Airline management is often about making tradeoffs. Consider the following made by airlines in recent quarters.

A major US-based international carrier sought to improve on-time performance (OTP) with a more aggressive policy of departing on schedule; this meant leaving late-connecting passengers behind despite the price paid in terms of upset passengers, the stress on gate and booking agents who had to deal with the angry customers, and higher passenger-compensation costs. Another legacy carrier decided to “buy” better OTP by increasing its block times (the total flight time, from pushing back from the departure gate to arriving at the destination gate). The company built more buffer time into its schedule, but the move resulted in lower plane utilization rates and higher costs for crews that worked longer hours.

Another example: Most low-cost carriers tend to schedule tight turnaround times on the ground to maximize aircraft utilization. But in order to maintain their OTP, they require passengers to arrive earlier than needed and wait in the aircraft or stand in the Jetway (after their boarding passes have been scanned), often in either very hot or very cold conditions.

These tradeoffs may or may not be good business decisions for the companies making them. The bigger problem is that many airlines can’t know in advance whether they are making a good choice—and they often don’t have an effective way to find out. Many companies are operating on gut feel and the assumption that achieving one goal necessitates giving up ground somewhere else. But there is a better way.

Getting Operational Performance Right

Some airlines are good at balancing the operational tradeoffs that they face. These companies tend to have a couple of things in common. First, they make an explicit commitment to what they see as essential. Delta Air Lines, for instance, is the “on-time machine.” Alaska Airlines’ promise is “safe, on time and with your bag at the lowest cost.” In Europe, Ryanair has been famously direct about what customers can expect onboard, and it is equally well known for its low fares and excellent OTP. (Ryanair has more recently acknowledged the value of investing more in customer satisfaction.) A number of Asian and Middle-Eastern carriers have set expectations for, and consistently deliver, high levels of service; they are achieving impressive growth rates despite all the challenges faced by the industry.

Second, successful airlines invest in and develop advanced analytical capabilities that help them weigh the tradeoffs. Qatar Airways, for example, recently launched a new advanced performance management system, which allows for real-time decision making in addition to providing detailed performance management data. Southwest Airlines has developed an advanced disruption-management tool, with the goal of improving its OTP by more than 30 percentage points on days when its service is disrupted.

Successful airlines invest in advanced analytical capabilities that help them weigh tradeoffs.

Many low-cost carriers are able to not only sustain OTP rates well above industry averages but also maintain their high customer satisfaction rates and low-cost structures. Azul in South America is an example.

Why Some Airlines Struggle to Improve

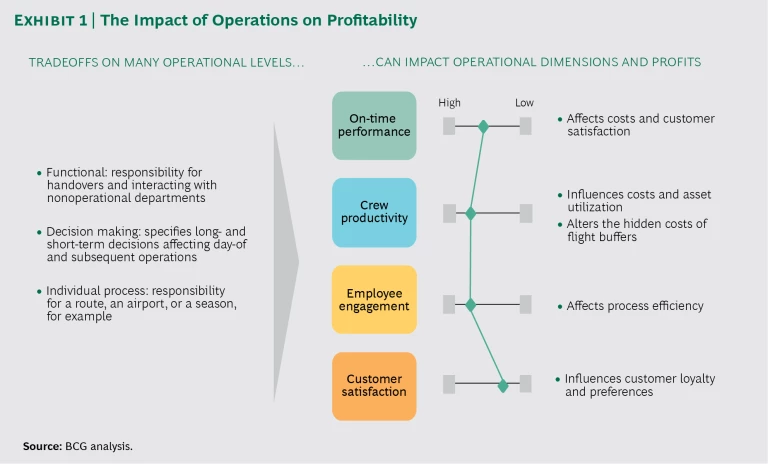

But for plenty of airlines of all types and sizes, the challenges of improving operating performance while also maintaining or even improving profitability are real and seemingly becoming only more complex. (See Exhibit 1.) The interplay of such issues as OTP, crew productivity, and aircraft utilization, under widely varying circumstances and in the face of daily uncertainties related to weather, mechanics, and air traffic control, bedevil even the most sophisticated companies. Long-running labor issues add yet another complication, particularly for legacy carriers. And all the while, customers are demanding more great products, a seamless experience, quick responses during disruptions, a friendly crew, and, of course, safety—all at a low price.

We find that airlines face three common issues: an inability to connect the tradeoffs they make, inadequate data and reporting systems, and a focus on the operating system rather than on the customer.

Tradeoffs. On any given day at many airlines, operations’ decision making is intuitive because systems are not integrated and the tradeoffs that managers need to make, such as between fleet availability and crew rest, are handled manually across multiple flights. Equally, longer-term tradeoffs are not discussed explicitly or at the same time. For example, labor relations may be asked to reduce salaries or increase productivity, but it won’t be asked to increase or monitor crew engagement and customer satisfaction. Or procurement may be asked to save on outstation costs but without discussing the service level agreements needed to monitor performance. Organization silos, such as the ground crews and gate agents, further inhibit collaboration toward company-wide goals and targets. For example, it is not uncommon for network schedules to be developed and handed over to operations without a feedback loop to assess the feasibility of implementation or the impact on costs. Sometimes shifting a schedule by as little as 15 minutes would allow the crew to do another rotation.

Data and Reporting. Airlines typically have big gaps in the data they can access and use. They have access to high-level data (on system-wide OTP and profitability, for example) as well as incident flight reports (which provide the reason, such as weather, for a flight delay). But companies and their operations officers often lack the kind of data and reporting that identifies systemic issues that can actually be addressed. Airlines also often lack integral reporting that connects data, company objectives, and tradeoffs. For example, HR has some information on people performance, marketing has high-level data on customer satisfaction, and operations know a lot about OTP. But these data points are insufficiently detailed and not linked, so it is hard for senior executives to get a full picture that is easy to analyze and assess. In addition, most operational dashboards are inward looking; they lack external benchmarks and industry financial criteria, for example. This also prevents top managers from achieving a full view of company performance.

Airlines often lack integral reporting that connects data, company objectives, and tradeoffs.

System Focus. Within the operations function, the focus is on keeping the system running; customer impact is often a secondary consideration. This mindset leads to a lack of focus on the customer experience, even though most of the interactions between airline staff and customers are handled by (at least traditionally) operations’ departments. For example, it is all too common for frontline staff, such as gate agents or the cabin crew, to lack real-time information about system operations (including up-to-date expectations for the flight they are working). Frontline employees often do not receive training in simple interventions that can improve both customer satisfaction, because someone actually helps, and employees’ own engagement, because they have been put in a position to help.

Assessing the Drivers of Operational Performance

BCG performed an outside-in analysis of the operational performance of several carriers and millions of flights in 2016 and early 2017. We focused on operational performance metrics, such as OTP and efficiency (aircraft utilization, for example), as well as on customer satisfaction and staff engagement. Our analysis led to significant findings with respect to systemic differences and challenges across carriers as well as the management of, and recovery from, one-off events, such as bad weather.

Here are examples of the systemic issues we uncovered:

- For most network or hub-based carriers, the OTP for wide-body aircraft consistently lags narrow-body OTP. Although this is likely (at least partially) a deliberate choice by airlines to favor connecting passengers, it means that many passengers will experience the anxieties associated with delays.

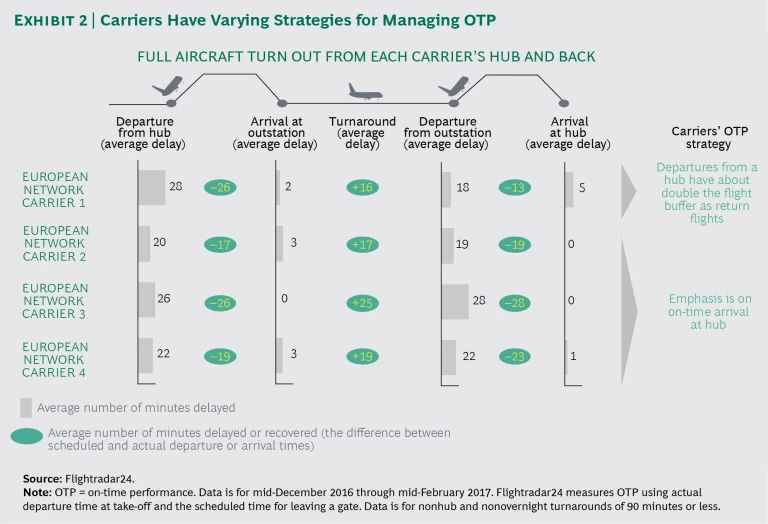

- Low-cost carriers tend to use shorter turnaround times combined with higher flight buffers that favor arrival OTP over departure OTP. (See Exhibit 2.) This strategy is likely designed to keep pressure on turnaround times, but it may come at the cost of customer satisfaction because passengers are well aware of late departures and time wasted waiting at the gate.

- Customer satisfaction with respect to OTP does not always correlate with actual performance. Whether or not an airline provides real-time information on delays, their expected length, and the reasons for them can have a significant positive or negative impact on passengers’ perceptions of performance.

In addition, as frequently happens, several carriers showed low “fleet launch” OTP early in the day, leading to a ripple effect on flight OTP throughout the day. And a number of hub-based carriers have difficulty maintaining OTP during peak hours. Some resort to adding significant buffers throughout the day to recover, while others accept heavy delays later in the day.

Disruption management also varies significantly. For example, during an air traffic controllers strike, at least two European flag carriers had aircraft captains explaining the delay to passengers at the gate or live in the cabin. On another carrier’s plane, the captain did not even welcome passengers onboard, let alone explain the delay of more than two hours. Even within the same airline, how disruptions are explained and handled can be left to local decision makers.

In a similar vein, although all airlines claim to focus on the digital customer experience, the actual experience differs significantly. For example, one European low-cost carrier sends users looking for OTP information to an external source. As we wrote last year, thanks to digital innovators such as Amazon and Netflix—not to mention travel industry disruptors such as Uber and Airbnb—consumers’ expectations are on the rise. So, for example, if an airline’s OTP is not as reliable as its competitors’, and the company is worried about the impact on its frequent flyers, it ought to identify which customers pose the highest risk of defection and reach out with individually tailored offers designed to maintain their loyalty. Yet many carriers still fail to deliver even the digital basics, such as responding to customer queries within the time promised. (See “It’s High Time Airlines Got Personal,” BCG article, August 2016.)

Applying the PMOP Approach

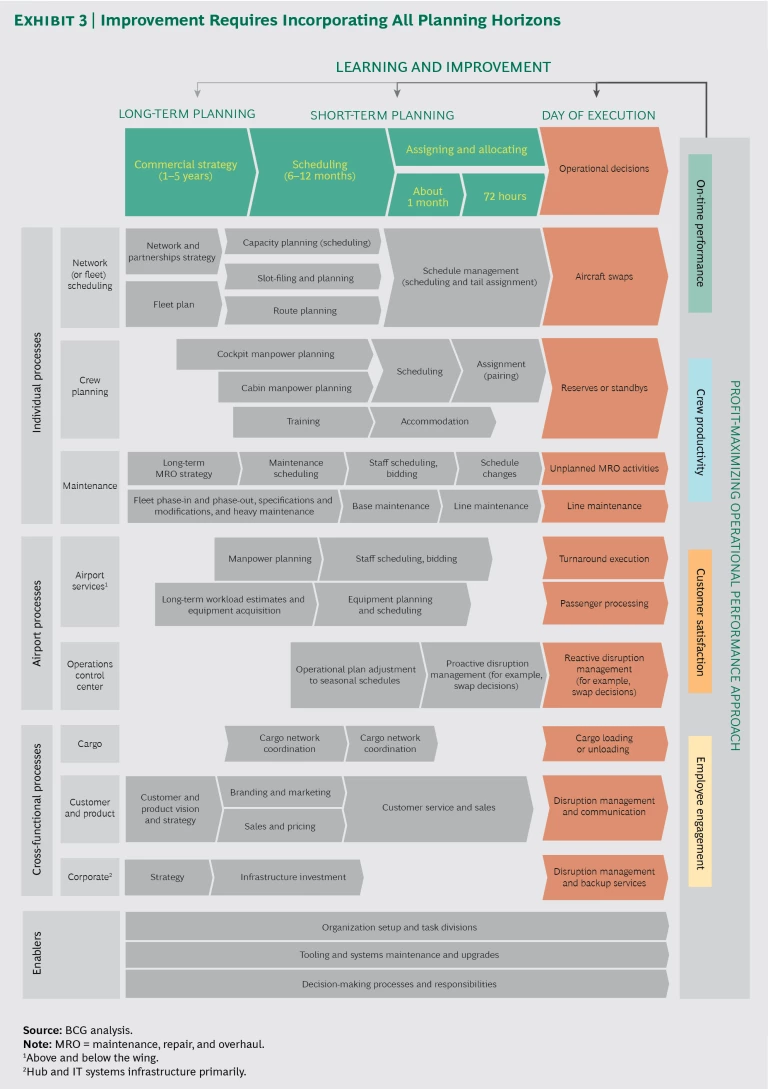

We believe that airlines can improve their profitability by tens of millions of dollars through improved operational performance. Our approach, profit-maximizing operational performance (PMOP), takes an integrated and analytical perspective. It examines all planning horizons (long and short term and day of execution) and all processes (for example, network scheduling, crew planning, and maintenance) and the tradeoffs among them. (See Exhibit 3.) Since every airline is different (long-haul versus short-haul, network versus point-to-point, legacy versus low cost), it’s important that each carrier assess such factors as the drivers of its organizational processes and teams; where decision rights reside; how data and information are collected, stored, and used; and how information, tools, and other enablers help (or hinder) making the right decisions and providing accurate information to customers.

All these dimensions and tradeoffs need to be put into the context of the company strategy. For example, Delta is now facing the challenge of renewing its fleet, which creates the need for higher utilization. This, in turn, may put pressure on its OTP. At the same time, low-cost carriers maximize utilization of brand-new aircraft (with limited need for maintenance downtime) with tight on-the-ground turnarounds, which can be detrimental to both customer and employee satisfaction (for example, when the cabin is not adequately cleaned on every turn).

During the initial analysis, the focus is on systemic issues, factoring out atypical disruptions and one-time incidents. It clusters data by route, time of day, fleet type, flight direction, and type of competition. It disaggregates these and other factors to focus on the variability of each one, instead of on meaningless averages that cannot be acted upon.

The analysis also combines internal and external sources of data and perspective. Internal sources are usually very detailed and accurate. But by themselves, they often do not provide a comprehensive perspective on how the company is doing, compared with others operating under similar circumstances. PMOP starts from a relative perspective, looking at an airline’s performance, compared with that of several peers.

Spoiler Alert: No Silver Bullet

Striking the right balance across the various factors affecting operational performance can help airlines improve profitability regardless of network strategy, region, or price point. As is often the case when solving complex business problems, however, no silver bullet applies to all carriers. For some underperforming airlines, increasing profit while improving operations will require a transformation touching all of their operational functions and processes.

The greatest challenge for these carriers will be to find the optimal balance for profit maximization. Improving OTP by adding spare aircraft or ground staff is an easy fix, for example, but it doesn’t necessarily improve profitability. For most carriers, the interventions will still consist of making tradeoffs—though now the impacts will be clearly understood. For example, can airlines segment crews as they do customers, moving away from one-size-fits-all scheduling? Can companies shift buffers to improve OTP and connections to increase customer satisfaction? Or, can carriers change some schedules with marginal revenue impact, while allowing the crew to do another rotation or flight?

Underneath the PMOP approach is the belief that optimizing operational performance can never be fully automated. Although companies need the right systems in place, even the best carriers with the best processes, data, and technology still require employees to apply good judgment and make smart decisions. This is particularly true with respect to the operational control center and the management of disruptions. It is important to prioritize and monitor critical flights and have playbooks ready-made to deploy, but even more critical is to clearly define decision rights and responsibilities and have the right set of functions involved in real-time decision making.

Optimizing operational performance can never be fully automated. Companies still require employees to apply good judgment.

A PMOP Health Check

PMOP helps identify the necessary tradeoffs and the costs and benefits of each decision scenario within the context of the airline’s strategy. It then helps determine the interventions to develop in the implementation phase. For example, our work with one European low-cost carrier identified initiatives that resulted in a 14 percentage-point improvement in OTP. A European legacy carrier expects to gain a 15 percentage-point OTP improvement.

This study is complemented with internal data, such as operational logs (lost bags, delay codes, and the like), as well as field observations and interviews with frontline staff. The health check phase concludes with a workshop to jointly assess the findings and agree on the best implementation plan. The goal is to clearly examine the inevitable tradeoffs—such as sacrificing customer satisfaction to reduce costs and increasing buffers to help passengers make connections—on the basis of the airline’s strategy, of course. Once the priorities are established, implementation can include focused interventions that target a particular issue (such as passenger communications) or a complete transformation of a function (to improve crew productivity and engagement, for example).

Airlines that master these tradeoffs to improve their efficiency of operations while maintaining or enhancing the passenger experience can deliver margin improvement of 5% to 10%. The effort is complex and takes time. In today’s hypercompetitive airline industry, however, the results will stand out to customers, employees, and investors. Airlines will also derive long-term benefit from the improved analytical and operational decision-making capabilities that they employ as they move forward.