Technology, media, and telecommunications (TMT) companies clearly won the last decade, but will they have the right ingredients to sustain that performance in the 2020s? Can these companies continue to innovate as they expand, reshaping ecosystems that fueled their past success, and can they excite consumers and businesses while grappling with issues of privacy, influence, trust, and regulation?

We explore these companies’ past performance and future potential through the lens of value creation. As the 2010s closed, the TMT sector was standing strong. Seven TMT companies were among the ten most valuable public companies in the world. (See Exhibit 1.) A decade earlier, three energy companies, three banks, and just two TMT companies made the list, so a broad economic and social shift from physical to digital has clearly occurred.

The end of a decade is a convenient time to take a long look backward. We analyze value creation on the basis of total shareholder return (TSR) over five years, a time horizon that smooths out blips and reveals the impact of strategic and operational choices on shareholders’ true bottom line.

Past Rewards

The 2010s will be known as the decade of social media, smartphones, streaming, sharing, machine intelligence, and the cloud. Many of the top TMT performers rode those trends to great heights. Netflix, Amazon, and Microsoft all finished in the top 20 in TMT value creation for the period from 2015 to 2019. Taking advantage of strong demand for parallel-processing chips to power artificial intelligence (AI), Nvidia rose to number three, while number-eight WWE built a subscription business around pro wrestling. (See Exhibit 2.)

WWE and many of the other top TMT performers are still relatively small. Almost half of the top 20 TMT companies have market caps of less than $30 billion, just a fraction of the market caps of Amazon, Microsoft, and others that continue to create the greatest amount of absolute value.

Many of the top TMT performers are still relatively small, with market caps of less than $30 billion.

Value creation is not distributed equally. For the second year in a row, no telecom operator earned a spot in the top 20. The telecom industry finished 28th out of 33 industries in median five-year value creation, weighed down by risk aversion, regulation, national footprints, heavy investment, and old business models. (See Exhibit 3.) We explore Unlocking and Building Value in Telecom and suggest ways for operators to break away from the pack.

Tech and media finished third and fourth in median value creation across the 33 industries. Semiconductor companies and gaming companies, respectively, led the top ten in those two industries.

Even the most successful companies, however, should not rest on their accomplishments. Many tech companies must make challenging business model transitions if they are to Competing on the Rate of Learning or in the development of ecosystems. Meanwhile, traditional media companies are struggling to build direct-to-consumer and subscription businesses amid a sea of free content. Many of these companies need to reinvent and transform themselves as deeply as any telecom operator.

Traditional media companies are struggling to build direct-to-consumer and subscription businesses amid a sea of free content.

Notably, the bottom performers in tech and media are doing no better than the bottom performers in telecommunications. For every company that has built a successful subscription business—such as Amazon’s Prime Video, the number-two video streaming service in the US, or Apple Music, which has more paid subscribers in the US than Spotify—there are others that may struggle for relevance in the 2020s. Their situation calls for bold moves, not just efficiency gains. In the US market, for example, operators are placing bets on TV programming and feature films.

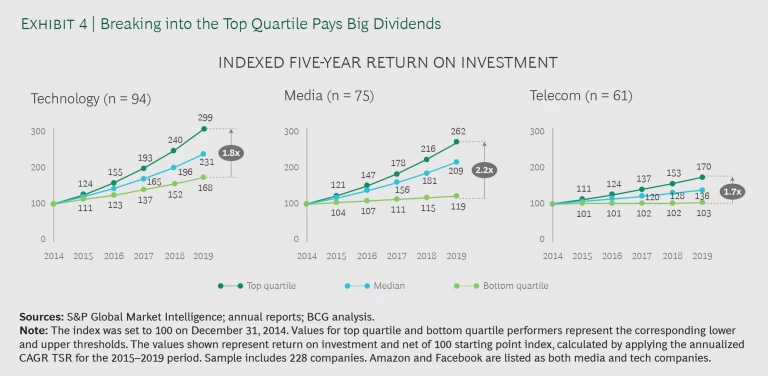

Companies that advance from the top of the bottom quartile to the bottom of the top quartile in value creation will generate outsize returns for shareholders. (See Exhibit 4.) This is especially true for media companies, but it also holds for telecom operators. A dollar invested in an operator ranked at the top of the bottom quartile for the five-year period from 2015 to 2019 would barely have appreciated. A dollar invested in the bottom company of the top quartile would have been worth $1.70.

What the Future Holds

Some global trends that helped propel growth in the 2010s are fading. The number of Internet users will not more than double in the next decade, as it did in the previous one. The rate of smartphone adoption has also begun to slow, even in emerging markets.

In their place, a mix of productive tailwinds and troublesome headwinds are emerging. AI will almost certainly play an ever-larger role in the 2020s. The decade will also likely see the long-awaited mass emergence of augmented and virtual reality.

AI will almost certainly play an ever-larger role in the 2020s.

On the other hand, global growth is at risk of slowing. US–China trade tensions are rising, driven by trade disputes and issues of national security. US semiconductor companies could face export restrictions, bringing a strong stretch of value creation to a close and undermining the industry’s ability to maintain its current high level of R&D investment and to continue to deliver technological breakthroughs. Barriers to technology and markets could slow the rollout of 5G infrastructure and the development of the next generation of digital services. Investors share many of these concerns.

The TMT sector will continue to face regulatory and public scrutiny over its ability to monitor and limit unintended uses of its products and services; to control the spread of falsehoods and deep fakes; and to keep pace with unending developments on social media. At the same time, companies will be facing new scrutiny over Flipping the Script on Climate Action.

Still, the TMT sector remains vibrant. As we wrote last year, its companies can lead consumers, companies, and the public sector into the future. Their work will improve lives, livelihoods, and productivity while creating shareholder value. TMT companies stand to benefit from growth in the cloud, the Internet of Things (IoT), AI, 5G, and quantum computing.

The sector is balanced between global stress and vibrancy. As we look forward, six themes that cut across technology, media, and telecommunications emerge.

Staying Vital and Innovative. As companies age and enlarge, reinvention becomes harder. Business and organizational models grow old, the day-to-day business becomes a grind, and increased complexity poses a barrier to change. Almost inevitably, incumbents find themselves at risk of losing vitality. Our colleagues at the BCG Henderson Institute (BHI) have shown that only 44% of today’s industry leaders were able to The Global Landscape of Corporate Vitality. This figure is down from 77% in the mid-20th century.

The good news is that TMT companies may be well positioned for the future. In cooperation with Fortune, BHI created the Fortune Future 50, a forward-looking index that identifies companies with future growth potential based on their market potential and their capacity (a combination of strategy, technology and investments, people, and structure). TMT companies make up more than half of the current Fortune Future 50 list. (See Exhibit 5.) Industry standard-bearers Adobe and Nvidia reinvented their business models to prepare for the future, while digital natives such as Spotify and Salesforce caught emergent trends.

For old and new companies alike, imagination, reinvention, and resilience are critical in the next decade. The Business Imperative of Diversity. Diverse companies and teams are better able to innovate, take risks, solve problems creatively, bounce back from failures, and turn challenges into opportunities.

Creating and Maintaining Ecosystems. The seven TMT companies with the largest market capitalization at the end of 2019—Apple, Amazon, Microsoft, Alphabet, Facebook, Alibaba, and Tencent—all took advantage of multicompany, largely digital ecosystems. They were able to shape the market in their favor by coordinating with other companies. Amazon’s Alexa digital assistant ecosystem, for example, has around 40 core partners, one-third more than its competitors in the smart-home market.

In the future, these ecosystems will increasingly cross over into the physical world. The rapid development of AI and the IoT will create many opportunities for blending bricks and clicks. TMT companies will enter The New Logic of Competition. Amazon’s purchase of Whole Foods, Google’s efforts to build self-driving cars, and John Deere’s decision to embed sensors and intelligence in its equipment are all signs of this trend.

In the future, digital ecosystems will increasingly cross over into the physical world.

Blending Machine and Human Intelligence. TMT companies are in the vanguard of designing the organization of the future. The engine room of this new organization will be data and machines, and the control room will be human judgment and creativity. Early organizational models of this blended approach first emerged in tech startups such as Spotify.

Scaling these models will be one of the pressing challenges of the 2020s. Whether through agile or some other form of work, organizations must fundamentally refresh their leadership, talent, and operating engines. They must also become self-learning organizations that take advantage of AI and advanced analytics. As Microsoft CEO Satya Nadella said, “AI-powered digital feedback loops that connect products, operations, customers, and employees to create predictive power, automate workflows, and ultimately improve outcomes are key for all organizations.”

Exciting Consumers in a Crowded Field. The competition to win the attention and loyalty of consumers will heighten. In one notable case, a content creator, Disney, is becoming a distributor and competing against a retailer, Amazon, to sell video subscriptions. The launch of 5G has attracted 4 million subscribers in South Korea, and they expect edgy, practical, and even life-saving new services to emerge from it. These examples, often requiring investments in the hundreds of millions or even billions of dollars, underscore the stakes.

This opportunity is especially salient for media companies, which no longer rely on ad spending for a majority of their revenue. Whether their focus is news, audio, or film, their success depends on In Media, Subscriptions Matter Most.

Getting Data and Privacy Right. For TMT companies, the data supernova carries rewards and risks. On the reward side, TMT companies can help consumers and corporate customers exploit sensor, location, and usage data to move from insight to action, building new businesses based on data platforms.

At the same time, TMT companies must strike a balance between monetizing data and respecting privacy, against a dark background of cyber-risk. Unlike during most of the past few decades, TMT companies will not have unbounded room to operate. The economic survival of many companies will depend on their ability to manage trust and protection while fighting off cybercriminals, bullies, state actors, and predators. Ultimately, governments will hold TMT companies accountable for fixing their security weaknesses.

TMT companies must strike a balance between monetizing data and respecting privacy.

Saving the Planet. The time for climate action and not just talk has come to the TMT sector. In particular, the tech industry’s cloud-related energy consumption demands attention. Many TMT companies are making progress, but it’s not nearly enough. Employees, customers, and governments are pressuring all companies to make attention to the climate a priority.

The future of TMT is harder to predict than ever before. At the end of 2018, the famous FAANG stocks (Facebook, Amazon, Apple, Netflix, and Alphabet’s Google) had collectively lost $1 trillion in market valuation from their all-time peaks—only to rebound in 2019. A trade war could provoke a similar selloff in the 2020s. The strongest TMT companies will withstand future shocks because they will offer both essential and playful services to their customers while protecting data and the climate. By doing those things, they will earn the right to operate in a decade in which technology, media, and telecommunications will continue to play a leading role.

Acknowledgments

Acknowledgments

The authors would like to thank the following colleagues for their invaluable contributions to the research, analysis, writing, and marketing of this report: Abby Antony, Luca Bazzani, Lars Dalsegg, Rubia Fatima, Jody Foldesy, Vesa Haukkavaara, Meinrad Heuberger, Christian Kluge, Guxin Lin, Martin Link, Tim Matusch, Alejandro Mayer, Jake McKenzie, Paola Oliviero, Alex Perez, Lianne Pot, Pavan Rao, Benedikt Scheffer, Thorsten Schweer, Sam Shapiro, Juuso Soininen, Devon Thompson, Sebastian Ullrich, Antonio Varas, and Kevin Whitaker. They would like also like to thank Katherine Andrews, Francesca Bressan, Kim Friedman, Marie Glenn, Steven Gray, Shannon Nardi, and Mark Voorhees for editorial and production support.