The global luxury market has a fast-growing new base of consumers: secondhand buyers. In the past, some luxury brands and retailers didn’t consider the secondhand market, but as new players enter and consumer interest rises, that is an increasingly untenable position. Our analysis shows that the market for secondhand hard luxury items—primarily watches and jewelry—is worth about €21 billion worldwide and growing at 8% a year, faster than the luxury industry overall. Moreover, this market is still in the early stages, creating an opportunity for brands and retailers to take proactive steps in order to shape demand and stake their claim.

We recently surveyed consumers, performed deep market research, and interviewed senior luxury executives. Critically, our research analysis shows that secondhand sales do not reduce the purchase of new products. In fact, the right approach can complement the sales of new goods, reinforce the brand’s value, and give companies access to a critical group of future consumers that luxury brands and retailers should cultivate.

Snapshot of a Growing Market

Our survey identified several key insights about the market for secondhand hard luxury.

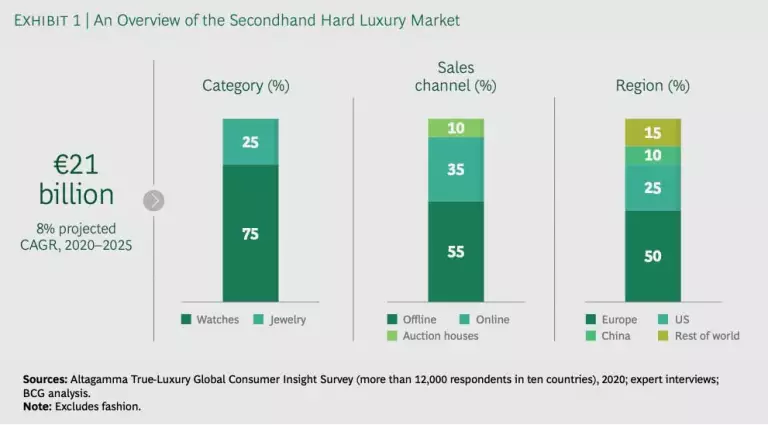

The market is large and expanding. In the hard luxury category, watches account for about 75% of secondhand sales, with jewelry making up the remaining 25%. Offline sales still dominate—though the online channel will expand its share as a result of consolidation and the market entry of classic players—and Europe is the largest region. (See Exhibit 1.)

Secondhand luxury sales are expanding for many reasons, among them an increase in online sales, changing consumer preferences, and rising concern about the sustainability of luxury goods, particularly among younger consumers. These trends were already well underway before the COVID-19 outbreak hit, but the pandemic—and the economic slowdown it created—has accelerated them. Notably, our interviews show that the financial uncertainty prompted by the crisis is spurring more buyers across all age groups to consider secondhand hard luxury as a promising investment vehicle. Prices are more attractive for secondhand products (with no immediate drop in value as occurs following the purchase of new items). In addition, a more robust secondhand market boosts liquidity for these types of investments.

Another factor in the growth of secondhand hard luxury is social media and digitization, which are becoming far more influential in driving purchases, giving consumers easier access to personalized premium services. These new channels make heritage storytelling more relevant in shaping a brand’s identity. And brands and retailers increasingly rely on social media to promote luxury experiences and events as well as geographically specific product offerings.

Consumer demand is flourishing. Perhaps the biggest growth driver is the surge in consumer demand for secondhand hard luxury goods. In a BCG survey conducted with

Our analysis also found that consumers of secondhand hard luxury items skew slightly in favor of men (55%) and tend to be younger (mostly millennials and Gen Z). The increased activity of younger generations reflects their pronounced preference for an experience with a brand: they would rather the relationship be more like a service than traditional ownership. These consumers are also more interested in hunting for bargains and making deals. They factor sustainability into their purchasing decisions to a greater degree than previous generations and pay increasing attention to resale value, treating hard luxury goods as investments.

Today’s consumers expect luxury brands and retailers to get involved in secondhand sales.

Perhaps most important, consumers expect luxury brands and retailers to get involved in secondhand sales. In our research, 70% of luxury consumers said they would like to purchase secondhand products directly from luxury brands. And a slightly higher percentage, 74%, indicated they would like brands to certify secondhand products that are sold through resellers. These consumers have clear expectations regarding the security, convenience, and service of a purchase, offering a promising opportunity for forward-looking companies.

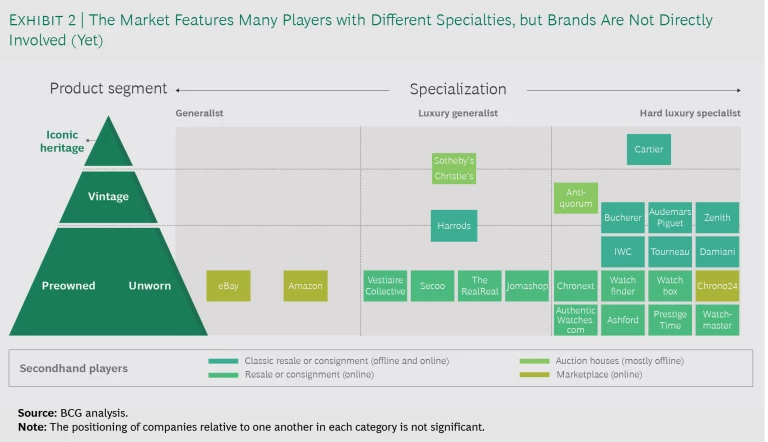

The rapid evolution of the market creates opportunities. Many players operate in the secondhand hard luxury market, responding to a wide array of consumer needs. Companies position themselves in the market according to two dimensions: their degree of specialization and the product segments in which they compete. We divide the market into three components. (See the sidebar, “The Three Segments of Secondhand Hard Luxury.”)

The Three Segments of Secondhand Hard Luxury

Unworn and Preowned Pieces. Luxury products that have never been worn (typically from last season) are highly desirable to budget-conscious consumers because of the items’ discounted prices. Similarly, preowned pieces are usually less than ten years old, making them valuable but still accessible to many buyers. Both unworn and preowned segments offer important opportunities for a brand to recruit new consumers—secondhand owners can be motivated to exchange their existing products, thus stimulating demand for new ones.

Vintage Pieces. These hard luxury products are valuable and generally 10 to 30 years old. They are in high demand due to their timeliness and quality and have a substantial impact on brand equity.

Iconic Heritage Pieces. These historic, high-value products are at least 30 years old. They are the most desirable pieces because of their iconic history and have the largest impact on brand equity.

For example, eBay and Amazon are generalists that focus on preowned or unworn products. Harrods, in contrast, developed a secondhand offering (in addition to sales of new products) that focuses on preworn pieces as an additional service for its customers. Similarly, Cartier offers secondhand iconic and heritage products alongside new pieces in its high-end jewelry business, thus reinforcing the company’s rich history. (See Exhibit 2.)

The segmentation of the market creates an opportunity for luxury brands and retailers. Online marketplaces (such as eBay) and resale companies (Jomashop, for instance) have strong operations and e-commerce capabilities, along with high volume and a large inventory. In addition, a number of online players—like Watchbox, Watchfinder, and Chrono24, among others—have successfully focused in recent years on higher-priced preowned products.

But many of these marketplaces are still lacking in terms of the luxury experience they offer: they are often associated with low-quality items and perceived to not be “true luxury.” Marketplaces can also pose a risk for brand dilution if they do not vouch for the authenticity or condition of secondhand products.

At the other end of the spectrum are classic luxury brands and retailers that offer an established experience but may be not as strong in terms of operations and e-commerce; some may be entirely offline.

Luxury brands and retailers do not need to design a secondhand model from scratch—they can apply lessons learned from other segments.

Our research suggests that an opportunity exists for classic players to invest in this segment through the right mix of capabilities: operational excellence, reach, and e-commerce, along with existing luxury elements such as quality, brand storytelling, and technical know-how. By combining these elements, brands and retailers could cultivate new customers, preserve their brand’s heritage, better meet the changing needs of consumers in areas such as sustainability, and build their brand equity overall.

Other luxury categories show what is possible. Notably, luxury brands and retailers do not need to design a secondhand model from scratch. Rather, they can apply the lessons from established segments that are more mature in secondhand sales, such as car manufacturers. After all, luxury cars are akin to hard luxury goods—they are heritage products with a long life cycle, a hefty purchase price, and the kind of technical complexity that creates demand for a high-quality, brand-authorized secondhand market.

For example, luxury car manufacturers such as Lamborghini partner with authorized dealers to certify and sell preowned cars, increasing the resale value of their cars while recruiting new customers with a relatively small investment and low risk for the brand. These companies also have a separate offering to refurbish classic cars, including special service centers with highly trained staff and certified parts. This approach tends to foster long-term brand equity by curating an iconic and scarce product.

Needed: A Tailored Approach

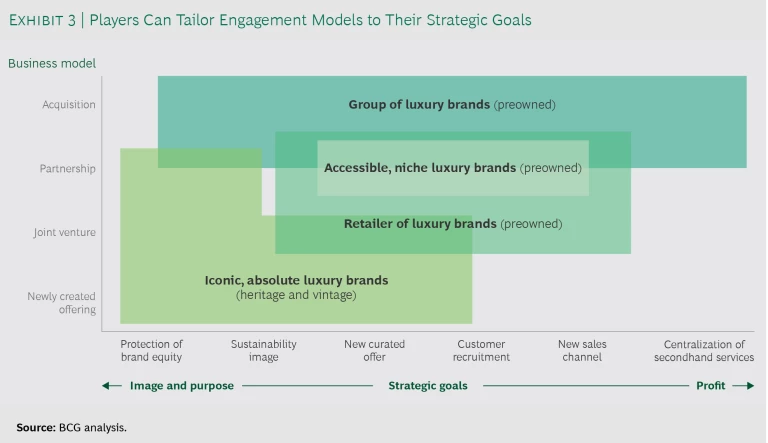

Luxury brands and retailers can conquer the secondhand hard luxury market in a variety of ways. To design the right solution, companies should start by looking at their strategic objectives. For example, some luxury players are more concerned with goals related to their brand’s image, such as protecting their brand equity or establishing themselves as a sustainability leader. Other strategic aims are more financial in nature, such as recruiting new customers, developing a new sales channel, or centralizing secondhand business services as a profit pool.

Once a company identifies its strategic objectives, it can choose from four engagement models:

- Acquisition. Luxury brands and retailers could acquire a platform or retailer and fold it into their organization. Acquisitions have the advantage of speed and centralization—a company can quickly gain access to critical capabilities for the secondhand market while still retaining full control. As with any acquisition, however, the integration element can be challenging (for example, if the two organizations’ cultures do not mesh), and success requires that the two businesses address these issues head-on.

- Partnership. Another option is to partner with an existing player—for example, a department store teaming up with an online platform. Partnerships are recommended for players that want to quickly complement their capabilities and expand into the secondhand market with a limited investment.

- Joint Venture. Companies could coinvest with an existing player, such as an online platform or retailer, in a new joint venture that specializes in secondhand hard luxury. These arrangements are a good option for players that want to control their brand equity and complement their own capabilities with those of another company.

- Newly Created Offering. Luxury brands and retailers could create a novel offering that features secondhand pieces (typically branded as “certified preowned”) along with the portfolio of new products. The offering could be part of the existing brand or a new one, with operations run either internally or externally. This approach is recommended for players that want to preserve their brand heritage and invest in a more sustainable offering and image.

After considering the strategic objectives and potential engagement models, a company can begin to tailor a solution that meets its own unique context. (See Exhibit 3.) There are many options and no universally applicable approach.

For example, an iconic, heritage brand could create its own offering. One approach is a bespoke sales channel developed and executed internally—including an online platform, in-store sales and dedicated events, as well as private auctions—with the capabilities needed to certify products as authentic and price them accordingly. Brands could use this offering to forge lifelong relationships with their customers by giving them a direct, exclusive experience through brand heritage and history. They could also reach a wider base of consumers using heritage secondhand initiatives as a marketing opportunity.

To be clear, building a new offering from scratch can be costly and time-consuming for iconic brands. Organizations that choose this path will need to find the right approach—and could even outsource some aspects to industry players with established expertise. In addition, technology could eventually make some aspects of this offering easier and cheaper, such as RFID and similar tools that could make verification and authentication of products less complicated and less expensive.

Retailers and accessible niche brands have a different set of considerations—a relatively high sales volume and a lower risk of brand dilution. That creates the potential to develop a new joint venture with an established secondhand player that already possesses strong capabilities in areas such as assessing and pricing secondhand goods, marketing, and fulfillment.

The right solution for groups of brands will also differ. Given the broader scope of their needs, groups of brands would likely need more than a traditional partnership. As a result, they could explore acquiring an existing secondhand company that has a purpose and identity that are aligned with their brand. In doing so, they could create a platform to support multiple brands, with a custom set of in-house capabilities.

In the past, luxury brands and retailers could ignore the secondhand market, but today that is no longer true. Consumers are increasingly interested in secondhand hard luxury goods and have greater access to them than ever before. Most important, our research suggests that they want luxury brands to get involved. This creates a significant opportunity for brands to add complementary sales, recruit new customers, and support sustainability agendas. Brands could face some operational challenges in capitalizing on the opportunity, but the market for secondhand hard luxury goods is large, growing, and dynamic—and it is here to stay in the new luxury reality.