It may not have the same allure as bringing the latest battery-powered concept car to life. But public charging represents an explosive market opportunity for participants in the rapidly evolving electric vehicle ecosystem. Sales of electric vehicles, including plug-in hybrids, were virtually untouched by the COVID-19 pandemic—and they are on track to account for one out of every two new cars sold in Europe by 2030, according to BCG estimates. As sales of EVs grow, energy demand will increase exponentially.

Today, two-thirds of the electricity demand for EV charging is private, whether at home or in company parking lots. Over time, however, the proportion of public charging activity—at service stations, public parking spaces, and retailers’ parking lots—will balloon. By 2030, the share of electricity demand from public charging will be close to that of private vehicle charging; we estimate that the number of individual public charge points throughout Europe will increase tenfold.

This growth holds great promise for the many companies that are already—or could be—catering to the EV public-charging market, a broad array that includes infrastructure firms, manufacturers of charging equipment, companies that install or maintain public charge points, station operators, site owners, and the charging-software providers that offer apps for payment and location searches.

Our analysis revealed seven broad strategic plays that companies can pursue in what is poised to be a fast-moving market. As this market unfolds, what specific opportunities await these companies? What levels of profitability can they expect? And what will it take for each type to secure a leading position? Although this report focuses on Europe, where the electric vehicle is gaining ground most rapidly, we believe that our analysis has similar implications for other major markets.

Rising Demand for Public Charge Points

Tighter emissions regulations, along with advancements in batteries (in affordability as well as the greater ranges they support), have helped EVs gain traction even faster than our initial projections. So have government subsidies, which in France and Germany amount to between €7,000 and €9,000 per EV, respectively. Bans on the future production or sale of internal combustion engine (ICE) vehicles—notably in China, France, and California—are yet another incentive spurring EV adoption worldwide.

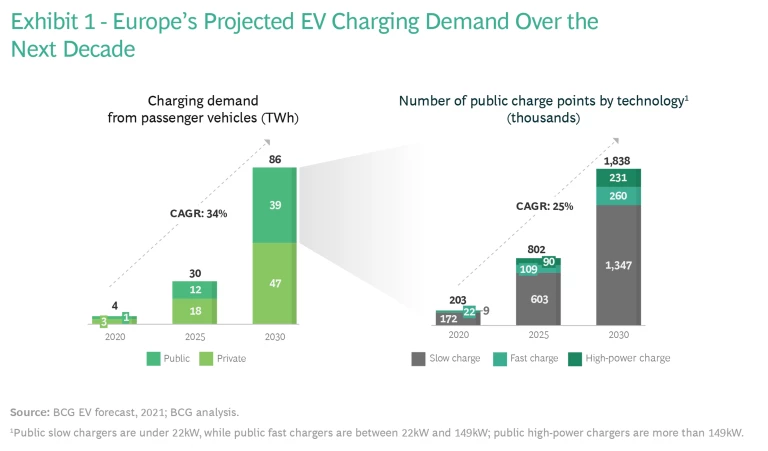

We estimate that, between now and 2030, the number of charge points—pedestals for EV charging in the public infrastructure—will increase in Europe from around 200,000 to 1.8 million. This demand growth will, of course, require an increased supply: during this period, we calculate that electricity demand from passenger EVs will grow at a compound annual rate of 34%, to reach around 86 terrawatt hours (TWh). (See Exhibit 1.)

To put the scale of demand growth in perspective, the EU’s 27 member states currently produce around 3,000 TWh of electricity annually, of which EV demand accounts for slightly more than 0.1%. At 86 TWh, charging demand will account for just under 3% of total electricity production by 2030, an incremental rise. The demand/supply question is thus less about meeting total volume and more about preventing local bottlenecks during peak load times—for example, when the residents of a neighborhood are all charging their cars at the same time on a Friday night in preparation for the weekend. Such situations will make grid network expansion a necessity.

Already, the sale of electricity to EV end users generates around €1.5 billion per year throughout Europe. Assuming electricity prices remain at 2020 levels, we estimate that the market will expand to some €33 billion by 2030. Two-thirds of Europe’s current vehicle energy supply comes from privately owned chargers, primarily because most early adopters of EVs have access to home charging stations. In ten years, however, 40% to 50% of the energy will be supplied by public chargers—including those at semi-public stations, such as supermarket parking lots.

Certainly, there will be regional differences: in the Nordic countries, where home ownership is high, we will probably see less public charging, because charging at home is cheaper and more convenient. In countries with decentralized populations, such as Germany, most public charging will occur en route; in countries with centralized populations, in-town destination charging will prevail.

In ten years, 40% to 50% of the energy for EVs will be supplied by public chargers.

Not only will demand grow over the next decade; so will the power output of the chargers themselves. Most chargers today are slow—below 22 kilowatts (kW)—but customers’ preference for speed and ease will make fast chargers (22kW to 149kW) and high-power chargers (more than 149kW) increasingly popular. The latter two are projected to grow from 15% of the total public charger market today to 27% by 2030. In the public-charging arena, slow chargers will predominate in cities and rural areas. High-power chargers will be most prevalent on or near highways, as minimizing wait times during charging sessions is more important for those en route. (High-power chargers can charge EV batteries 15 to 30 times faster than the average slow charger, so a 10-minute charge could extend a vehicle’s range by 250 kilometers.)

The European Commission, through its Alternative Fuels Infrastructure Directive, now recommends a minimum of one charge point for every ten electric vehicles. Europe currently has seven EVs per charge point; however, because EV growth will likely outpace the development of charging infrastructure, we expect the EV to charge-point ratio to increase to 17 in the next ten years. In addition, the number of charging sessions taking place at public locations will skyrocket, from approximately 131 million annually today to around 2.5 billion by 2030—the equivalent of 1.2 sessions a week for every battery-powered EV.

The Emerging Marketplace for Public Charging

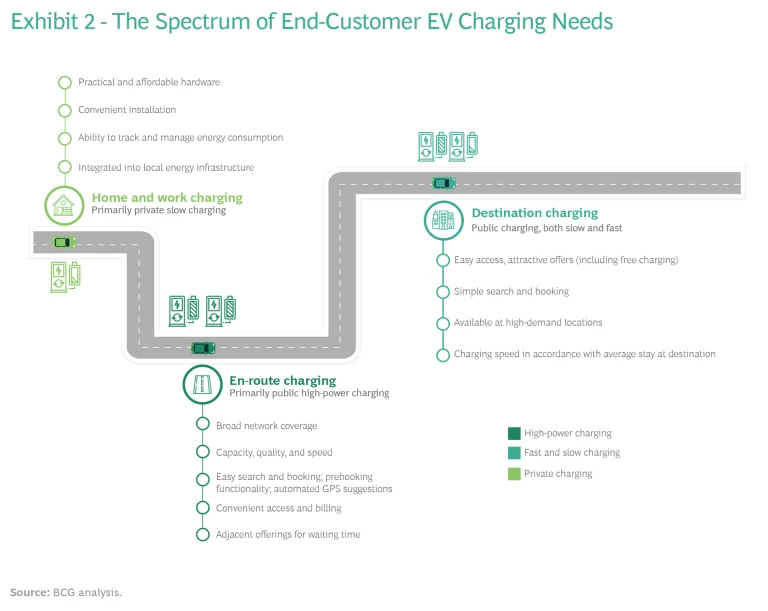

The charging environment is still very new. But as sales of electric vehicles rise and battery ranges increase, customers will develop a broad range of needs—from private charging at home and at work to public charging while traveling and at destinations. And these needs must be addressed as seamlessly as those related to gas-powered vehicle travel currently are. (See Exhibit 2.)

Unlike home charging, where users primarily require practical and affordable charging hardware and the ability to track and manage their energy consumption, customers’ needs en route and at destinations are different. En route, the search for charging stations must be easy and convenient, which means users need high-speed charging to minimize wait times, broad and reliable network coverage, and simple payment mechanisms. For destination charging—at the supermarket, shopping mall, or sports arena, for example—users expect convenient access and attractive locations and offerings.

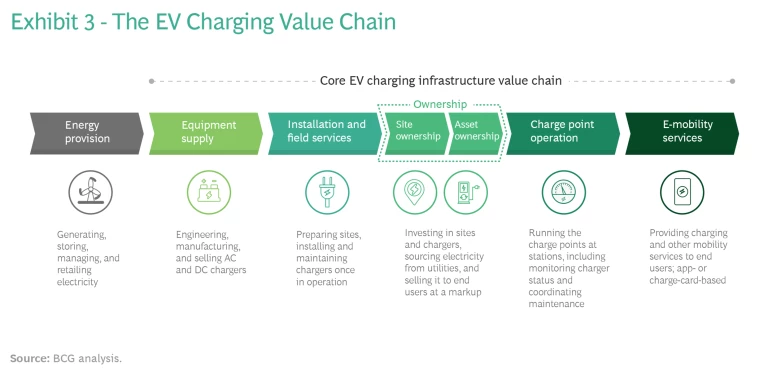

To meet these needs, a value chain has emerged. (See Exhibit 3.) It includes:

- Equipment Supply. Engineering, manufacturing, and selling AC and DC chargers.

- Installation and Field Services. Preparing sites and installing the chargers, routinely checking them, making repairs, and providing cleaning services.

- Site Ownership and Asset Ownership. Investing in sites and chargers, sourcing electricity from utilities, and selling it to end users at a markup.

- Charge Point Operation. Running the charge points at stations. This entails connecting chargers to e-mobility service providers (e-MSPs), monitoring charger status, and coordinating maintenance. While charge point operation is a value-chain step, the term “charge point operator” or “CPO” is commonly used to refer to the pioneers that operate and lease or own EV charge points and charge point establishments—companies such as Allego, Fastned, and IONITY—the EV equivalent of the gas station.

- E-Mobility Services. Providing charging and other mobility services to end users. These app- or charge-card-based services include service maps, payment mechanisms, and roaming services, in which the end user can charge at different charging networks with one charging card.

Seven Strategic Plays

At this early stage, the marketplace is not yet fully organized. Companies from different areas and sectors of the EV market are getting in on the action, with different approaches and business models that address different segments of the value chain. The picture is much like that of an anthill, in which the participants are scurrying about to test opportunities.

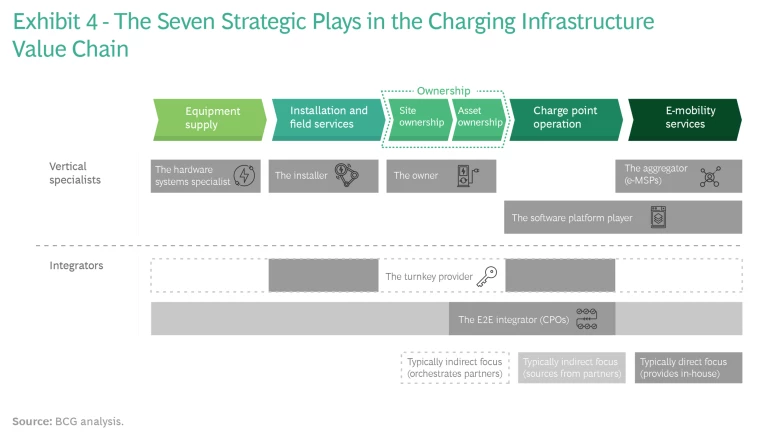

Patterns are emerging, though—and from them we have distilled seven core strategic plays in the EV charging value chain. Some market participants will specialize in one link in the chain, while others will provide an integrated offering to establish their independence and secure bigger margins. At this point, most business models remain unprofitable; that’s a reflection of low charger utilization. Participants must therefore weigh the benefits of seeking first-mover advantage against those of waiting for an economically lucrative moment to enter the market.

The seven strategic plays include five vertical specialists—the hardware systems specialist, the installer, the site and/or asset owner, the software platform player, and the aggregator—and two integrators, the turnkey provider and the end-to-end integrator. (See Exhibit 4.) Here, starting with the vertical specialists, we define each of these roles and their competitive arenas, analyze their prospects, and provide a broad-brush assessment of what it will take to win in each.

The Vertical Specialists

1. The Hardware Systems Specialist

The likely players here are equipment suppliers. The role involves engineering and manufacturing charging hardware such as the pedestal, power receptacles, and charge cords. The hardware elements are designed to the customer’s specs: for example, charger heads that are branded or chargers that can accommodate sophisticated software for payment solutions such as “plug and charge,” in which payment is automatic once the user plugs in to the charger. Another example of customization would be designing for add-on business, such as ads running on the charger’s display during charging.

In the next five to seven years this business can be attractive, but as competition intensifies and the rollout of chargers reaches maturity, margins will deteriorate. Providers will either have to consolidate or find a niche—such as specializing in the construction vehicle market, where the value proposition can be repositioned toward, for example, being dust- and heat-resistant.

Several hardware systems entities are trying to broaden their scope—by offering software for predictive maintenance, for instance, or installation and field services—to secure their position. Although differentiation moves will take considerable effort, those that involve software offerings may well be essential, considering that any such software must be compatible with asset owners’ and CPOs’ hardware choices. The bigger challenge may well be competition from low-cost Chinese equipment suppliers that are making inroads in Western markets (see the sidebar, “The Challenge from China”).

The Challenge from China

Chinese manufacturers are offering DC charging (120kW) equipment for well under €20,000—equipment that most European manufacturers are selling at significantly higher prices. The Chinese companies are not only offering competitive products, such as bundled software, but they are also adept at meeting country-specific market and regulatory requirements. The sophistication and low pricing of these products are pushing European incumbents to redouble their innovation and design. By fully automating production, for example, they could match or undercut Chinese manufacturers’ prices.

As with the photovoltaic market, it is more than likely that the charging hardware market will end up being commoditized.

R&D and design expertise, along with software capabilities, will ensure hardware systems specialists stay ahead of the pack as products become commoditized. Companies will also need to be cost efficient in their sourcing and manufacturing processes, potentially seeking synergies with makers of related components, like converters. Finally, they’ll need to have well-honed go-to-market and distribution capabilities, including in the aftersales market.

2. The Installer

Likely players here are midsize to large-scale electrical service providers and specialized service companies, primarily those installing fast chargers. This play is about installing and maintaining public charge points with a dedicated field force; it entails excavating and putting in posts, stations, and chargers. Because the barriers to entry are relatively low and the tenders sizable, a number of companies are joining the fray and competition is intense. But the market is mainly local and fragmented; providers with national-level coverage are rare and will likely remain so. Installers will thrive over the next ten years, given the burgeoning demand while the market is developing, but returns will have peaked once most charge points have been built.

As a business, installation can deliver reliable margins, but—as labor-intensive work that is performed on site—it is not especially scalable. We envision a fragmented market of primarily small and midsize companies. Economies of scale are few, so providers will need to emphasize labor force efficiencies and pursue volume discounts by sourcing hardware directly.

Quality, speed, and reliability are paramount for capturing business in this segment. Companies will need to provide broad geographic coverage in order to offer customers prompt service, such as fast turnarounds for maintenance activities. They’ll also need to utilize staff at a high rate in order to offer competitive prices—a requirement that could prove tough, given the competition for high-quality workers.

Quality, speed, and reliability are paramount for capturing business in this segment.

To circumvent the intense competition, some might focus on the nascent, and more lucrative, DC charging market. Forging close partnerships with hardware systems specialists could give installers an edge in serving owners and CPOs, as well as in adapting to their installation requirements and individual field-service processes.

Those companies that are able to generate steady demand and utilize assets efficiently will prevail; that includes diversifying the customer base to manage the flow of work orders and having the flexibility to ramp up or streamline the workforce.

3. The Owner

Oil and gas companies, CPOs, retailers, infrastructure investors, and utilities are the likely players here. This role entails site or asset ownership: investing in sites or chargers, buying electricity, and earning revenues from whoever rents those assets back, such as a CPO or a gas station owner that is shifting to electrification but lacks capital. (For context, one charging station with eight charge points and one transformer takes an investment of anywhere between €300,000 and €1.2 million—not counting the cost of land, which is especially high in urban areas.)

An array of well-capitalized players wants to seize opportunity in electrification, although at present there are more shoppers than buyers. Those serving end users must take seriously the old real estate adage of “location, location, location” and situate charge points in the areas of greatest potential demand. Oil and gas entities have the most attractive highway sites; CPOs are a natural, as a pure play entity with clear EV brand advantage. Retailers are also favorably positioned, as they can leverage their footprint to invest or coinvest in chargers.

Infrastructure investors, chiefly those investing in real estate, are also likely to participate where utilization will likely be greater or more predictable. Utilities, which already control energy generation and distribution, can price to their own advantage. This strategy would yield returns on electricity sales, on sheer market growth, and on adjacent business opportunities—retail shops, restaurants, and advertising revenues that can monetize customers’ 20- to 30-minute wait times during charging.

For owners, access to existing sites in heavily frequented locations is crucial.

Utilization risk always lies with the asset owner, but in this play, the owner could be a site owner, not necessarily the CPO. A restaurant chain, for example, would be more likely to bring in an experienced company to own, operate, and maintain the charge points at a lower cost than they would bear operating it themselves. En-route fast-charging facilities are often owner-operator businesses, so as the CPO, they bear utilization risk.

To win in this play, access to existing sites in heavily frequented locations is crucial. So is access to low-cost capital. Successful participants need to be able to make major capital expenditures and weather a long payback period. By creating adjacent offerings that beat today’s rest-station experience—offerings that make customers want to spend time there, rather than simply have to—participants can capture additional revenues to boost their financial strength and facilitate their further expansion and growth.

4. The Software Platform Player

The likely players here are equipment suppliers, CPOs, and specialty software makers. This role provides the software for CPOs and e-MSPs; such software is typically developed to provide different functionalities, including the monitoring and remote diagnosing of the charging network, running payment processes and billing, and managing energy use. It can also include the end-consumer-facing interface, which is often app-based.

As with any software business model, this one entails high upfront costs for platform development. The market offers attractive margins—more than 20% in many cases—so any participant must strive for scale to amortize those costs. It is also a fragmented, highly competitive, and potentially winner-take-all market. Specialty startups are battling for important contracts with CPOs and e-MSPs.

To win, a provider must ensure its platform is compatible with many different types of charging and vehicle hardware so that it can be operated in mixed hardware, multiple car-brand environments. Equipment suppliers and CPOs can use their market access in hardware to gain ground—but it’s challenging for them to develop their own platforms in-house, given the complexities of covering multiple countries and the need to be hardware agnostic. Smaller specialty companies can use their IT know-how to create customized software to meet the demands of different customer segments.

To win, a software provider must ensure its platform is compatible with many different types of hardware.

Successful companies will apply their customer insights to develop a differentiated product. They will need to offer strong algorithms (such as self-healing mechanisms for charger issues), breadth in their functionalities, ease of use, and service reliability. Finally, they’ll need to scale their systems quickly to achieve a dominant, defensible market position that will enable them to win over leading CPOs and e-MSPs.

5. The Aggregator

The likely players here are e-MSPs, big tech companies, and automotive OEMs. This role entails providing an integrated payment solution and an intuitive interface so end users have a convenient, seamless experience. (Because this play is pursued chiefly by e-MSPs, the name of the player and the play are often used interchangeably.) Aggregators create roaming platforms: essentially, networks of different charging providers that enable drivers to use charging stations other than those of their primary provider. By expanding access, aggregators not only offer users convenience and ease, but they also will help expand EV adoption while charging infrastructure is in its infancy. Providers get direct access to customer data on charging and driving behavior, and they gain financially in two important ways: greater charging volumes through app usage generate ad revenues, and providers also earn commissions on the charging revenues.

Aggregators could also potentially influence the end customer’s use of charge points. Low barriers to entry invite abundant competition, although consolidation is beginning to take place. At present, only a fraction of charging points offer plug-and-charge capability, but the more common it becomes, the less important aggregators become. Pure billing or credit card providers could make the aggregator obsolete if plug-and-charge or credit card terminals are rolled out widely. Finally, automotive OEMs could integrate all charging points into their head units, and they will more than likely try to integrate aggregator or charging location services into their offerings through their navigation systems.

Successful aggregators will offer a large, dense network of charge points.

Successful aggregators will offer a large, dense network of charge points. Quality, ease of use, and service reliability are essential. So is the ability to offer an intuitive customer interface and integration into the driving experience itself by embedding in onboard navigation systems. Aggregators will need a large user base to ensure economies of scale in what will no doubt be an intensely competitive segment. They can also monetize customer data.

The Integrators

1. The Turnkey Provider

Equipment suppliers, CPOs, and utilities are the likely players in this category. This is a pure B2B play—the one-stop shop that installs and operates charge points for customers, such as warehouses, corporate parking areas, commercial fleet operators, supermarkets, and retail parking garages. The turnkey provider could also offer energy management and site optimization services, such as grid connections, smart charging technology, or photovoltaic battery solutions that generate and store electricity (and that feature chargers to power up an electric fleet). This role promises reliable recurring revenues, particularly with the growth of destination charging. It also offers the possibility of cross-selling services such as electricity management.

Given the size of these contracts, the turnkey area will be highly competitive, so deep pockets and scale will be crucial in order to offer competitive pricing. Beyond providing superior installation, operations, maintenance, and customer service, segment leaders will need to stand out in a number of ways. They’ll have to customize the charging service to their customers’ needs. For a retail customer, for example, they would need to integrate the service into the customer’s core business by creating a “shop and charge” station; for a corporate customer, they could provide employees easy access to charge points through a company ID badge.

The turnkey area will be highly competitive, so deep pockets and scale will be crucial.

Successful turnkey providers will also provide integrated energy optimization for the customers’ location. They’ll need technical expertise in charger deployment, both in the project planning stage and in ongoing system operations. Marketing prowess and a quality sales force will help them stay head of the competition.

2. The E2E Integrator

The likely players here are oil and gas companies, CPOs, utilities, and investors. This strategic play entails the entire spectrum of charging offerings, which the players—site and asset owners—provide either in-house or through partnerships. (Because many CPOs adopt this play, integrators are often referred to simply as CPOs.) The idea is to offer a superior customer experience while benefiting from the growth of electrification along the whole value chain. The E2E integrator gains strategic independence from suppliers and a higher share of margin in each value-chain step.

The barriers to entry are high, owing to the hefty investment required and the lengthy planning cycles and contract periods. As core offerings, charge-point operations and asset ownership are a starting point for expanding along the value chain. Thus, the shift from gas stations to charging stations represents a natural move for large oil and gas companies. Pioneer CPOs, on the other hand, are moving quickly to secure competitive locations and lock in the customer base.

For E2E integrators, site and asset ownership are keys to success.

Site and asset ownership and charge point operation are at the heart of this play. Speed is crucial: players must act fast in order to secure the most attractive locations that, over time, will capture higher utilization and thus be more profitable. First and foremost, integrators—chiefly oil and gas companies or utilities—need extensive capital reserves in order to expand or make M&A plays (or both). They’ll need the ability to integrate the individual steps into a compelling end-to-end offering and to orchestrate a charging network, from hardware sourcing to charger servicing.

Skill in forging partnerships will also be crucial: with leaders in areas outside of their core competencies; with existing site owners at heavily trafficked locations, such as restaurant chains and highway convenience stores; and with installers and field services companies. Ideally, integrators should be able to minimize their dependence on software providers and to develop an IT infrastructure in-house or engage in M&A to secure this capability.

How Current Market Participants Are Positioned

Within the strategic plays we’ve just described, where are current major market participants—those other than specialists such as software and installation service providers—best positioned to play? And what actions must they take in order to secure a foothold and prevail in those areas?

Utilities: well positioned but software-challenged. As owners of the electric supply and the power grid, utilities are poised for opportunity. Of course, their ability to meet burgeoning demand will directly affect the growth of the entire charging infrastructure, public and private, and of EVs themselves.

Utilities can electrify the parking facilities of companies and retailers. They might also develop green energy sources on customers’ sites, such as solar panels on charging station roofs and battery storage tanks that hold wind power. In addition, utilities might position themselves directly in the charging value chain, with the sale of wall boxes and energy contracts. They might also partner with auto OEMs to develop vehicle-to-grid technology that can help manage capacity in local areas during peak demand. For utilities, the best bets for success will be in the turnkey provider, owner, or E2E integrator plays.

Oil and gas companies: long on location, short on attractiveness. Oil and gas companies already hold the prime locations for en-route charging. They also have the kinds of adjacent businesses that will become even more important to customers and thus could offer an important revenue stream.

But that’s not enough. First, these companies need to pivot their core business from gas to electricity to stay ahead of demand and maintain their dominant position. This will take great vigilance and strategic discipline as the parallel world of EV charging emerges and erodes their longstanding dominance. Because of the longer wait times EV charging requires, it’s also crucial that oil and gas retailers shift from a vehicle-centric to a customer-centric model. Many locations today are often unaesthetic or unwelcoming or don’t offer competitive pricing; retailers will need to offer such services as food, shopping, lounge areas, and even last-mile delivery such as Amazon’s delivery lockers, to enable customers to be comfortable and use their wait times productively. The best bet for oil and gas companies will be the owner or E2E integrator plays.

CPOs: brand advantaged, location-challenged. Because many CPOs also lease or own hardware and sites, they have the ability to quickly establish a brand profile. Still, they face major challenges. Chief among them is the need to secure prime locations fast, given that traditional gas stations have a significant lock on top locations. Equally important, CPOs must make those sites attractive to consumers via the adjacent businesses they line up. For en-route charging, at least, CPOs have an opportunity to redefine the customer experience by creating an entirely new and more inviting rest-station network than what we know today , with upscale cafes, stylish shops and restaurants, coworking lounges, sports facilities, and the like. This strategy is critical for ensuring high utilization and achieving profitability relatively early on.

CPOs must also carefully assess current and future demand and determine charge-point capacity. To attract and keep customers, and remain attractive to end users, they need to create differentiated end-to-end offerings that feature sophisticated software along with a reliable field force for maintenance and repair service. Those interested in ownership need deep pockets or well-capitalized partners to fund them. The best bets for CPOs will be the owner, E2E integrator, and turnkey provider plays.

Equipment suppliers: product knowledge, strong client relationships. Suppliers have the goods and the client connections, but they must guard vigilantly against commoditization and the threat from low-cost, high-tech Chinese competitors. Doing so means aiming for quality in manufacturing as well as efficiency, removing cost wherever possible. Equipment suppliers are developing software which would be compatible with the hardware of other suppliers, but their results are not perceived as being as hardware-agnostic as that of third-party developers.

Equipment suppliers must also focus on developing smart solutions—cloud-connected technologies that allow a station owner to monitor and control charge-point use remotely, thereby ensuring efficient energy consumption. In this way, they can continue to enhance their customer value proposition. Finally, for their operations and servicing business, they need to combat the perception that they are only able to service their own equipment. The best bets for equipment suppliers will be the hardware systems specialist and turnkey provider plays.

Auto OEMs: conceiving the full customer journey. As manufacturers of EVs, OEMs need to consider the full spectrum of charging needs for the end user, from private charging at home and at work to public charging en route and at destinations. Because “range anxiety” is still a major reason why people don’t buy EVs, OEMs have a vested interest in ensuring that public charging networks are sufficiently dense and broad. Even if they don’t build their own networks, OEMs will need to aggregate as many charging offerings as possible in order to provide breadth and depth in their coverage. The closed ecosystem is unlikely to last for long, considering the regulatory and economic pressures to open up. The best bets for OEMs will be the aggregator and E2E integrator plays—the latter through a consortium with other investors.

Investors: varied opportunities, the benefit of time. Real estate investors can cofund hardware or invest in developing sites with the potential to attract significant traffic—or both. These moves would yield substantial revenues on electricity sales, thanks to high charger utilization and revenues from tenants with adjacent businesses—rents and royalties from restaurants and cafés, for example. Venture capital investors can fund software platform startups, knowing that if those startups can beat competitors, they can potentially capture a winner-take-all market that has significant financial potential. Investors’ horizons are typically longer, so they are able to bide their time before capturing profits throughout the charging value chain—which we expect will come at the end of the decade. For investors, the best bets will be the owner and E2E integrator plays.

As Players Stake their Claims, Growing Demand Ensures Opportunity

We’ll likely see a gap—at least temporarily—between what the market needs and what it can actually provide. Still, consumer advocates, environmentalists, and the auto industry itself are pressing the European Commission to ensure that at least three million charge points are in place by 2029. While the market participants pursue their stakes, governments are well positioned to help minimize the gap. They can set the right regulatory levers and incentives that help manage demand on the grid while fostering its expansion and innovations in efficiency.

Such measures are particularly important in the near term in order to reduce the risk of undersupply. To get an idea of what undersupply would mean, consider that a two- or three-year delay in ramping up charging points would, by 2025, translate into average queue times of up to 30 minutes at high-power charging stations during peak demand times, such as rush hour or holiday weekends—and that’s before actual charging begins.

Meanwhile, although some companies are already moving towards market leadership, the field is still wide open. That’s not even counting the electrification of commercial fleet depots, another huge market opportunity on the horizon, especially for turnkey market participants. Further consolidation is likely, particularly in the more capital-intensive strategic plays. Technological developments in battery size, charging speeds, and (more fundamentally) EVs themselves—along with electric power generation and grid management—are the wild cards that may most shape market forces and influence fortunes.

Before gas stations dotted the American driving landscape, drivers relied on pharmacies and blacksmith shops to buy gas, sold in a container. The widespread adoption of the automobile could only happen once a network of roads and gas stations was established; but gas stations could only be viable if there were enough cars to patronize them.

Today, the evolution of a charging infrastructure for EVs is somewhat analogous, with a few considerable differences: car mobility is deeply entrenched throughout the world, the electrical grid that powers EVs is beyond the control of market participants, and EVs have the added advantage of multiple forces—including regulation and societal pressures—fueling their rise. Nonetheless, to supersede ICE-powered vehicles and become a viable form of longer-distance mobility, EVs need a well-developed charging point infrastructure —one that exists beyond the residential garage. Developing this infrastructure won’t be easy, but it presents all kinds of opportunities to those with vision, imagination, and the wherewithal to lock in advantage early on.

This is the first article in a two-part series on the charging infrastructure for electric vehicles. The second piece will explore the issue from a government planning, policy, and regulatory perspective.

The authors wish to thank Aakash Arora, the global leader of BCG’s Center for Electrification and Climate Action, for his contribution to this report.