Digitalization and a host of societal and technological trends are transforming the automotive industry. Advances in autonomous driving, the Internet of Things, and big data analytics are redefining how drivers interact with vehicles and creating opportunities for innovative products, services, and business models. Urbanization, ubiquitous connectivity, and the embrace of mobile devices and social media, meanwhile, are giving rise to a mass customer base that is increasingly open to replacing car ownership with shared, on-demand mobility services, ushering in a new era of digital service solutions.

This convergence of forces is causing a paradigm shift in how automotive original equipment manufacturers do business and organize their companies. In the past, OEMs saw themselves primarily as providers of hardware. Now, they are beginning to evolve into providers of connected mobility solutions. Until very recently, OEMs interacted with customers mainly through intermediaries, such as dealerships. Now, they are recognizing the value and the necessity of engaging directly with customers throughout a vehicle’s life cycle and beyond.

What Automakers Can Learn from the Tech Industry

To seize the growing opportunities in new digitally enabled businesses, automotive OEMs are looking to adopt the flexible, agile, and collaborative approaches that have succeeded in the faster-moving tech industry—and that have been adopted by such attackers as Tesla. These strategies include:

- Continuous Life Cycle Management. Traditionally, the automotive world has operated in strict, multiyear development cycles that clearly sequence product development and launch. Products are hard to upgrade because their functionality stems mainly from hardware components and embedded software. Of course, the digital tech world and new auto players such as Tesla also sequence product development and launch. But products are released at an earlier stage and are then continually upgraded. Additional software and functions follow the main launch. The goal is to build a large, installed base of customers who are likely to keep buying products or services. OEMs are now moving away from this “one off” style of product development and embracing “living” products. With that change, however, comes the need to develop stronger life cycle management capabilities and sustain the required teams.

- Agile Development. Instead of taking an engineering-driven, sequential waterfall approach to development, companies in the tech world focus on discerning the future demands of customers and then use an agile approach to design, test, and refine products in multiple iterations. Reusable software platform designs give them an advantage over competitors that continually redesign to solve isolated problems.

- Software- and Ecosystem-Based Innovation. The tech world focuses on differentiation through software innovation and speed to market rather than hardware. Standalone design, in which all aspects of product design are vertically integrated and tightly controlled by the OEM, is no longer feasible. Therefore, companies must leverage a broad and diverse ecosystem of partners to secure innovative technologies and new ideas for products, business models, and sales channels. Ecosystem development and the ability to integrate best-in-class components from internal and external sources, often market-specific or even open-source solutions, become critical differentiators.

- Customer Centricity and Individualization. Tech companies engage buyers through a variety of channels and seek to cultivate a seamless customer experience across all customer touch points. They take advantage of frequent customer feedback for continuous improvement. Customer centricity becomes the guiding principle in the design of products, which are built to exceed users’ needs rather than satisfy complex technical aspirations.

For most automotive OEMs, adapting to these new rules of the game will require a transformation of the organization. However, the traditional automotive manufacturing business will not disappear. The challenge will be to integrate the traditional business with the digital business so that they complement and work alongside one another.

To be sustainable and to ensure that all parts of the company operate in sync, this digital transformation requires a holistic approach. It should begin at the strategic level and extend through product offerings, the value chain, organizational structure, and mindset.

Four Archetypes of the Digital Organization

Virtually every major automotive OEM has begun to offer connected mobility services in some form and to adapt its organization to the digital era. But some are further along than others. While there is no one-size-fits-all template for what the digital automaker of the future should look like, clear patterns are emerging.

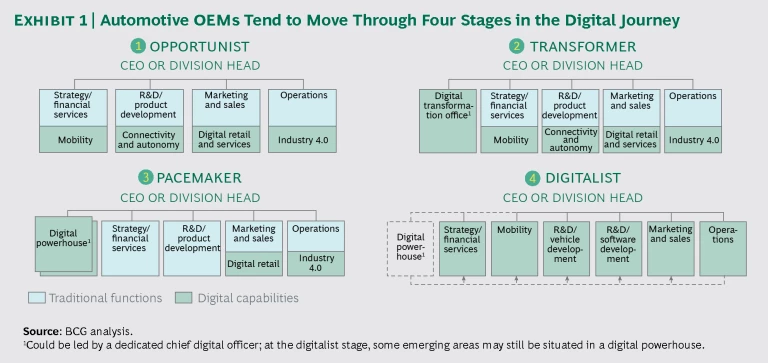

We see five topic areas at the intersection of the traditional automotive and the digitally enabled business that OEMs must be able to address: mobility, connectivity, autonomy, digital retail and services, and Industry 4.0. On the basis of our analysis of 20 automotive OEMs in North America, Europe, and Asia-Pacific, we also have identified four basic organizational archetypes, or stages, that major automakers adopt, generally in sequence, on their digital journeys: the opportunist, the transformer, the pacemaker, and the digitalist. (See Exhibit 1.)

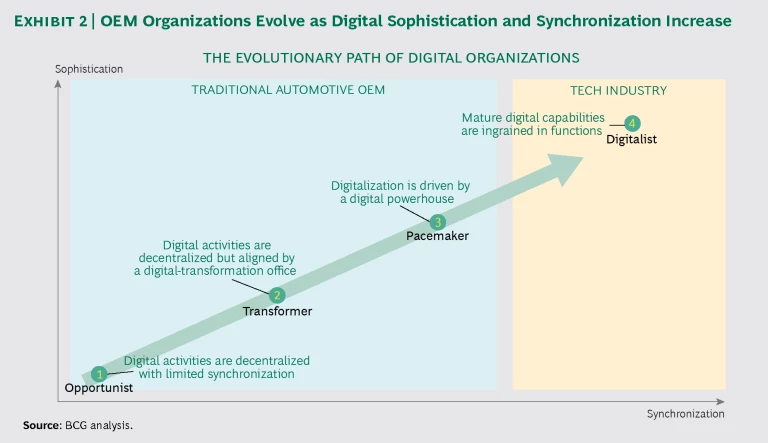

An individual OEM’s position on this evolutionary path can be plotted along two axes. The first is its level of sophistication in digital activities—from small pilots to mature businesses—in the five topic areas. The second is the degree to which digital activities are synchronized across the organization. This can range from limited coordination to an organization in which digital is fully synchronized and ingrained, as it is in the tech industry. (See Exhibit 2.)

- The Opportunist. This is the starting point for most organizations. At this stage, individual functions pursue digital opportunities as they arise and synchronize them across the organization in only a limited way. This results in faster time to market, but often at the expense of quality, consistency across products, and an optimized user experience. R&D may begin work on connected-car solutions, for example, while marketing and sales enters digital retail channels and operations tackles Industry 4.0 topics. At this early stage of digitalization, solutions are generally not yet complex enough to require major cross-functional alignment.

- The Transformer. As OEMs delve into more-sophisticated applications of digital technologies—or as initiatives developed at the opportunist stage come to fruition—they recognize the need for greater cross-functional coordination. At the transformer stage, OEMs typically create a digital-transformation office, often comprising fewer than 50 full-time employees, that coordinates resources and orchestrates digital initiatives across the organization. OEMs at this stage also often appoint a chief digital officer (CDO) to complement the role of the chief information officer, who is responsible for such traditional IT tasks as planning, building, and running IT systems; data administration; and security management. The CDO can handle new responsibilities related to digitalization, such as digital business building, infrastructure management for new digital offerings, and ecosystem development. The company’s circumstances determine whether the CDO requires a dedicated staff.

- The Pacemaker. As digital offerings grow more complex, merely synchronizing digital activities is not enough. Pacemakers go a step further and establish one or more centers of excellence—or “digital powerhouses”—that take responsibility for delivering digital products and services in a coordinated way. These powerhouses are standalone, cross-functional units with up to 400 full-time colocated employees; some have their own profit-and-loss responsibilities and legal status. Digital powerhouses typically encompass mobility, connectivity, autonomy, and digital services, while Industry 4.0 and digital retail remain in their respective functions. If a company has appointed

a CDO, he or she often leads the digital powerhouses. - The Digitalist. At this last phase of digital evolution, the automaker operates more like a tech company. The digital mindset is ingrained in the organization. As capabilities developed in the digital powerhouse mature, they are integrated into the respective business and production functions, becoming the “new normal.” Digital topics that are still nascent continue to be developed in the digital powerhouse.

As their digital businesses become larger and more complex—and the need for cross-functional collaboration rises—automotive OEMs tend to move from opportunists to digitalists. They need not follow the stages in sequence to succeed in digital, however. The starting point will depend on the activity or technology the OEM is pursuing. And the speed required to reach the desired stage will depend on a company’s circumstances, capacity, and skills. The key is to ensure that the OEM’s organization fits its digital strategy.

In many cases, OEMs can successfully launch connected-car solutions, enter the digital retail space, and implement basic Industry 4.0 technologies while they are still at the opportunist stage. The development of self-driving cars, however, requires a greater degree of coordination across components and subsystems. It also requires a step change in software and digital capabilities, which must remain closely integrated with the traditional product development cycle. Therefore, OEMs typically need to have reached at least the transformer stage. Mobility services pose a fundamental challenge to the traditional OEM business model. Because they are in the nascent stage, they require both focus and agility. Consequently, many OEMs that are introducing mobility services at scale are following the pacemaker model.

Of all the automotive OEMs around the world, only one, Tesla, is in our view at the digitalist stage. The digital organization of another leading US carmaker is rapidly moving toward that stage: General Motors is reintegrating many of the services developed by its former digital powerhouse, OnStar—such as navigation, remote diagnostics, and subscription-based communications—into its core product development function. Leading German manufacturers of premium automobiles have established digital powerhouses. French and other US OEMs are in the process of doing so, but their organizations are less digitally mature. Most Japanese automakers are at the transformer stage but are in the process of reorganization. Most other Asian automotive OEMs so far are at the opportunist stage because they lack the internal capabilities and fast decision-making processes to succeed in digital mobility solutions.

A Roadmap for Building a Digital Car Company

The first step in reorganization is to develop a clear picture of what the car company of the future will look like and the factors that will be critical to success. What kinds of technologies must be mastered, and which capabilities will be required? A rigorous health check can gauge the current level of readiness for competing in each of the major topic areas: mobility, connectivity, autonomy, digital retail and services, and Industry 4.0. An OEM can then identify gaps between the company’s current capabilities and where it needs to be, as well as the roadblocks in the way.

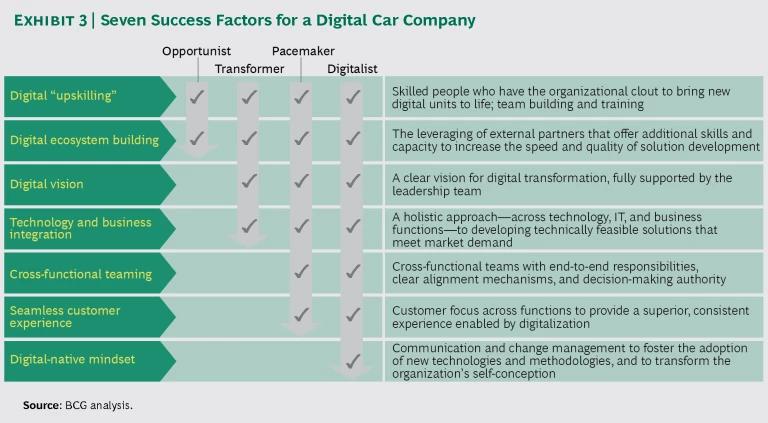

We have identified seven success factors for digitalization. Their importance depends on where OEMs are in their evolution. (See Exhibit 3.)

- Digital “Upskilling.” Whether an OEM is an opportunist, a transformer, a pacemaker, or a digitalist, it needs digitally skilled people who have enough clout to bring new digital units to life. This requires team building, training, and often hiring.

- Digital Ecosystem Building. The OEM should leverage the experience and resources of a network of close partners that complement its own capabilities and capacity in order to increase the quality of its solutions and decrease development time. Even OEMs at the opportunist stage should start building an ecosystem.

- Digital Vision. The organization’s leadership team must be fully committed to and aligned with a clearly defined vision for a digital organization. This vision is important at the transformer, pacemaker, and digitalist stages because it lays out how the automaker wants to position itself in the digital game over the long term.

- Technology and Business Integration. Developing technically feasible, comprehensive digital solutions that meet customers’ demands requires an approach that involves technology, IT, and business functions. This holistic approach is important for transformers, pacemakers, and digitalists because it enables them to further align all parts of their organizations with an increasingly complex digital business.

- Cross-Functional Teaming. Internal silos impede digital speed. OEMs need to create teams that work across functions and have end-to-end responsibilities, decision-making authority, and clear alignment mechanisms. For pacemakers and digitalists in particular, this ensures that their work is in line with the goals set by the C-suite.

- Seamless Customer Experience. Dedication to the customer must be the common denominator across functions in order to provide a superior, consistent, and seamless digital experience. That kind of experience helps pacemakers and digitalists differentiate their offerings from competitors’ and achieve superior satisfaction ratings. The more varied and numerous the customer touch points, the more challenging it is to achieve seamlessness.

- Digital-Native Mindset. An effective communication and change management program is essential to the adoption of new technologies and methodologies, and helps companies think of themselves as digital organizations. At the digitalist stage, this mindset makes digital the new normal and avoids fragmenting the organization.

Only if the whole organization supports digitalization, and achieves the seven key success factors, can an automotive OEM work in a fully digitalized way, as a technology company does.

Key Questions to Ask Before Beginning the Journey

As OEMs embark on the path to becoming a digital organization, executives need to ask themselves three questions:

- What is the current stage of maturity of our digital organization, and what is our target? Answering this question first requires insight into the organization’s digital maturity. What are its digital capabilities, technologies, and organizational setup, and what are the roadblocks to achieving the key success factors? Next, an OEM needs a clear target picture of technology, digital topics, and digital maturity to make sure the final digital organization is in line with the company’s strategic goals.

- What path should we take through the four organizational stages, and how should we identify anchor points? OEMs need to identify the required intermediate steps and stages of technology and of digital maturity. They need to differentiate between nascent and mature activities when determining organizational focus.

- How can we ingrain digital throughout the organization as we evolve into a mobility solutions provider? Achieving this requires a fundamental shift so that the OEM thinks of itself as a mobility solutions provider; it also requires a new way of working. An automotive OEM needs new methodologies, technologies, and cultural traits to be able to play by tech industry rules.

The most successful automakers have already begun to refine their digital organizations to reflect the breadth and maturity of their digital businesses. OEMs in the vanguard are learning from companies in the technology and digital consumer product industries how to raise their game and build organizations that can deliver on the possibilities for new mobility solutions for customers. Automotive OEMs that embark on this journey now will be in a much stronger position to realize the enormous growth opportunities of the digital age.