In June 2016, when Maarten van Beek became the new HR director at ING Netherlands, he was struck by a powerful realization: his company looked more like a tech startup than the nation’s largest bank. Just one year earlier, the bank had officially gone live as an agile organization, complete with tribes and squads, standups and scrums, and a dramatically flatter structure. Since joining the bank, van Beek has witnessed its transformation into a leading-edge digital entity. The organization that began its agile journey by taking field trips to the likes of Spotify, Netflix, and Zappos is today giving its own twice-weekly guided tours for agile-aspiring organizations from all over the world. There’s even a waiting list.

ING Netherlands’ agile transformation is no longer big news. The Dutch domestic-banking unit of ING has been celebrated as a paragon of agile ways of working among nontechnology companies. The transformation has accelerated the time to market for new services and fostered a wholly customer-centric mindset—two big reasons, its executives believe, why it garnered Global Finance’s Best Bank of the World award for 2018. What some may be unfamiliar with, though, is the role that ING’s HR team played in this transformation and the fact that it has undertaken its own agile odyssey. Both experiences offer important lessons for other companies making the shift—and for their HR organizations, as agents and adopters of agile transformation.

Why Agile?

ING Netherlands’ agile transformation began in 2011 as a grassroots effort in the bank’s IT group. In 2014, as CEO Nick Jue (now CEO of ING Germany) and the senior leadership team were setting the bank’s new Think Forward strategy, they realized that they were in the business of delivering products digitally. (See “ Nick Jue on Transforming ING Netherlands and Introducing an Agile Way of Working ,” BCG article, July 2017.) In effect, they were running a tech firm with a banking license. They saw how leading digital companies were reshaping customer expectations across every industry, banking included. ING, they decided, should be the banking world’s digital leader, organized and primed to deliver an unparalleled customer experience to its retail, commercial, and investment clientele. Change was imperative. And it had to happen immediately so that the company could establish itself as a front-runner.

Becoming the digital leader meant enhancing the customer experience, being faster to market, minimizing handovers and hurdles, boosting employee engagement, and attracting top talent. Given all that, Jue and his team knew they would have to redesign the work environment. The silos and traditional hierarchical structure had to go. An agile way of working was the answer, but it had to be implemented across the board.

From Old Way to Rollout, in Six Months

Inspired by the principles of the famed Agile Manifesto, ING’s leaders took a minimum viable product (MVP) approach to implementation. Their corollary approach, still operative, was the “it depends” principle: without having all the answers upfront, leaders needed to stay flexible.

The changeover started in what the bank refers to as its “delivery organization”: marketing, product development and management, data, and IT—all the groups involved in designing, implementing, and maintaining new products and services. As the steward of people and change management, HR’s first job was to help build the structure of an agile organization and assign people to their new groups. (See the sidebar.) In parallel, HR had to communicate and coordinate with Netherlands work councils to ensure compliance in the overall transformation.

Squads, Chapters, and Tribes: The New Building Blocks

Squads, Chapters, and Tribes: The New Building Blocks

Modeled on the standard agile structure for software development teams, the bank’s delivery organization was arranged into more than 300 multi-disciplinary squads, 13 tribes, and over 200 chapters. (See the exhibit below.)

Squads hold the collective expertise (such as customer and product knowledge as well as IT and data analytics skills) to create a given product. They work together autonomously in two- or three-week sprints and have the authority to prioritize backlogged work. This multidisciplinary team structure vastly reduces the multiple handovers of the preagile days, when members were located in different departments and spoke to each other primarily at biweekly meetings. It also accelerates product release times and enables products to better meet customer needs. By working elbow to elbow, team members expand their expertise; if someone leaves, the work can continue. Every squad is supported by an agile coach.

ING established three new key roles: product owners, chapter leads, and agile coaches. Redefining jobs for some 3,000 people—roughly 25% of its Netherlands workforce—in two months was unprecedented. It also called for reducing the number of job types from approximately 85 to 15, including retiring the traditional full-time manager role. (Teams are now self-managing—“self-organizing” in ING parlance—and more autonomous.) This dramatic change in power structure and roles sent some managers to the exits—even those who had once been very successful.

Equally unprecedented was the approach to employee selection. Most employees had to reapply for a position in the new organization. Because of the importance of digital and cross-functional collaboration, employees were interviewed by peer panels and chapter leads or product owners from different functional areas. The selection process—from rewriting job descriptions to appointing squad members—took four months. Within six months, ING Netherlands did a Big Bang rollout involving those 3,000 employees. In 2016, the call centers and sales force went agile, bringing 7,000 more people into the fold. (These groups adopted a modified version of agile; call center personnel, for example, are organized into 10- to 20-person customer loyalty teams and 50-person “circles” modeled after the structure used by Zappos.)

As the bank continues tweaking its working model, more areas are making the shift. Agile is now being introduced in ING’s wholesale banking division and in other operational units in various countries. An enterprise-wide implementation is under way and set to go live in 2018.

HR Goes Agile

As agile took root and spread during 2016, van Beek and his team members found themselves increasingly called on for support. People wanted to know: How do we conduct performance management? How do we develop our people? What should career paths look like now?

Certainly those issues were high on the HR agenda. But the rapid change had left little time to tackle them. Now the team needed to turn its attention to its own transformation: redesigning processes and systems and reinventing their product portfolio so that they could accelerate the new people agenda and ways of working. Says van Beek, “We realized we needed to change our own ways of working in order to de-liver on our own purpose. We needed to move faster, be more proactive, and become top-notch HR professionals.”

Like the broader organization’s transformation, HR’s shift to agile was fueled by the need to streamline product and service development, which would free up its leaders to focus on more strategic concerns. “The new ways of working were already transforming the business,” notes van Beek, “so we figured, why shouldn’t we—as the ‘people’ people—adopt them too?” Over several months, HR leaders gathered at workshops and offsites to hammer out a vision, objectives, and a working model.

Revamping the Three Pillars

ING’s HR organization, like that of many companies, is built on three pillars. Reorganizing these pillars using agile allowed HR to work more efficiently and create more consistent—yet still high-quality—products and services, with fewer staff and fewer handovers. The pillars today work in an integrated way to deliver HR’s purpose: building the craftsmanship and the engagement of everyone who works at ING, so they can deliver on the purpose and the strategy of the bank.

HR Business Partners. HRBPs advance the people strategy throughout the business. A dozen individual HRBPs have their own accounts—senior management, leaders of tribes and communities of expertise (CoE)—and are responsible for driving the people agenda of these groups.

The rest of the HRBPs make up a flexible pool of partners who work primarily on execution-based teams (so-called to emphasize action) modeled loosely upon the delivery organization’s squads. Each of these “impact teams” is dedicated to one area: for instance, one is executing the bank’s new Step-Up Performance Management program; another is implementing ING’s new ways of working in other parts of the bank. This flexible pool enables HR to prioritize how it assigns resources, to ensure standardized products and services, and to develop and implement new tools and processes in far less time than it once took. The model allows ING to allocate resources where their impact will be greatest.

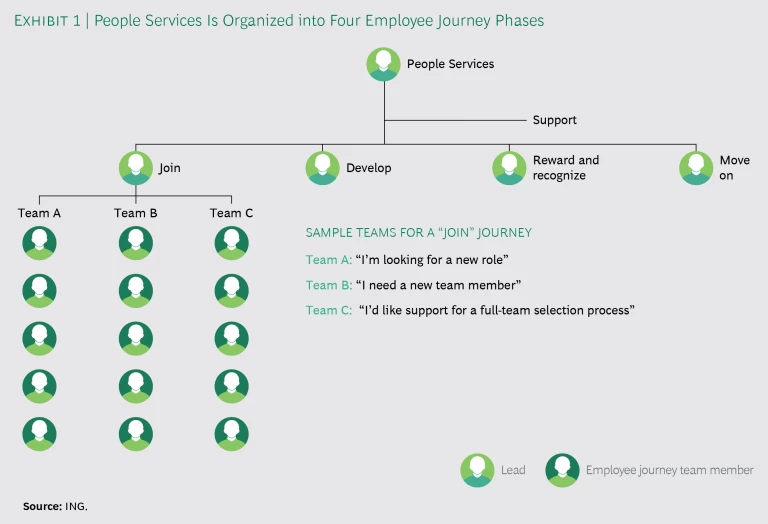

People Services. This group, which provides day-to-day services to employees, is modeled along the lines of the call center teams, with circles dedicated to the four phases of the employee journey: join, develop, reward and recognize, and move on. Each circle consists of several employee journey teams, each responsible for a specific process. For example, changing jobs is a journey in the develop phase; earning a bonus or a sabbatical is a rewards journey. (See Exhibit 1.) People Services’ objective is to manage as many of the operational aspects of HR as possible, thus freeing HRBPs to focus on strategic priorities. Above all, the most crucial role of People Services is to create differentiated employee experiences that are customized by need and that make ING stand out from its competitors.

Communities of Expertise. CoEs create thought leadership, develop the vision, share knowledge, and manage the work portfolio for their particular area of expertise, such as employer branding, workforce planning, or performance management. The expert teams that make up CoEs are divided into two clusters: talent and learning and performance and reward. Working closely with the impact teams, they develop HR processes and products together with their global colleagues (most are developed globally, some locally). The CoEs are also responsible for building HRBPs’ capabilities and helping them to work more effectively.

New Ways of Working

In addition to adopting many agile practices—smaller teams, sprints, and an iterative approach to product development and execution—HR also created a special workspace for its planning and operations. Known as the Marketplace, or the Obeya (Japanese for “large room” or “war room”; a term borrowed from lean manufacturing), the room serves as a combination meeting place, control tower, and information base. Its walls are covered with posters and sticky notes that display objectives, priorities, epics (major projects), quarterly and annual plans, and dashboards—all designed to facilitate discussion and decision making. There is a communication wall, an action wall, a performance wall (newly added), and a portfolio wall for managing projects and activities (similar to Jira project management boards); leaders create tickets, which are then cascaded down to the appropriate teams. Information on the walls is kept up to date for viewing anytime. The Obeya has allowed HR to dispense with printed reports, minutes, and internal newsletters.

HR leaders assemble in the Obeya every two weeks for standups to check in on the strategic themes and examine new data and customer feedback. (The larger team assembles quarterly to set bigger, longer-term priorities and accountability; all relevant personnel, not just HR leaders, are invited to their meetings.) Meetings and interactions are thus more frequent, more fluid, and less top-down. Van Beek considers his time in the Obeya to be the most productive time of his week. He says, “In an hour and a half, I know the status of every major deliverable and potential resource issues. When I need more in-depth information, I join one of the team standups or demos.”

These new ways of working have allowed HR to standardize and streamline its output dramatically. Now, instead of creating different talent development, performance management, and benefit programs for each business and department, HR has one consistent approach. By using the MVP concept, HR can develop products and services more quickly and improve them iteratively over time.

Agile has allowed HR to standardize and streamline its output dramatically.

How HR Is Helping Accelerate Performance

Today, the HR team is concentrating on integrating the new ways of working into programs tied to the bank’s performance. Among its highest priorities is executing ING’s Step-Up Performance Management program, which promotes regular ongoing feedback and motivates people to aspire to be their best, through personal “stretch ambitions.”

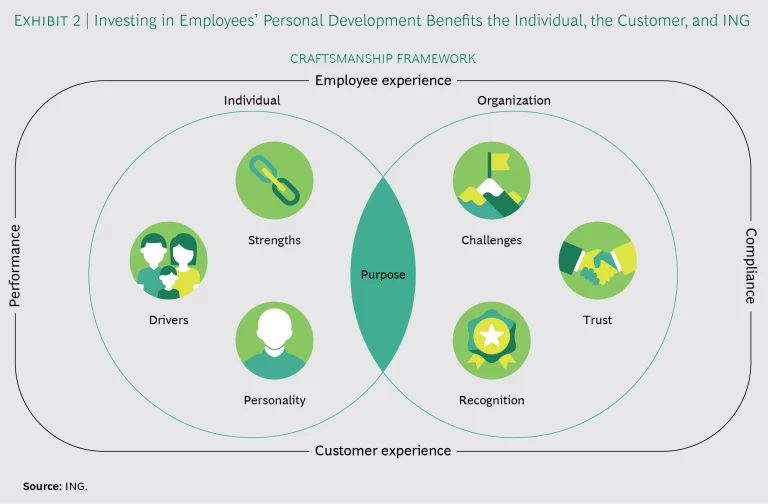

Perhaps the most significant innovation is HR’s new Craftsmanship framework, essentially a statement of the bank’s compact with the employee in the new era. The term “craftsmanship,” reminiscent of the guild era, underscores the bank’s emphasis on skills and pride in professional development. “Stay curious, keep learning, and take ownership”: this motto greets all new employees on their first day of work. The Craftsmanship framework basically says that in return for the investment that ING makes in each employee’s development, the bank expects the employee to constantly hone his or her skills and expertise, become more agile and adaptable, and grow professionally and personally. In this way, the employee becomes more valuable to the bank and more marketable in general.

Leaders believe that the Craftsmanship framework gives people a sense of belonging and fuels their passion for their work.

The Craftsmanship framework makes each employee responsible for identifying his or her strengths that are worth developing (and, to a lesser extent, weaknesses that need improving). It also aims to explore the employee’s core motivations (or drivers, such as professional advancement or fun). The bank pledges to create appropriate challenges for employees, provide a trusting environment that encourages experimentation and makes it safe to fail, and explicitly recognize employees for their contributions. Pursuing these goals ensures that people perform better, understand regulatory compliance, and are equipped to provide customers with an exceptional experience. (See Exhibit 2.) Leaders believe that Craftsmanship gives people a sense of belonging and fuels their passion for their work.

ING now uses Craftsmanship as a foundation for its frequent employee performance checks as well as for its personal-development plan, which each employee is expected to begin crafting on his or her 100th day.

A Never-Ending Journey

Already, agile has had a tangible effect on talent at ING. Van Beek comments, “The focus on innovating for our clients makes working at ING inspiring. It also helps us attract top talent. We see this daily in our recruiting efforts.” In HR, agile adoption has had the same effect. He says, “We’re putting the right people together and encouraging them to take end-to-end responsibility for the task they face.”

In the spirit of continual learning and improvement that are the hallmarks of the agile organization, 90 HR team members recently convened for an agile retrospective: they reviewed what works and what needs work. Although HR is maturing, they agreed that more change is needed; for example, they will modify some of their hard-wired HR practices and focus more closely on building line-manager capability. Van Beek says, “We got a lot right when we implemented the new HR organization, but we also made mistakes. We need to change what we got wrong and try a new way.”

So, what lessons does van Beek have to share with others at this stage? For one, companies considering adopting agile in HR should be sure to involve HR early in the organizational process. Such exposure gives them the perfect foundation and creates advocates. In addition, leaders should be generous in giving responsibility to those involved. “Make sure they feel enabled to make mistakes as they learn,” van Beek says. And “be transparent about the vision and the dream; allow room for how you will get there.” Agile is an ongoing journey, but it’s not a purpose in itself. Van Beek says, “The bigger challenge for HR leaders is ensuring that the HR function delivers on your organization’s purpose. Agile is helping us deliver on ours: empowering people to stay a step ahead in life and in business.”

Agile is an ongoing journey, but it’s not a purpose in itself.