Demand for semiconductors and software pushed the tech sector’s five-year total shareholder return higher than that of any other industry.

The technology industry was the undisputed leader in five-year total shareholder return (TSR) of the 33 industries we analyzed in our annual Value Creators Report series, and it delivered the largest increase in market value.

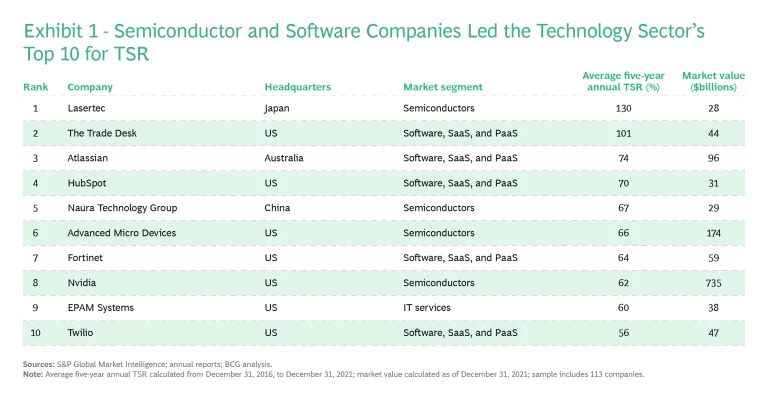

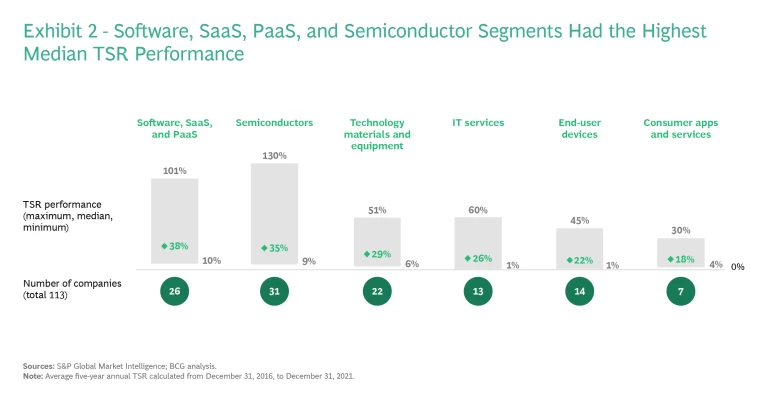

The 113 tech companies in our sample posted a median five-year annual average TSR of 30% as of December 31, 2021, led by software and semiconductor market segments. (See Exhibit 1.) The tech industry average was more than double the cross-industry average of 13% and represented a significant jump from its median five-year TSR of 24% in 2020, when it ranked third among the 33 industries analyzed.

But the relatively benign fiscal and economic environment that contributed to tech companies’ recent success, growth, and high valuations might not be present in the future, as the volatility that roiled equity markets in early 2022 makes clear. Tech industry stocks were affected by concerns about overvaluation, the effects of inflation on interest rates, government regulation, changing privacy standards, ongoing supply chain issues, and geopolitical discord. To continue to deliver strong returns, the diverse array of companies in the tech industry must take appropriate actions to be able to continue to grow.

New Ways of Working Fueled Growth, Value Creation for Tech Providers

The tech industry reaped the benefits of equipping their customers across industries with advanced technologies to help modernize operations , improve efficiencies, and bolster customer experience . Tech companies also gained by effectively innovating and selling enterprise and consumer cloud and subscription services and apps, as well as from the switch to working and supporting customers remotely—a shift that accelerated during the COVID-19 pandemic, causing demand for online collaboration tools and cybersecurity apps to skyrocket. Widespread demand for semiconductors, IT services, infrastructure, and consumer devices contributed to the leap in valuations.

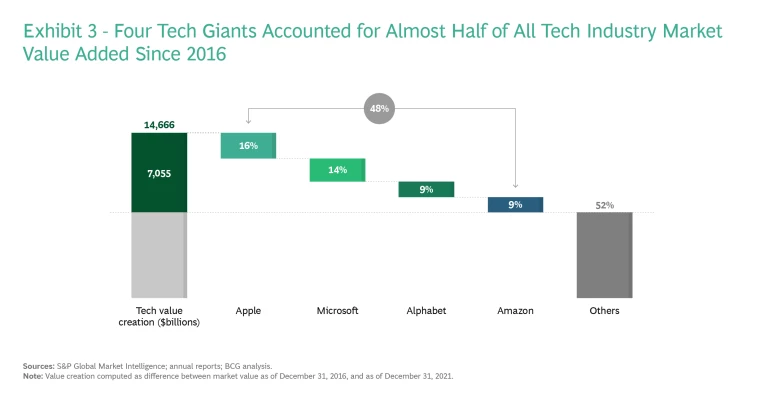

From 2016 to 2021, the combined market value of the tech companies in our sample grew more than threefold, from $6 trillion to $21 trillion, the largest increase posted by any industry we study. A full 60% of that increase came during the 21 months from March 2020 to November 2021, a period that includes the peak of the COVID-19 pandemic.

The outstanding performance of the top 10 tech companies for TSR in our sample was driven mostly by sales growth and increasing EBITDA multiples. Software and platform providers, in particular, saw their market value balloon as a result of this growth. The Trade Desk was one of them. The US adtech company, which runs a platform for digital media buyers, saw growth in data-driven online advertising push its five-year annual average TSR to 101%. Fortinet was another software segment standout. The Silicon Valley maker of cybersecurity software benefited from the shift to cloud-based services and remote work, which led companies to take greater precautions against online attacks. Fortinet’s annualized average TSR of 64% landed the company in the seventh spot on our list, up from number 26 in 2020.

Fortinet is one of five companies that appeared on our list of top 10 tech companies for TSR for the first time, along with Lasertec, HubSpot, Naura Technology Group, and Twilio. The top 10 includes a total of five software, software-as-a-service (SaaS), or platform-as-a-service (PaaS) providers. The software sector’s median TSR performance of 38% was higher than that of any other subgroup in our sample, followed by semiconductors at 35%. (See Exhibit 2.)

Demand for Semiconductors Created Outsized Returns

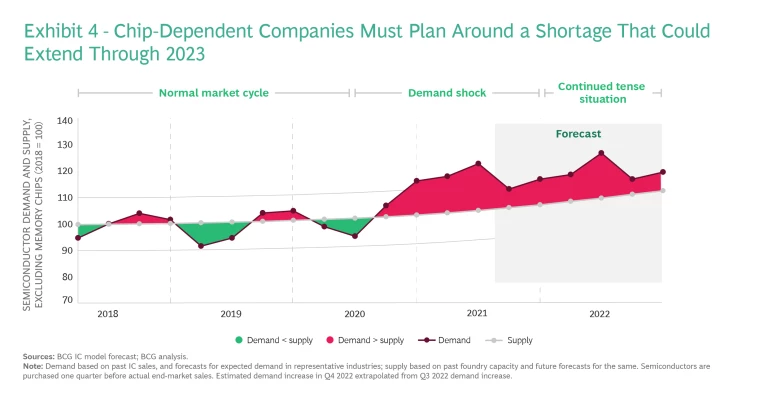

Computer chips have become indispensable in today’s economy , powering smartphones, cloud servers, cars, industrial automation, and critical infrastructure and defense systems, among other things. Ongoing shortages have posed a significant challenge since the second half of 2020, when increased demand from chip-dependent innovations such as electric cars and 5G—combined with a COVID-19 era surge in the use of all things digital—created a mismatch between supply and demand for nearly every type of semiconductor device.

Those market conditions drove the median TSR performance of the semiconductor companies in our sample to 35%. It also explains the presence of four semiconductor industry players in the top 10 tech companies for TSR in our rankings for 2021. Lasertec is one of them. The Japanese company makes equipment for testing and inspecting the semiconductors used in mobile phones and other devices, and is the world’s leading supplier of photomask inspection equipment. Demand for its technology saw Lasertec’s revenue and net income spike over the past several years, leading to a five-year average annual TSR of 130%. The other three semiconductor companies in our 2021 top 10 are Naura, Advanced Micro Devices (AMD), and Nvidia.

Digital Transformation Boosted IT Services Performance

IT services companies saw the biggest jump in median five-year annual TSR from our previous report, increasing from 12% in 2019 to 26% in 2021, a period of time marked by increased penetration of digital transformation, accelerated adoption of platforms, and growing prominence of as-a-service models. EPAM Systems, a global

digital transformation services

provider, saw its five-year average annual TSR hit 60% in 2021, landing it at number nine in our latest ranking.

Expanded Services Added to Tech Giants’ Total Market Value

Four tech giants—Apple, Microsoft, Amazon, and Alphabet—accounted for approximately 48% of growth in market value for the companies in our sample. (See Exhibit 3.) The same four made up 44% of the total market value of all companies in our sample, up from 34% in 2016.

Tech giants continue to add value by offering new services and further expanding their business models and partnerships. In one example of the latter, Amazon’s AWS subsidiary, Alphabet’s Google Cloud Platform business, and Microsoft’s Azure service—three hyperscalers that run data centers and cloud services that can rapidly expand to accommodate client demand—have partnered with telecommunications companies to

explore opportunities in 5G and edge computing

. To fuel innovation and expand beyond their core products, tech companies such as these

routinely spend 20% or more of their revenue on R&D

, and in some cases as much as 40% to 50%.

How the Tech Industry Can Create Value in the Future

Growth has been one of the biggest drivers of TSR in tech. Because the tech industry is diverse, the actions that foster growth aren’t the same across all companies. Still, given current market conditions, certain patterns have emerged that tech companies can act on in their quest for growth.

Software companies should use net revenue retention as a measure of growth. Software, SaaS, and PaaS companies fueled their recent value growth by helping customers digitize operations during the pandemic. SaaS companies need to hang onto those customers in order to maximize net revenue retention (NRR) and add future growth. Investors increasingly consider NRR, the revenue generated from existing customers, a highly tangible indicator of the strength of a company’s product offerings and customer health. Furthermore, our research shows that, for SaaS companies, NRR is one of the most prominent contributors to valuation multiples and TSR. SaaS companies can improve NRR by embracing a customer success mindset—a shift in the approach to customer management that uses data and AI-based intelligence to improve all parts of the customer experience over the lifetime of the relationship. In such an approach, companies adopt more at-scale, proactive, predictive, preemptive, and targeted strategies and go-to-market campaigns.

IT services companies need to search for a post-pandemic growth engine. IT services companies’ recent value growth came first from helping their clients set up systems and upgrade infrastructure to support remote operations during the initial phase of the pandemic, and then from increasing their pace of innovation, acquisitions, and consolidation, and offering verticalized solutions and platform builds. As the world settles into a new post-pandemic normal, IT services companies should look for additional opportunities to spur growth in such areas as cloud, analytics, robotic process automation, cybersecurity, and experience engineering. They might also explore new areas such as mobility and 5G , and offer vertical-specific solutions for such industries as automotive, energy, banking, and health care.

Chip-dependent companies must maneuver around the supply shortage. Semiconductors are now so ubiquitous that the current shortage has affected a wide range of companies—none more so than chip-dependent companies shaping innovative technologies such as autonomous driving, 5G networks, and online gaming. Yet as demand continues to outweigh the industry’s ability to add capacity, the shortage is likely to continue through the second half of 2023. (See Exhibit 4.) To deal with it, chip-dependent companies need to get creative. For example, automotive companies can update the software architecture of the cars they manufacture to centralize processing on fewer chips.

Current value-creation leaders have to look out for innovative newcomers. A fact of life in the tech industry is the constant threat that young, innovative companies could upend the status quo of the industry’s current value-creation leaders. From January 2020 to June 2021, companies in BCG’s Growth Tech 100 cohort grew by 93%, more than three times the overall market’s growth of 27%. The strong showing of these newcomers is reflected in the tech industry Value Creators ranking, which includes three top 10 companies for TSR performance from the Growth Tech 100: The Trade Desk, Twilio, and HubSpot. Other Growth Tech 100 companies include the parent companies of popular social media platforms TikTok (ByteDance) and Snapchat (Snap); Zoom, the videoconference call app; Square, the digital payments provider; and Shopify, the B2B e-commerce platform; as well as online marketplaces and Internet of Things applications.

Meanwhile, companies from such diverse industries as health care , finance, and insurance are pouring investments into artificial intelligence and other advanced technologies to become tech companies themselves and offer tech solutions to their customers. For example, the Washington Post has commercialized its publishing tech stack. And Octopus Energy, a UK utility player, licenses an in-house billing platform to other energy retailers. This trend puts pressure on current tech players to respond.

Tech companies should consider whether and how to compete in the metaverse market. By some estimates, the value of the metaverse ecosystem will reach $1 trillion by 2030. The metaverse market represents a merging of three areas of existing technology whose capabilities are rapidly evolving: platforms enabled by increased computing capacity and connectivity; augmented reality, virtual reality, and mixed reality ; and digital and web3 assets enabled by blockchain . It’s too early to pinpoint which technologies or platforms will dominate. But it’s not too early for tech companies to plan how to participate in the metaverse ecosystem. For tech companies in particular, it’s an opportunity to help shape future standards and platforms.

Industry players need to invest in growth to offset the risk of declining valuation. Recent stock market gyrations suggest that the benign market conditions partially responsible for tech companies’ high valuations in the recent past may not persist. The risk is not limited to public companies, as valuations in public markets directly impact private company valuations . If multiples contract, tech companies will have to work even harder to grow and deliver an attractive return to investors. That means improving sales effectiveness to acquire new customers and doing more to retain net revenue. These are already priorities for emerging players, but getting extra juice out of this squeeze may become the top priority for CEOs at tech companies of all sizes.

The technology industry benefited during the past couple of years from a confluence of trends that pushed market valuations and shareholder returns above those of any other industry. Staying on top could be difficult, however, especially if market conditions shift. To retain the industry’s momentum, tech companies must continue to innovate—not just in what they offer, but also in where they compete, how they operate, and how they interact with customers.