Pharmaceutical innovations—particularly those that cure chronic or life-threatening diseases—create enormous value for society by preventing deaths, improving lives, and lowering health care costs. Witness the medicines that cure hepatitis C (HCV) and those that hold great promise to cure other diseases, such as certain types of cancer.

But the pharma industry’s predominant economic model—charging per treatment at the time of care—can limit society’s ability to reap the full benefits of a cure. The problem: a mismatch in the timing of payment versus the timing of benefits. The prevailing model front-loads the payment to pharmaceutical companies while the treatment’s value to society accrues over time, sometimes decades.

The advent of cures creates a true pricing dilemma for pharmaceutical companies and those that pay for medicines. If drugs were priced today to reflect only the value that accrues over time, the resulting (high) prices would strain payers, prompting some of them to limit patient access. Conversely, treating all patients as fast as possible—and in doing so, accelerating eradication—requires prices so low that developing certain cures would become far less economically attractive, particularly compared with the economics of drugs that treat chronic diseases.

Is it possible to solve this dilemma and align the incentives of pharmaceutical companies, payers, and patients?

We argue that the answer is yes. The solution is an alternative, population-based treatment-pricing model—what we call the payer licensing agreement (PLA). Its rationale lies in the differences in economics between “managing” and “curing” a disease. For most diseases, treatment focuses on the acute and follow-up regimens to manage individual patients whose current symptoms meet a specific profile. To align value and stakeholder incentives with that objective, pharma manufacturers traditionally apply a fixed, per-patient pricing model. Eradicating diseases, in contrast, should take an entire “population” of patients with a given disease into account at a price that reflects the value of curing all patients. In this article, we use the case of HCV, whose cure was first introduced in 2013, to demonstrate the advantages of a PLA over traditional per-patient models. Our arguments are built on a concept that we first presented in February 2018 at the 5th Annual Global Health Economics Colloquium, held at the University of California, San Francisco, Institute for Global Health Sciences.

The solution is an alternative, population-based treatment-pricing model—what we call the payer licensing agreement.

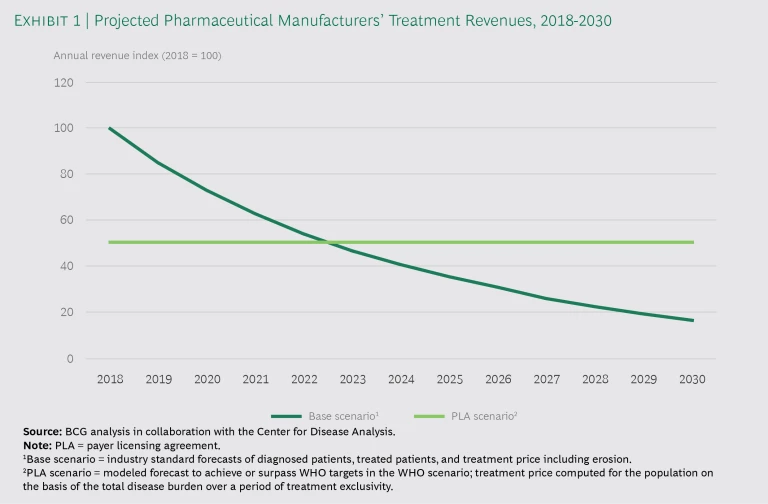

We maintain that licensing a treatment that provides access to the entire population over a specified period—say, five to ten years—would provide pharma manufacturers with a more predictable revenue stream as they earn back their investments. Exhibit 1 compares the annual revenues for a base scenario (fixed, per-treatment pricing model) with the annual revenues for a PLA, in this case over 12 years. The PLA generates higher aggregate revenues over the license period, even though revenues are higher in the early years under a traditional model.

One advantage of a PLA is that it eliminates the need for significant price erosion, which usually gives payers an incentive to deprioritize immediate treatment for early-stage patients. Even though the price for the HCV cure has fallen by more than 60% since its launch, some payers still limit access, partly because many patients are asymptomatic and partly because payers expect that prices will continue to fall. The price erosion has been among the most extensive the industry has seen, but it is still insufficient to encourage payers to look for and treat all patients.

Hepatitis C: The Economic Burden of a Cure

According to the World Health Organization (WHO), 71 million people worldwide are chronically infected with HCV, twice the number with HIV. In the US, HCV kills more people annually than the next 60 most deadly infectious diseases combined. Prior to 2013, patients were treated using various therapies with challenging side effects. This discouraged many patients from taking the medicines, and some patients’ conditions deteriorated so badly, they required expensive and risky liver transplants.

Innovative medicines introduced in 2013 can cure HCV in 8 to 12 weeks. Yet since their approval, more than 90% of the world’s infected population remains uncured. The target that the WHO set for the eradication of HCV—2030—is now looking unrealistically ambitious. HCV persists as a global crisis.

Why haven’t more people been cured? In addition to pricing, there are several other barriers to treating HCV patients, including inadequate patient awareness, screening, linkage to care, and access to physicians and medication. (See “ Hepatitis C: Common, Deadly, and Curable ,” BCG article, September 2017.)

The initial price of HCV treatments was so high that it was not possible to provide treatment to all patients because a patient-based model does not spread costs over a long time horizon.

Despite these challenges, the WHO goal of HCV eradication by 2030 remains worthwhile. PLA implementation could expand treatment access to all patients, potentially achieving the WHO HCV target before 2030 and reducing payers’ total health care costs without jeopardizing pharma manufacturers’ revenues.

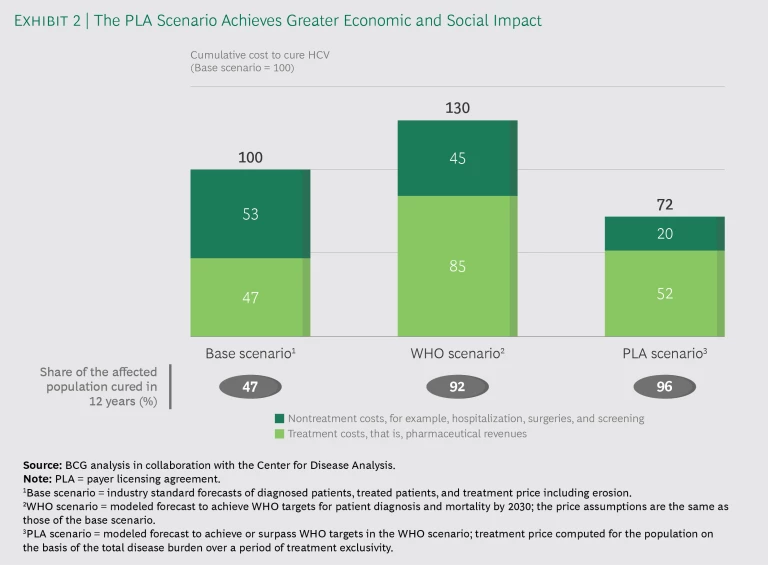

Exhibit 2 illustrates the economic and social impact of three pricing scenarios. The base scenario is the current fixed, per-patient pricing model, which would cure less than half the population, the costs split about evenly between hospital and drug costs. The middle scenario shows the prohibitive expense of trying to pursue the WHO’s eradication goal with that pricing model. It would cure 92% of the population, but costs would be 30% higher. The third scenario shows that the PLA model is a win-win-win: more patients would be cured, but overall costs would be significantly lower, and revenues for the pharma manufacturers would be higher than in the base scenario. In the first two years, three times as many patients would be cured under the PLA as in the base scenario. This speed is a reason for the significant savings in hospital costs.

How a PLA Works

Pharmaceutical companies would sell payers a license—on a per-population rather than a per-patient basis—for access to a treatment for a defined period and fixed annual charge, depending on considerations such as patent expiration and eradication targets. In this way, a PLA spreads out payments and resolves the payment-value timing misalignment. Ideally, the period of the license would correspond to the length of time that a payer determines is required to cure most of the population. A PLA’s stable revenue stream also neutralizes the incentive problems created by the patient-based model. It promotes affordability and provides strong motivation for identifying, diagnosing, and treating as many patients as possible before the expiration of the payer’s license.

A PLA spreads out payments and resolves the payment-value timing misalignment.

The PLA has its roots in the enterprise licensing agreements (ELAs) pioneered by the software industry. With an ELA, the value that different users derive from the product can vary by an order of magnitude. For instance, when Microsoft licenses its Office suite to a large company, it uses an ELA to charge a single annual fee for all the company’s employees rather than selling unit licenses for individuals. That fee is estimated and negotiated on the basis of the mix of users across the organization—from experts to casual users—and represents the total value created and consumed. This model is used widely throughout the industry to ensure that all eligible users of the software—even those who hardly use it—enjoy unrestricted access. In contrast, a fixed price per user would lead large companies to equip only high-value users with the software.

Netflix uses a similar model. If a PLA version of the Netflix model were applied to a health care system, the patients would be the subscribers, the payer would be Netflix, and treatment manufacturers would be the production studios. When Netflix licenses a movie, it pays the production studio a single price for a fixed length of time and makes the film available to all Netflix subscribers. Some consume far more media than others (as some of us reluctantly acknowledge after late-night binge-watching sessions) and thus receive differential value from the service.

The Numbers Behind a PLA: Why It Works for HCV

Setting the license price under a PLA starts with defining the value of curing all patients in a given population. Next, the payers and the manufacturer must agree on how they will share that value. Thanks to the growing availability of data on disease progression and costs, such calculations are now possible. Conducted in collaboration with the Center for Disease Analysis, our epidemiological and economic modeling related to HCV considers the current disease burden, disease progression rates, in-system health care, hospitalization and screening costs, and existing programmatic interventions to derive cohort-specific, direct economic costs of treatment. The costs are a proxy for the value that a cure creates. Like companies in other industries, pharmaceutical manufacturers can capture a portion of that value, and the remainder can be passed on to the consumers—in this case, the payers and patients. To realize the cost benefits of the model and for the manufacturer and the payer to share value and risk, the contract period should span a significant number of years.

In every health care system we modeled, we found that—regardless of variable disease burdens and health care economics—a PLA works better for patients, payers, and manufacturers. Our modeling also showed that in the coming decade, a PLA would have significant impact on the status quo:

- Tripling the number of patients treated and cured within two years

- Reducing the number of liver-related deaths by some 60%

- Reducing the total cost to payers by approximately 30%, because patients would be treated much earlier—before the disease progresses to more costly stages

- Providing higher and more predictable revenues and profits to biopharma manufacturers

We have focused our in-depth study of the PLA model on HCV, but we are confident that our findings are relevant to other treatments and therapeutic areas. PLAs would be most effective in areas that have three characteristics: value that accrues over time, vast value discrepancies among patients, and low incremental manufacturing costs. On the basis of these criteria, we have determined that curative therapies for diseases are strong candidates for the PLA model, yet they are not the only ones. In any case, epidemiological and economic modeling validates the win-win-win.

The Challenges of Implementation

The PLA model is best suited to single-payer systems, such as those in Canada, the UK, France, and Japan. In a multipayer system, PLAs work best when all payers opt into the model, ensuring that over time, fixed license payments represent the relative share of the covered population, thus avoiding patient churn to other payers as patients seek coverage.

But every health care system—single or multipayer—is complex, highly regulated, and slow to change. State-run payers face both legal restrictions on innovative contracting and frequently changing priorities. Multipayer systems have little incentive to consider long-term costs when their insured population is subject to high rates of attrition.

Dealing effectively with these systemic challenges will be critical to successful PLA implementation. Nevertheless, we are convinced that in the near term, the model could be beneficial from both the health care and economic standpoints. As pharmaceutical companies prepare to bring other cures to market, they should explore population-based pricing models that are aligned more with the economics of cures than with treatments that manage disease. Our investigation into the effectiveness of the PLA approach for HCV has demonstrated the high potential of such models. Single-payer systems can seize the opportunity to work with manufacturers on the development of an eradication strategy supported by a population-based pricing model.

Challenges aside, for HCV patients, a pricing model borrowed from the tech industry could be just what the doctor—or the economist—ordered.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit

Featured Insights

.