategic importance . Today, the average bank treasurer serves as the overall resource manager for the balance sheet.

They also have increasing responsibility for steering and execution activities and a heavier slate of profit-and-loss-related risks to manage. Unfortunately, however, treasury IT, systems, data, processes, analytics, and digital tooling have often not received the level of investment needed to allow treasurers to excel in their broadened mandates.

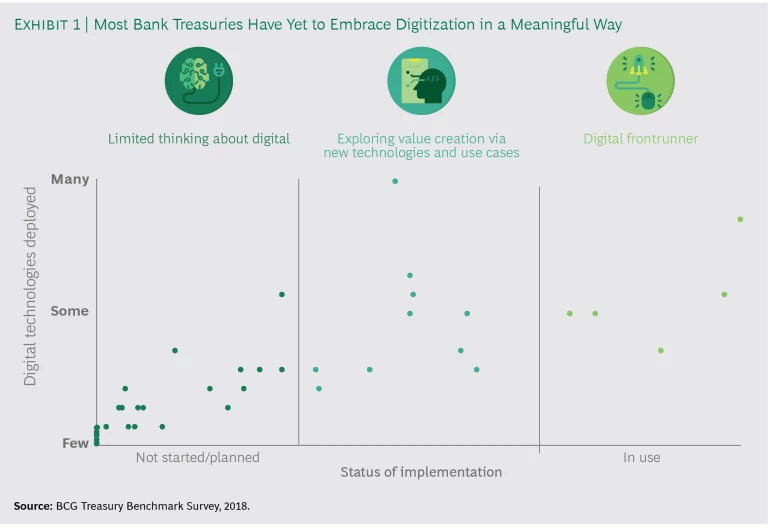

A BCG survey of 44 banks revealed that most treasury functions have a relatively low level of digital maturity. Our analyses found that only 11% of bank treasuries make widespread use of advanced digital technologies and use cases, while about 70% have yet to embrace digitization in any meaningful way. While treasuries may have installed a digital officer, few officers have the authority, budget, and staff to enact a comprehensive digital strategy.

Treasuries Face Three Key Challenges

Low rates of digitization mean that bank treasuries often cannot carry out their growing responsibilities as efficiently or effectively as they could. (See Exhibit 1.) Their most critical challenges include:

- A Fragmented Data and IT Landscape. Treasury personnel often have to toggle between multiple systems to get needed information, efforts that consume time, cost, and manual labor. The lack of integration also means that functionality like cash flow forecasting or valuation often has to be replicated in different systems, which can create data reconciliation challenges and operational risks.

- Visibility Gaps. BCG survey data found that only 50% of bank treasurers have daily insight into the entire banking book. Blind spots from data inadequacies can inject delays as treasurers attempt to gain needed information and can prevent the necessary risk management decisions from being made at the right time.

-

Outdated Modeling Tools. Likewise, while treasuries play a crucial role in helping banks to maintain stable NII, most lack the simulation and analytics capabilities needed. Inflexible modeling tools and the inability of existing systems to process unstructured information or synthesize data from internal and external sources can make it hard for treasurers to plan long-term funding.

These same issues also make it hard to accurately predict intraday and short-term liquidity needs and factors that impede the efficient use of resources and erode value.

With so many mission critical items on their plates over the past decade, few treasuries have had the time or resources to invest in strategic matters, such as the use of digital tools and capabilities to improve balance sheet steering and risk management. But now that markets are largely stabilizing and many regulatory reforms are completed, treasuries have the opportunity to make up for lost time and use digitization to optimize the bank’s financial resources and unlock significant long-term value.

Introducing Treasury 4.0

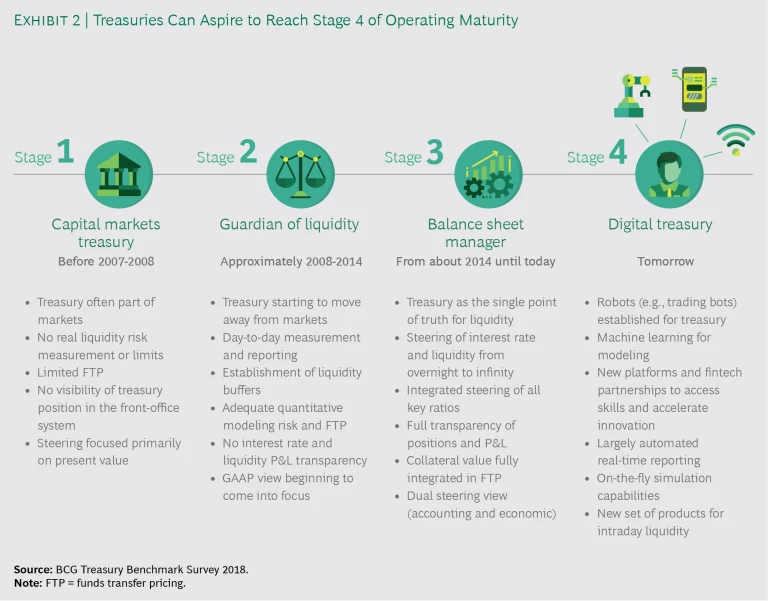

In terms of operating model maturity, BCG survey data finds that many banks consider themselves to have reached (or are closing in on) the Treasury 3.0 stage of development, meaning they now serve as the key balance sheet manager for the bank and act as a single point of truth for liquidity. (See Exhibit 2.)

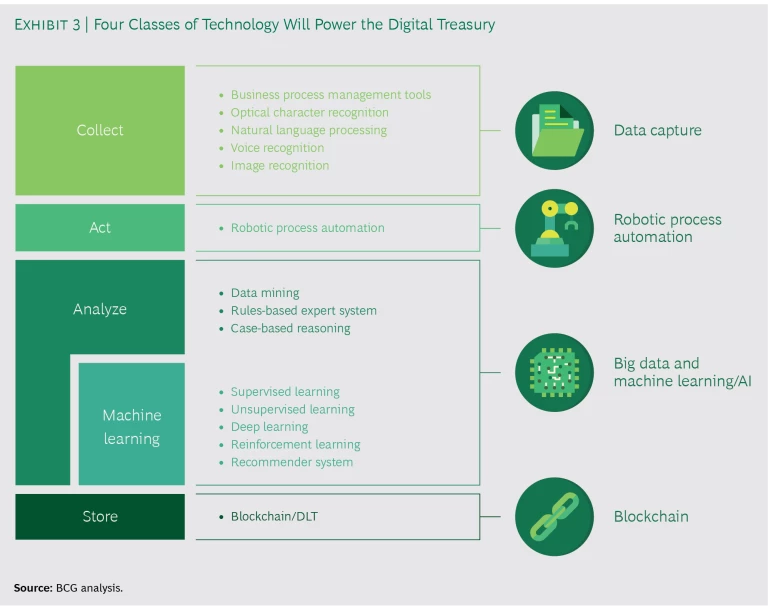

It’s now time for treasurers to look to the next stage, in which a suite of advanced digital tools will help them work far more effectively. (See Exhibit 3.)

While banks continue to run longer term programs to establish golden data sources, treasurers can gain visibility across the banking book using tactical data solutions. Machine learning and predictive analytics can improve the quality and speed of decision making. And robotic process automation (RPA) can speed and streamline routine tasks. These advances will reshape the value that treasuries can bring to the bank—delivering average annual profits of $100 million to $350 million in each of the top 20 banks in North America, Europe, and Asia-Pacific, according to BCG’s research and benchmarking data.

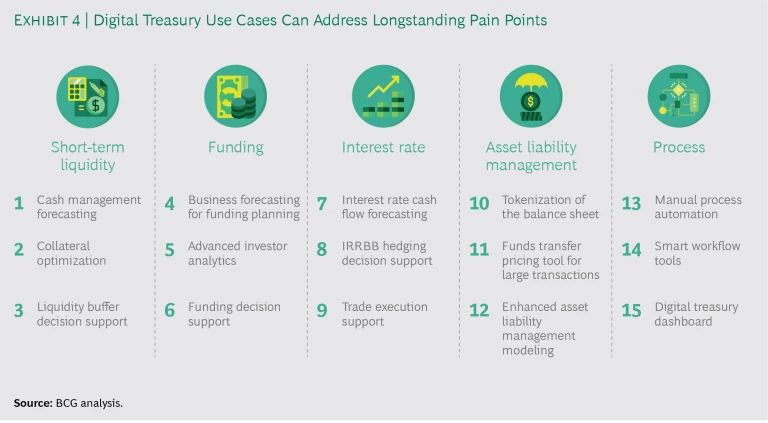

How will treasuries deliver this value? A number of existing and emerging use cases—many of which can be implemented relatively quickly—will help treasurers address longstanding pain points in forecasting, decision support, and cycle time performance. (See Exhibit 4.)

The results can be transformative—over the next three to five years, digitization can help treasuries become smarter and leaner in the following ways:

-

Forecasting. Machine learning techniques and AI will allow treasuries to meet a variety of forecasting needs, such as anticipating expected daily cash flow volumes and optimizing intraday and end-of-day liquidity reserves. Rather than relying on static, historical data, treasuries can take advantage of the dynamic pattern-recognition capabilities that come with ML engines. Predictive analytics can tease out monthly cash flow patterns, seasonal variations, and anticipate the downstream impact of macroeconomic fluctuations and market stresses, giving treasuries improved visibility and deeper real-time insights into the bank’s intraday and end-of-day positions. The ability to confidently predict how much liquidity a bank should hold could also allow the average player to reduce the overall size of the buffer. That would free resources the bank could then deploy into higher-yield categories.

Similar insights can also help treasurers understand when they need to increase their liquidity reserves beyond historical peaks to reduce risk. In addition, treasuries can use improved forecasting capabilities to anticipate downstream funding demands from new business—a capability that would overcome a long-standing pain point between treasuries and business units and help optimize the overall funding strategy.

- Decision Support. Treasuries can use a variety of proven decision-support systems to determine the most effective hedges, purchase the best liquid assets, and pledge the most useful collateral. Liquidity buffer “switch tools” can help treasury CIOs optimize the treasury portfolio for risk, return, and resource consumption within regulatory and accounting guidelines—an important capability since those portfolios can represent roughly 20% of a bank’s total assets. Tools that use optical character recognition and rules-based expert systems can allow treasuries to scan documentation and quickly determine the optimal (cheapest to deliver) collateral to post. These and related decision-support tools, the most advanced of which use ML engines, provide granular and real-time insights that treasurers can use to eke out additional basis points on their repo books and collateral positions.

-

Cycle Times and Consistency. Greater automation and process integration would allow treasuries to improve coordination across stakeholders. RPA can help automate repetitive manual processes, thus speeding response times, lowering error rates, and freeing treasury personnel to focus on strategic, high-value activities. As a “bridge” technology, RPA can also help treasuries overcome legacy IT constraints until the bank is ready to fully automate its core processes. Smart workflow tools can help coordinate and simplify process and approval steps, especially in tasks involving multiple stakeholders.

Other use cases include creating digital treasury dashboards to facilitate better reporting and performance management. Using RPA, for instance, one treasury automated its management reporting, intraday cash management, and a portion of its data reconciliation activities. Emerging solutions also show promise. Some fintechs are applying distributed ledger technology to deliver solutions for liquidity management and collateral management for institutional clients in the global securities and repo markets.

Bank treasuries that go leaner and smarter in these ways can drive significant cost and P&L improvements, money that can be redirected to fund the larger Treasury 4.0 journey while contributing to overall NII and ROE.

Digitization Will Allow Treasury to Play a More Strategic Role

Over the next decade, treasuries will be able to manage balance sheet processes in a more holistic way. As platforms evolve, they will become intermediation managers, capable of overseeing the origination-to-distribution cycle end to end. Instead of the warehousing function many bank balance sheets play today, distributed ledger technologies could allow treasurers to put the balance sheet to work more effectively. One European digital treasury front runner is looking to use distributed ledger technology to offer securities in smaller lot sizes, with specific exposures based on investor preferences that are not available in the market today.

Over the next decade, treasuries will be able to manage balance sheet processes in a more holistic way.

With automated processes supporting many routine tasks, treasury personnel will be able to focus on important programs that require specialized expertise, advising senior leaders across the bank on business and financial risk and becoming a creative sparring partner in helping them to protect and advance the bank’s interests. That expertise can also be directed to anticipating and planning for disruptive changes. Right now, for instance, most central banks do not have the digital infrastructure in place to move to a prorated intraday interest schedule. But we believe it is only a matter of time before those infrastructures evolve and a new market for intraday liquidity products will be created. That shift will turn traditional market dynamics upside down, requiring treasuries to extend the same rigor to intraday liquidity management that they apply to short-term liquidity management—and be able to complete transactions within minutes, not hours or days.

Meeting these demands will require treasurers to embrace new and agile ways of working, changes that include collaborating in small, cross-disciplinary teams on a flexible and iterative project basis, versus the more static, waterfall-based approaches and functionally specific teams that many treasurers employ today. But treasuries might also need to seek external collaboration with fintechs and others to help them access niche capabilities and accelerate development.

Getting Started

The transition to Treasury 4.0 is focused on helping treasuries run their existing operations smarter and leaner in the short term while preparing for deeper structural changes in the broader marketplace. Banks interested in beginning—or advancing—their Treasury 4.0 transformations can take two important actions.

1. Perform a digital treasury diagnostic. Treasuries need to take stock of their current approaches, assess their digital maturity, and identify their most critical pain points by considering the following steps:

- Focus on the biggest treasury challenges. By interviewing key stakeholders internally and looking outside to assess what other banks are doing, treasury teams can gauge where their most significant trouble spots and opportunities are. Those insights can inform how far and how fast to push the transformation.

- Size and prioritize the right opportunities. Treasuries should evaluate initiatives based on their expected value and P&L impact, ultimately winnowing the list to between one and three use cases that solve existing issues, are within reach of the bank’s current capabilities, and can deliver significant returns.

- Build the digital roadmap. Next, treasuries can begin to chart what it will take to implement the initial set of use cases, focusing not only on the IT requirements but also on the team structure, data, skills, and governance needs.

- Secure the necessary budget. Our analyses suggest that payback can occur within months of solutions going live—so treasuries should not be shy in asking for the startup funding they need. Digitally enabled savings can be reinvested to support deeper and more sophisticated digitization efforts over time.

- Launch “quick win” pilots using agile practices . Using agile practices to fast-track initiatives and starting with pilots that address significant balance sheet steering issues—such as forecasting, trading, or automation—can deliver proof of concept faster and build buy-in for deeper changes. BCG benchmark data found that projects and pilots that are developed and managed using agile practices are far more likely to deliver on time.

2. Transform and evolve the operating model. The second action bank treasuries can take to transition to Treasury 4.0 is to ensure that, along with acquiring ML capabilities, they plan how to use the insights they generate. Adopting sophisticated new technologies requires anticipating the methodology, people, and process changes needed to apply them and the ripple effects those changes will have. To increase the odds of success, treasury teams should consider doing the following:

-

Manage the increased risk that comes with new models. A key insight on the path to using AI is to recognize that there can be tremendous value in using the technology to create challenger models that bring deeper risk management insights and uncover previously hidden correlations with high predictive power. This can help banks identify important payments and lending patterns, and then manage cash flow accordingly. Yet, new technologies will naturally raise important questions. Among the questions treasurers might consider are, “Do I trust this machine?” “Have we thought through relevant compliance and risk oversight issues?” “How do we apply the results within the context of our current methodology?”

In short: understanding and managing model risk will need to be a top priority for AI to be successful in any context. Because AI, and other advanced technologies represent a departure from traditional static, rules-based systems, training, and ongoing communication are crucial. Treasury teams must engage early on with key stakeholders such as IT, the second line of defense, internal and external audit, as well as with regulators to explain how models using these technologies work and provide enough time for these parties to develop trust and confidence in the resulting outputs.

- Develop new skills and talent profiles. Digitization will make some roles and tasks redundant and other skills crucially important. In addition to data scientists, developers, and engineers, treasurers will need “business translators” to help communicate treasury’s digitization program as well as people who have a broader understanding of how the bank works overall. As automation frees capacity, treasuries will have the opportunity to redeploy valuable subject matter experts and thus accelerate how quickly strategic priorities are identified and deployed. Employing such individuals productively will take careful advance planning.

- Align with other transformation efforts. Treasuries will need to determine which digital initiatives should be managed within the treasury function and which can be supported or executed centrally to align treasury’s digital priorities with the bank’s broader digital transformation efforts. Moving to a new treasury operating model is a serious undertaking, but embracing the changes required will help treasury squeeze the most value from its digital investments and generate the most value for the bank in return.

As fintechs, bigtech, and an expanding financial services ecosystem threaten to disrupt traditional banking business models, incumbent banks need to become more efficient and strategically adroit. The same is true for bank treasuries. Digital tools and capabilities give treasurers a powerful arsenal with which to execute their role. Treasuries that go digital will generate significant competitive and financial advantage for years to come, allowing their banks to become far more resilient and successful in the face of change.