For a decade or longer, the food industry has been working on tracing food from its source in the field or sea to its final purchase. These traceability efforts are gaining momentum. In the past six years, the UK and France have adopted laws holding companies responsible for human rights abuses that occur in their supply chains. France’s law also covers environmental abuses, as does a new law in Germany that will take effect in 2023.

A proposed US Food and Drug Administration (FDA) regulation would require participants in the food value chain to maintain sortable end-to-end electronic records to be made available upon request within 24 hours during a food-borne outbreak or food recall investigation. The regulation would apply to categories that, by our estimate, account for 20% to 30% of food consumed in the US. Early estimates suggest that this regulation could affect more than 20,000 farms, more than 10,000 manufacturers, nearly 20,000 distributors, and more than 350,000 retail establishments and restaurants. It is the most sweeping proposed change in food regulation to emerge in decades.

The global movement to hold food companies accountable for the provenance of the goods they grow, distribute, and sell creates an opportunity to devise a broadly beneficial solution for food systems and security . By establishing an end-to-end, near-real-time view of their supply chain, industry participants can become more resilient, a critical capability in light of the COVID-19 pandemic. They can also improve public health and reduce food waste. One-third of the food produced globally each year, or 1.6 billion tons, goes to waste . In meeting the updated health and sustainability goals, companies can strengthen their bottom line, reputation, and customer loyalty by selling food products that consumers trust.

On the other hand, failing to act productively could be devastating for an industry that operates on low margins. If poorly managed, traceability requirements could add $700 billion in costs globally to food supply chains. This risk is likely to fall most heavily on those who can least afford it, such as small growers, low-income consumers, and society as a whole.

The food industry should come together to work on these efforts. The initiative could be led by a few large companies, by a broad-based coalition of industry participants, or even by different groups so long as their systems communicate with one another. Under all of these approaches, the industry should work with food regulators to shape regulations that reduce risks and increase value for all participants throughout the chain.

The provisions of the new FDA regulation will take effect two years after the FDA publishes the regulation in its final form—either later this year or in 2022—so the industry still has time to play a constructive role in the US and in other nations that will likely follow suit.

What’s at Stake with Traceability

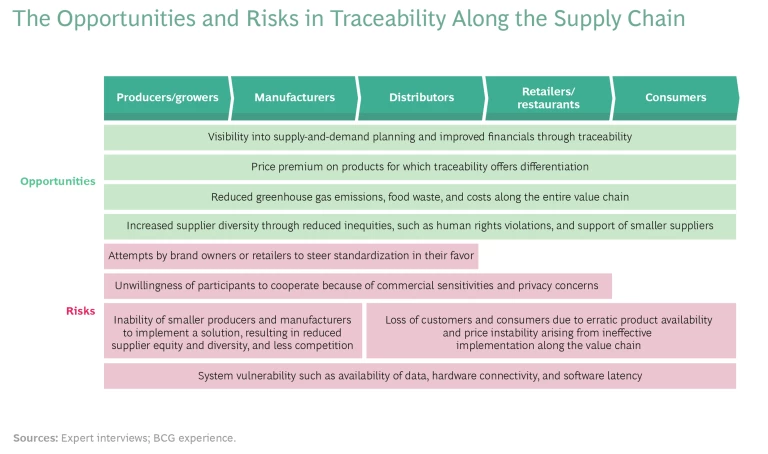

Industry participants that are prepared to transform their supply chains could see improved value creation and social benefits as a result of the proposed FDA regulation. (See the exhibit.) The regulation could encourage advances on several fronts:

- Stronger inventory transparency and supply and demand planning

- Faster progress toward climate and sustainability goals such as lower emissions and reduced food waste

- Greater supplier diversity and more equitable labor practices across supply chains

- The ability of consumers and market forces to nudge supply chains toward increased environmental and social sustainability

On the other hand, the proposed regulation could be costly if the industry fails to respond to it strategically. Several potential drawbacks could come into play:

- Fast-moving consumer goods (FMCG) companies, distributors, and retailers could push their own siloed and inefficient solutions.

- Smaller growers and manufacturers, which tend to have more sustainable practices, might be unable to implement changes effectively, potentially leading to greater concentration in the supplier base, less product diversity, and higher input prices.

- Product availability and price stability might experience disruption as the regulation takes effect.

- Industry participants could face greater systemic risks related to data, privacy, and compatibility across different tracing systems.

Getting Traceability Right

Each year, about 48 million people in the US get sick, more than 100,000 are hospitalized, and about 3,000 die from foodborne diseases. The proposed FDA regulation would cover a wide range of foods that have led to outbreaks, including fruits, vegetables, soft cheeses, peanut butter and other nut butters, most fish and seafood, and eggs sold in their shells.

The regulation would impose a new set of record-keeping protocols and responsibilities to ensure quick identification of potentially contaminated food. The “first receiver”—the entity other than a farm that takes initial possession of a food item—must collect and pass along critical data about that item. At the other end of the supply chain, a typical grocer, for example, would be responsible for knowing the provenance of each item of thousands of different products. (The pharmaceutical industry operates under a similar traceability regulation.)

The FDA currently requires only that participants know the immediate source of a food product and where they sent it. Many such “one-up, one-back” records are stored on spreadsheets and paper. Identifying the complete trail of a foodborne-disease outbreak can take weeks.

What sort of end-to-end traceability would enable the FDA to act more swiftly to identify the sources of the outbreaks and avoid disrupting sales of safe spinach or romaine lettuce? One approach would be for a large retailer, distributor, and FMCG company or a small group of them to propose a solution for other industry participants. On the positive side, these multinational companies have the capital and expertise to create a workable system. But on the negative, the resulting approach would likely be biased in favor of the companies’ own business models, would have the weaknesses typical of one-size-fits-all solutions, and could exclude smaller producers.

Alternatively, a broad coalition of industry participants could work with a standards-setting organization, such as GS1 (propagator of the barcode standards), the FMI (the food industry trade association), or another neutral party to create a more equitable and broad-based solution. Achieving a sustainable supply chain ought to be a business goal of any end-to-end initiative.

Technology Can Help

Either approach could rely on distributed ledger or blockchain technology. Walmart and IBM, for example, have partnered to create a distributed ledger that can trace food items as they move along the supply chain. The platform can reduce tracing time from days to seconds.

The World Wildlife Fund has partnered with BCG Digital Ventures and social capital investors to create OpenSC , a company that allows businesses and consumers to verify specific claims about the sustainability and ethical production of a product. OpenSC’s platform uses many different technologies—including IoT sensors, machine learning, and blockchain—to verify these claims. It then traces the movement of a food item through its supply chain and shares this history with businesses and consumers.

Austral Fisheries, part of Maruha Nichiro, one of the world’s largest fishing conglomerates, was one of the first companies to join the OpenSC platform. Fishing crews sailing in sub-Antarctic waters are tagging every captured Patagonian toothfish, known in the US as Chilean sea bass. OpenSC’s machine learning algorithms then automatically analyze tagging information, geolocation data from the ship, and other relevant data sources to verify that fishing took place only in locations where it is sustainable. After the boat returns to shore, a QR code replaces the tag on the packaging of the processed fish. This arrangement allows distributors and even a diner at a restaurant or shopper in a store to inspect the fish’s journey from capture to purchase. Up to 15% of the global Patagonian toothfish catch is being verified and traced through the OpenSC platform.

A Coalition of the Willing

Data-sharing technologies such as blockchain provide a useful tool but not a final solution to the challenge of traceability. The effectiveness of any solution depends on the willingness of industry players to participate in it. Despite the existence of mega-farms, mega-distributors, and mega-retailers, the food industry remains fragmented. Many products pass through several middlemen before reaching its final destination. If one or a few of the largest growers, distributors, and retailers take the lead, they must still take smaller players into account if they are to achieve a diverse supply chain.

As the proposed FDA regulation comes closer to reality, food industry participants should ensure that several principles inform their responses to it:

- Cooperation. Industry participants should endeavor to encourage a wide universe of industry participants to work together.

- Digital enablement. Traceability in food and agricultural products represents a critical opportunity to move away from inefficient, paper-based legacy systems.

- Flexibility and interoperability. A one-size-fits-most solution is likely to be too rigid to accommodate the industry’s variety of participants and complexity of supply chains.

- Future-proofing. The proposed regulation will undoubtedly continue to evolve over the coming months; and if it is eventually enacted, the final rule will likely require further modification in response to real-world experience. In addition, other nations will probably adopt their own versions. Any industry solution should accommodate likely scenarios that could emerge.

- Supplier diversity and equity. Smaller growers and manufacturers are likely to be the least equipped to meet the new regulations. A new food tracing process could provide an avenue to support strategic suppliers in return for access guarantees or other benefits.

Food traceability is here to stay. The question is whether food companies, distributors, and retailers treat it as a regulatory burden or a strategic opportunity. The industry has an opportunity to create an equitable platform that generates value and protects public health—whether that solution is oriented from the top down or from the ground up.