When the COVID-19 pandemic forced banks to shut down much of their face-to-face interactions with clients and step up virtual operations, consumers quickly adapted to digital applications such as mobile banking and customer support through artificial intelligence (AI). These changes have been in the making for the past decade, but the pandemic has accelerated the inevitable: the traditional banking industry is undergoing a seismic shift and will be digitized within the next five to seven years. Advances in technology, big data, and AI are leading customers to change old habits. They’re also empowering tech companies and startups to challenge banks on their home turf.

The new wave of digital disruption has made incumbent banks vulnerable. They stand to lose market share to tech firms that have already established themselves as financial services players. Because these disruptors can afford to compete with lower costs to customers, banks are likely to lose margins as their services become commoditized. If they are to survive, banks must start acting more like digital giants before digital giants—including Amazon, Facebook, and Google—start acting like banks.

The End of Traditional Banking

Whereas a decade ago, most of the world’s largest banks weathered the financial crisis because governments deemed them “too big to fail,” now even size and long-term stability do not guarantee that banks will have an edge over the growing number of successful financial technology companies or withstand the increasing competition between incumbents. Those that wait to adapt might find themselves stuck with the label “too slow to survive.” They face a scenario, and a time frame, not unlike that of horse-drawn carriage makers in the 1910s; within a decade, those that hadn’t switched to automobile manufacturing were doomed.

Banks that are committed to the future should create an organization that works “bionically,” with AI supporting and enhancing the customer relationship. Bionic banks leverage their data and analytics capabilities to serve a broad range of customer needs that likely extends beyond traditional banking products. And they must recognize that they will be able to take advantage of the insight, speed, and power of this AI-led approach only if their organization is agile enough to keep up with their tech-driven challengers.

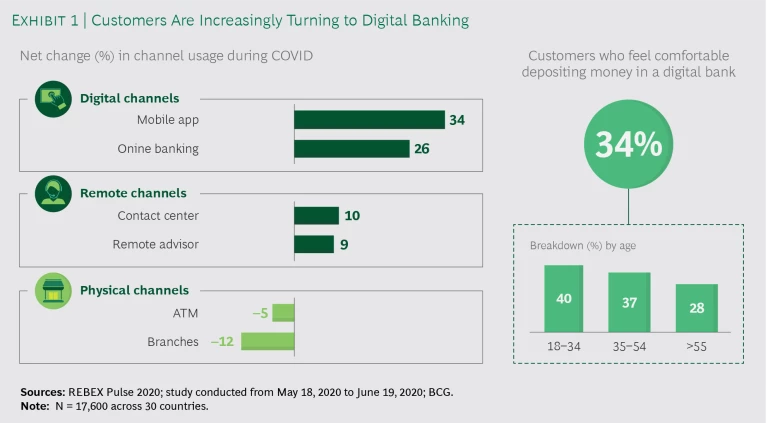

Here’s why: even customers who had previously been digital holdouts are not going back to their pre-pandemic banking habits. BCG found that between February and June 2020, mobile banking usage grew by 34%, while banking at branches declined by 12%. Younger customers are increasingly willing to go all-digital, as are a significant share of older account holders. (See Exhibit 1.)

Willingness to change providers and to share personal data across providers is strong and growing. In many markets, customers are becoming used to the “bank” as an app rather than a building. They are increasingly able to compare mortgage rates, interest on savings accounts, and other banking deals online, picking the most favorable terms without regard for whether the product comes from a traditional bank or whether they’re getting the information from a human or a machine. As this approach to financial products gains traction, customers will enjoy much higher price transparency and direct comparability of products.

Customers are becoming used to the “bank” as an app rather than a building.

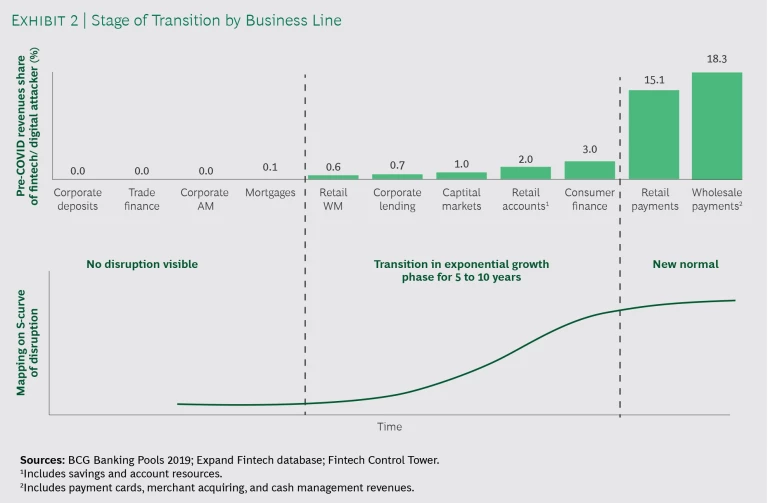

Digital attackers had transformed the payment business even before the pandemic, and their revenue share in corporate lending, capital markets, retail accounts, and consumer finance is ramping up. (See Exhibit 2.) Well-known fintechs, including PayPal and Squared in the US and Adyen and Klarna in Europe, have achieved market caps in the tens or even hundreds of billion-dollar range, higher than some multinational banks. Indeed, PayPal’s $225 billion market cap surpasses that of all but the three largest banks.

Most banks have made strides with innovations such as AI-powered chatbots for financial planning programs, digital currency, differentiated pricing based on behavioral data, facial recognition at ATMs, and even participation in the sharing economy through such means as lending based on a customer’s AirBnb income or operating P2P lending platforms. However, these initiatives have been mostly incremental, standalone changes that don’t affect core processes.

Banks cannot afford to waste any more time making changes that merely optimize existing practices. They must reimagine all processes—thinking offensively, not defensively, about what is possible in the digital age.

How Banks Can Come Out on Top

For now, banks still have a home advantage. They have the trust of their existing clientele and unique knowledge about their account holders and what they’re doing with their money. Technologies can’t cover all aspects of advice, and for now, customers still prefer human help when it comes to complex transactions.

Another point in banks’ favor: startups and new fintechs face regulatory and political barriers that, while surmountable over time, will challenge these new market entrants for a few more years to come. But the advent of open banking, which allows the free sharing of client data across banks either directly or via processors, will make it possible for new entrants to build detailed customer profiles as easily as established banks can. Granted, the utilization of open banking directives such as the EU’s Payment Service Providers Directive (PSD2) has been sluggish, but as tech disruptors take advantage of these directives, we can expect them to leapfrog legacy approaches to banking, deploying agile organizations and “made for AI” solutions to customer needs.

Moreover, to assume that a wall of compliance measures will keep banks safe is to miss the point of how digitization adds value. A day may come when tech companies can use new tools, particularly natural language processing (NLP), to automatically cover all compliance requirements. As it stands now, a tech company can partner with the bank to provide the digital capabilities for white-label bank products; for example, Google’s Plex, a banking capability that will become available on the Google Pay app next year. With that partnership, they can harness the most valuable aspects of the banking business, compiling enough client data to own the relationship and develop new revenue pools with the same customer base. The bank will be left with only lower-margin businesses such as core accounts and lending. There will be banks that survive in this manner, sustaining their cost of capital with a B2B model. However, the B2B market has room for only a few banks.

What gave banks an advantage in the past is now standing in their way: reliance on the inertia of long-standing customer relationships, the perception of “experience,” the emphasis on stability rather than agility, and the expensive physical presence of branch networks. We are now at the last stop before digital attackers figure out how to overcome the remaining compliance barriers.

Two Big Plays for Transformation

To remain competitive, banks must be willing to make strategic, fundamental changes to both their business and operating model. Essentially, they need to map out what we call the two “big plays” for transformation.

Big Play 1: Reconceive How the Bank Works

Data, analytics, and AI should drive the way every part of the business operates. They should be embedded as organizing principles in the technology, operations, and customer service.

Many of the successful principles of agile tech companies are directly relevant for banks of the future. Standardized products and procedures allow end-to-end automation and customer self-service wherever possible. The use of AI can steer entire systems, while at the same time quickly determining when there is an exception that requires a human expert to interact with the customer.

The use of AI can steer entire systems, while quickly determining when an exception requires a human expert to interact with the customer.

Under this big play, three key elements will define the bank’s functions and processes. If any one of them is neglected, the strategic transformation will fail.

AI and Insight. Because banking is an information business, AI is widely applicable. Most immediately, it can build capabilities in conventional banking areas. AI can greatly enhance personalized interactions and decisions, based on profiles derived from customers’ banking activities and lifestyle. It can help tailor offers and messages to clients and provide swift credit risk analysis and loan decisions as well as assessments of non-financial risk related to compliance and operational risks—in particular, criminal behavior. In sales-related use cases such as these, it is feasible to capture many of the benefits of AI just by bringing it into the existing processes. This innovation will transform what’s possible without a Big Bang or a recreation of bank functions in a greenfield digital operation.

People and Organization. The role of people will inevitably shift and change as banks go digital. In a tech company, human expertise is not siloed within specific activities. Banks need to create a broader functional model in which everyone thinks in terms of constant overall enhancement. In today’s typical bank, up to 90% of employees are dedicated to day-to-day operations, with only the remaining 10% devoted to change and innovation. In the future, the balance will look more like this: 40% of employees run standardized processes, 20% manage the exceptions to standardized processes, and 40% are dedicated to change and continuous innovation.

This shift will give rise to new roles; for example, automating the remaining manual work batch by batch, shaping the dialogue and narrative with individual customers, and building and maintaining the ecosystem. All of this will be accomplished with a much smaller headcount than today. People with new capabilities must be hired, and existing teams will need to be motivated and upskilled to apply AI across the bank. Processes should be redesigned to combine the best of human talents with AI. To make these changes effectively, banks will have to adopt an agile way of working, with extensive training in the new processes and the new organizational culture.

IT and Technology. To enable AI at scale, a bank will need to build and develop a digital and data platform (DDP) that makes it possible to introduce use cases incrementally, while at the same time liberating data and modernizing the legacy core. Doing so will require a switch from IT-focused transformations to a value-driven approach that delivers benefits in stages.

The DDP build should start with a clear vision of the platform architecture, laying out the details of cloud migration, machine learning, and DevOps tooling as well as cloud security. A bank can begin with raw data dumps, then gradually develop more sophisticated real-time streaming for key data pipelines. Once the foundation is in place, use cases can be delivered faster. The DDP should also be used to spearhead improvements in data quality and governance, transforming these ways of working one step at a time. While the platform can support traditional business intelligence reports and dashboards, it is critical that the focus remain on building and scaling AI use cases. This is what will transform the bank and ensure overall success.

Big Play 2: Expand the Business Model

In tomorrow’s disintermediated digital markets, customers will increasingly seek to have their needs served digitally. While this will put a great deal of pressure on traditional banking margins, it will also open up opportunities for incumbent banks to tap into new value pools outside of banking—possibly yielding greater value than the traditional pools themselves.

The banking competitors of tomorrow will be experts at providing plain vanilla financial products like accounts and loans cheaply, effectively, and in a way that provides a satisfying customer experience. Banks that do not settle for a B2B role, however, will need to build up their premium margin capabilities to protect their customer relations.

With richer customer profiles enabled by AI, banks can act as financial allies to their account holders.

Banks have already begun turning line items of transactions on current accounts or card statements into rich customer profiles. Now they need to find ways to add value to their customer profiles. For starters, they can act as “financial allies” to their account holders and loan customers, providing spending and saving suggestions, advice on big-ticket purchases and other important financial decisions, and financial literacy guidance. They can continue by leveraging their data to provide non-financial information; for example, a bank might notify certain customers about hot deals on leased cars or offer consumer insights on insurance, mobile phone plans, rental properties, utilities—or even shopping bargains.

Before they can develop stronger customer relationships, however, banks have to earn back the right to communicate with account holders. Customers trust the banks to safeguard their money but don’t necessarily see them as allies in their financial management. Right now, many regularly delete bank emails; and in certain European markets, compliance restrictions preclude banks from sending emails altogether. Changing this dynamic will require regaining customer interest and trust; the bionic bank needs to be more like a 19th-century bank when it comes to close client relationships—able to show, through its practices and messaging, that its interests are aligned with those of its customers. There are many examples. Take mortgage default: a bank is better off if it can negotiate a payment plan rather than foreclose and be left holding the debt. And for banks that manage retail investment portfolios, investor behavior studies have found that the biggest hit to returns comes not from management fees, but from either lack of diversification or the client not staying invested over the medium term, so attentive discretionary portfolio management benefits both parties.

To begin reaching out to each customer, a bank should tap into its data insights and, with the customer’s permission, launch a consistent communication program. The digital channel will play a prominent role complemented by advisory interactions. The bank can build client rapport with financial tips, advice, or offers tailored to a client’s interests and needs. (See “More Than a Mortgage.”) An account holder who spends money on fitness equipment might appreciate briefings with evaluations of related products or special deals, for example. A client who is interested in sustainability might receive briefings with information about financing solar panel installation.

More Than a Mortgage

The bank platform suggests that since Suzanne and her husband both work full time, they hire a mover that will do all of the packing, and it recommends several companies. When the couple consider renovating their kitchen, the ABC platform advises against the DIY approach, since neither of them are experienced at construction and their time will be better spent focusing on their careers; it then recommends several reliable contractors in the area.

What makes all of this possible is AI. Behind the scenes, a large team is focused on being the customer’s financial ally, continually improving the mortgage platform and client interactions. A smaller team is dedicated to continuously automating the mortgage process further.

In this way, the bank can gain a significant edge before tech competitors become major players in the mortgage business.

The competition from tech companies like Google will be fast and furious, however, so banks should act now—while they still have insights on customer behavior that disruptors have not yet compiled.

The Need for Immediate Action

To stay viable, banks must transform themselves into AI-powered bionic organizations, serving customers in ways that the financial world has barely begun to envision. For those that hope to succeed in the increasingly fast-paced and competitive arena of digitized financial services, the imperative is to get going now.

While the future for individual banks may be full of uncertainties, there are concrete, high-impact use cases that a bank can implement within a six- to nine-month time frame. Existing data and IT deficiency will not hold them back. As long as a bank has a strategic overall transformation plan, it can introduce new uses of AI step by step, with the expectation that each use case will generate financial value and serve as a beacon to show the way and create excitement within the organization.

It will take time to upgrade technology, and there will be several generations of use cases before the bank becomes fully bionic. While this is happening, tech disruptors will also be developing their financial services capabilities and, in the near future, they will be able to offer customers the knowledge and security that used to be the exclusive domain of banks, but with rapid delivery.

Nevertheless, banks that take the initiative now can play their home advantage, fend off the challengers, and evolve into better financial partners to their customers. The future can be bright for those that recognize the possibilities.