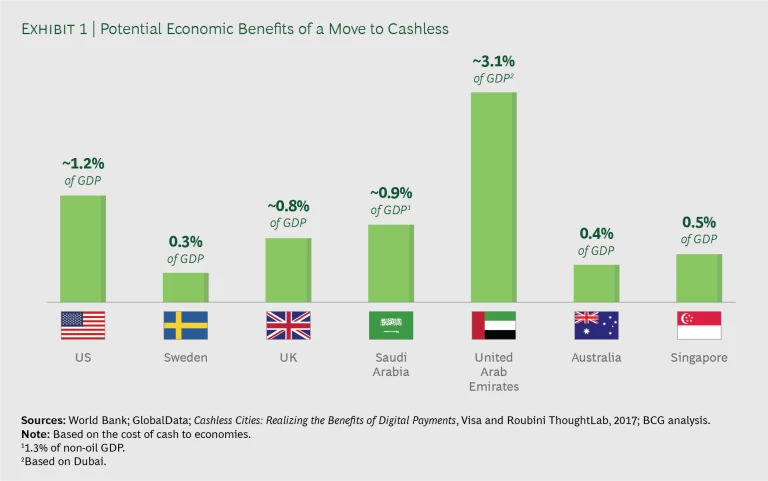

Cash is no longer king. In fact, economies that are more cash intensive tend to grow slowly and miss out on significant financial benefits. Conversely, economies that switch to digital are more successful; the switch can boost annual GDP by as much as 3 percentage points, BCG research shows.

Numerous examples around the world illustrate how cashless payments are economic propellers. Bangladesh’s bKash, which enables transfers via mobile phones, has spurred growth and boosted financial inclusion in that country. The upside comes not from more money but from digital’s role in simplifying the process of sending and receiving payments. Among advanced economies, Sweden and South Korea have moved steadily away from cash. (Cash transactions in Sweden made up less than 2% of the value of payments in 2018, for example.) The result has been a shrinking gray economy, booming online commerce, and a sharp reduction in fraud.

And yet, despite the evidence, there is little sign the world will go cashless anytime soon. Cash remains the world’s most widely used payment instrument. Perhaps surprisingly, the global ratio of cash to GDP rose to 9.6% in 2018, compared with 8.1% in 2011. In Europe, 80% of point-of-sale transactions are still conducted in cash. People have a strong emotional connection to notes, coins, and currency—and a lingering distrust of digital alternatives.

Slow progress toward cashless economies may be a source of frustration to policymakers, merchants, and financial institutions, all of which stand to accrue benefits from digital. However, there are steps they can take. The right strategies, incentives, infrastructure, and regulation can encourage innovation and boost public confidence in noncash systems. Partnerships, both public and private, can also be critical in marshaling expertise and creating momentum. The tools are in place. All that is required to move forward is the will to act.

The right strategies, incentives, infrastructure, and regulation can boost public confidence in noncash systems.

Cash Versus Digital

Despite huge growth in smartphone adoption and increasing demand for digital banking, the majority of countries remain heavily dependent on cash. Some 2 billion people globally do not have a bank account, showing that cash remains essential to financial inclusion. And cash is entrenched in the economies of many developed markets. In the UK, the broad measure of money supply, encompassing coins, notes, and cash-like instruments, reached £82 billion in late 2018, compared with about £68 billion four years previously.

Cash is popular because it is user-friendly. It is inclusive, trusted (it does not require intermediation by third parties), accessible, and reliable. It doesn’t require point-of-sale (POS) technology and can’t be hacked or undermined by a loss of power, a cyber attack, or a system failure. Spending cash does not create a data point that might be exploited for cross-selling.

Still, cash is inherently problematic. Undeclared payments in cash lead to tax gaps, and there are costs associated with handling, printing, transporting, and safeguarding cash. One major North American bank spends approximately $5 billion per year processing cash and check transactions and servicing ATMs. In the UK, the cost of free-to-the-customer ATM withdrawals is estimated at about £1 billion a year. Where ATM fees are charged, they are regressive, impacting lower-income demographics more than others.

Cash is inherently problematic.

Payments using a card, app, or computer, conversely, are transparent, clean, and usually quite simple. No trips to the ATM are required, and there’s no need to worry about carrying large amounts of cash in public. There is no cost of handling (although those savings are more than offset by card fees paid by merchants and indirectly by customers).

Further, because cards, apps, and other digital solutions make it easier to send and receive money, they increase economic activity and generate a wide array of financial and nonfinancial benefits.

BCG estimates that a move to a cashless model would add about 1 percentage point to the annual GDPs of mature economies and more than 3 percentage points to those of emerging economies. (See Exhibit 1.) One reason is that mobile money can increase the velocity of value transfers. In addition, digital transactions provide more transparency, making it easier to offer and obtain financing.

In an increasingly urbanized world, many cities (among them Bucharest, Seoul, Dubai, Madrid, and New York City) have introduced smart-city initiatives, leveraging digital to improve lives across a variety of parameters. Digital-payments technology is part of that equation, and one study estimates that increasing digital payments in 100 leading cities could generate direct net benefits of $470 billion per year. Small businesses in particular may benefit, with mobile payments enabling them to rent, buy, and get paid more easily.

Cashless payments can help supervisors, central banks, and commercial banks do better jobs. Electronic payments enable more comprehensive oversight and monitoring and can inform central banks’ monetary and economic policies. More visibility aids credit process management, allowing banks to make more-informed lending decisions. Cashless societies may also bring less obvious benefits: During the European sovereign debt crisis in 2012, some economists argued that moves by central banks to cut interest rates to below zero would be ineffective without a concurrent ban on cash. If people must pay to make bank deposits, it makes sense to keep money under the mattress.

Challenges in Making the Switch to Digital

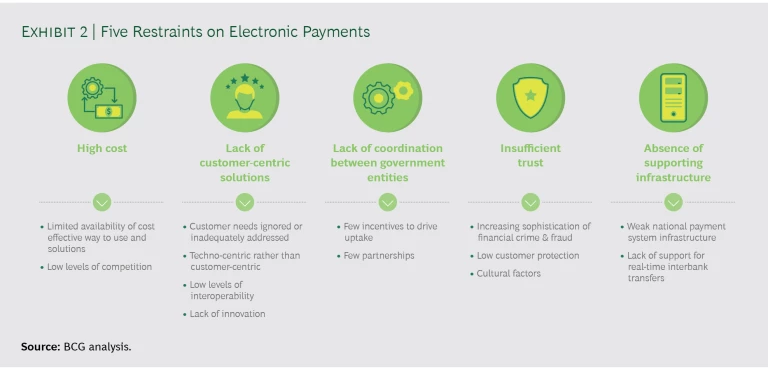

Digital is an attractive alternative where the cost of cash is high (transport, ATM servicing, security, labor), where technology uptake is accelerating, or where the government struggles to collect sales tax. Numerous countries meet one or more of these criteria, according to an analysis in Harvard Business Review. They include developed markets such as France, Belgium, Spain, and Germany. Still, barriers to uptake remain. We have identified five principal areas of resistance. (See Exhibit 2.)

The High Cost of Electronic Payments. Electronic payments incur significant fees and charges. The British Retail Consortium said in 2018 that, despite regulation of interchange fees, the all-in cost of digital payments had risen in 2017. UK retailers spent an additional £170 million to process card payments, for a total cost of almost £1 billion. Increasing card costs were driven entirely by scheme fee increases, which rose 39%, measured as a percentage of turnover; the problem was exacerbated by limited market competition, the BRC said. Most payments systems are monopolies or duopolies.

A Lack of Customer-Centric Solutions. Payments solutions are often designed without customers’ needs in mind and with a focus on technology rather than user-friendliness. Many countries offer a fragmented patchwork of solutions that lack interoperability. In many cases, you cannot make a payment from one brand of e-wallet to another. Consumers habitually need to carry multiple cards to meet their daily needs. As a result, the penetration rates of person-to-person (P2P) solutions have remained relatively low (below 15%) outside the frontier markets of Norway, Sweden, and Denmark.

Minimal Coordination Between Government Entities. Lacking a central authority to drive transformation and coordination, projects are likely to fail. In addition, a lack of proper governance, planning, and education on the implementation frontline is likely to result in fragmentation, bureaucracy, and parallel processes.

Insufficient Trust in Electronic Payments. Banks and companies are under rising pressure to protect their customers against cyber attacks. More than a few large companies with global operations have been hacked in recent years, resulting in massive losses of customer data. The UK’s national crime agency said in April 2018 that seven of the country’s biggest banks reduced operations or shut down systems following an attack the previous year. One reason is that, in many cases, attempts to increase cyber resilience do not keep pace with the rapid uptake of digital payments.

In some countries, consumers are concerned about the impact of digital payments on the cost of living and their control over their own budget. Japanese consumers remain wedded to cash, for instance, and visitors to the country are often struck by how many transactions are still conducted using notes and coins compared with neighboring China. Uptake in Germany is also relatively slow.

The data created by digital transactions is a valuable commodity. It may bring significant benefits to companies, even though consumers in many countries experience a “trust gap” and are less certain of those benefits. Even in Sweden, the most cashless society globally (about three-quarters of all purchases are made by card), there are residual doubts, particularly over security. In early 2018, Sweden’s central bank governor, Stefan Ingves, urged his government to consider the vulnerability of the payment network in case of extreme circumstances.

The Absence of Supporting Infrastructure. Infrastructure is a key element of a thriving payments ecosystem. Equally, its absence can be a hindrance. Rural areas in particular may not have infrastructure in place. In some places, there is a gender divide, with women excluded from internet access. In many countries delays of two to three days in real-time interbank transfers are common. The necessary standards to support infrastructure are also often absent.

For a digital-payments system to take root, support in the form of legal frameworks, electrical networks, and security is also necessary.

How Policymakers Have Driven Uptake

In September 2016, the G20 heads of state and government endorsed the High-Level Principles of Digital Financial Inclusion (HLPs), recognizing the capacity of digital to help people get access to financial services. Certainly, countries with dedicated digital policies and infrastructure have seen faster progress. Examples abound:

- In Singapore, cashless payments took a major step forward in 2017 with the introduction of PayNow, a national real-time payment platform.

- South Korea saw accelerating adoption after introducing end-of-year tax credits for up to 30% of spending on debit cards.

- Sweden has rolled out an array of policies encouraging cashless payments, from eliminating infrastructure such as ATMs while putting in place enabling measures such as electronic know-your-customer (e-KYC) capabilities and real-time payments and by granting stores the right to refuse cash. A tangential impact has been a surge in tax receipts, with value-added tax rising nearly 30% over five years.

- The Reserve Bank of Australia has taken action to address the high cost of digital payments, capping interchange fees and putting a ceiling on card surcharges for small businesses. The moves led to a US$11 billion decline in merchant payment costs and an acceleration in the growth of card transactions. A similar cap in the US in 2011 led to an 8% rise in credit card usage.

An emerging group of “payments tigers” have also made especially rapid progress. Poland, for example, saw card transactions increase from fewer than 30 per capita in 2010 to approximately 125 in 2017, driven by initiatives such as Cashless Poland, a public-private partnership to support cashless payments for small businesses.

Numerous initiatives are underway in Africa. Ghana is digitizing with the aim of improving access to financial services, and Malawi has seen a sharp rise in cashless transactions. Rwanda aims to become a cashless economy by 2024. In late 2018, the nation’s central bank launched a regulatory sandbox for testing digital payment solutions.

Clearly, given the diversity of economic systems around the world, there’s no single solution that will guarantee a seamless transition. Still, several foundational elements raise the chances of a successful digital journey.

Laying the Foundations

Laying the foundations for a cashless economy should typically begin with a holistic and overarching national payments agenda, driven by a consortium of key stakeholders including the government, the central bank, financial institutions, consumer protection agencies, and merchants. The government should determine a timeline and a target end state, based on a thorough assessment of the technological, competitive, and regulatory landscape and benchmarking of functional requirements and enablers. (See “Enablers of a Cashless Economy” for two ways in which stakeholders can support an environment conducive to a cashless economy.)

Begin with a holistic and overarching national payments agenda.

Enablers of a Cashless Economy

Enablers of a Cashless Economy

In addition to taking direct action to effect cashless transactions, stakeholders will benefit from helping to create an environment that is conducive to a cashless economy. Two areas of focus stand out as being particularly valuable.

Safeguarding of Consumer Interests. Consumer protection is vital. One regulatory initiative that addresses this issue is Europe’s General Data Protection Regulation, which came into force in May 2018. The GDPR has increased consumer confidence by requiring companies to safeguard consumer data and seek explicit permission for its commercial use. Government-mandated means of streamlining dispute resolution mechanisms would further bolster consumer protection and confidence, building comfort with the notion of a cashless economy.

An Ecosystem of Innovation. One in four fintechs globally is focused on payments. They bring with them, of course, a new focus on digital technologies. Several central banks are now evaluating the potential of these technologies, including blockchain and digital currencies, which may promote financial inclusion and increase efficiency through disintermediation and faster settlement cycles. Open-banking initiatives in many countries are encouraging collaboration between financial institutions and startups, leading to more data sharing, increased cross-selling, and the emergence of payments ecosystems.

Appropriate governance and operational structures must be put in place. These would include establishing an overarching body to manage strategy and facilitate alignment and an operational committee to provide feedback and identify issues as projects move forward.

Industry stakeholders should be closely involved, providing both technical and market expertise.

Finally, teams driving change need to be multidisciplinary, bringing together skills and know-how spanning economics, technologies, and payments.

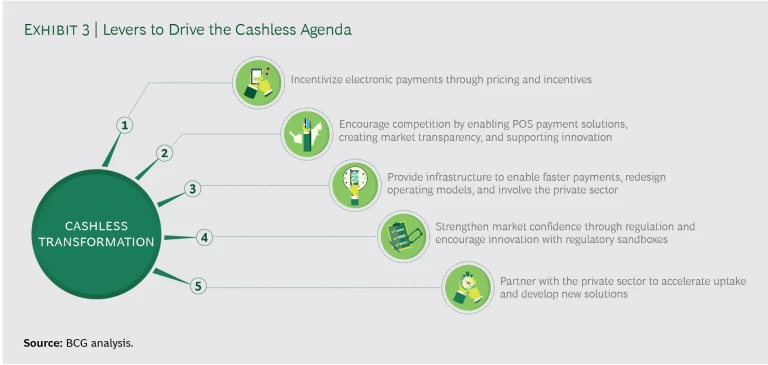

It makes sense to start small, targeting low-value, high-frequency transactions. However, it pays to think big in terms of collaboration and long-term implementation. BCG has identified five levers that can drive the transformation process. (See Exhibit 3.)

Establish the right incentives. Targeted incentives will encourage consumers and merchants to consider moving away from cash. This might be achieved through reducing the cost of digital payments, introducing cash-handling charges, or restricting the use of cash above certain thresholds (the EU is currently considering this final measure). In Sweden, a consortium of banks launched a free mobile payments app, which was adopted by 50% of the population within four years of launch.

PromptPay , the electronic payment service under the Thai government’s e-payment plan, encouraged uptake by removing charges for online banking. Chinese mobile payment leaders Alipay and WeChat Pay are engaged in an ongoing battle to attract users to their e-wallets, offering incentives that include cash rebates, free bus rides, and even the chance to win gold.

Governments and companies might also consider consumer-friendly schemes such as weekly prize drawings based on transaction IDs or systems with specific demographics in mind.

Encourage competition and ensure a level playing field. Competition naturally exerts downward pressure on prices and encourages innovation, helping to offset the high cost of electronic payments. Measures to enable point-of-sale solutions are likely to help, as are rules for transparency regarding fees. And governments can seek to actively support innovation. The UK, for example, offers research and development tax relief and has introduced a number of tax-related initiatives as part of the National Innovation and Science Agenda, including for investors in startups. The country’s Faster Payments Central Infrastructure is open to established banks and challengers and creates a mechanism for fintechs to access payment systems.

Some countries encourage competition by encouraging or enabling the creation of privately owned payment rails. This has long been the case in the US, where The Clearing House operates several privately owned payment rails that integrate with the federally owned rails.

Provide world-class supporting infrastructure. Infrastructure is the key enabler of a cashless payments model and should encompass the internet, mobile and payments technologies, regulation, security, and electricity networks. Governments should in parallel encourage innovations that promote real-time interbank payments for retail transactions and strengthen operations through new business and operating models.

Already, some countries have transferred responsibility for payments infrastructures from central banks to private companies or consortiums of banks. The UK Faster Payments Service, an initiative to reduce payment times between bank accounts, is run by privately owned Vocalink, for instance. In 2018, a group of Australian financial institutions and the Reserve Bank of Australia launched the New Payments Platform, which is based on ISO 20022 messaging formats and enables consumers, businesses, and government agencies to make real-time, data-rich payments between accounts. And Hong Kong and Singapore, among others, have built multicurrency payment systems for interbank transfers, strengthening their positions as global trading hubs.

Streamline and enforce regulations. Targeted and proportional regulation can strengthen confidence in electronic payments and enforce financial inclusion. Initiatives such as rapid dispute resolution mechanisms, licensing schemes, and fee caps have been highly effective in boosting the uptake of cashless solutions.

A strong and proactive regulator is essential. For example, the US regulator made a big push after 9/11 to enforce an electronic check exchange standard. If the regulator does not make this kind of effort (for example, in real-time payments), everything takes longer.

Partner with the private sector. Policymakers should seek to collaborate with stakeholders to foster innovation; already around the world many are doing so. Thai state authorities, for example, have joined with the private sector to launch the National e-Payment Master Plan. The plan’s PromptPay initiative enables interbank fund transfers using mobile phones and has signed up more than 2 million merchants to QR-code payment. In Europe, the Cashless Poland Foundation provides small and medium-sized retail businesses with point-of-sale terminals and subsidizes them to take low-value card payments, which otherwise might not be cost-effective. Noncash payments in Russia grew from approximately 25 per capita in 2010 to roughly 150 in 2017, amid collaboration between banks and government. Russia’s Sberbank, with its 55% market share, employed 10,000 meet-and-greeters in bank branches to provide information and encourage adoption.

As digital lifestyles expand and more people around the world get connected, it makes sense that payment systems will adapt. Consumers, companies, and governments stand to benefit, and the rise of e-commerce requires an efficient electronic payments infrastructure. However, after thousands of years of fiat currencies, policymakers and corporate leaders should not underestimate the challenges. The solution should be a holistic approach, comprising the right infrastructure, legal frameworks, technologies, and a willingness to partner and collaborate. The task is complex, but the prize is faster growth and an economy enabled for the future.