New technologies are profoundly changing industrial production, giving rise to “the factory of the future.” What will the factory of the future be like with respect to its structure, technologies, and processes? What enablers will manufacturers need in terms of strategy and leadership, employee skills, and IT infrastructure to make it a reality?

The Boston Consulting Group recently conducted a study that addressed these questions. The study focused on a global survey of more than 750 production managers from leading companies in three industrial sectors: automotive (which includes suppliers and original equipment manufacturers, or OEMs), engineered products, and process industries. The goals were to define a vision for the factory of the future in 2030, assess the benefits, and create a roadmap for implementation. Our research partner was the Laboratory for Machine Tools and Production Engineering at RWTH Aachen University.

We found that industrial companies have high ambitions to enhance their factories—85% of respondents believe they can benefit from implementing elements of the factory of the future. But they appear to be struggling to build momentum. Among survey respondents, 74% said that their company has implemented, or plans to implement (within the next five years), elements of the factory of the future, but only 25% said they achieved their related targets last year. When we looked at the participants’ responses by industrial sector, the results were consistent with the overall findings. Furthermore, we found that German companies are the most advanced: 47% of respondents said they have developed their first concepts for the factory of the future. However, even among German companies, nearly 1 in 5 said that they are not yet prepared to introduce the related technologies.

Many manufacturers have started to selectively implement elements of our vision for the factory of the future. Below, we provide many examples of these efforts, most of which are being piloted on a small scale in specific areas of the plant. In order to realize our vision, manufacturers must apply these advances comprehensively throughout their plants and across an integrated value chain.

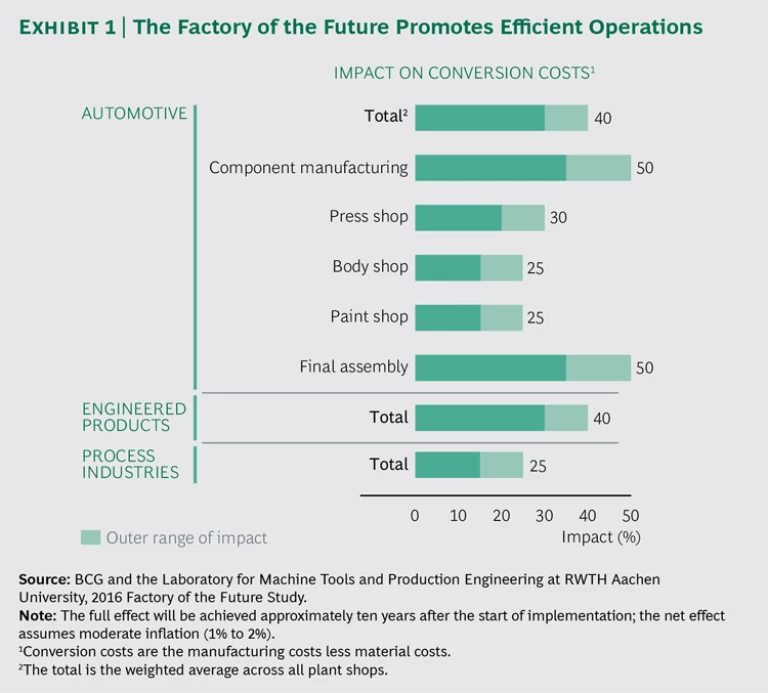

We analyzed how conversion costs and manufacturing costs would be affected ten years after starting implementation. We found that total conversion costs will be reduced by up to 40%. (See Exhibit 1.) Total manufacturing costs will be reduced by up to 20%, depending on the material costs. Manufacturers will also capture the benefits of enhanced flexibility, quality, speed, and safety. Over a ten-year period, a company’s cumulative investments to capture these benefits will amount to 13% to 19% of one year’s revenue.

In this report, we focus on automotive suppliers and OEMs. In recent decades, such companies have been the leaders in implementing innovations in production to improve efficiency. Their initial efforts to implement the factory of the future help to illustrate the use cases and improvement opportunities and serve as a model for other industrial manufacturers.

What Is the Factory of the Future?

The factory of the future is a vision for how manufacturers should enhance production by making improvements in three dimensions: plant structure, plant digitization, and plant processes. We discuss the elements of each and provide selected examples that illustrate how leading automotive suppliers and OEMs are testing new concepts.

Plant Structure

The plant structure of the future has a more flexible, multidirectional layout, with a modular line setup and environmentally sustainable production processes. Respondents to our survey from the automotive industry expect plant structure to be important in the factory of the future: 86% said this dimension would be highly relevant in 2030, compared with 43% who think it is important today.

- Multidirectional Layout. The factory of the future deploys a multidirectional layout in which products are placed on driverless transport systems and individually guided through production by communicating with production machinery. The Audi R8 manufacturing facility in Heilbronn, Germany, does not have a fixed conveyor. Instead, driverless transport systems, guided by a laser scanner and radio frequency identification technology in the floor, move the car bodies through the assembly process. Such systems enable assembly layout changes to be made quickly.

- Modular Line Setup. The plant structure of the future has interchangeable line modules and production machinery that can be easily reconfigured. Toyota is setting up “simple and slim” production lines in factories in Mexico and China. The automaker will use a modular conveyor, which is built on the factory floor instead of in a pit, giving workers greater flexibility in changing the length of the line and in moving the line-side equipment.

- Sustainable Production. The factory of the future is designed for ecologically sustainable production, including the efficient use of energy and materials. Webasto has equipped its facility in Arad, Romania, with LED lighting and an active nighttime cooling system, thereby significantly reducing energy consumption.

Plant Digitization

Manufacturers are increasingly using digital technologies. Of automotive respondents, 70% said that plant digitization would be highly relevant in 2030, compared with 13% who think it is important today. Companies are enabling smarter automation and promoting efficiency in various ways.

- Installing Smart Robots. Robots can perform more complex tasks than human workers can. Robots can also collect information from each work piece being produced and automatically adjust their actions to its characteristics. Changan Ford has installed flexible industrial robots on a “body in white” welding line. The company plans to use the robots’ functionality, together with a body-framing system, to process six models on a single welding line, performing a changeover to accommodate different models within 18 seconds.

- Using Collaborative Robots. Robots can collaborate with humans without protective fences. In the power train preassembly at Volkswagen’s plant in Wolfsburg, Germany, a collaborating robot supports workers by tightening screws that are difficult for them to reach.

- Implementing Additive Manufacturing. Manufacturers are implementing 3D printing of tools and components. To build the Rolls-Royce Phantom, BMW has used 3D printing in series production to create more than 10,000 parts, such as plastic holders for center lock buttons as well as for electronic parking brakes and sockets.

- Employing Augmented Reality. The use of augmented reality, such as through smart glasses, enables employees to see information as an overlay on their visual field. This assistance is especially helpful in, for example, assembly, maintenance, and logistics. At a plant in Germany, Volkswagen provides 3D smart glasses to logistics workers to facilitate order picking.

- Applying Production Simulations. Manufacturers are using real-time, 3D representations of production to optimize processes and material flows. The 3D simulation of material flows at Faurecia enables more flexible responses to changes and allows operators to visualize workflows prior to adjusting the production line.

- Developing Immersive Training Sessions. Training methods have been developed that use 3D simulations to help workers learn in a realistic environment. Mercedes-Benz has developed virtual assembly lines with digital models of the vehicle and assembly components. Employees use an avatar in the virtual environment to analyze the best way to perform an assembly task.

- Implementing Decentralized Production Steering. Companies are using advanced technology to enable communication among work pieces, machines, and people, thereby creating autonomous production processes. Bosch is developing tools that detect their location in the plant. On the basis of a tool’s location and the information it receives about the exact position of a work piece, the tool automatically loads the appropriate program to perform a specific action. For example, a screwdriver adjusts its torque to tighten screws on a given work piece.

- Using Big Data and Analytics. Manufacturers are using applications to automatically analyze large amounts of data. To produce cylinder heads at its plant in Untertürkheim, Germany, Mercedes-Benz uses predictive analytics to examine more than 600 parameters that influence quality.

Plant Processes

By using new digital technologies, manufacturers are taking lean management to the next level and exploiting its full potential. Indeed, our survey results indicate that optimizing plant processes will be even more important in the future: 97% of automotive respondents said lean management would be highly relevant in 2030, compared with 70% who said it is important today. Two key elements of lean management that are being further enhanced by digital technologies are customer centricity and continuous improvement.

- Customer Centricity. Manufacturers are gaining a better understanding of customer needs by, for example, applying big data analytics to obtain insights into how customers use products. Companies are, in turn, using these customer insights to improve their product designs and production processes. Companies are also envisioning using new technologies to allow customers to provide input regarding the production of their vehicle. According to Daimler, customers will be able to request last-minute modifications, such as a change to a vehicle’s color while it is in route to the paint shop.

- Continuous Improvement. Manufacturers are using a wide variety of new technologies to perform more value-adding activities and to continuously improve production processes. Bosch has implemented software that analyzes data about its production of fuel injectors in real time. The software monitors process adherence and recognizes trends. It automatically transmits information about deviations to operators, allowing them to improve the process accordingly.

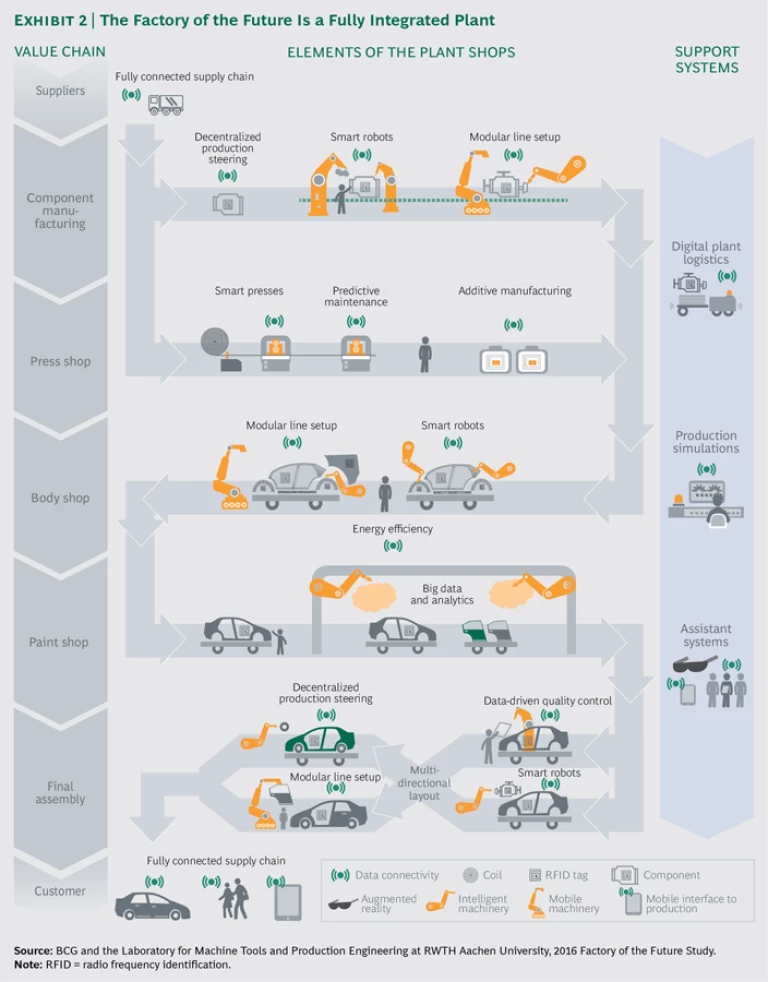

A Fully Integrated Value Chain

In the factory of the future, the value chain—made up of suppliers; component manufacturing; press, body, and paint shops; final assembly; and the customer—will be fully integrated, blurring traditional boundaries. (See Exhibit 2.) Throughout the value chain, manufacturing will be facilitated by the comprehensive integration of IT systems and the availability of all required production data. Within a company, this integration will strengthen connections across R&D, production, sales, and other functions. For example, Continental Tire has accelerated product testing by setting up a research and production facility in which all machinery is fully integrated using sensor systems and software. Such integration will also be possible outside a company’s boundaries, creating real-time connections with suppliers and customers. An OEM’s press shop, for example, will be able to adjust the pressing parameters for a specific coil on the basis of data provided by the supplier. Customers will be able to view the production of their vehicle in real time and request last-minute changes. Of automotive respondents, 87% said that integrated value chains will be relevant in 2030. These respondents overwhelmingly recognized the benefits: reducing costs as well as improving production flexibility, quality, and speed.

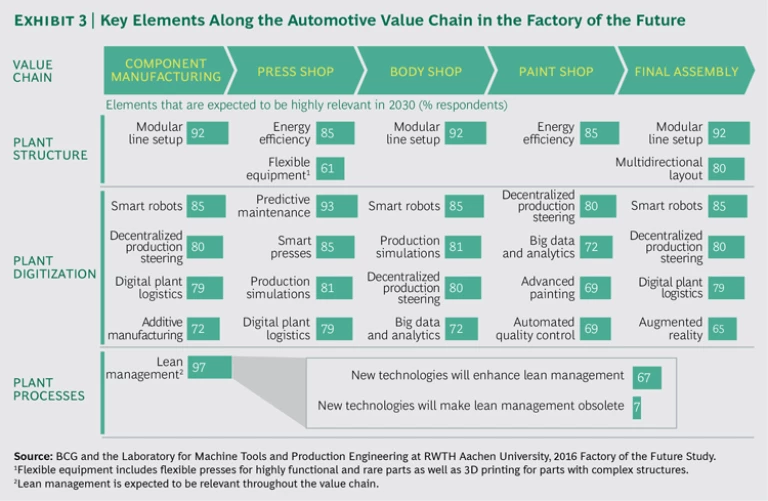

For each plant shop in this integrated value chain, automotive respondents provided insights into what they considered will be the most important elements in the dimensions of plant structure, plant digitization, and plant processes. (See Exhibit 3.)

Component Manufacturing

Component manufacturing will benefit from greater flexibility and improved working conditions. For example, 80% of automotive respondents cited the relevance of decentralized production steering and, in particular, the automated adjustment of machine parameters in the factory of 2030. Nearly all of these respondents pointed to flexibility improvements currently arising from communication between machines and products. When producing camshafts, ThyssenKrupp assigns each one a Data Matrix code comprising product data. The production machines scan each camshaft’s code and make appropriate adjustments to their parameters prior to executing manufacturing tasks. Additionally, more than 70% of respondents noted that additive manufacturing (commonly known as 3D printing) will be relevant to component manufacturing in 2030. The main applications cited for additive manufacturing today are not only the creation of prototypes but also the printing of tools and spare parts.

Press Shop

The press shop will benefit from improved equipment effectiveness. Of automotive respondents, 93% cited the relevance of predictive maintenance in 2030. In fact, most respondents have implemented, or plan to implement within the next two years, their first applications of predictive maintenance. Schuler has developed robots that not only move parts along the press line but also monitor the condition of components and signal to workers if a replacement is required. Fraunhofer IWU is conducting research to determine how to enable a press to take corrective measures on the basis of information it receives about a raw material’s specific characteristics. Energy efficiency is expected to be relevant in 2030 by 85% of respondents. Škoda Auto will recover energy released during pressing by installing press lines that consume up to 15% less energy, compared with conventional systems.

Body Shop

Automotive companies are using new technologies to promote greater flexibility in the body shop. More than 80% of automotive respondents said that smart robots and production simulations will be relevant in the body shop in 2030. Already, automotive manufacturers are using smart robots that communicate with the car body and adjust their actions in response to the information received, while simulations assist in the planning and configuration of the shop’s layout. For the body shop that builds the Jeep Wrangler, Kuka and Microsoft have developed an intelligent system that not only connects all robots but also monitors their wear and tear. Magna has implemented a simulation program developed by Siemens that facilitates digital planning and replicates body shop processes, such as the interaction of up to six robots.

Paint Shop

The paint shop will benefit from technologies that improve energy efficiency and the quality of the paint job. Of automotive respondents, more than three-quarters said that energy efficiency will be relevant in the paint shop of 2030. For example, in its Leipzig factory, Porsche currently uses waste heat from a nearby biomass power plant to provide a carbon-neutral supply of up to 80% of the paint shop’s heat requirements. Nearly three-quarters of automotive respondents noted that big data and analytics will be relevant. Most automotive companies have already started to use big data in the paint shop. The goal is to analyze data to identify the factors that cause variances in paint jobs and thereby improve quality.

Final Assembly

Final assembly will benefit the most from a more flexible, multidirectional layout. Increasingly, automotive companies will have to offer a wider variety of car models to meet higher customer expectations and government regulations; a multidirectional layout will enable producing a wider variety while maintaining high production output. More than 90% of automotive respondents expect a modular line setup will be relevant in final assembly in 2030, with the flexible and cost-efficient replacement of line elements seen as especially important. For example, Toyota is introducing smaller and more flexible lines, leading to reduced line investments. Eighty-five percent of respondents cited the relevance of smart robots in final assembly. Companies are hoping for advancements in robotics that would allow these devices to take on tasks requiring high precision. And more than 75% of respondents noted that digital plant logistics will be relevant. This can be used, for example, to automatically replenish workstations with preassembled parts.

With respect to plant processes, lean principles will be important throughout the value chain in 2030. Two-thirds of automotive respondents expect that new technologies will enhance lean management and the continuous improvement of production processes. The use of production simulations, for example, will enable manufacturers to increase “pull” in production, thereby reducing waiting times and the work in progress. Augmented reality (for example, smart glasses) will support operators in executing assembly and maintenance activities by displaying operating procedures. By analyzing production data with advanced big data algorithms, manufacturers will gain a significantly better overview of each production step, allowing them to continuously improve production processes. Only 7% of automotive respondents expect that new technologies will make lean management obsolete.

The Three Enablers

To realize the vision of the factory of the future, auto manufacturers must address topics related to three enablers: strategy and leadership, employee skills, and IT infrastructure. Companies must make the factory-of-the-future strategy an integral part of their corporate strategy and adapt their leadership styles to new ways of working. Manufacturers also must focus on building a workforce with the new set of skills required for performing technology-centered production tasks. Finally, companies must install IT infrastructure that supports connectivity throughout the value chain while ensuring the security of data.

Strategy and Leadership

Manufacturers must include their strategy for implementing the factory of the future as an element of their overall company strategy and put in place organizational structures that promote rigorous governance. Of automotive respondents, 35% see issues relating to the organization as a major challenge. Companies must address three organizational requirements:

- The Strategy and Roadmap. The strategy for implementing the factory of the future must be anchored in the overarching company strategy. Approximately one-third of automotive respondents see the factory-of-the-future strategy as a major challenge. Many companies lack a strategic vision to guide a structured implementation process.

- Governance. To realize their vision, manufacturers must put in place organizational structures (such as clear responsibilities for steering and coordinating all efforts related to the factory of the future) and define the processes required to ensure that their factory-of-the-future strategy is translated into implementation actions. Approximately one-third of automotive respondents see governance as a major challenge, with the main issues being a lack of communication among departments, unclear responsibilities, and insufficient management commitment.

- New Leadership Styles. Automotive respondents say that an advisory leadership style will be more important in the factory of the future, while an authoritarian style will be less relevant. Transformational and group-oriented leadership will also gain in importance.

Employee Skills

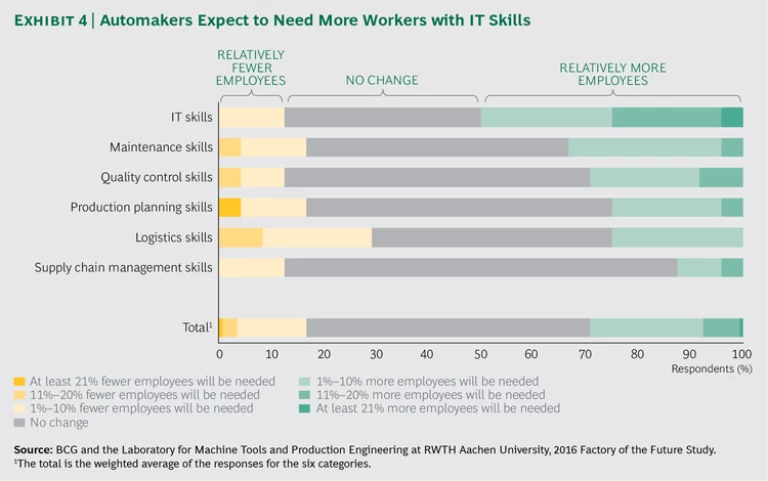

Although the greater use of robotics and computerization will reduce the number of jobs in assembly and production, the number of manufacturing jobs requiring skills in IT and data science will increase. Approximately 50% of automotive respondents said that they expect to employ more workers with IT skills, and approximately 25% expect the number of IT employees will increase by more than 10%. (See Exhibit 4.) Approximately one-third of respondents expect to need more workers with competencies in maintenance and quality control, while about 25% expect to need people with production planning and logistics skills. These additional staffing resources will be needed to respond to the insights provided by the trove of new data available.

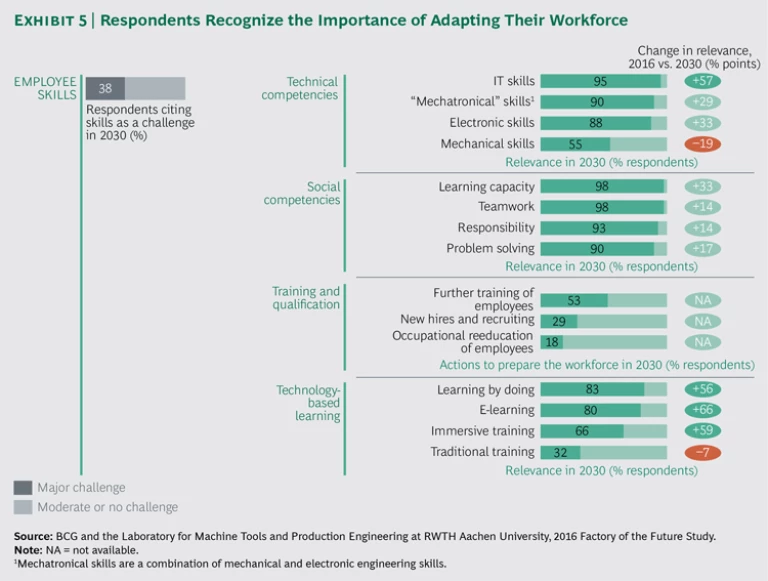

Recognizing that they need to adapt their workforce to the factory of the future, 38% of automotive respondents see employee skills as a major (“big” or “huge”) challenge. (See Exhibit 5.) To ensure that their workforce evolves appropriately, companies must focus on building technical and social competencies. They also must implement new approaches to qualify their employees and ensure that the right skills are in place.

- Technical Competencies. Manufacturers need to strongly focus on technical skills and backgrounds when training or hiring employees. Automotive respondents expect that capabilities in IT, electronics, and “mechatronics” (combined mechanical, electronic, and IT skills) will be more relevant in 2030, while purely mechanical skills will be less relevant.

- Social Competencies. The pace of change in the factory of the future means that workers must be willing and able to continuously learn new skills. Rather than primarily performing repetitive tasks, they will often be called upon to solve problems as members of interdisciplinary teams. More than 90% of automotive respondents see each of the four key social competencies—learning capacity, teamwork, responsibility, and problem solving—as relevant for 2030.

- Training and Qualification. Manufacturers cannot expect workers to build the necessary technical and social competencies on their own. To successfully transition to the factory of the future, manufacturers need to develop an approach to training and qualifying workers. Most automotive respondents in our survey (53%) cited further training of employees as the main route to building the required skills. Significantly fewer cited hiring new employees (29%) or reeducation (18%).

- Technology-Based Learning. The new generation of workers wants training options that enable flexibility in terms of where and when instruction is available. Self-learning programs on mobile devices, not slide presentations in a classroom, are the preferred way to obtain information. Automotive respondents appear to recognize the need to offer innovative, technology-based learning. They see learning by doing, e-learning, and immersive training using virtual environments as more relevant in 2030. They see traditional training courses as less relevant in 2030.

IT Infrastructure

One-third of automotive respondents see IT infrastructure as a major challenge. Two related requirements must be addressed:

- Cloud and Connectivity. Manufacturers need plant-wide connectivity infrastructure (such as a wireless local area network) and technology to capture and store production data. Respondents said that using private cloud services as a central platform for data storage and software as a service will increase in importance, but they are skeptical about using public cloud services. The two main challenges for improving plant-wide connectivity are a lack of network standards and poor network infrastructure.

- Data Security. Enhanced supply chain connectivity is essential, but safeguards are required to ensure the secure exchange of data. Indeed, data security is a major concern of automotive companies. More than 40% of automotive respondents see data security as a major challenge, and about 30% cited concerns over the uncertainty of data ownership.

Getting Started

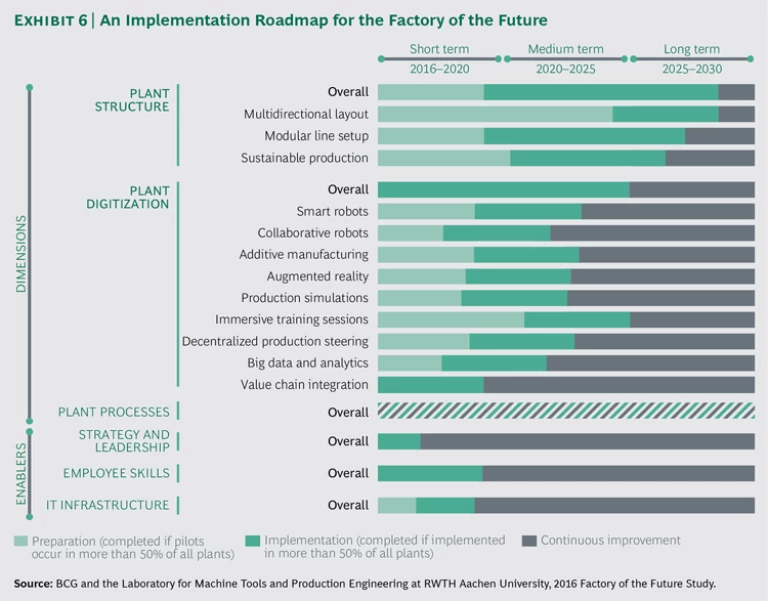

BCG has applied the insights from the study to develop an implementation roadmap for the factory of the future. (See Exhibit 6.) Each manufacturer must tailor the roadmap to its specific starting point. In most cases, manufacturers should focus on plant digitization in the short to medium term, so as to avoid falling behind competitors that are already implementing use cases for digitization. Changes to the plant structure should be pursued in the medium to long term, because these modifications affect all equipment and the plant layout. Such changes are typically undertaken at the same time that plants are overhauled or new product models are launched. For plant processes, manufacturers should continuously implement new technologies to improve processes and customer satisfaction as an extension of their current lean management agenda. Manufacturers should immediately launch efforts to put in place the foundational enablers, because training current employees and hiring new ones, as well as installing an IT infrastructure, are time-consuming efforts.

To help manufacturers customize the implementation roadmap, BCG has developed a “health check,” which quickly assesses the current state of a company’s implementation efforts. The results are then benchmarked against other plants, the industry average, or peer groups to determine the starting point.

To understand how to address the points identified in the health check, company executives and staff can participate in workshops on and demonstrations of advanced technologies at the model factories operated by BCG’s Innovation Center for Operations (ICO). To identify use cases for examination, companies can apply filters to BCG’s database of more than 200 examples of factory-of-the-future applications, sorting by applicability to specific industries as well as by the plant dimension or plant shop. ICO experts then discuss use case applications in detail with a company’s plant team and evaluate a list of potential technology vendors to identify the opportunities, assess the expected financial and nonfinancial benefits, and quantify the related implementation costs and required investment.

As the many examples presented in this report illustrate, manufacturers are already working with bits and pieces of our vision for the factory of the future. However, achieving this vision will require much more than isolated implementations of discrete use cases. Through the holistic application of new design principles and digital technologies, leading manufacturers can intelligently coordinate all aspects of their plant operations and integrate the value chain that runs from suppliers to end customers. The first manufacturers to succeed in transitioning to full-scale adoption will usher in a new era of industrial operations.

Acknowledgments

The authors would like to thank their colleagues Andreas Dinger, Konrad Eltz, Philipp Konecny, Aclan Okur, Felix Pfeiffer, Jan Schlageter, and Bernhard Strack for their contributions to this report.