Big retailers are already racing toward a $100 billion high-margin annual revenue prize in retail media. Companies in other industries characterized by extensive customer interaction and deep first-party data—travel and tourism, for example—have a similar opportunity. For companies already implementing personalization programs, retail media can be a high-profit extension of their current efforts.

But building the business is a heavy lift, especially in terms of data, technology, and skills. Amazon has already grabbed a leading share (some estimate as much as $26 billion in 2021 revenue), and other major retailers, including Walmart, Target, and Kroger, are moving fast to establish their own positions. The good news for potential players is that we expect the market to subdivide into one broad, and several specialty, media markets in segments such as consumer electronics, health and beauty, and DIY. Because of the operative dynamics, the top three or so companies in each submarket will dominate, while others will find themselves largely shut out. Time is short for those that want to play.

Why Now?

Advertisers continue to reallocate their marketing dollars among traditional advertising channels, digital channels, and trade and co-op spending. In what we expect to be a seismic shift, retail media is already well on the way to establishing a major new advertising option—a once-in-a-generation sea change, not unlike the move from traditional to digital media over the past decade. (See “The Rise of Retail Media.”) We believe that, apart from Amazon’s share, about $75 billion in shifting funds is in play.

The Rise of Retail Media

Advertisers come in two types: endemic and nonendemic. The first are brands that currently sell through the retailer. Nonendemic advertisers are brands that benefit from the retailer’s data. Think about a home insurance company that advertises through a home improvement retailer or an apparel brand that targets back-to-school shoppers at a drugstore chain.

Retail media gives both types of advertiser access to data about who is in the market for which products and enables them to get in front of the customer at the moment of decision making, promote add-on products, retarget previous customers, and learn which advertising tactics are working by closing the loop on actual purchase behavior. For brands, retail media can be a critical channel for marketing dollars going forward. It offers a better way to speak to customers and to actually measure the impact of their marketing dollars through closed-loop reporting. For retailers, a media capability supercharges their personalization efforts.

Tightening consumer privacy standards—those of both governments and tech companies—have undercut longstanding digital-marketing tools , such as third-party browser cookies, making it more difficult to communicate with consumers in personalized ways and gain attention in a crowded marketplace. Retail media fills this void: retailers’ ability to access first-party data and “close the loop” by identifying those who make a purchase after seeing an ad makes retail media a compelling new channel for advertisers.

If the prospect of a new high-margin revenue stream (as much as 80%, compared with the typical in-store margin of 10% to 20%) is not a sufficient incentive, some retailers will also want to think about the need to protect existing trade and co-op dollars. In recent years, as brands have benefited from the relative transparency of digital marketing, the trade and co-op category has been facing pushback. Retail media is a way for retailers to hold on to this spending and tighten relationships with the companies whose brands they sell.

The Personalization–Media Flywheel

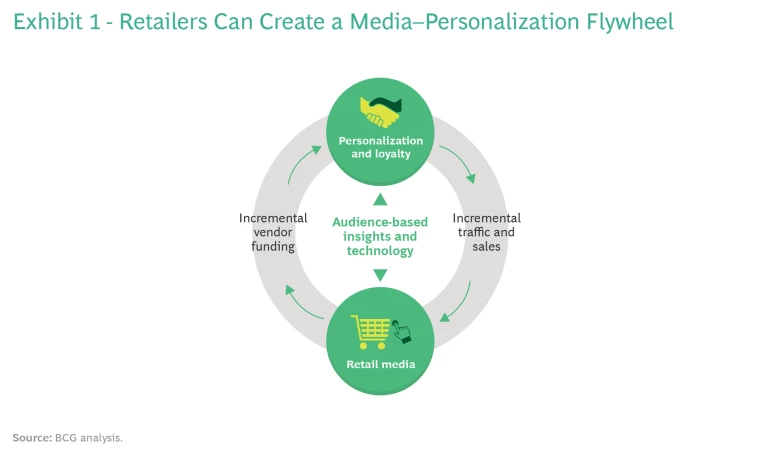

For those retailers that get it right—and get it right early—retail media can supercharge their personalization efforts and start a virtuous flywheel whereby media and personalization programs propel each other’s success. (See Exhibit 1.)

Because of the interplay among customer data, closed-loop reporting, and real-world results that generate more and better data, the top players in retail media will soon crowd out the also-rans. They will be able to optimize ad targeting and messaging according to actual in-store and online sales (as opposed to proxies for those amounts) and outperform on return on advertising spend. An effective retail media network funds additional retailer investments in personalization, which, in turn, drive a better consumer experience, greater customer loyalty, and increased vendor and retailer sales and bottom line. Think about a maker of sunscreen and related products that can target known beachgoers with special deals and add-on offers during the months when they stock up for the season. Or a garden products company that can offer customers of a DIY center the fertilizers and pest treatments best suited to the plants they are growing at home.

Companies in other industries will want to examine their media potential as well. Airlines, for example, have multiple attributes that make them attractive partners for advertisers. These include customer identification and match potential, large and active loyalty programs, access to data, control of a multitouchpoint customer journey (booking, confirmation, reminders, travel, post-travel), and highly valuable customer segments. They also have extensive marketing partnerships—with hotels and credit card companies, for example—already in place. We have projected that one airline could generate up to $100 million in additional media revenue, with an average profit margin of 75%.

New Challenges and Capabilities

If the premise is simple, execution is anything but. While many retailers have long been major advertisers, most have not built the skills and tools they need to compete in retail media. Some challenges are common to starting any new line of business (building the team, for example, or shaping the initial product offering, aligning the merchandizing team, and building excitement with advertisers). But several are specific to digital businesses and involve new capabilities. Data and digital technology skills are key. And as BCG has pointed out with respect to bionic organizations that successfully combine human and machine capabilities , it may ultimately be new organizational structures and the ability of the company’s people to work in new ways that determine success.

Because of the interplay among customer data, closed-loop reporting, and real-world results that generate more and better data, the top players in retail media will soon crowd out the also-rans.

Data. The critical factor for retailers building media businesses will be their first-party data. Sophisticated marketers understand that first-party data is differentiating (because it is proprietary), relevant (it directly relates to the company and its customers), and high quality (it comes from the source). First-party data is critical to better understanding consumer behavior, segments, and trends; to delivering more tailored and meaningful messages to customers; and to measuring effectiveness at multiple touchpoints along the customer journey.

A retailer’s breadth of data—the size of the contactable audience—establishes the potential scale of the business. The depth of the data around shopping and purchase behavior leads to predictive patterns that deliver the ROI advertisers will pay for. Loyalty programs and the ability to track customers over time and purchase channels are essential to building unified customer profiles and rich omnichannel data. Distinctive shoppers—such as those who are high spending or hard to reach—will garner a premium.

Many retailers are still in the process of building clean, unique customer IDs, a critical prerequisite for the kind of audience building and personalization for which brands are willing to pay. Clean data is also the foundation of the closed-loop measurement that can be an enormous differentiator for retail media networks over other digital channels. But on top of the data, retailer analytics teams need to build a flexible offer platform and links to advertising delivery platforms to enable attribution of sales to various marketing activities. Most retailers do not currently have this level of sophistication in analytics, martech, and adtech. Additional challenges are evolving data privacy regulations and industry practices; the EU’s General Data Protection Act, the California Consumer Protection Act, and Apple’s policy on the use of its Identifier for Advertisers (IDFA) are several examples in just the last few years.

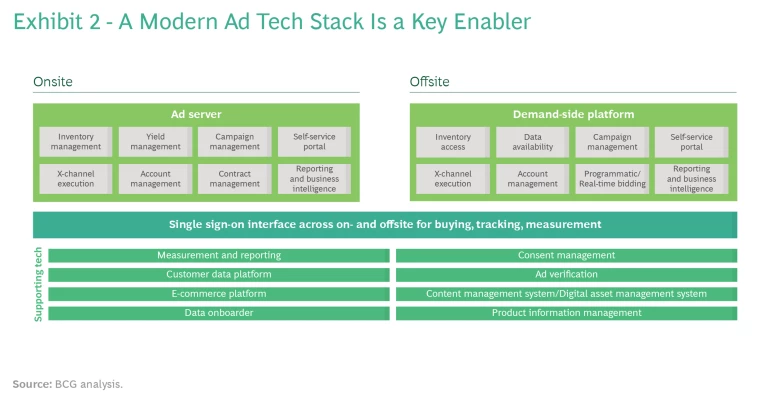

Tech. Retailers should not underestimate the mechanics of delivering ads. They will need to build or access a sophisticated advertising tech stack that can deliver both onsite and offsite outreach across multiple locations and channels. (See Exhibit 2.)

New tools are becoming more and more sophisticated. Some of the technology can be purchased off the shelf, especially when retailers’ programs are small. But as media businesses scale up, the options for sufficiently flexible and configurable functionality such as onsite ad serving are limited. Similarly, retailers will need to provide advertisers with a one-stop capability for building and launching campaigns that includes omnichannel inventory, the ability to see live campaigns, and measurement tools. In the early days of a retail media operation, retailers can offer managed service, allowing for the manual launching of campaigns, but as these scale, they will require automated, self-serve solutions.

People and Ways of Working. Many of the attributes that make bionic companies successful, such as agile teams and cloud-based technologies, are well known. But the formula for putting the elements together is neither immediately evident nor easily implemented. Retailers vary substantially in their digital maturity and ability to apply systems thinking—addressing all elements of the bionic operating model at the same time. That said, once companies have a good understanding of the long (but manageable) list of elements required for systems thinking, rapid progress and value creation are possible.

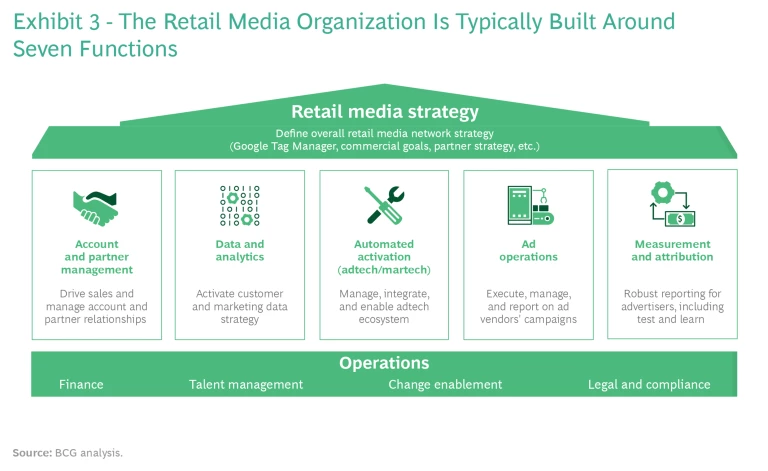

For all but the most advanced retailers, the media business will require the acquisition of new skill sets—such as sales teams that can sell media and tech experts who can set up an ad ops team—since advertisers will expect the same level of capability, professionalism, and performance that they receive from digital publishers and tech giants. Generally this requires establishing an independent retail media group organized around seven functions. (See Exhibit 3.) And if retailers don’t align merchant incentives with the new group, they will experience substantial resistance to change, pitting the internal “startup” against the existing organization.

Getting Started

Through our work with both retailers and personalization programs, we’ve established a playbook for how to start a retail media network. (See “The Basics of a Retail Media Operation.”)

The Basics of a Retail Media Operation

- Set your ambition

- How big a business are you targeting?

- Is the ambition large enough to capture the attention of ad agencies that control brand advertising dollars?

- Decide your focus

- Will the primary advertiser base be made up of endemic (current) brands or nonendemic brands (others that can benefit from the retailer’s data)?

- Will most activity be onsite or offsite?

- Which channels have the greatest potential for your customer base and first-party data?

- Assess your current capability gaps

- Data. What is the current breadth and depth of access to first-party data? What additional data sources do you need? What will targeting and measurement look like? How can you organize cross-functional teams to deliver?

- Tech. Do you want to build, buy, or partner? When will the shift from off-the-shelf to customized systems need to take place in order to scale the business? Do you want to go it alone or perhaps partner with another complementary retailer to share costs?

- Skills and Ways of Working. Do you have people coverage in sales, media execution, and data and analytics? Whom do you need right away, and in what skills can you retrain existing staff or hire later? How do your merchandizing, retail media, and analytics teams work together to deliver on the top-line goal?

The first step is to set your ambition—the focus and scope of your media offering. As noted above, we expect there to be a small handful of dominant players in the mass or general-interest retail media market and a few leaders in each of a number of specialty or niche markets. The latter are not necessarily small. US consumers spent almost $100 billion on lawn care products in 2019 ($500 per household), for example, and nearly $50 billion on cosmetics and beauty products. Since retail media will be a new offering for both retailers and advertisers, management needs to clearly articulate its vison to help bring the merchandizing organization, as well as prospective clients, along. Tying retail media closely to existing personalization efforts will help.

Second, determine the type of advertiser, the nature of the activity, and the channels that will be your focus. Third, assess where the big gaps are in your capabilities, with particular attention to data, technology, and human skills, as well as what you will need to reach your first- and five-year goals. Finally, be prepared to test, learn, and adjust. Start by selecting an advertiser-partner or two with which to pilot or test a minimum viable capability in real time with real customers. Take a page from the digital natives: don’t be afraid to fail and adjust. Move fast but make decisions based on what the data tells you is working. When something is working, scale up quickly.

Finally, clearly communicating retail media’s value to vendors with a well-articulated product roadmap and specific stories of early success can build excitement and turbocharge early sales. The annual planning meetings of retailers and their major suppliers that will take place later this year are a launch opportunity that should not be missed. Retailers can also use subsequent interactions around the planning and execution of campaigns to promote the effectiveness of retail media compared with other advertising channels.

Retail media is a big pie, but it has a limited number of slices, and gaining a seat at the table requires vision, commitment, and resources. Retailers that want to seize significant share of a major new market need to start now.