In cities in the future, autonomous vehicles (AVs) won’t just be an exciting new form of mobility. They will enable passengers to perform work tasks—or simply spend travel time relaxing—as the vehicles’ autonomous features safely and seamlessly navigate the road network. But more importantly, by replacing traditional private cars and increasing average vehicle occupancy, AVs will make the urban environment greener and more livable and will contribute to sustainable transportation systems.

This scenario will depend as much on cities as on consumers, automakers, and technology companies. City planners will need to build infrastructure, enact enabling regulations, and collaborate with companies and industry groups to make AVs happen. Although the COVID-19 pandemic is currently having a huge negative impact on urban mobility—as discussed in “ How COVID-19 Will Shape Urban Mobility ,” published in June 2020—and is likely to favor private forms of transportation such as cars and bikes over shared mobility for the next 12 to 18 months, many cities will embrace shared AVs in the long term because these vehicles can help solve deep-seated challenges.

But the way the technology plays out will be shaped by the specific characteristics of each individual city and its urban mobility ecosystem . Policy shifts, changes in behavior, and new transportation offerings will influence users’ choices, too. And although some cities will gain significant benefits by introducing AVs, others will fare better by pursuing other mobility options. Indeed, in some cases, AVs might exacerbate the problems that cities are hoping to solve. On the basis of simulation results and real-world assumptions, we expect leading global metropolises to see the following benefits, among others, if policymakers take certain actions:

- Los Angeles, for example, could cut its CO2 emissions by 2.7 million metric tons per year via policies promoting shared AVs and curbing private vehicle use.

- Berlin households could save a total of $1.6 billion per year on transportation costs if the city restricted the use of private cars and promoted micromobility and public transportation.

- New York could free up the equivalent of about 900 blocks of space currently being used for parking, by promoting shared AVs.

- London could avoid more than 60 road fatalities and more than 15,000 nonfatal traffic accidents each year.

- Hong Kong could cut the time each citizen spends commuting each year by 20 hours if it promoted micromobility.

Following an initial wave of euphoria in the mid-2010s, self-driving cars have more recently been the object of considerable skepticism. One reason for the change in attitude is the realization that AVs are unlikely to be available at scale soon. To cut through the noise about AVs and gain an objective view of their advantages and likely effects on different cities, BCG and the University of St. Gallen, Switzerland, conducted a one-year study that combined qualitative and quantitative approaches with current industry insights.

Together, we carried out a detailed simulation of transportation conditions in five urban archetypes, based on an extensive analysis of cities across the globe and using a tool that can model 1.7 billion trips. In parallel, we asked more than 30 leading executives from universities, cities, and transportation-related industries for their perspectives on the key enablers, success factors, and roadblocks facing AVs.

Among our key findings: Municipal authorities must decide early whether AVs are the right choice for their city, and plan accordingly. Not all metropolitan areas should bet big on self-driving vehicles, but those that do nothing could see their transportation systems grind to a halt. And in cities where AVs could be important contributors to the mobility landscape, planners must collaborate with other players—including manufacturers, technology companies, and fleet providers—and create win-win partnerships if these vehicles are to flourish.

How AVs Could Solve Cities’ Transportation Problems

Cities are grappling with difficult transportation-related issues on multiple fronts. (See “Urban Mobility Challenges Today.”) If shared and designed to work alongside robust public transportation systems, AVs could help tackle these challenges. We expect that about half of all AVs will be communal—rather than privately owned—vehicles, delivering greater convenience than conventional mass transit options do.

Urban Mobility Challenges Today

Urban Mobility Challenges Today

Traffic systems around the world are broken. Decades of poor management have placed huge strains on networks and resources, resulting in inefficient use of different travel modes. In many cities, transportation systems built around the automobile are on the brink of collapse.

The urban problems caused by aging systems will worsen as more and more people live in cities. The United Nations estimates that around 60% of the world’s population will be city dwellers by 2030. A growing number of metropolises will be megacities with more than 10 million inhabitants. For city planners, the most desirable technologies and transportation modes will be those that can help them shape urban mobility ecosystems and solve problems such as congestion and air pollution.

Cities face challenges in four key areas: emissions, congestion, space, and road accidents.

Emissions. City-based vehicles account for 40% of all CO2 emissions from road transportation worldwide and up to 70% of other pollutants, according to the European Commission. Private cars are the main culprit—and the high levels of pollutants they generate carry heavy human and economic costs. The nonprofit European Public Health Alliance estimates that the annual cost of road-traffic-related air pollution in Europe (in lost productivity and health-care expenses) is around €88 billion. According to the World Health Organization (WHO), over 90% of the world’s population lives in locations where air pollution fails to meet the agency’s guidelines. Among the biggest polluters are megacities in developing countries, many of which exceed WHO guidelines by a factor of more than five. But even in the developed world, emissions are a serious problem. Academic studies in North America have found that long-term exposure to air pollution increases the risk of diabetes, obesity, mental health problems, and emphysema. In Europe, poor air quality causes about 400,000 premature adult deaths a year, according to the European Environment Agency.

Congestion. “If you make more roads, you will have more traffic,” Jan Gehl, the Danish urban design consultant, has famously said. And after over 100 years of automobiles, this observation is widely acknowledged to be true. Traffic congestion today significantly wastes city dwellers’ time, erodes their productivity, and negatively impacts their quality of life. According to data firm INRIX, traffic jams cost the economy $87 billion in lost productivity in 2018. Worldwide, older cities that predate the rise of the automobile suffer the worst congestion. In Bogotá, Colombia’s capital city, drivers spent an average of 272 hours stuck in traffic in 2018, the poorest record of any metropolis. The decline in average vehicle speed due to congestion is a key reason why driving in most cities takes so long: in Mumbai, the average speed is less than 12 kilometers (about 7.5 miles) per hour.

Space. The vast expansion of parking spaces and roads since the birth of the automobile has eaten into shared public spaces, encroaching on the needs of pedestrians and cyclists and weakening cities’ social fabric. Because parking spaces tend to be concentrated in financial districts and other key urban areas, they take up high-priced land. Especially in historically planned cities such as Barcelona, Hong Kong, and New York, more than a third of all land within city limits is devoted to roads or parking spaces, according to the United Nations. New York has more than 3 million public parking spaces, the equivalent of more than half a parking space per household, or to 12 Central Parks.

Road Accidents. Road accidents are responsible for about 1.35 million fatalities each year, according to the WHO, and for an additional 20 to 50 million injuries or disabilities each year. They are the leading cause of death among children and young people from 5 to 29 years old. Crashes cost most countries 3% of their gross domestic product. The bulk of the world’s road fatalities occur in low- and middle-income countries, where motorization is growing rapidly and where pedestrians are among the most frequent victims of fatal accidents.

Mobility solutions in the cities of tomorrow will be based on driverless electric vehicles. —Johann Jungwirth, vice president of mobility-as-a-service operations, Mobileye

By replacing private cars, shared AVs would reduce traffic volume, free up land currently used for parking spaces, and improve transportation access for disadvantaged social groups. By removing human drivers, they would operate more efficiently and safely, reducing journey and wait times. Matched against the total cost of ownership of private cars today, shared AVs would also be much cheaper, lowering the cost per passenger kilometer by as much as 30%.

Introducing AVs could significantly decrease road fatalities and accidents, too, with concomitant reductions in human suffering and in expenses for medical treatment and repairs, which are estimated at $500 billion per year in the US. “Mobility solutions in the cities of tomorrow will be based on driverless electric vehicles,” says Johann Jungwirth, vice president of mobility-as-a-service operations at Mobileye. “So moving from A to B will be safer, more convenient, and more affordable.”

Other benefits will arise from the fact that AVs will be shaped by other disruptive technologies. The evolution of AVs will coincide with a rapid rise in electric and hybrid cars. As declining ownership costs and tougher regulations drive EV adoption, we expect all shared AVs to be powered by electricity.

The rise of the sharing economy will spur growth in micromobility and in autonomous mobility on demand (AMoD), which will enable people to use an app on their smartphones to request an AV. Over time, many city dwellers, particularly young people, will opt to purchase access to e-scooters and e-bikes and to share AVs rather than own a car. Micromobility providers and AVs are likely to provide first-mile and last-mile trips, taking suburbanites from their doorsteps to a public transportation network and back again. Experience with this option will accustom inhabitants to taking multimodal journeys (combining transportation modes) rather than single-mode trips by car.

In our view, AVs could play a more fundamental role in urban transportation than other mobility options. Besides replacing cars and taxis on short- and long-distance trips in many cities over the next two decades, they will also gradually supplant ride-hailing services and buses.

How AVs perform in practice will depend on each city’s particular characteristics and policies. In all cities, introducing robo-pods (small AVs for hire) into the transportation mix would result in greater congestion. Although self-driving vehicles will emerge to some extent in every archetype, other forms of transportation, such as micromobility, could deliver greater benefits for city dwellers in some circumstances. In addressing their urban mobility challenges, cities should take a holistic approach that considers levers such as promoting micromobility, further regulating private cars, and introducing AVs.

Modeling the Transportation System of the Future

To investigate AVs and their impact on mobility ecosystems in cites in the future, we built a sophisticated simulation tool to assess the technology’s effects over time on six key performance indicators (KPIs): traffic volume, road fatalities, transportation costs, total parking space, energy consumption, and journey times. We chose these KPIs so that we could examine how AVs might improve or worsen the urban environment and quality of life in different archetypes. The tool simulated more than 1.7 billion daily trips via different transportation modes.

We also looked at how different scenarios, such as a strong uptake of robo-shuttles or micromobility, might change the KPIs in our archetypes. In this way, we could begin to answer pressing questions about how the adoption of AVs will affect different cities. Planners can apply the tool to any city to help them visualize future developments in their transportation systems.

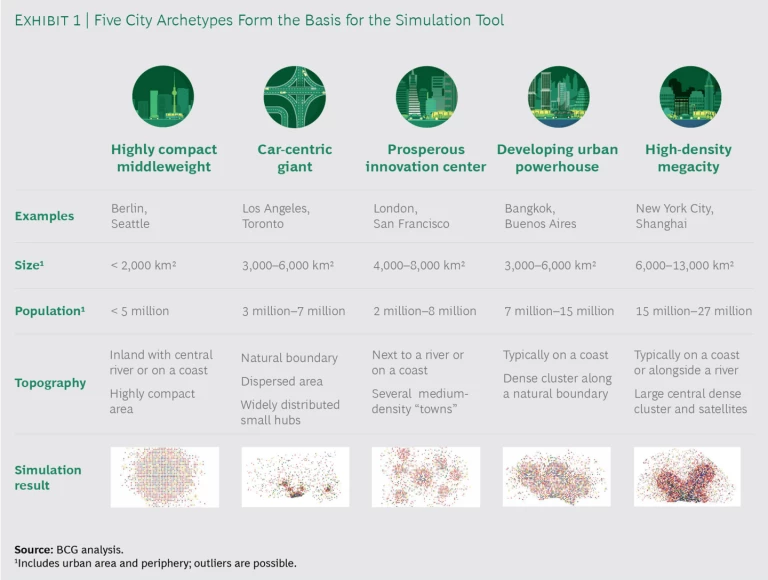

As a first step, using data from more than 40 cities worldwide, we identified five city archetypes on the basis of similarities such as the cities’ age, population density, congestion, urban street pattern, journey times, and topography. (See Exhibit 1.) Although every city has a unique structure, it can be sorted into a category of cities with similar characteristics that make certain forms of transportation more suitable for them than others. We then built five virtual cities, each representing a different archetype.

We modeled each virtual city on a grid pattern composed of tiles scaled down to represent 1-square-kilometer areas. Next, we divided the city into smaller zones to map different categories of land use, including residential and shopping districts, and assigned a population density to each one. By modeling traffic flows between tiles, we were able to calculate KPI changes that resulted from the effects of different scenarios.

The five virtual cities/archetypes are as follows:

- Archetype 1: The Highly Compact Middleweight. Most of the inhabitants live within a well-defined central area, making this archetype compact. Berlin and Seattle are good examples. Population growth and density, although above average, are not the highest among our five virtual cities. Inhabitants use a broad range of transportation modes, with demand evenly distributed across options.

- Archetype 2: The Car-Centric Giant. This automobile-dependent archetype includes North American cities—such as Los Angeles and Toronto—that have large populations but very low population density. Owing to the city’s large geographic area, dispersed population, and underdeveloped public transportation network, about 60% of all trips are currently taken by private car. The car-centric giant has a densely populated center and smaller low- and medium-density satellite hubs. Because this archetype is relatively new, it has a highly regular grid-shaped street pattern.

- Archetype 3: The Prosperous Innovation Center. This archetype represents established cities that have developed over an extended period, with low population growth and average density. London and San Francisco are examples. Several medium-density hubs are contained within the city boundaries. The street pattern is irregular and thoroughfares are often narrow. Inhabitants use a range of transportation modes equally.

- Archetype 4: The Developing Urban Powerhouse. Bangkok and Buenos Aires are typical of this city archetype. Both are modern, rapidly growing metropolises with a high population density. Developing urban powerhouses are often found in tropical and subtropical regions. They are composed of multiple distinct hubs clustered along a coastline or river. Most inhabitants currently use public transportation.

- Archetype 5: The High-Density Megacity. Relatively modern cities, such as New York and Shanghai, that have grown considerably over the past century fall into this archetype. Such cities have a large population, with a high-density central hub surrounded by densely populated satellite hubs. The archetype is typically located on a coastline. Its streets are generally configured in a grid pattern. At present, inhabitants use a range of transportation options.

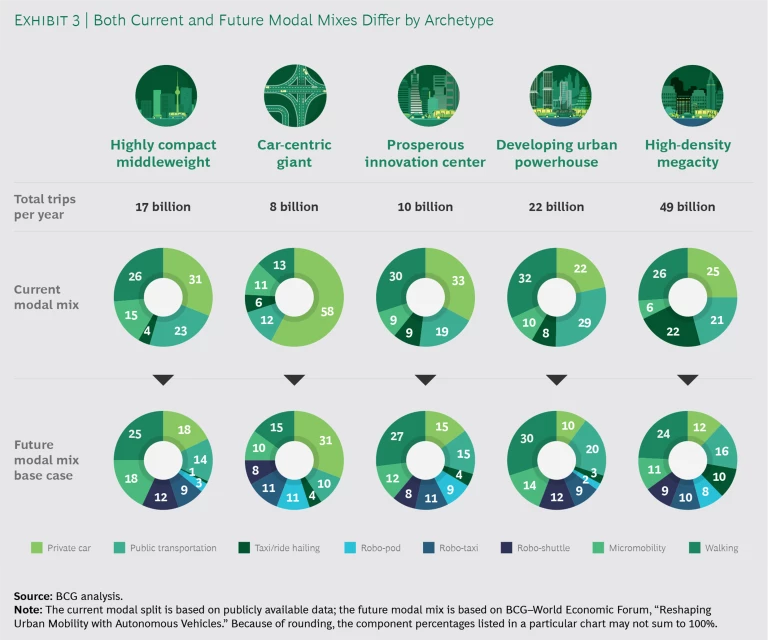

In developing each virtual city/archetype, we used publicly available data from our city sample to model the current modal split and to establish an initial set of KPIs. For the current modal split, we included five transportation modes: private cars and motorbikes, public transportation, taxis/ride hailing, micromobility (including bicycles), and walking. This information formed the starting point for our simulation.

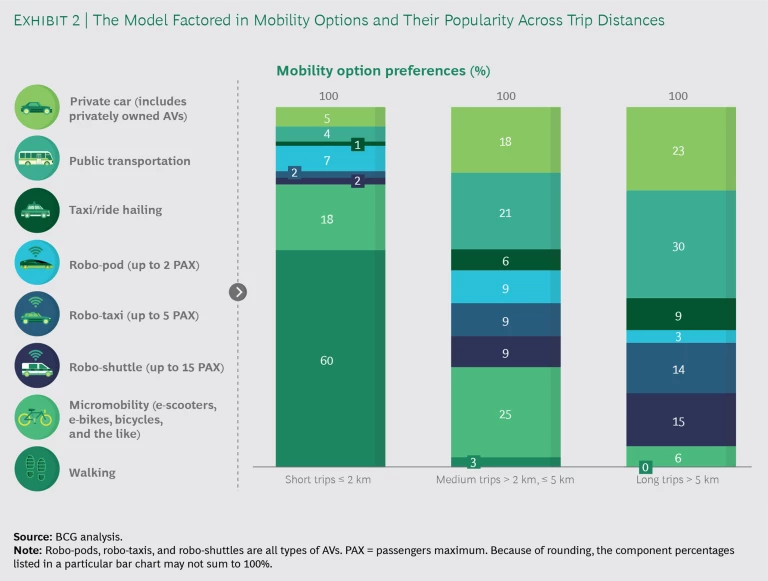

To create a projection of what the future modal split might be in each virtual city if inhabitants had the option of using AVs, we used the findings of a study conducted jointly by BCG and the World Economic Forum (WEF)— Reshaping Urban Mobility with Autonomous Vehicles , published in June 2018—that asked 5,500 inhabitants across the globe what mode of transportation they would choose for making different types of journeys. (See Exhibit 2.)

To the five existing options in today’s modal split, we added three on-demand AV modes: robo-pods (which seat up to 2 passengers), robo-taxis (up to 5 passengers), and robo-shuttles (up to 15 passengers). The resulting future modal split then served as our base-case scenario. (See Exhibit 3.)

When we ran the simulation, we took into account the distribution of mobility options across short-, medium-, and long-distance trips, using current data along with the results of the BCG/WEF survey. We also factored average vehicle speed, parking spaces for private cars, curb space for AVs, and average vehicle occupancy into the model.

On Average, AVs Delivered Improvements Across All KPIs

In conducting simulations of the base-case scenario, we found that AVs produced the following changes in our KPIs when we averaged the effects across all five archetypes:

- The land area needed for parking spaces shrinks by 35%. Because city dwellers switch from private cars to shared AVs (and in some archetypes to micromobility options), the parking requirement diminishes.

- Traffic volume declines by 4% as new shared transportation modes cause the number of vehicles on city streets to drop. AVs also improve the efficiency of the overall transportation network and optimize traffic flows.

- Fatalities from road accidents decline by 37% per year because AVs reduce the incidence of driver errors.

- Transportation costs as a percentage of household incomes dip by 13%. Taxis, ride-hailing services, and private cars are the most expensive mobility modes today. Driverless transportation lowers the cost of a taxi, and shared, on-demand AVs improve access to mass transit services, so fewer inhabitants depend on owning a car.

- Average journey times fall by 3% as the lower traffic volume resulting from use of shared AVs reduces congestion and allows all transportation modes to move faster.

- Energy consumption declines by 12% because of the switch from private cars to more-efficient electric-powered AVs. An increase in shared mobility and the growing popularity of micromobility, mass transit, and walking contribute to the drop as well. (The calculated decline does not take into account additional effects from widespread electrification of private cars, taxis, buses, and other vehicles.)

Four Future Scenarios

Policy and behavioral changes will strongly influence the shape of urban transportation systems. By understanding how different scenarios will affect different archetypes, mobility operators can look ahead and make effective business decisions. (See Exhibit 4.) And by altering their policies, planners can maximize the potential of AVs or encourage other, more beneficial mobility options.

We wanted to explore how four possible scenarios would play out across our five city archetypes. To accomplish this, we raised or lowered the share of a given transportation option in the future modal split and then assessed the impact of that change on our KPIs. The results were as follows:

- Scenario 1: Shift from Private Cars to Non-AV Transportation Modes. Metropolitan authorities introduce policies that curb private car trips and encourage other forms of transportation. In this scenario, we assumed that self-driving vehicles were still in their infancy and therefore had little impact on the modal split. In the real world, cities could affect prevailing traffic-mix patterns by levying a charge on private vehicles that enter designated areas at certain times. Planners could also invest in mass transit networks and give network users credits to discourage car trips.

- Scenario 2: Dominance of Micromobility. The share of e-bikes and e-scooters increases substantially. This result could follow from tough regulations on car journeys and the rise of the sharing economy. Rather than being primarily a last-mile transportation solution, micromobility would become a citywide phenomenon and encourage more multimodal journeys.

- Scenario 3: Strong Push for Robo-Shuttles. Shared robo-taxis and robo-shuttles become the central component of urban transportation systems. The new vehicles are a hybrid form, with far less passenger occupancy than mass transit offers but far more than private cars. Generational change could support their adoption: millennials and members of Generation Z already share more products and place less value on car ownership than did previous generations.

- Scenario 4: Strong Uptake of Robo-Pods. Small robo-pods dominate the modal split, as their greater flexibility and privacy in comparison with other options make them a popular choice.

We chose these four scenarios because they capture important mobility trends today. Several major cities, including Amsterdam and Madrid, have already begun restricting the use of cars, and the number of countries that plan to ban the sale of gasoline-powered vehicles is growing.

Although some observers have dismissed e-scooter sharing as yet another overhyped industry, micromobility is by no means a fad. In fact, as the urban landscape becomes increasingly congested and polluted, cities will urgently need shared e-scooters. “Micromobility forces us to think about redistributing space in our towns,” says Cem Özdemir, chairman of the committee on transportation in the German Bundestag. “Everything that is emissions-free needs more space in our towns and cities. The rise of micromobility helps us to have that debate.” Since their debut, in the fall of 2017, shared e-scooters have spread to hundreds of cities worldwide. We estimate that the global e-scooter market could be worth $40 billion to $50 billion by 2025, as discussed in “ The Promise and Pitfalls of E-Scooter Sharing ,” published in May 2019.

As for robo-shuttles and robo-pods, the changes in behavior underlying the rise of ride hailing and car sharing will favor the uptake of these self-driving vehicles, too, when they emerge.

Micromobility forces us to think about redistributing space in our towns. —Cem Özdemir, chairman of the committee on transportation, German Bundestag

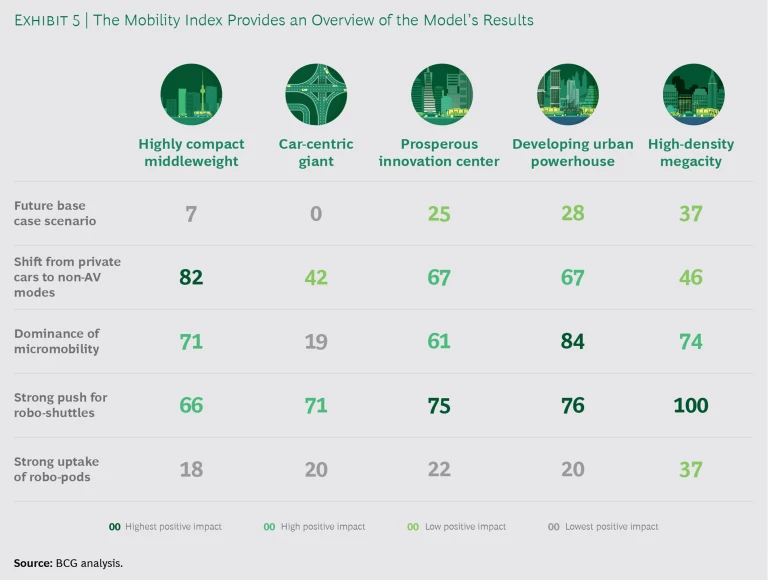

How Future Scenarios Will Affect Different Archetypes

To compare the findings we obtained from the simulation tool, we created a mobility index. The index generates an aggregate score on a 100-point scale when we apply a scenario to an archetype. The score is based on the percentage change in the tool’s KPIs for each archetype, with each KPI contributing equally to the overall score. (See Exhibit 5.) All scores gauge positive impact, and they range from zero for the lowest possible positive impact to 100 for the highest possible positive impact. In Exhibit 5, we use darker colors to indicate scores that show above-average positive impact and lighter colors to indicate scores that show below-average positive impact.

For three of our archetypes (car-centric giants, prosperous innovation centers, and high-density megacities), promoting robo-shuttle use would deliver the greatest advantage as measured by improvements in the model’s KPIs. For developing urban powerhouses, however, micromobility would deliver more benefits; and for highly compact middleweights, a shift from private cars to other non-AV modes of transportation would be the smartest choice. Still, in every case, choosing the best-choice scenario for each archetype’s characteristics would yield significant real-world benefits. (See Exhibit 6.)

Here’s how the data breaks down:

- Highly Compact Middleweights Paired with a Shift from Private Cars to Non-AV Modes of Transportation (Micromobility and Mass Transit). Among our five archetypes, highly compact middleweights such as Berlin and Seattle would benefit the most from shifting away from private cars and toward micromobility and public transportation. Curbing car use would reduce traffic volume by 21%, thereby positively impacting congestion and emissions; it would also lower the number of annual fatalities by 42% and shrink the total parking area by 47%. The highly compact middleweight’s density and its characteristic short-distance trips mean that energy-efficient micromobility options could replace cars relatively easily. Our simulation tool indicates that the shift to non-AV transportation modes would cut transportation costs by approximately 18%, saving households in Berlin about $1.6 billion a year. At the same time, energy consumption under this scenario would fall by 21%, the biggest decline across all scenarios and archetypes.

- Car-Centric Giants Paired with a Strong Push for Robo-Shuttles. Car-centric giants such as Los Angeles and Toronto, which are spread out and have poor public transportation access, would benefit more from robo-shuttles and robo-taxis than from pursuing any other scenario. As shared AVs replaced private cars, annual fatalities and total parking area would decline by 53% and 52%, respectively. Traffic volume would drop by 12%, energy consumption by 17%, and transportation costs by 16%. By promoting robo-shuttles and reducing its private vehicle fleet by 600,000 cars, Los Angeles would reduce its CO2 emissions by 2.7 million metric tons a year, according to our calculations. On the flip side, journey times would increase by 2%.

- Prosperous Innovation Centers Paired with a Strong Push for Robo-Shuttles. For prosperous innovation centers such as London and San Francisco, the best course of action would be to promote robo-shuttles and robo-taxis. As a result of adopting this approach, prosperous innovation centers would see traffic volumes dip by 1%, energy consumption by 15%, transportation costs by 16%, and journey times by 4%. Annual fatalities and total parking area would improve the most as a result of shared AVs, declining by 57% and 52%, respectively. By introducing policies that encourage the use of robo-shuttles and robo-taxis, London could avoid more than 60 road fatalities and more than 15,000 nonfatal traffic accidents annually.

- Developing Urban Powerhouses Paired with a Dominance of Micromobility. Promoting micromobility would be most beneficial to developing urban powerhouses such as Bangkok and Buenos Aires. These cities are well suited to short e-scooter and e-bike trips because of their dense configuration. In combination with existing public transportation systems, micromobility could effectively replace many private cars, reducing traffic volume by 14% (in part, owing to much smaller vehicle sizes) and energy consumption by 19%. And because of this archetype’s high share of short-distance trips, the growth in light and flexible micromobility vehicles would cut journey times by 6% (reducing an average Hong Kong city dweller’s commuting time by almost 20 hours a year) and transportation costs by 22%. Annual fatalities would decline by 46% and total parking area by 42%.

- High-Density Megacities Paired with a Strong Push for Robo-Shuttles. Robo-shuttles and robo-taxis would deliver major benefits for all our archetypes. But of the five, high-density megacities such as New York and Shanghai stand to gain the greatest advantage from promoting these options. In this archetype, city dwellers would rely on public transportation, private cars, taxis, and ride-hailing services for their journeys, with trips evenly split among short, medium, and long distances. Because they offer an excellent alternative for all trip distances, robo-shuttles would be widely adopted. And by replacing private cars, taxis, and ride hailing, these shared AVs would provide greener, cheaper, and safer mobility. Annual fatalities would fall by 58% as private cars became increasingly redundant; the total parking area would shrink by 45%; and traffic volume would decline by 9% and energy consumption by 18% as city dwellers switched from personal to shared mobility. In addition, transportation costs would decline by 27%, and journey times by 5%. New York planners could free up the equivalent of about 900 blocks of space (80 by 270 meters) now used for parking if they created the conditions for robo-shuttles to thrive. Imagined as a continuous area, this is almost the size of six Central Parks. Several of the leading industry experts we interviewed agreed about the benefits of robo-shuttles. “Shared autonomous shuttle buses are the most promising use case,” says Pete Daw, a former director of urban development and environment at Siemens.

An Expert View on What AVs Will Need in Order to Succeed

While some automakers and tech companies plan to launch autonomous and near-autonomous vehicles by the mid-2020s, it will probably take cities several more years to fully prepare for them. According to a panel of leading experts, most cities are unlikely to be ready for AVs until 2030. Once they are, sales of self-driving vehicles will rise rapidly, led by the US.

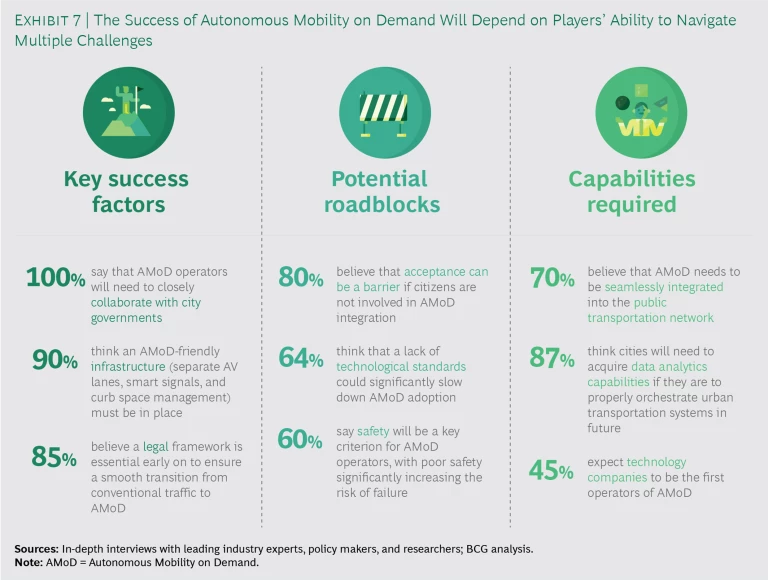

To better understand what key success factors, potential roadblocks, and required capabilities will shape the introduction of AMoD in our cities, we conducted a series of in-depth interviews with 30 leading industry experts, policy makers, and university researchers worldwide. (See Exhibit 7.)

According to our interviewees, stakeholders must address four key areas in order for AVs to succeed:

- Infrastructure. To function properly AVs will require new hard and digitally connected infrastructure, according to 90% of our interviewees. Needed structural improvements include dedicated lanes to separate AVs from other traffic, and sensors to enable self-driving cars to communicate with their environment. Cities will also have to build charging stations to power up the new vehicles.

- Regulations. Effective rules are a prerequisite for successful AV introduction, 85% of our interviewees told us. Policy makers must tackle issues including safety, accident liability, and laws governing road use. Data access and ownership will be another important area. About 87% of those we spoke to said that cities will need to develop data analytics capabilities so they can control and improve how AVs operate. Regulators will also need to consider ethical dilemmas regarding how autonomous systems should respond to an emergency.

- Acceptance. In our interviews, 80% of respondents said that public acceptance could suffer, to the detriment of AV adoption, unless cities actively involve customers and city dwellers in pilot projects and incorporate their feedback in municipal AV plans. Although many citizens are willing to give AVs a chance—primarily because it would mean not having to find a parking space—most are reluctant to share a self-driving taxi with strangers. “Citizen participation in the integration process is very important,” says Patric Stieler, head of the City of Cologne’s office for traffic management.

- Collaboration. All of our interviewees said that the success of AMoD will depend to a large extent on establishing close partnerships among mobility providers, infrastructure companies, and city authorities. Only by combining key capabilities from all three can AMoD flourish sustainably. “The mobility industry needs to have a much better-developed view of what future urban transport solutions should look like. And cities need to understand digital components, software, and data sharing far better than they do today,” says Philipp Rode, executive director of LSE Cities and an associate professorial research fellow at the London School of Economics.

Countries and cities that innovate to solve these issues are likely to become the leaders in AVs. Cities that introduce pilot projects—so they can solve potential teething problems and gain public support early on—will improve their chances of experiencing a smooth transition to AVs, according to most of our experts. Amsterdam, Singapore, and Boston have all taken this advice and are testing autonomous buses, drafting regulations and multimodal transportation strategies, and opening public roads to vehicle testing. “For densely populated cities like Singapore, vehicles with a larger capacity, such as autonomous shuttle buses, are the best way to carry lots of people during peak hours,” says Wee Shann Lam, chief innovation and technology officer at Singapore’s Land Transport Authority.

For densely populated cities like Singapore, vehicles with a larger capacity, such as autonomous shuttle buses, are the best way to carry lots of people during peak hours. —Wee Shann Lam, chief innovation and technology officer, Singapore Land Transport Authority

Action Steps for Different City Archetypes

Different cities will need to take different actions to create their optimum mobility environment, although restricting private car use is critical to all cities’ success. But municipal authorities need to plan ahead and start acting now. According to Pete Daw, “The key for cities is to have a vision of where they want to be in 20 years—and create policies that enable them to get there.”

The urgent need for cities to act becomes clearer when you consider how urban environments would evolve without any targeted policy intervention. To simulate this situation, we modeled a “business as usual” future scenario in which AMoD failed to take off and growth in private car use increased in line with past trends (at from 5% to 9% over the next 15 years, depending on the archetype).

Unlike the environments in our other scenarios, the environment in our virtual cities under this scenario worsened significantly: traffic volume increased by an average of 6% over the ensuing 15 years, required total parking space grew by 8%, and energy consumption and transportation costs rose. In light of this outcome, it is easy to imagine a meltdown in traffic systems and a significant deterioration in quality of life and health for the citizens of megacities that choose this path.

What should cities do to avoid this worst-case scenario and instead reap maximum benefit from the opportunities that new mobility can provide? Here are the best moves for each archetype:

- Highly Compact Middleweights. For cities such as Berlin and Seattle, where a shift from private cars to other non-AV forms of transportation creates the best overall outcome, planners should prioritize measures that reduce car volumes in urban centers. First, they should identify and employ the regulatory levers—whether congestion pricing, road closures during peak hours, or high parking fees—that will be most effective for their city. Mass transit networks will pick up the slack by carrying more passengers. But to avoid overcrowding those networks, planners must invest in additional routes and new hybrid public transportation, such as on-demand public buses. City dwellers in highly compact middleweights take a higher proportion of short-distance and last-mile trips than do their counterparts in most other archetypes. To cater to these travelers, planners should develop sustainable citywide transportation plans that include micromobility options. They will also need to improve micromobility access at public transportation stations to create a seamless, multimodal travel experience. They can do this by investing in e-bike and e-scooter docking bays, collaborating with micromobility players, providing free last-mile trips to travelers who have purchased an annual mass transit pass, and developing apps that enable users to pay for public transportation and micromobility journeys.

- Car-Centric Giants. Because robo-shuttles and robo-taxis are the best choice for cities such as Los Angeles and Toronto, planners should run pilot projects early and use policy measures such as dedicated lanes, easy availability, price advantages, and a good user experience to encourage the uptake of shared AVs. Mass transit systems in car-centric giants tend to be poor, so robo-shuttles will have to be extremely convenient to convince commuters to give up their private vehicles. But municipal authorities should also invest in modernizing mass transit systems and improving service frequency. By planning AV routes to improve access to public transportation, they can reduce traffic volume and free up urban space. Because of the relatively large proportion of medium- and long-distance trips that inhabitants take, micromobility offers fewer benefits. It should be deployed selectively in central areas, where it can handle short-distance trips more conveniently than private cars.

- Prosperous Innovation Centers. Although cities such as London and San Francisco gain the largest positive impact from robo-shuttles and robo-taxis, they also benefit significantly from reducing the number of private cars and encouraging micromobility and other non-AV transportation modes. Planners should adopt a balanced approach that promotes all three. Introducing larger, shared AVs will pose challenges, however. Prosperous innovation centers tend to have narrow streets and aging architecture. Planners should consider curbing private cars in city centers and creating car-free zones that favor AVs. They can also build AV-friendly infrastructure, such as dedicated lanes and sensors, to help the new technology take off. They should run AV pilot projects in zones that have relatively simple street patterns before venturing into areas with more complex configurations.

- Developing Urban Powerhouses. In cities such as Bangkok and Buenos Aires, where micromobility promises the greatest benefits, planners can adopt several measures to facilitate its uptake. By improving access and affordability, they can transform micromobility into a key part of the urban transportation ecosystem. Building docking bays and parking areas close to mass transit stations and creating attractive subscription models that combine micromobility with public transportation (such as free last-mile trips for holders of annual mass transit passes) are two ways to do this. Creating a single booking platform and end-user interface will further encourage use of these modes. Planners can also take steps to reduce accident rates by creating exclusive micromobility lanes. Some developing urban powerhouses, such as Bangkok, suffer from disorganized transportation systems, underinvestment, and low-tech mobility equipment. They should treat AMoD as a longer-term goal to be realized after they have addressed these deficiencies.

- High-Density Megacities. Because megacities such as Shanghai and New York derive the maximum benefit from robo-shuttles, they should start introducing them early. Planners can run pilots to create consumer acceptance, test incentives that encourage switching, and solve problems that could delay a wider rollout. Because small AVs will deliver far fewer benefits, policymakers should encourage robo-shuttles and robo-taxis over robo-pods. City dwellers take a relatively high proportion of long-distance trips, so planners should create dedicated robo-shuttle lanes that facilitate these longer journeys while ensuring that slower-moving, shared AVs do not hamper the movement of other vehicles. We expect AVs to replace conventional taxis and ride-hailing services in high-density megacities, so city authorities need to prepare for this transition and its impact on the taxi industry.

How Players in the Mobility Value Chain Can Prepare for AVs

All transportation players—not just city planners—can learn valuable lessons prior to planning for the arrival of self-driving vehicles.

Collaboration between government, the automotive OEMs, and the technology companies is fundamental to make AVs a success. —Hadi Zablit, senior vice president of business development, Renault Nissan Mitsubishi Alliance

Because AVs depend on sensors and smart infrastructure as well as on mobility technologies, they will have a better chance to flourish if cities, vehicle manufacturers, and technology companies create collaborative partnerships to ensure that these elements are in place. “Collaboration between government, the automotive OEMs, and the technology companies is fundamental to make AVs a success,” says Hadi Zablit, senior vice president of business development at the Renault Nissan Mitsubishi Alliance.

Players in the mobility value chain can participate in pilot projects that educate city inhabitants and officials about the benefits of AVs and make it easier for regulators to develop suitable rules for introducing them. They can work together to create the incentives and conditions that encourage public participation in and support for shared mobility initiatives and ensure that mass transit remains a key component of urban transportation, thus avoiding an unsustainable cannibalization of the public transportation system. Furthermore, they can cooperate in establishing the digital mobility platforms that will be an important feature of urban transportation in the coming years, enabling users to choose among options including AVs, as discussed in “ In Building an Urban Mobility Platform, Cooperation Is Key ,” published in June 2019.

Here are some specific actions that different stakeholders should consider:

- AMoD Fleet Operators. Owners and operators of AV fleets must identify cities that offer the best business opportunities, starting with high-density megacities. To make the introduction of AV vehicles attractive for individual cities, fleet operators should consider offering AV services through emerging urban mobility platforms so that planners can more easily control the mobility ecosystem. They will need to build strong partnerships with automotive OEMs and tech players in order to share the investment cost of scaling up vehicle fleets. But they should also tap new business opportunities—such as in-vehicle entertainment—that will arise because travelers no longer have to steer their cars.

- Car Makers. Automotive OEMs have yet to realize that, increasingly, AV mobility will be consumed as a service, as users request robo-shuttles and robo-taxis via their mobile devices and digital mobility platforms. Other players will rely on OEMs’ production knowledge to manufacture self-driving vehicles at scale. But car makers should redesign their products so that they have greater connectivity and should move into adjacent business areas such as owning and operating AV fleets. Building strong partnerships with other players, such as cities and technology companies, will help them make these moves. They will also need to move away from standard traditional vehicle designs, such as four-seat automobiles with steering wheels, toward more purpose-built vehicles, which will involve huge changes in exteriors and interiors.

- Micromobility Providers. E-scooter and e-bike providers should target developing urban powerhouses and highly compact middleweights to maximize their chances of success, while avoiding car-centric giants, where their prospects are weakest. They will need support from city officials if metropolises are to invest in the docking bays and infrastructure that micromobility will need if it is to achieve its full market potential. Providers can help persuade planners by identifying opportunities where micromobility would provide better access to public transportation.

- Traditional Urban Mobility Providers. Public transportation will likely continue to be the backbone of urban mobility in most archetypes. As new transportation options evolve, traditional mass transit players should prioritize collaboration with AMoD fleet operators and micromobility companies so that they can deliver a seamless, multimodal travel experience to city dwellers. They should include these new providers when planning long-term infrastructure investments and should work with them to improve network access. Traditional taxi companies are the overall losers in all scenarios and archetypes, as the more cost-efficient AV business model will supplant their business model. These companies should aim to serve demand in small and medium-size cities or in crowded urban areas where robo-taxis are less likely to operate at scale.

- Infrastructure Technology Providers. Companies that drive the introduction of smart municipal infrastructure on a holistic level will have a significant impact on the success of AVs by shaping the physical environment in which they operate. They will need to collaborate with developers of new mobility technologies, such as AVs, so they can respond early and prepare for future infrastructure requirements. Planners will have an important role in approving projects, of course, but infrastructure providers will also need to closely monitor today’s AV technology landscape in order to make the right investment decisions.

AVs have the potential to transform cities and help solve pressing urban problems. But planners should not consider the technology in isolation. They must take into account the specific urban environment. For some cities, adopting measures that actively promote other mobility options will create greater benefits overall. And in cities where self-driving vehicles are the best choice, municipal authorities will need to work hand-in-hand with operators, manufacturers, and technology companies if AVs are to succeed. Although AVs may not become a feature of urban transportation systems for another decade, players should act now to start paving the way for a radically new and improved mobility environment.

Acknowledgments

More than one year of extensive research and insights by BCG, BCG GAMMA, and the University of St. Gallen, a data travel demand model simulating more than 1.7 billion daily trips in total, and insights from approximately 30 qualitative interviews with industry experts, policy makers, and researchers contributed to this study. This research project would not have been possible without the efforts and contributions of several persons. We would like to express our gratitude to our BCG team—Maximilian Rohnke, Wiebke Werning, Pia Hösl, and Benjamin Dobrovits—for their assistance, research, and coordination within the project, as well as to all other BCG colleagues who provided valuable input to this project.

Further, we thank our BCG GAMMA team of Oliver Bandte, Wenting Hou, Cassandra Pallai, Ben Thornton, and Nhan Dang for developing a complex travel demand model that allows the 3D visualization of our city archetypes and the scenario-based KPI calculations. We owe special thanks to Christian Kimmling and Robin Graber for providing us with appealing video material and illustrative animations.