The COVID-19 crisis has demonstrated the enormous influence and value of an enterprise capability that is often underestimated: global business services (GBS).

Transforming Experience with GBS

As large companies around the world responded to the pandemic, their GBS organizations became important sources of leverage. These business units have been a cornerstone of resilience for their companies while experiencing a dip of less than 15% in their own capacity. After the crisis began, most GBS groups returned to full productivity within three to six weeks by rapidly adapting their operating models. During the next few years, as companies evolve to be more digitally adept and analytically oriented, GBS will lead the way.

The typical GBS organization is about to change its ways.

GBS organizations worldwide employ more than 1.5 million people, and their revenues are increasing at compound annual growth rates of 7% to 8%, about twice that of global GDP. The traditional role of these groups, starting with their inception in the late 1990s, had been to drive cost efficiency. Now, they have moved far beyond that, providing leading companies with technologically advanced, multifunctional, end-to-end services.

GBS will never return to the way it was. The typical GBS organization is about to change its ways. One powerful next step for GBS design, called Smart Simplicity , has been an ongoing theme at BCG and Genpact. Smart Simplicity involves the consolidation of all GBS activities into a more modular, interoperable, and far more comprehensively coordinated form. It is designed to achieve excellence and transform customer and employee experience, as well as user experience in general.

The Path of Evolution

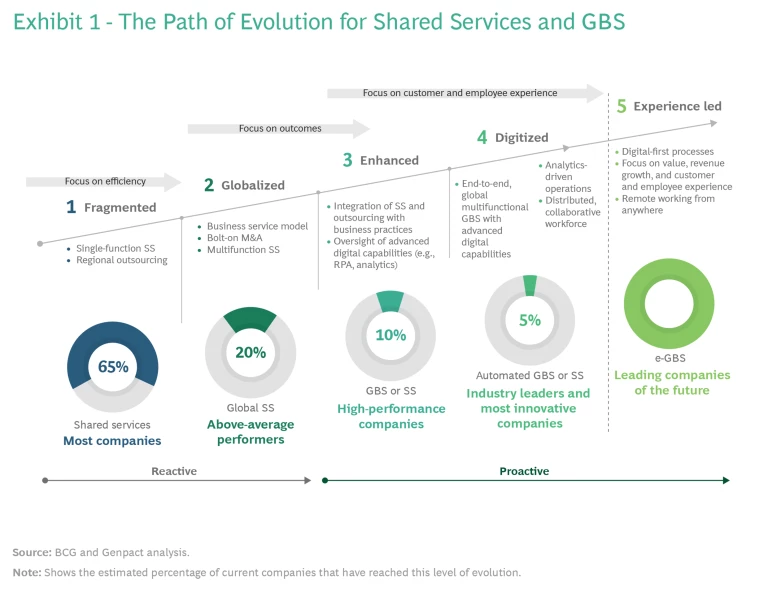

The change in GBS organizations around the world is shown in Exhibit 1. Even today, about 65% of companies still follow a fragmented model, characterized by single-function shared services and regional outsourcing. But the GBS function is evolving in many companies, through several stages. First, there is a focus on efficiency: seeking standardization, simplicity, scale, labor arbitrage, transparency, and control. This in turn gives way to an emphasis on outcomes, characterized by end-to-end optimization, agility, analytics, insights, innovation, governance, and compliance.

The next level of GBS maturity will be driven by experience and characterized by technologically augmented human activity. Value will be expressed from the user perspective. These GBS organizations will enable remote work and tighter collaboration with other enterprises through data engagement platforms and other systems that support interaction.

The Smart Simplicity design will bring these digitized, experience-led forms of GBS to life. They will take advantage of digital acceleration —the same advanced technological and operating-model trends that are disrupting businesses everywhere. These include:

- Resilient business models for internal services

- Rapid adaptation to geopolitical changes

- Digital platforms for end-to-end processes and experience

- Advances in AI and analytics, embedded throughout the business

- Modular IT architecture

- Flexible supply chains

- Widespread use of agile teams

- A “work from anywhere at scale” ethic, with collaborative working practices, influenced by lessons from the COVID-19 crisis

Predictive and prescriptive analytics and digital technologies—like artificial intelligence (AI), machine learning (ML), and blockchain—will be deployed to develop superior user experiences. GBS will provide its companies with new insights into their stakeholders (including customers, suppliers, external parties, firm management, and employees) and offer continuous-learning opportunities across the organization.

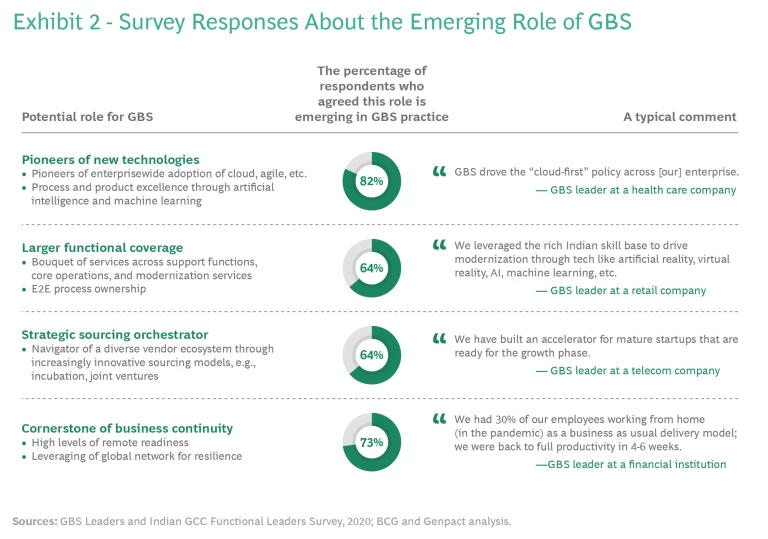

In 2020, Genpact and BCG surveyed more than 100 top executives—a combination of GBS leaders around the world and senior executives at companies in India where GBS is prominent. The respondents confirmed that these groups are playing a more strategic, technologically advanced role focused on proactively driving outcomes. This means less emphasis on fulfilling immediate transactional assignments and more on building capabilities as a service for the business. (See Exhibit 2.)

From Complexity to Smart Simplicity

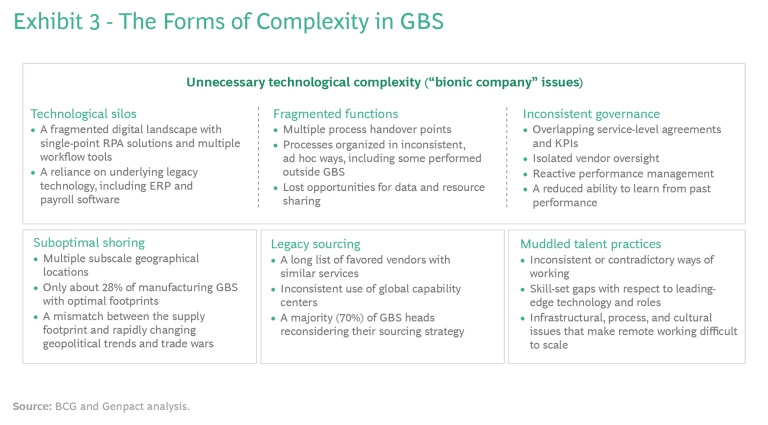

As the GBS role develops, new complexities have become apparent that could hold back the evolution of this critically important function. Exhibit 3 shows six common forms of complexity that manifest as symptoms of organizational dysfunction. The pandemic has made these issues more visible to business leaders. Indeed, 75% of GBS executives surveyed agreed that, even as their operating models are rapidly evolving, the pressure from these complexities has become more of a problem.

The act of reducing complexity is not simple. But the results can be elegant. Before COVID-19, the Smart Simplicity approach had already delivered positive business results consistently in most organizations when applied to GBS. Over the course of a year, these efforts often yielded revenue uplifts of 1% to 2%, better working-capital allocation and cash flows, enhanced customer acquisition with customer satisfaction scores doubling or tripling owing to a unified experience across process journeys, and 30% to 40% cost savings from further gains in bottom-line efficiency.

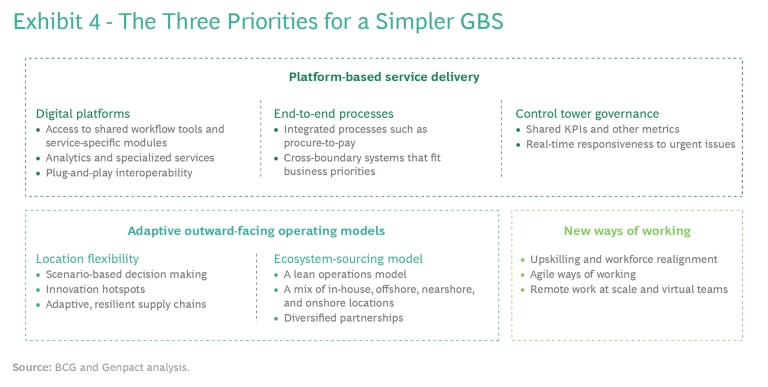

Exhibit 4 illustrates the three main priorities for establishing Smart Simplicity in GBS. Each involves several levers that can be activated selectively. The most effective use of these levers will vary from one company to the next, depending on the GBS group’s stage of evolution and the larger enterprise’s appetite for disruption. But the three priorities apply to all companies.

Platform-Based Service Delivery. Delivering a seamless customer experience requires organizations to adopt an approach to business transformation that is oriented to scaling human endeavor through broad-based digital platforms. The platforms of the future will provide continuous end-to-end processes with embedded, intelligent conversion of data to insights. They will be designed for the humans in the loop, enabling rapid business decision making and using real-time data to make fast, accurate predictions.

Digital platform technologies will become critical when defining and building new processes. So-called “systems of experience” provide a seamless user interface, freeing up the human workforce to focus on more important activities: partnering with businesses and customers and acting on domain-based, data-driven insights to support repeatable, best-action outcomes.

The call center script will become an artifact of the past.

For example, the call center script will become an artifact of the past. It will be replaced with multichannel customer interactions where an unexpected question or unclear sentiment is no longer a cause of misunderstanding. Instead, machine-based intelligence will interpret the remarks and enable human respondents to be prepared. Augmented by rapid machine analysis, call center staff members can make predictive, best-case responses in real time. This results in service delivery excellence.

One barrier to the use of digital platforms in many organizations is their complex legacy technology landscapes, with multiple systems of record: unstructured data repositories and fragmented tools driving inconsistent experiences for the business and customers. Often built over time through organic growth or inherited via mergers and acquisitions, these landscapes need complex integrations to provide even a base level of interoperability. Developing end-to-end customer journeys that deliver the right experience has been historically difficult.

Technology leaders have recognized that fixing these legacy problems would usually involve intricate, costly, multiyear technology-oriented transformations. Complex initiatives of that kind have traditionally impeded digital modernization. But these barriers are beginning to come down, thanks to advances in data engagement and digital platforms that drive a modular, customizable approach to digital enablement and platform growth.

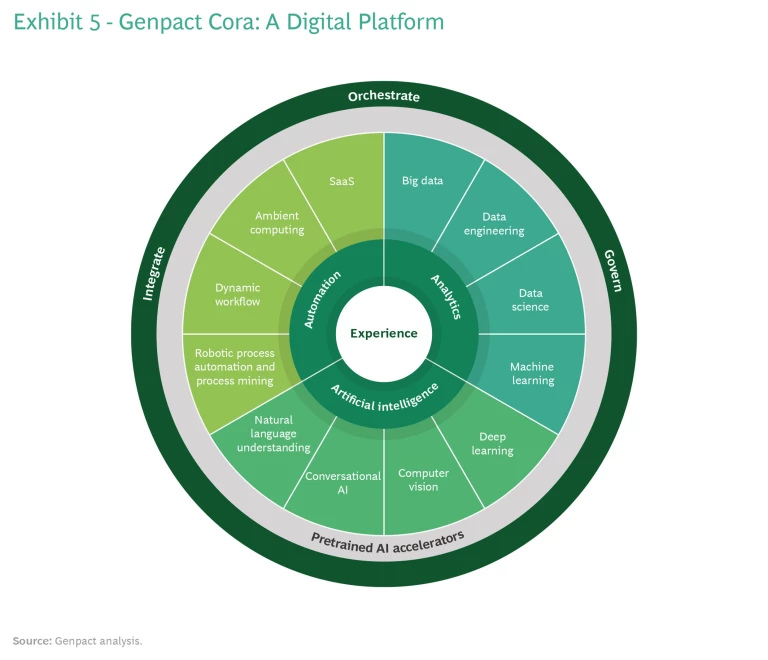

Genpact’s Cora digital platform will integrate a data engagement approach to enable seamless, open integration of application programming interfaces with the digital platform. (See Exhibit 5.) The platform harnesses elements of the digital core with analytics and AI. It uses customizable, best-of-breed digital technologies that can be brought together to solve complex business problems in a digestible manner.

For example, in an order-to-cash (O2C) process, the GBS implementation goes beyond transactional KPIs. It uses digital platforms to harness data insights, enabling companies to achieve better cash flow outcomes through direct bad-debt management and billing validation. KPIs also drive intelligent collections practices through analytics, all managed via an O2C structure oriented to the full customer journey and experience.

These outcomes create a need for a new governance life cycle. Co-sourced innovation centers identify and oversee transformation opportunities. Change management practices incorporate digital and human elements. Structured process “control towers” deploy predictive analytics to look ahead and spot potential problems or opportunities while they are still nascent and use real-time insights to measure and improve the performance of end-to-end processes.

Adaptive Outward-Facing Operating Models. Just a few years ago, GBS service centers were grouped largely in a handful of offshore and nearshore locations, placed there to capture scale synergies. Now the world’s global sourcing and operational dynamics are far more unpredictable than they used to be. In most multinational companies, GBS will play a key role in navigating these tensions, making sure that the right capabilities and processes are available where and when needed.

As the years go by, GBS organizations will increasingly adopt a work-from-anywhere operating model, powered by collaborative technologies and a secured digital infrastructure that is set up for business continuity and rapid responses. Unlike operating models of the past, which were grounded in relatively stable working relationships and oriented toward lowering costs, these operating models are flexible and oriented toward resilience and innovation.

GBS organizations will increasingly adopt a work-from-anywhere operating model.

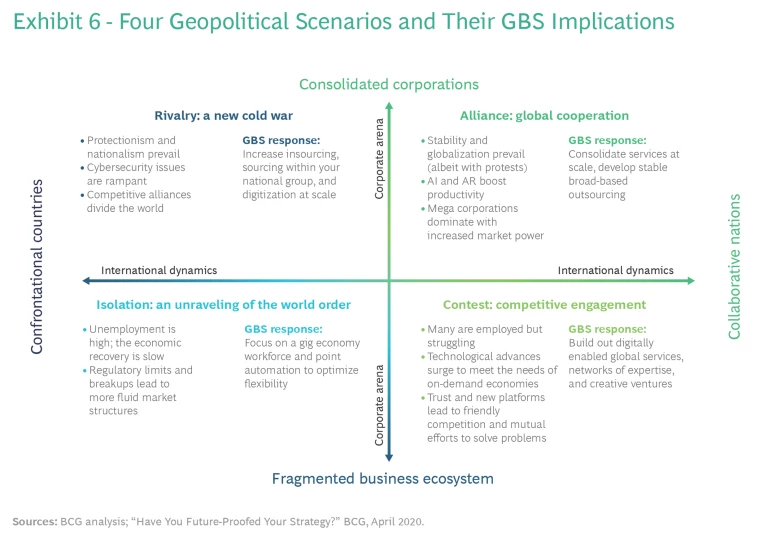

Scenarios about important future trends have proved to be a great starting point for strategic decision making in this context. A set of geopolitical scenarios developed by BCG has demonstrated its effectiveness in the development of GBS strategies. The scenarios comprise four alternative descriptions of how tomorrow’s geopolitical environment could evolve (see Exhibit 6):

- A new cold war between dominant powers (rivalry)

- International cooperation and open trade (alliance)

- Global nationalism and anarchy (isolation)

- A division of the world into trade blocs (contest)

The future of a company may depend on the ability of its GBS-oriented digital strategy to provide flexibility and rapidly adjust to whichever geopolitical situation prevails.

Some GBS simplification strategies will be robust no matter which scenario comes to pass—for example, optimizing a company’s geographic footprint by bringing together subscale operations in different locations. A footprint with 30 GBS locations is almost certainly too large and should be reduced to no more than 5. One exception is innovation hotspots: if a region has expertise in a specific field (such as Israel in cybersecurity, Germany in Industry 4.0 or the Internet of Things, or the US in cloud computing), a company may gain leverage by establishing specialized centers of excellence in the appropriate locations.

In the BCG-Genpact survey of GBS leaders, about half (51%) of the executive respondents recognized the shortcomings of their current location strategies. While this year’s geopolitical tensions have propelled geographic considerations to a higher level of management attention, our survey findings suggest traditional offshoring locations like India are already reaching prepandemic hiring levels in GBS delivery centers. And they are expected to expand in the upcoming year.

Likewise, vendor ecosystems are growing more adaptive. While it is important to reduce complexity by consolidating at-scale vendors, GBS organizations also need to experiment with flexible collaboration models, such as joint ventures, innovation incubators, and short-term contracts through the gig economy. Creating these collaborations is becoming increasingly important; they can help a company’s GBS gain access to the niche skills and technology capabilities necessary to achieve a resilient platform vision.

New Ways of Working. As GBS organizations evolve, they will lead their companies in bridging the digital talent gap in fields like analytics and AI. GBS setups have a proven ability to recruit new people (through hiring or outsourcing) and help develop a rich talent pipeline. Employee learning and development can occur through formal training or on-the-job immersive experiences, where large groups of people gain new digital skills.

COVID-19 has hastened the shift to a work-from-anywhere model, and the functional staff in a GBS are natural candidates for making this change permanent. In a recent BCG survey on remote work , respondents overall said they expect 40% of employees to shift to an ongoing flexible work model. A separate survey on the topic of remote work, conducted with chief information officers in summer 2020, found that at least half will continue to prioritize this approach during the next 12 to 24 months.

Some companies are already asking their GBS groups to pioneer a movement toward virtual work at scale: ushering in the future of distributed work and building collaborative teams across national boundaries and time zones. Enabling “virtual at scale” or a work-from-anywhere model would require shifts across three key dimensions:

- Agile work in a highly distributed setting

- Culture and behaviors

- Technology enablement

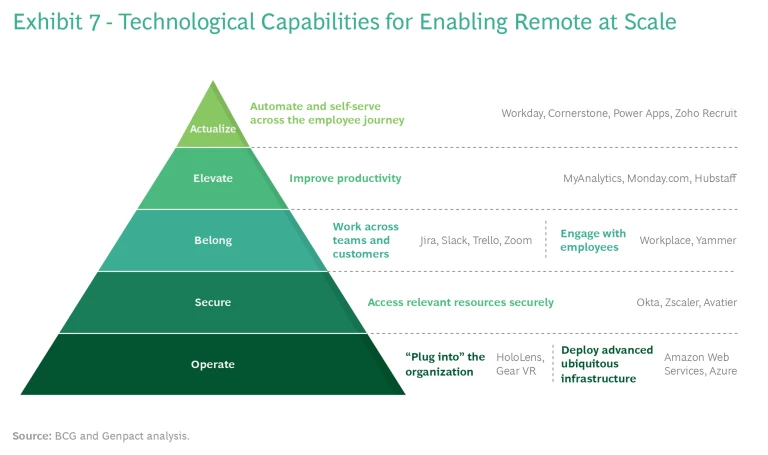

GBS setups offer companies an advantage over other parts of the organization in developing and leading the transition to agile management, a digital workforce, and a digital culture. The key to success lies in setting an ambition for virtual at scale in the technological hierarchy. (See Exhibit 7.) GBS becomes a suitable home for new digitally enabled roles, such as robotic process automation specialist, digital marketing expert, and data scientist; and for newly augmented skills, such as design-centric thinking and machine training.

Unlocking the Potential of GBS

More than 70% of the GBS leaders we surveyed acknowledged the importance of intelligent automation-led transformation as well as better sourcing and shoring strategies. But companies need a more holistic understanding of how GBC can achieve excellence and transform experience through Smart Simplicity. Measures like these can unlock the full potential of GBS:

- Consolidating Vendors and Services. By scaling up the optimal configurations of ecosystem partners and locations, and thus decreasing the number of centers, GBS can reduce costs by up to 40% per operation. The methods for this include right-shoring, right-skilling, and optimized infrastructure synergies.

- Transforming to a Digital Enterprise. As a GBS builds up a platform and related body of practice, enabled by a modular digital architecture and leading-edge skills, it will not only achieve 10% to 30% cost savings but also develop an enhanced customer experience and promote higher resilience and digitization throughout the enterprise.

- Monetizing the Talent Base. A company can subsidize its efforts to scale GBS capabilities by monetizing its existing GBS talent base. This is particularly beneficial for organizations that face a talent shortage or limited resources but can gain leverage by sharing their workforces across the business ecosystem, coordinated with the digital platform. For example, one GBS group might partner with a large, strategic vendor partner to carve out some assets and transfer accountability. Another GBS might convert its activities into pay-as-you-go services, thus gaining access to its partners’ expertise. Many organizations have done this; benefits include an upfront capital infusion, year-over-year productivity improvements as high as 10% per year or more, and significant standardization.

Although it is possible to leapfrog quickly to an advanced form of GBS, the journey to the future may be long and iterative for many companies. Given the current cost pressures, self-funding becomes a high priority. The usual strategic levers stay relevant: these include setting the right vision, having a clear line of sight on the expected outcomes, and getting leadership buy-in.

The challenge remains to run a two-stream operation, delivering value-generating innovation sprints while simultaneously fixing the operating model, technology architecture, and ways of working. The exact sequence of activities depends on each company’s specific situation. Simplification always seems complex at first, but it is worth the trouble. It will secure long-term resilience and customer loyalty.

The authors are grateful to Karan Chadha, Sudhanshu Chawla, Fiorella Iannuzzelli, Sayan Majumdar, and Harshad Naik for their contributions to this report.