Since joining the World Trade Organization in 2001, China has emerged as the workshop of the world. China’s factories now generate more real manufacturing value added—$3.7 trillion in 2017—than the US, Germany, South Korea, and the UK combined.

Recent trends have raised questions about whether China’s ascent as a manufacturing superpower has hit a plateau. Years of rapidly rising wages have eroded China’s once-overwhelming cost advantage, and some production is shifting to locations where labor is cheaper or that are closer to customers in advanced economies. Policymakers have been adjusting China’s economic growth model so that it depends less on export manufacturing and more on services and domestic consumption. Escalating trade tensions with the US and other major trading partners are jeopardizing China’s access to some of its largest export markets.

Despite these headwinds, China’s manufacturing future remains bright. While the country is losing its edge in some labor-intensive sectors, it remains globally competitive across a remarkable spectrum of industries—and is gaining strength in others. With its sheer scale, immense internal market, productivity gains driven by strong adoption of advanced manufacturing systems, fully developed local supply chains, and growing investment and prowess in high technology, China has the potential to boost its annual real manufacturing value added by another $2 trillion by 2030.

To make this next leap, manufacturers in China must move sharply up the value chain to higher-tech, higher-value products. This will require accelerating productivity growth by investing in and disseminating next-generation Industry 4.0 manufacturing technologies and adopting world-class practices throughout its industrial value chains. The private and public sectors must also upgrade research and development so that Chinese industry generates more breakthrough innovations, rather than incremental improvements. Companies must also work with national and local governments to make it easier for innovative new entrants to compete in and gain access to domestic markets.

China’s track record of rising to such challenges is impressive, and government and business leaders are devoting immense resources to bring the manufacturing sector to the next level. We believe that with the right policy and investment support, China can maintain its global competitive edge for decades to come.

Manufacturers in China must move sharply up the value chain to higher-tech, higher-value products.

China’s Manufacturing Prowess

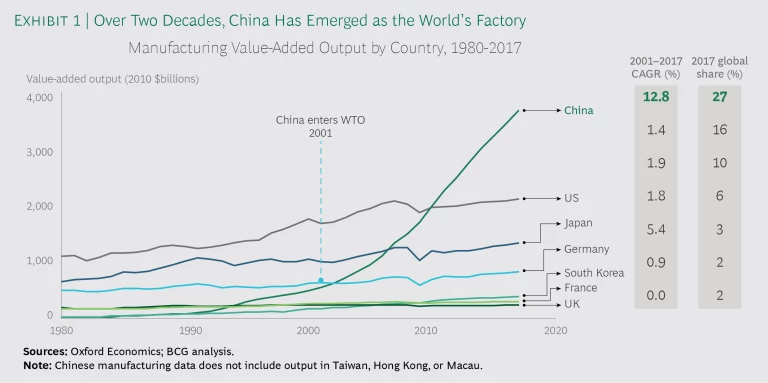

To understand the power of China’s manufacturing sector, start with its scale. The country was a minor factor in global trade in the early 1990s, when it emerged as an export platform for light manufacturers in search of abundant, ultra-cheap labor. By 2001, when China joined the WTO, it still generated only around half the real manufacturing value-added output of Japan and one-quarter that of the US.

Since then, China has exploded onto the world stage as a manufacturing platform for both domestic and international companies. China’s manufacturing value-added output has been growing at a 12.8% average annual clip, according to Oxford Economics, compared with 1.9% growth in Japan, 1.8% in Germany, 1.4% in the US, and virtually no growth in the UK. China now accounts for 27% of global manufacturing value added—1.7 times more than the US, 2.8 times more than Japan, and 4.4 times more than Germany. (See Exhibit 1.)

China is just as powerful as an export manufacturer. Even though the country has many lower-cost competitors, they pale in comparison. For example, it would take a 50% increase in the combined real manufacturing value-added output of Indonesia, Malaysia, Thailand, and Vietnam to equal just a 6% increase in China’s manufacturing output—which is its current annual growth rate. Consider how China has remained a production powerhouse in apparel, a very labor-intensive industry that would seem to be among the easiest to shift to lower-cost countries. From 2007 through 2017, a period when Chinese labor costs rose sharply, China’s annual apparel exports grew by $36 billion, to $145 billion. Over that same period, annual apparel exports from Vietnam, Bangladesh, Indonesia, India, and Thailand increased by $53 billion, to $88 billion. But only $2 billion of that output went to China. Indeed, imports from these countries have made only a tiny dent in China’s domestic market, accounting for less than 1% of total annual apparel sales.

China has remained a production powerhouse in apparel, an industry that would seem to be among the easiest to shift to lower-cost countries.

Moving Up the Value Chain

China’s manufacturing power is also manifest in the wide diversity of industries in which it is globally competitive. In addition to remaining the world’s biggest supplier of many labor-intensive goods—it accounts for around one-third of manufacturing value-added output in furniture and paper, for example—China is a global leader in “mid-tech” industries, such as cellular phones, optical instruments, and washing machines. Indeed, the country’s global competitive position in mid-tech industries is improving, a trend that is unlikely to change even if the high tariffs recently imposed by the US remain in place for the foreseeable future. China’s competitive position has also improved in such capital-intensive industries as paper products, fertilizers, organic chemicals, and electricity distribution equipment. What’s more, China is making great strides in high-tech industries in which it still accounts for a relatively small share of global markets, such as engines, agricultural machinery, machine tools, and pharmaceuticals.

China will keep climbing the industrial ladder. Its economy has already matured beyond the development stage, in which a nation’s competitiveness tends to be determined by such factor costs as unskilled labor and natural resources. With a nominal per-capita income of around $8,000—nearly $17,000 when measured in purchasing- power parity, according to the World Bank—China is now at the stage at which efficiency and quality will increasingly drive competitiveness.

In a number of industries, China is already beginning the transition to a stage similar to that of South Korea, Japan, and the US, at which innovation increasingly defines competitive advantage. The government’s industrial development initiatives aim to dramatically increase the country’s strength in such high-tech sectors as microelectronics, aerospace, computing, robotics, and renewable energy.

China is now at the stage at which efficiency and quality will increasingly drive competitiveness.

Behind China’s Shifting Cost Structure

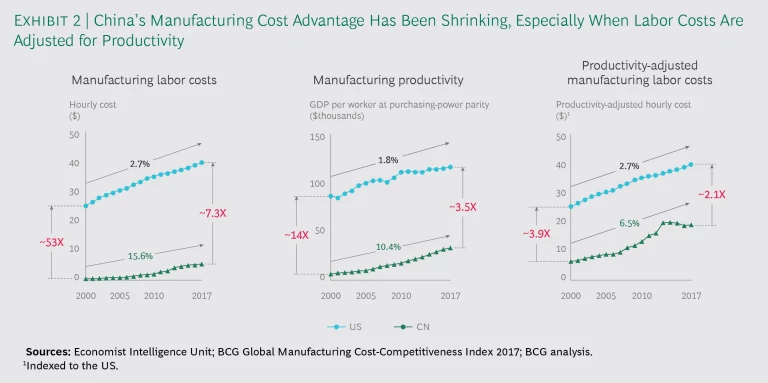

It is true that China’s manufacturing cost advantage has narrowed significantly over the past decade and a half. Back in 2000, Chinese manufacturing labor costs averaged only 46 cents per hour—53 times lower than the $25 per hour average in the US. Since then, Chinese manufacturing labor costs have been rising by 15.6% per year on average—faster than gains in productivity of 10.4% per year. In the US, meanwhile, manufacturing labor costs have increased 2.7% per year, while productivity growth has averaged 1.8%. (See Exhibit 2.) However, as a result of significantly higher US output per worker, lower US energy costs, and the appreciation of the Chinese yuan against the dollar, in 2016 overall productivity-adjusted manufacturing costs in China came within a few percentage points of parity with the southern US, the favored destination of new production capacity in most industries, according to the BCG Global Manufacturing Cost-Competitiveness Index. As a result of this shift in cost competiveness, a number of manufacturers began re-shoring the production of goods sold in North America back to the US to cut logistics costs and be closer to customers and core R&D operations. (See “ Honing US Manufacturing’s Competitive Edge ,” BCG article, January 2017.)

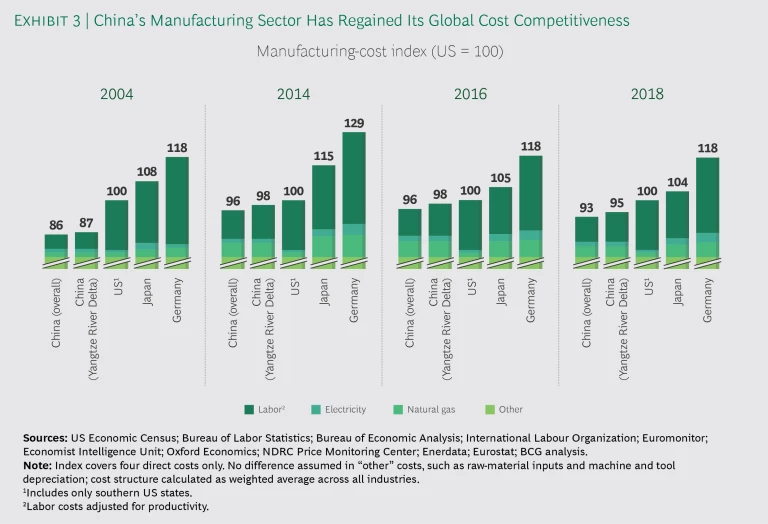

Yet China remains extremely cost competitive in a wide range of industries and global markets for a number of reasons. First, China’s overall cost competitiveness has recently improved relative to the US, after more than ten years of decline, because of a depreciating currency, higher productivity growth, and lower industrial energy costs. (See Exhibit 3.) China’s productivity- adjusted manufacturing cost advantage is higher when one considers the central and western provinces, where much of the new production capacity is being installed, not just the country as a whole or coastal regions such as the Yangtze River Delta.

What’s more, productivity comparisons can be quite different at the company-to-company level. While productivity is very low at some Chinese companies, we find through our client work that certain leading Chinese and multinational companies—particularly in industries such as pharmaceuticals, chemicals, and process industries—often establish factories with levels of automation similar to those in Europe and the US. As a result, these Chinese factories still have a large nominal labor-cost advantage.

A large producer of industrial chemical components with plants in the US, Western and Eastern Europe, and China illustrates how some Chinese factories are nearing parity with international productivity standards. The company has standardized most production processes around the world, yet its Chinese production lines are around 10% more efficient than those in the US and Europe. The Chinese production lines also have the fewest operators per shift and managers per production worker, and generate less scrap than factories in the US.

China as a whole has a productivity-adjusted manufacturing cost advantage of 5 to 7 percentage points over the southern US because factory wages are significantly lower in the country’s interior than in coastal provinces. As explained below, cost structures in China’s interior will become more relevant to global competitiveness as manufacturing continues to shift to central and western provinces.

The US and EU contend that Chinese manufacturing benefits from government policies such as investment support, forced technology transfers, and barriers for foreign companies. Government policies do help domestic industries by providing inexpensive funding and, in some cases, protecting markets. However, we don’t regard this support as the ultimate driver of manufacturing growth in China.

Three Sources of Sustained Competitiveness

Several powerful advantages are likely to enable China’s manufacturing sector to keep growing, succeeding in global markets, and diversifying into higher-value sectors—even if access to certain export markets becomes more difficult. The following are some of the most important advantages.

An Expanding Domestic Market. China’s enormous, rapidly expanding internal market will continue to propel strong growth in manufacturing—and stimulate industrial expansion further inland. The falling contribution of exported goods to manufacturing GDP—from around 57% in 2007 to around 46% in 2017, according to Oxford Economics—is strong evidence of internal market growth.

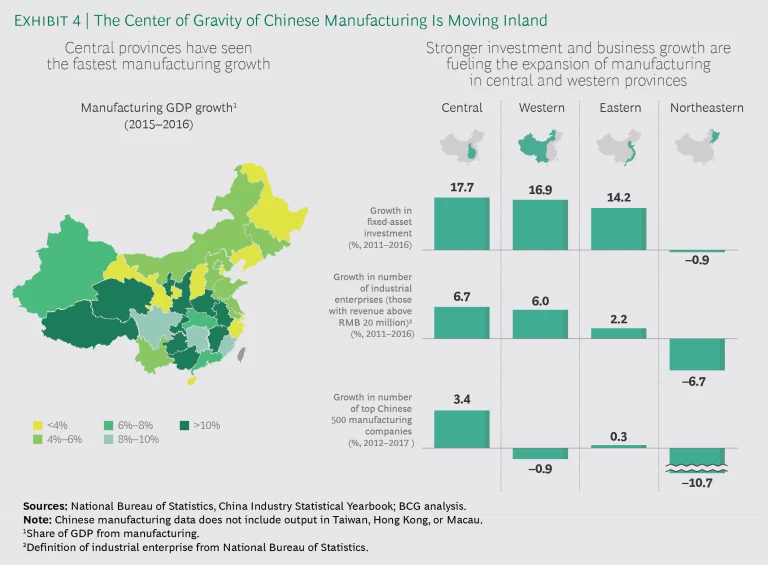

Although more than 60% of China’s manufacturing is still in eastern coastal provinces, such as Guangdong, Zhejiang, and Jiangsu, government initiatives are driving industry to central and western provinces and out of major cities. While growth in manufacturing value-added output has cooled to around 4% to 6% a year in eastern China, it is expanding by 8% to 10% in heavily populated provinces such as Sichuan and Henan, and even higher in provinces such as Shaanxi, Guizhou, and Jiangxi. Meanwhile, some eastern provinces, such as Guangdong, are pushing out low-value manufacturing facilities to make room for higher-tech industries.

Government initiatives are driving industry to central and western provinces and out of major cities.

The growth in interior China is helping compensate for contraction in the northeast, one of the country’s older heavy-industry bases. Investment in fixed assets contracted by 0.9% a year from 2011 through 2016 in the northeast—but increased by 16.9% annually in the west and 17.7% in central China over that period. And while the number of industrial enterprises (those with revenues greater than RMB 20 million) fell sharply in the northeast over those five years, they increased markedly in the west and center. (See Exhibit 4.)

Interior provinces still lag well behind the east in terms of physical infrastructure. As a result, higher logistics costs can offset gains from lower wages. The interior also lags in terms of capital investment and supplies of skilled workers. But as China continues to address these challenges, industrial growth in the interior is upgrading the nation’s competitiveness in several important ways: it is reducing China’s dependence on exports, pushing manufacturing to lower-cost locations in China, and adding to the country’s already giant scale in many industries.

Dense Regional Manufacturing Ecosystems. The fully developed value chains of several Chinese industrial regions, with their massive concentrations of assembly plants, skilled workers, and material and component suppliers, make them hard to replace as global suppliers of many products. China has surpassed South Korea as the world’s leading manufacturer of flat-panel displays, for example, accounting for 41% of the world’s production capacity and most of its next-generation plants. China produces more than 90% of the world’s smartphones, most of them in the “smartphone capital” of Shenzhen—even though wages have been rising fast in the Pearl River Delta. Around one-quarter of the world’s fiber-optic cable is made by a cluster of factories in Wuhan.

More major clusters are forming in central provinces. Chongqing, for example, is a growing center of automotive production that includes assembly plants for Hyundai, Changan Ford, Changan Suzuki, and Lifan. Chongqing’s swelling electronics manufacturing cluster includes a major Foxconn facility; Sichuan now produces 21% of Chinese-made computers.

The breadth, efficiency, and vertical integration of Chinese supply chains is a major reason why little production of goods ranging from smartphones to chemicals has gone offshore, despite rising costs.

Strong, Investment-Driven Productivity Growth. Aggressive investment in technology, skill development, and infrastructure has fueled many years of double-digit productivity growth, enabling Chinese manufacturers to dramatically narrow the efficiency gap with major developed economies. When China entered the WTO, US factories were 14 times more productive. Since then, the gap in productivity-adjusted labor costs between China and the US has narrowed by nearly half. The success of neighboring South Korea suggests that Chinese manufacturers—at least in some leading-edge industries—can approach parity with competitors in advanced economies in the not-too-distant future as they continue to invest more in automation, improve skills training, and adopt international management best practices.

Government investment in technology and infrastructure at the national and local level should propel further productivity growth. At the same time, many Chinese manufacturers are accelerating their deployment of automation and robotics. The automotive sector is a good example. Back in 2011, US auto factories deployed 63,000 industrial robots, three times as many as Chinese facilities. Over the following five years, Chinese auto plants reached parity by installing robots at three times the pace of those in the US.

While continued productivity increases will drive cost competitiveness in the coming years, achieving productivity parity with the US may not be a blessing for China in the long term, since abundant cheap labor has long been China’s chief competitive advantage. The more Chinese factories automate, the share of labor decreases, and the less relevant that labor cost advantage becomes.

China’s Manufacturing Challenges

To remain globally competitive, Chinese manufacturers must continue to boost productivity and flexibility, and move up the industrial value chain with higher-tech, innovative products.

In our interviews with large manufacturing companies in several industries in the Pearl River Delta, we found that, in addition to rising wages, their major concerns relate primarily to challenges in meeting fast-changing downstream demand. The companies’ antiquated demand-planning systems and old, inflexible production lines left them with high inventories and low return on investment. The southern Chinese manufacturers said they see investment in Industry 4.0 manufacturing technologies, with smart robots and advanced planning systems, as an opportunity to improve flexibility and productivity.

Another constraint is that China remains a difficult place to do business for foreign manufacturers, as well as for domestic ones seeking access to the national market. China ranks lower than many of its Asian peers on international indices of commercial openness and bureaucratic efficiency, for example, and taxes on labor are the highest in the region.

Many Chinese manufacturers in coastal provinces will have to confront such challenges to remain cost competitive as they move inland. More Chinese companies in eastern provinces will have to shift production to the interior to take advantage of lower labor costs, while keeping higher-value production in clusters in coastal regions.

The quality of research and development in China is another issue. The country has massively increased spending on R&D over the past decade. As a result, Chinese patent applications more than quadrupled from 2010 through 2016, to 1.2 million a year—around as many as the US, Japan, and South Korea combined. The quality and value of those patents still lag, however. One revealing measure is the number of “triadic patents,” those filed in the US, the EU, and Japan. Because it is expensive to file in all three countries, triadic patents are an indicator of intellectual property’s potential value. Japanese researchers filed more than 17,000 triadic patents in 2015, the most recent year for which OECD data is available, and the US nearly 15,000. Chinese inventors filed around 2,600 triadic patents that year. And while US patent holders earned $124 billion by licensing their technology in 2015, Chinese inventors received only around $1 billion.

Chinese patent applications more than quadrupled from 2010 through 2016, but the quality and value of those patents still lag behind.

Similarly, China has recently surpassed the US in scientific and engineering publications, generating more than 400,000 articles a year. But Chinese journal articles have much less impact than publications by US, German, and South Korean researchers, which are cited far more frequently by other authors. Chinese researchers also have around one-third fewer articles published in top international journals than US and German authors.

The stress on R&D quantity over quality translates into insufficient breakthrough innovation by Chinese manufacturers.

Enabling China’s Next Manufacturing Leap

Business and government leaders can take a number of actions to ensure that China’s manufacturing sector remains on course to sustain growth and move to the next level.

Improving the macro environment for manufacturing must be a high priority. As the emphasis of China’s economic growth model shifts to services and boosting personal consumption, industry will have to compete harder for private capital. To ensure that manufacturing remains an attractive investment, government agencies should ease regulatory hurdles and other barriers that raise the cost of doing business. This will move China toward a market-driven economy that encourages upgrading through competition, resulting in higher-quality manufacturing.

Manufacturers can also partner with government to facilitate the dissemination and adoption of Industry 4.0 technologies and world-class manufacturing practices. Public-private partnerships should increase support for skills training, such as by sponsoring “learning factories” and vocational programs in regions that are developing new industrial clusters. Financial incentives for investment in next-generation industries can include tax relief, matching funds, and debt guarantees. Public financing for R&D could be designed to offer stronger incentives for higher-quality research, breakthrough innovation, and technology transfer to small and midsized manufacturers. Government programs could also place stronger emphasis on increasing the contributions of private and public industry to collaborative R&D programs.

Chinese manufacturers should focus on improving innovation and climbing the value chain. This is especially true for small and midsized manufacturers that have relied on China’s traditional cost advantages. Many need to improve their capacity to adopt world-class manufacturing practices and leverage flexible, digitally connected international value chains that can

respond quickly to changes in the global environment.

MNCs will also need to raise their game to compete with rising local competitors in China’s growing internal market. They must further localize their Chinese operations and gain a better understanding of the needs and preferences of customers in specific cities and regions. MNCs must expand their manufacturing and supplier footprints in more parts of the country to be more responsive to local markets. And they must become more competitive against domestic competitors in the battle for talent.

MNCs will need to raise their game to compete with rising local companies in China’s growing internal market.

China’s manufacturing sector certainly faces competitive challenges as its labor cost advantage dissipates and access to traditional export markets becomes more constrained. A host of economic, technological, and geopolitical megatrends will continue to reshape the global environment. But China’s industrial history of the past three decades is largely the story of entrepreneurs and government continually rising to such challenges and ascending to the next level. As the world continues to spin, it is reasonable to assume that China will remain manufacturing’s center of gravity for the foreseeable future.