Advanced analytics and AI can drive more than 10% of sales growth for consumer packaged goods companies, based on our recent research study with Google , of which 5% comes directly from marketing. The value at stake for developing advanced data capabilities is significant: for a company with $10 billion in annual sales, that translates to $500 million in revenue. Yet because CPGs traditionally sell through retailers, they face a fundamental challenge in acquiring data from consented consumer connections (that is, where customers are fully aware of and consent to the use of their personal data), which limits the impact of their outsized marketing budgets. As a result, advanced analytics and AI tactics remain a largely untapped resource for CPG companies. That’s a challenge in strong economies, but it’s an even bigger issue given the current economic uncertainty inflicted by COVID-19. In this context, many marketers are asked to do more with less budget and adapt to rapidly changing consumer behavior. Therefore, it’s even more important that CPGs turn to advanced tactics now to achieve greater marketing productivity.

We recently partnered with Google in a second joint study to help CPGs unlock the value of data. Although most CPGs have begun the journey to identify tactics and use cases that leverage data, our study finds that a key pain point in scaling the impact of those initiatives is quantifying the return on investment in data across business segments (such as categories or brands) to inform investment decisions. To support CPGs on the data journey, we developed a model to assess the value of acquiring and activating data within their own business contexts, as well as a set of best-in-class use cases across categories. Additionally, we identified success factors to support CPGs in generating benefits at scale. By using this approach, companies can build the right business case, with a clear ROI to justify the investments needed to apply advanced analytics and AI marketing use cases.

The Potential of Data for CPGs

Advanced analytics and AI marketing use cases have the potential for outsized impact for CPGs.

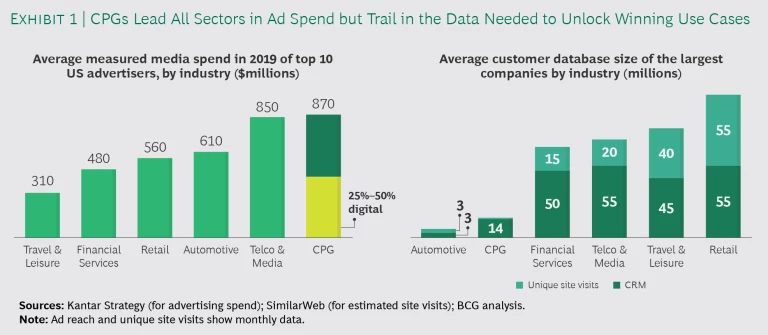

CPGs are prolific advertisers, with the ten largest companies spending an average of more than $800 million each year on marketing—the highest of any industry. At the same time, the largest CPGs have databases of CRM and site data that are, on average, one-tenth the size of the databases of their retail peers. (See Exhibit 1.) This disparity means that for most CPGs, the opportunity to capture and activate consented consumer data remains largely untapped; roughly 90% of the CPG leaders we spoke with cited data collection, activation, and scaling as key obstacles to achieving their marketing goals. Indeed, advanced analytics and AI marketing use cases have the potential for outsized impact for CPGs. In some categories, such as beauty, up to 45% of sales is attributable to marketing, in our experience. Even for other CPG categories, the impact of marketing on sales can be two to three times higher than in other industries. For that reason, the industry is uniquely positioned to capitalize on advanced analytics and AI to make marketing more effective.

Quantifying the Value of Consumer Data

Based on our research, the lack of advanced data and AI successes for CPGs stems primarily from scaling challenges: although many CPGs have piloted data use cases in a limited fashion, the translation to full business impact has been difficult. Given that CPGs often span a wide array of categories—each with a unique set of economics and consumer journeys—they need to be thoughtful about the relative impact and return of data in each category, as well as the tactics to utilize this data.

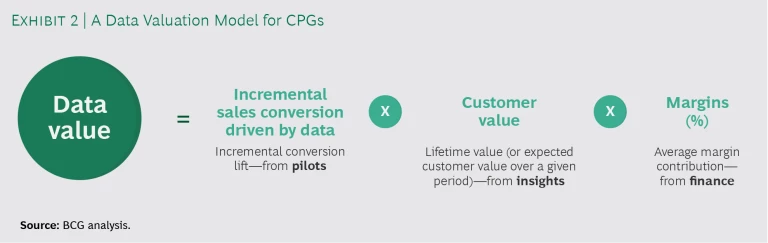

Companies can invest in programs to capture data from their consumers, but they need to focus on the right categories and brands, using the right tactics. To help CPGs make this determination, we developed a model to assess the value of the data, incorporating three key drivers: incremental impact of leveraging data; customer value; and category margins. (See Exhibit 2.)

These drivers may differ by category and type of data, and therefore it is critical to quantify them in a de-averaged assessment across the business.

- Incremental Conversion Rate. The first component measures the increased effectiveness that a CPG can generate by acquiring and activating consented consumer data. In paid media such as online ads, for example, this is the impact of using the data to deliver more targeted ads instead of employing broad, mass-market tactics. The conversion rate typically comes from third-party measurement reporting or initial pilots using the data. For data from a company’s internal CRM platform, this represents the growth in customer value for a consumer the company markets to using CRM data, versus one who does not receive such targeted messaging.

- Average Customer Value. The second component measures the typical lifetime value of a customer generated over a given period of time, factoring in purchase frequency and basket size. This is essentially the average amount each new customer will spend on the company’s products and often comes from historical data the consumer has shared.

- Profit Margin. The last component is the average contribution margin for the product or category of the CPG. While this metric doesn’t typically change when a company activates data, it does significantly impact the value of data to CPGs across different categories.

CPGs should not run this calculation once—rather, they should de-average this assessment by category and type of data to identify parts of the business where applying a specific advanced analytics marketing use case can be especially impactful. By understanding the value of data, companies can assess how much they’re willing to pay for external data—and, for CRM data, how much they’re willing to invest in building capabilities to capitalize on that.

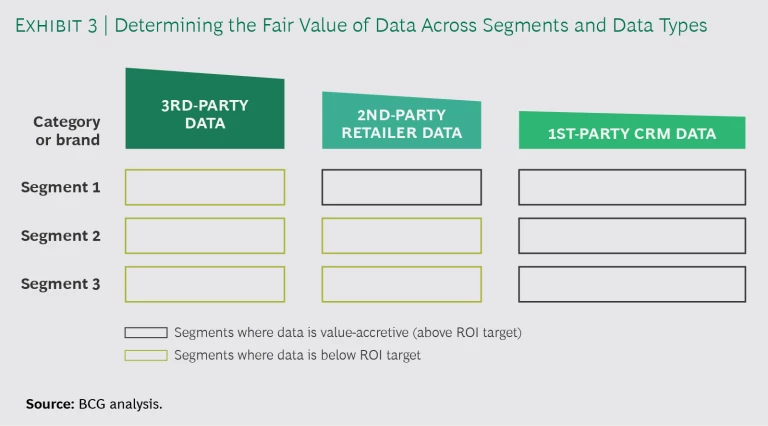

Exhibit 3 shows how this looks for a hypothetical CPG company. Categories in which the value of data, calculated by applying the data valuation model, exceeds the cost of acquiring that data are winning use cases and tactics to build business cases to scale. Conversely, this approach can also identify categories and types of data where the return does not justify an investment.

Use Cases to Unlock the Value of Data

Armed with a clear understanding of the approach to quantify the value of data across the business, CPGs can selectively identify use cases to pilot based on category- or brand-specific economics and consumer behavior. In our research, we analyzed the CPG landscape and identified three high-potential use cases for how companies can become more effective at acquiring and leveraging consented consumer data.

The intersection of consumer needs and company offerings is a prime place for companies to invest.

Capturing Data Organically. Consumers are increasingly willing to provide their data if CPGs offer something helpful in exchange, either through insightful content or rewarding digital experiences. Understanding the value of this exchange with consumers is critical; companies should focus on the consumer journey and key purchase drivers to identify unmet needs or pain points and determine where they have an advantage in meeting such needs. The intersection of these two considerations—consumer needs and company offerings—creates a mutually beneficial avenue to access data and is a prime place for companies to invest. (See the sidebar “Tailoring Data Acquisition Approaches to Product Categories.”)

Tailoring Data Acquisition Approaches to Product Categories

Content Hub. In some categories, such as health and baby products, consumers crave helpful content and information, and they do a significant amount of research before making a purchase. For these categories, CPGs can craft relevant, engaging, and high-demand consumer content in areas that they identify through consumer research.

Virtual Engagement. In categories such as beauty products, consumers need to experience the product directly, making trials critical. Here, developing innovative digital solutions can help increase awareness of new products and make consumers more willing to try them.

Packaging Innovations. In categories with ubiquitous products purchased frequently and in small basket sizes—such as beverages and snacks—companies can capture consented consumer data through loyalty-based rewards and innovative packaging. For example, a mass-market food and beverage brand can establish rewards programs to foster loyalty and develop innovative labels to prompt consumers to register for awards or prizes, thereby sharing their data.

Forging a Data Partnership with a Retailer. CPGs can also work directly with the entities that naturally have access to consented consumer data: retailers. For example, during health-crisis periods such as the COVID-19 pandemic, CPGs can analyze retailers’ longitudinal point-of-sale data to show how consumer purchasing behaviors change in response to the crisis. An emerging trend in the current environment is budget-conscious consumers trading down to lower-priced or private-label products in certain categories; for example, IRI point-of-sale data for March and April 2020 showed an increase in private-label product market share compared with the pre-COVID-19 period.

CPG companies can also use retailer data to gauge the effectiveness of their own marketing spending and to assess the performance and ROI of different types of campaigns and promotions. A global brewer partnered with several retailers to acquire granular point-of-sale data—broken down by product and geography—to rapidly optimize active campaigns, resulting in a sales boost of over 10%. CPGs are further empowered to acquire customer-level insights through digitization of data sharing between themselves and retailers in secure and privacy-safe cloud environments.

Applying Advanced Contextual Targeting. The third type of use case—advanced contextual targeting, or tailoring marketing messages to a consumer’s specific situation—is less about how to access data and more about how to apply it to improve sales. The basic concept of contextual targeting is not new. However, richer data provided by the customer and a broader examination of contextual cues allow CPGs to significantly expand their repertoire of targeting tactics, moving beyond basic audience and demographic information to leverage all types of demand levers in order to identify the signals that most accurately predict and boost sales.

Richer data and a broader examination of contextual cues allow CPGs to significantly expand their repertoire of targeting tactics.

The key to advanced contextual targeting is identifying accessible data that accurately predicts CPG purchasing patterns and that may differ significantly across categories. As with retailer data partnerships, there are COVID-19-related applications for advanced contextual targeting. For example, as the crisis eases, geographic markets are returning to normal at different starting points and paces. Given that kind of variable and localized recovery, CPGs can use demand-sensing analytics to detect and forecast areas with resurging sales. Additionally, distribution and inventory data can indicate where logistics disruptions may give a brand a supply advantage over the competition and enable it to use marketing to exploit that advantage.

For CPGs, acquiring and activating consented consumer data at scale represents a clear but untapped opportunity. Our research shows that it can drive 5% sales growth, translating to $500 million in incremental revenue for a $10 billion company. Although there are significant challenges to tackle, the size of the potential prize justifies meaningful investment of resources. Data and analytics become even more of a differentiator during uncertain or adverse economic conditions, such as the current COVID-19 period. CPGs with a competitive advantage in using data to detect demand, derive consumer insights, and activate marketing based on those insights stand to capture outsized share. They cannot afford to let the opportunity pass.