Quarter after quarter, a European media company watched with alarm as its market share sank. Recognizing that the source of the trouble was competition from digital leaders, the company decided to act. It pushed forward with a set of initiatives to overhaul its use of data.

It was a necessary step. But the efforts were undertaken by the company’s various print and broadcast divisions independently, with no coordination. When the board of directors realized this, it insisted that the divisions de-emphasize their individual initiatives and work together on a unified data improvement plan for the whole company. Without such a shift, the company would have wasted time and effort—and drifted toward irrelevance.

The urgency that the board felt isn’t unique to this media company. Facebook, Amazon, Netflix, Google, and Apple (called FANGA by some) have emerged as asymmetric competitors in the media sector and are creating challenges for publishers and broadcasters all over the world.

One challenge is that these global digital giants are giving consumers something else that they can do with their time. Another challenge arises from the superior way in which FANGA uses data. Facebook has deep information about its users’ likes and habits, which has made the site a favorite of advertisers. Amazon and Netflix are able to make personalized recommendations that vastly increase the popularity and usefulness of their services. Through advertisements, Google can funnel customers to a company that is selling exactly what those customers want at that very moment.

Because of these new methods for delivering content and ads to audiences, the old methods have lost some of their currency. The imperative now is to understand users’ identities, interests, and near-term purchasing intentions, which can be done by analyzing their online activities and using the right approach to data analysis. FANGA is way ahead on this front. Traditional media companies, therefore, have no choice: they must radically improve the way they manage and use data.

The good news for the chief information officers and chief data officers of traditional media companies is that this task is not impossible. Many third-party tools are available. Companies that take steps to coordinate their data initiatives across divisions and assets will have an excellent chance of regaining their long-term competitiveness.

Deep Data Insights Are the New Must-Have

Why has data analysis become one of the new crucial capabilities in the media business? One answer is that it removes some of the unknowns surrounding users’ identities.

In the digital world, everything the connected user does is discoverable. The high-level demographic data that media companies used to share with their advertisers has been replaced by named, verified visitors who have extensive profiles associated with their identities. And new insights about purchasing behaviors allow companies to anticipate a customer’s near-term purchasing intentions on the basis of something the individual has viewed or clicked on.

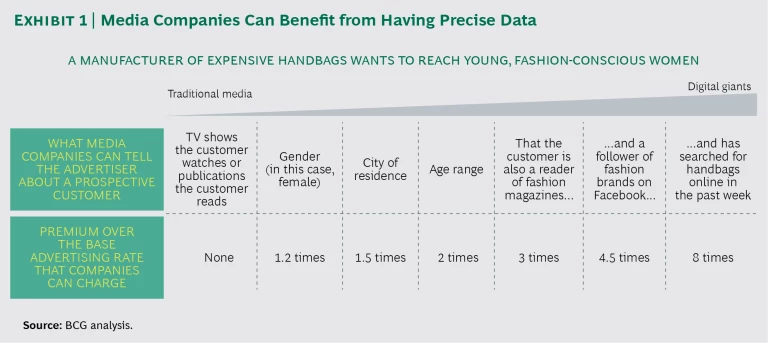

The pinpoint accuracy of such information occasionally prompts a backlash on the part of consumers. (See “ Bridging the Trust Gap: The Hidden Landmine in Big Data, ” BCG article, June 2016.) But there is no question that it increases media’s overall effectiveness. According to BCG analysis, media companies can charge advertising rates that are 1.5 times the base rate when gender and location of a customer are known—and potentially many times that level if that customer’s precise intention is clear. (See Exhibit 1.)

Pure-play digital companies are more apt to have this type of data about their customers than traditional media companies. However, traditional media companies can narrow the gap, particularly if they have diverse sources of data. North American cable companies, for instance, typically offer broadband access and internet services (such as video on demand and cloud-based digital video recording), social media integration, and landline phone service in addition to cable TV. These diverse sources of data let the cable companies form a much fuller picture of what their customers are interested in and thus strengthen their business proposition.

Traditional media companies must move beyond their analog past and break down the siloes between their individual businesses. They can do this by transforming their approach to data. (See the sidebar, “The Essential Actions Traditional Media Companies Must Take.”)

THE ESSENTIAL ACTIONS TRADITIONAL MEDIA COMPANIES MUST TAKE

In creating a future in which their data will be an important asset, media companies start in different places and have different challenges to overcome. To varying degrees, though, all of them must do the following:

- Hire the necessary talent. Some media companies may have to add data scientists or new IT architects and developers in order to succeed.

- Identify an initial set of data priorities that is based on return-on-investment projections and ease of implementation.

- Develop a plan for integrating customer data from different sources. Integrated data will benefit media companies in multiple ways, such as by helping advertisers reach customers with more precision.

- Strike a balance between centralized efficiency and benefits to individual business units to get the units’ buy-in.

- Use technology standards where possible to shorten time to market.

- Make data management part of the CEO’s agenda so its importance is clear and it remains a priority.

Key Steps on the Digital Road

The core challenge for such companies is to combine the databases from their different businesses, analyze the overlaps, and develop more relevant and targeted customer segments. This is a significant undertaking and should include the IT teams of various media businesses, the company’s data architects, and, in many cases, a legal expert to provide guidance on trust and privacy issues. The idea is to agree on a way of managing data that accommodates the current and future needs of the company.

Addressable TV is a good example of how better data management can create an opportunity for media companies. In its initial application, addressable TV allowed companies to target viewers in specific regions on the basis of data provided by market research companies. Now with the growing penetration of smart TVs and other such devices, media companies can capture richer data and target individual users more effectively.

Another opportunity involves using automation and artificial intelligence (AI) software to, for example, index images and videos. Some media companies, needing more video content to post on their websites or on social media sites such as Facebook and Instagram, have turned to outside services for help. The services automatically create videos from the companies’ written articles and from licensed content using AI.

Attaining the necessary level of data management expertise to transform their businesses will require traditional media companies to make investments in three areas: in the data itself, in their people and organization, and in technology and systems.

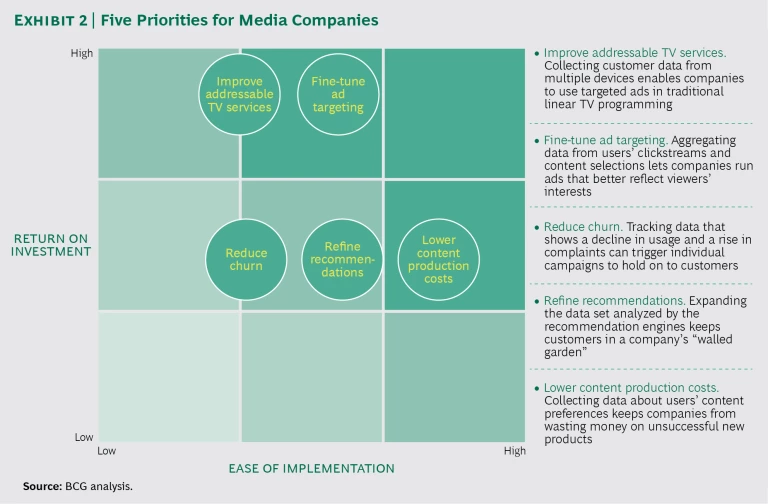

Data. A media company’s decision about where to begin should reflect input from its business and content leaders. These leaders should create a list of priorities that is based on return on investment and ease of implementation. Although the priorities for any given company will differ depending on the opportunities and the threats it is facing, many media companies can use data to improve addressable TV services, fine-tune ad targeting, reduce churn, refine recommendations, and lower content production costs. (See Exhibit 2.)

The company should also ensure that the data governance effort is coordinated centrally. This increases the likelihood that data formats will be consistent and puts a single entity in charge of specifying criteria for the technology landscape of the future. At the same time, it allows the data owner to determine which data will be shared and how it will be used. Comprehensive master data management can handle all the data and technology assets provided by various divisions, making the goal of shared governance easier to achieve.

People and Organization. Two teams are central to media companies’ attempts to rethink their approach to data. The first is a dedicated group of central data experts led by the chief data officer and staffed by data scientists, data architects, and IT operations staff. This team’s job is to select and manage technology, including tag management for data gathering, data lakes for storage of semistructured and unstructured data, and data management platforms for data processing and segmentation.

The second team consists of specialized IT developers from the media segments, along with business analysts and data stewards connected to individual lines of business. These staffers are responsible for the data-gathering and data management efforts within their own business units.

Both teams should work with a central steering body. This body consists of senior leaders whose job is overarching governance, including setting the initial business priorities.

Technology and Systems. Determining which data management application stack to use is critical. There are two choices: an integrated stack, for which a single vendor provides the majority of system components, and a best-of-breed stack, which is built from fit-for-purpose technologies provided by several vendors.

Many media companies are leaning toward the latter for three reasons: the specialized way in which media companies tend to use their data, the immense value of data to media companies’ core businesses, and the flexibility that a best-of-breed approach provides for future use cases. The downside of a best-of-breed approach is that it increases complexity and cost.

No matter which stack a company settles on—integrated or best of breed—it should try to standardize on the same software tools for the same priorities (marketing automation, for instance). This may be harder in areas where the requirements differ by media type; a good recommendation engine for a publishing site, for example, may not work as well for an over-the-top video platform.

A Matter of Survival

Five years ago, a media company CIO who said that data was media’s future would have received little support. The competitive landscape then was not the same as it is today, and boards of directors didn’t appreciate the severity of the digital threat. Even if a visionary CEO had decided to fund such a project, finding the right talent to execute it might have been impossible.

Times have changed. Media companies must recognize that adopting a new approach to data management is not only necessary but an imperative of the first order. If print companies don’t offer digital books and magazines, if broadcasters don’t offer vastly more video content on demand, and if all of them don’t capture data about their customers and provide personalized service—and go much further in imagining the future—they won’t survive.