Public concern about global climate change has been slow to take root across the Gulf States. But mounting government and corporate initiatives, and wider access to information, now appear to be making an impact. Our study of consumers in the six member states of the Gulf Cooperation Council (GCC) found surprisingly high awareness of the growing threats that global warming poses to their families and to future generations. And more than 80% of those surveyed said they would be willing to adopt more sustainable lifestyles .

The challenge for the region’s governments, business community, and civil society is to translate climate concern into action. Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE)—the GCC countries—recycle, reuse, or recover a small fraction of the plastic and metal waste that they produce, much less than the global average of 32%. Electric vehicles are scarce.

Why this gap between awareness and behavior? In our study, consumers said that a number of barriers make eco-friendly or sustainable practices challenging to implement—and they are looking to government to remove them. Thus, there is good reason to believe that more people would embrace sustainable lifestyles if the public and private sectors made them more accessible through financial incentives, public-awareness initiatives, investments in green infrastructure, and a wider choice of affordable eco-friendly goods and services. This would not only enable the GCC nations to advance their green agendas but also create important new growth opportunities in sectors as diverse as tourism, consumer goods, transportation, real estate, and education.

A comprehensive and coordinated push by the public and private sectors would stimulate a virtuous cycle. Wider adoption of sustainable living would promote greater social awareness and peer pressure. And that, in turn, would further embed environmentally conscious behavior into the values of GCC consumers so that ultimately, they become entrenched social norms.

A Stronger Focus on Sustainability

A number of actions taken by the GCC nations in recent years have improved awareness of climate change and made environmental sustainability a higher priority. All six member states are signatories to the UN’s Sustainable Development Goals, and several are making progress in providing affordable clean energy and implementing energy-efficiency targets. Sustainability initiatives include development of renewable power and recycling plants, reduction of construction and demolition waste in landfills, and regulations and incentives to connect rooftop solar panels to power grids.

Sustainability is also becoming a significant feature of major public events. Qatar has pledged to use sustainable construction practices at its FIFA World Cup 2022 facilities, for example, and to have 25% of its public bus fleet running on electricity by that time. Dubai has made sustainability one of the three pillars of the World Expo it plans to host in 2021. And “safeguarding the planet” was one of the three priorities in the presidency agenda of the 2020 G20 Riyadh Summit.

The region’s private sector is embracing sustainability as well, with a growing number of companies adopting principles such as the triple bottom line, net-positive water, and net-zero emissions. For instance:

- The Majid Al Futtaim Group, a major UAE-based shopping mall and hotel developer, has implemented initiatives to promote reduced water consumption, reduced use of single-use plastic, and increased use of renewable and clean energy.

- Saudi Arabia-based food and beverage giant Almarai has commissioned one of the country’s largest private solar-energy installations. It is also converting lighting at its facilities to LED and pledges to eliminate 3,000 tons of plastic packaging from its products.

- Nike’s retail store in the Mall of the Emirates in Dubai has transparent LED window displays that consume half the energy of conventional LED screens. The store also offers sustainably manufactured products curated for UAE consumers.

Consumer Awareness of Sustainability

To gauge the level of awareness of climate change across the GCC and whether consumers’ concern is translating into changing behavior, BCG’s Center for Customer Insight surveyed 6,000 adults of various income levels, ages, and nationalities in the region’s six nations in July 2020.

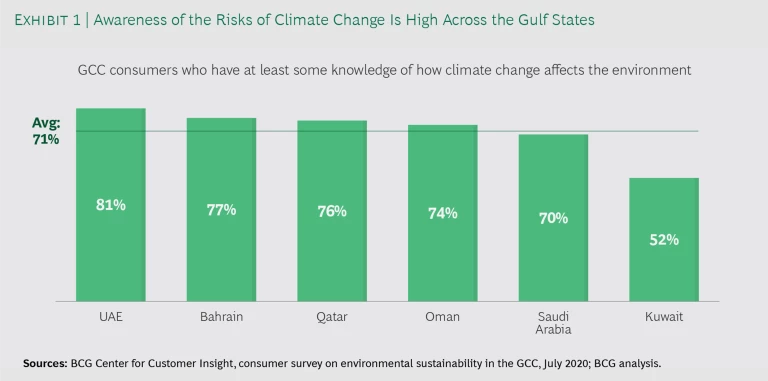

Seventy-one percent of respondents—ranging from 52% in Kuwait to 81% in the UAE—said they know what climate change is and are aware of its negative impact on the environment. (See Exhibit 1.)

It must be noted, however, that a significant portion of the region’s population remains poorly informed—or even misinformed. In fact, 28% of respondents said they believe climate change will have a positive impact on the planet. Still, 44% believe the warming climate is already adversely affecting their personal lives, and 63% think the impact will be felt by future generations. Thus, consumer concerns about climate change are likely to endure well into the future.

Our research also found that a large share of consumers are considering altering aspects of their everyday lives in light of environmental considerations: 56% of respondents said they feel strongly about the need to adopt a sustainable lifestyle. Indeed, consumers ranked environmental sustainability among the most important socioeconomic challenges.

Finally, we found a strong willingness to act. Depending on the country, from 80% to 95% of respondents said they are willing to start or are already taking action in response to climate change.

Consumer Engagement with Sustainability

While there is a growing perception in the GCC that global warming is a threat and that it’s important to be environmentally conscious, this does not always translate into sustainable lifestyles.

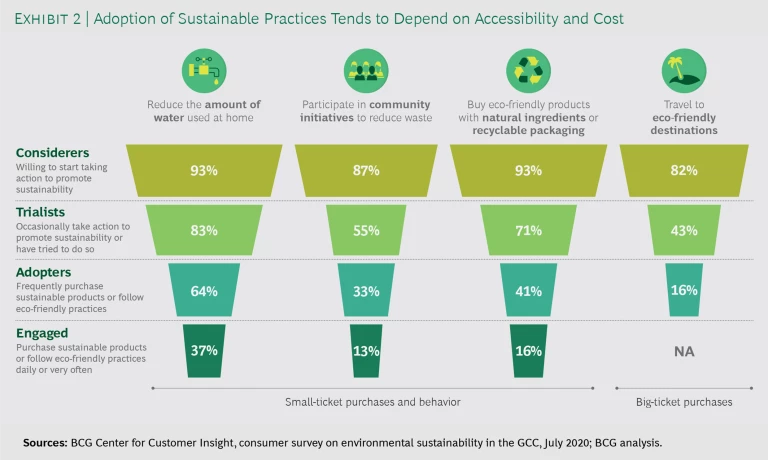

Based on their responses to our questions, we grouped respondents into four levels of engagement with sustainability. Those we call “considerers” say they are willing to purchase sustainable products or take other actions toward sustainability, but may not have actually done so. “Trialists” take such actions occasionally or have at least tried to do so. “Adopters” purchase sustainable products or follow eco-friendly practices often. “Engaged” consumers exhibit such behavior even more frequently, often daily.

We found that a majority of GCC consumers follow eco-friendly practices when the means of doing so are readily available or when they believe that it may save them money. (See Exhibit 2.) For example, 93% of consumers surveyed are considerers when it comes to reducing water and electricity consumption at home, while 64% are adopters and 37% are engaged. High shares of consumers have already begun or are considering buying eco-friendly products with natural ingredients or recyclable packaging. When eco-friendly options are more expensive or less accessible, however, adoption rates are much lower.

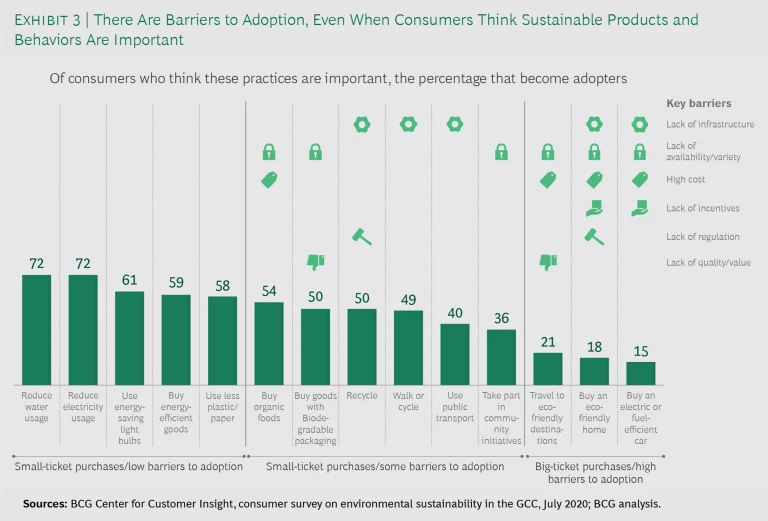

The more importance consumers attach to environmental sustainability, the more likely they are to act accordingly. The more barriers they encounter, or think they will encounter, the less likely they are to adopt sustainable behavior and products—even when they believe that doing so is important. (See Exhibit 3.) A good example is the use of energy-efficient light bulbs, which are affordable and easy to find and use. Raising consumer awareness of the benefits of using such bulbs, therefore, could further increase usage. Adoption drops significantly, however, when one or more impediments are perceived. Of the survey respondents who think it’s important to reduce emissions and waste during travel, for example, just 21% are adopters when it comes to traveling to eco-friendly destinations and only 15% are adopters of electric or fuel-efficient cars. To slowly increase adoption of such big-ticket purchases, wider availability, lower prices, financial incentives, and energy-efficient infrastructure will be required.

The Barriers to a More Sustainable Lifestyle

To better understand the gap between awareness and behavior, we asked consumers about the barriers hindering them from adopting more sustainable lifestyles.

“A sustainable lifestyle is too expensive to maintain” was the leading obstacle. A “lack of information” came in a close second, followed by “limited opportunities in the city,” “a sustainable lifestyle reduces the options available to me,” and “social pressure to maintain lifestyles.” Many respondents also said that they believe that eco-friendly products lack quality and that adopting them will bring a decline in the quality of their lifestyle. The latter sentiment, which was strongest in Bahrain, reflects the fact that many GCC households equate well-known brands with quality and social status, so they tend to view eco-friendly alternatives as inferior.

Many consumers view sustainable options as inaccessible because of limited infrastructure and variety. Another stumbling block is perceptions of cost versus quality.

Limited Infrastructure

The problem of accessibility across the GCC is often due to inadequate infrastructure. Consider recycling. Nearly 80% of waste in the UAE, and virtually 100% in Oman, ends up in landfills. In contrast, 40% to 50% of all waste is recycled in Germany and the UK, and 34% is recycled in the US. In the GCC, 43% of survey respondents cited the lack of conveniently located recycling bins or collection sites as a major constraint. Another 35% cited a lack of recycling companies.

Infrastructure constraints also help explain why only 17% of GCC consumers use public transportation and only 20% walk or cycle to their destinations frequently—even though 70% of respondents agreed that it is important to reduce vehicle emissions. In Dubai, which has one of the region’s best-developed public-transportation systems, only 18% of daily trips are via public transport, compared with 46% in London. Similarly, a lack of charging stations and maintenance garages—cited as a constraint by 43% of respondents—contributes to the low adoption of electric vehicles in the GCC.

Limited Eco-Friendly Products

Consumers in the region are often willing to try eco-friendly products but are hindered by a scarcity of providers and insufficient choices. Around 30% of respondents cited lack of options as an obstacle. What’s more, they often view the few products that they do find in stores as dubious: 47% of respondents said they would be more likely to adopt sustainable products if a wider variety of options were available or if they were of a higher quality.

Perceptions of Cost Versus Quality

A shared view among GCC consumers, cited by 39% of respondents, is that a sustainable lifestyle is expensive to maintain; in the UAE, 46% hold this opinion. Overall, half cited cost as a barrier to buying electric vehicles.

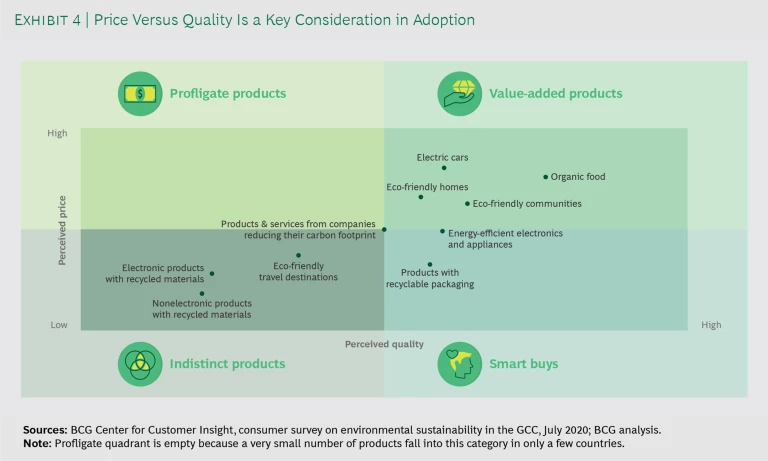

A key consideration for consumers with respect to eco-friendly alternatives is price versus quality. To better understand the relationship between these factors, we grouped products into four buckets: profligate, value-added, smart buys, and indistinct. (See Exhibit 4.) Some products fall into more than one category, depending on how they are perceived by consumers in different markets.

Profligate products are those that are perceived as expensive and offering little additional quality. In Bahrain, electric cars and eco-friendly homes fall into this category. Manufacturers need to help consumers rationalize paying more for such products by clearly communicating their differentiating features and benefits compared with conventional options.

Value-added products are those whose incremental costs and quality are perceived to be high. They are viewed as upgrades over conventional products. Organic foods, electric vehicles, and eco-friendly homes generally fall into this category. Increasing accessibility through more variety, sizes, and price points is key to their growth.

Smart buys are eco-friendly goods and services that seem to offer value for money at modest or no additional cost. Energy-efficient appliances and products with biodegradable packaging are examples of smart buys in some GCC markets. With stronger public-awareness campaigns and smart pricing, these products have the potential for mass appeal and much higher rates of adoption.

Indistinct products are perceived to have low quality and to lack a sufficiently compelling value proposition to justify their higher price. Eco-friendly travel destinations and products, such as apparel, that contain recycled components are examples. Companies selling such goods and services must improve the quality of their offerings.

Opportunities to Drive Wider Adoption

Although most of the GCC consumers we surveyed agree that government, companies, and individuals have a role to play in protecting the environment and reducing climate change, the vast majority (70%) believe that the primary responsibility lies with government. Only one-third, however, regard current government sustainability initiatives as sufficient.

What are they looking for government to do? Consumers want more information about recycling, renewable energy, how to live sustainably, and how to reduce energy consumption. They want to know more about energy-efficient homes and electric cars. They expect government to invest more in sustainable infrastructure, particularly recycling facilities, renewable energy, public transportation, and eco-tourism. There is also significant support for stronger government action in the form of financial incentives for green initiatives and prohibitions on the sale of high-carbon-footprint products and services.

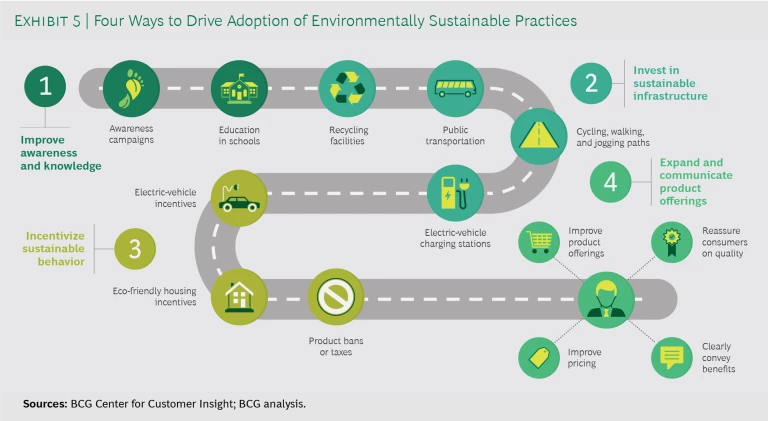

We believe that governments and the private sector in the GCC can promote far wider adoption of environmentally sustainable practices with initiatives on four key fronts: improving awareness and knowledge, investing in sustainable infrastructure, incentivizing sustainable behavior, and expanding and communicating product offerings. (See Exhibit 5.)

Improving Awareness and Knowledge

Our research indicates that raising awareness and educating consumers about the importance of climate change could lead to increased action. Governments can consider action in two areas.

Awareness Campaigns. Misconceptions persist in the GCC regarding the impact of climate change. For example, 35% of respondents—and 49% of 18- to 24-year-olds—said they had never heard of or were unsure of the meaning of “carbon footprint.” Consumers want to be more informed, and public and private initiatives would help close this knowledge deficit.

Education in Schools. Sustainability principles and values need to be instilled through public-awareness campaigns and by embedding them early in school curricula across subjects, starting in preschool. School systems should also invest in programs that will teach students how to adopt eco-friendly practices in their homes and communities. In Sweden, care for the environment is integrated into every aspect of the school day; for instance, students eat lunch from reusable dishes and are urged to scrape their leftovers into compost containers.

Investing in Sustainable Infrastructure

Our research indicates that GCC consumers would embrace sustainable practices if more infrastructure were in place to increase accessibility. The following areas offer particularly strong potential.

Recycling Facilities. Across the region, 58% of respondents said they would be motivated to recycle if they had access to conveniently located recycling bins—and 49% believe government investments in recycling facilities are needed.

Public Transportation. More connections among multiple modes of transport, within and between neighborhoods and cities, would make public transit more affordable, convenient, and eco-friendly. Governments can consider investing in fuel-efficient modes such as trams and hydrogen- or electric-powered buses and medium- to high-speed metro networks. The region’s urban planners should also consider designing cities more vertically, which would allow public transportation to be more efficient.

Cycling, Walking, and Jogging Paths. Cycling and walking would promote both alternative-mobility and health and wellness goals. More greenery, shaded pathways, mist dispensers, and energy-efficient ground-level cooling systems would make cycling and walking more comfortable. Urban planners can also ensure that grocery stores, beauty salons, and other commercial services are easily accessible to residents by foot or bicycle.

Electric-Vehicle Charging Stations. GCC nations can accelerate the shift to electric vehicles by funding the installation of charging stations. In France, the government covers 40% of the cost of equipment and installation, up to €1,860.

Incentivizing Sustainable Behavior

There are many policy tools available to GCC governments to help shift consumer behavior, including the following.

Electric-Vehicle Incentives. Consumers in the region consider electric cars to be an upgrade, and around 25% are willing to pay a high premium for them. But they’re only willing to pay an average of 15% to 20% more—well below the current market price. Governments should consider offering incentives such as purchase subsidies, lower interest rates on loans and financing, cash-back incentives to exchange a conventional car for an electric vehicle, or free public parking.

Eco-Friendly Housing Incentives. Survey respondents said they are willing to pay up to 15% more in rent, and almost one-third are willing to pay up to 20% more on the price of a home, for energy-efficient housing. But again, this likely falls short of actual costs. Governments can increase adoption by offering subsidies and other financial incentives and by implementing energy-efficient housing standards and regulations.

Product Bans or Taxes. Consumer support for bans on products and materials that are harmful to the environment, such as single-use plastics, ranges from 40% in Kuwait to 55% in the UAE. Household electricity costs as little as 3 cents per kilowatt hour in several GCC nations, compared with 26 cents in the UK and 38 cents in Germany. These low prices curb consumers’ interest in cutting consumption. GCC nations can consider actions taken by other governments, such as levying taxes on oil-based fuels and electricity.

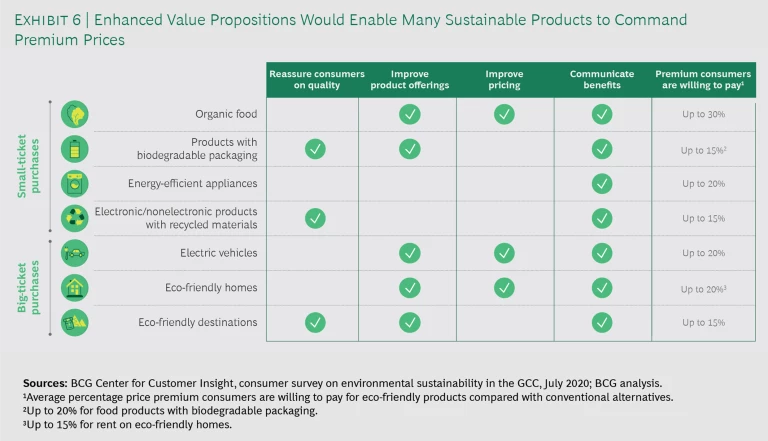

Expanding and Communicating Product Offerings

Our research confirmed that there is considerable untapped demand across the GCC for sustainable goods and services. Indeed, we found that most consumers are willing to pay a premium for eco-friendly options. To capture these opportunities, companies must match their go-to-market strategies with a wider array of choices and more accessible price points. (See Exhibit 6.) They can also reassure consumers that the quality of eco-friendly products is worth the price by more clearly articulating the benefits of their offerings. Such strategies can be deployed especially effectively in categories such as the following.

Organic Foods. Survey respondents indicated that they are willing to pay a premium of up to 20% to 30% on average for organic foods (which fall into the “value-added” product category). Companies can make these products more widely available and increase the number of flavors and other variants while leveraging and promoting their health benefits. They can offer smaller SKUs at more accessible price points. Companies can also reach a wider audience for their products by securing secondary placement in the main aisles of retail outlets, in addition to the sections dedicated to organic foods.

Energy-Efficient Appliances and Electronics. Companies can grow the market for energy-efficient products and other “smart buys” with marketing communications that reinforce such benefits as superior quality and lower utility bills. They can also emphasize these products’ “badge value”—the advantages they hold not just because of what they do but because of the ideals they represent.

Real Estate. According to our survey, eco-friendly homes and communities fall into the “profligate” product segment in some markets and into the value-added segment in others. Providers must offer special benefits that add value for consumers. For example, developers can include more energy-efficient features and strongly communicate their benefits, such as lower utility bills. We found that around two-thirds of the GCC’s consumers are very or extremely interested in power-generating rooftop solar panels and energy-efficient lighting, air conditioning, and appliances.

Travel and Tourism. In addition to highlighting their own commitment to waste recycling and renewable-energy use, eco-tourism promoters can improve the experience of this “indistinct” category. Respondents reported that they would find eco-travel destinations more appealing if they offered luxury amenities, were not overcrowded, and provided locally produced organic foods. Al ‘Ula, a UNESCO World Heritage site in Saudi Arabia that is being developed with a focus on preserving natural ecosystems, will include a luxury eco-friendly resort offering food sourced from the area’s farms.

The environmental sustainability movement is gaining traction across the GCC, propelled by rising consumer awareness of the dangers of climate change and a stronger commitment from government leaders to mitigate carbon emissions. The public and private sectors must seize the opportunity to convert this momentum into lasting change that will put the region—and the planet—on the path toward a more sustainable future. Our research shows that Gulf State consumers are ready to embrace sustainable lifestyles. It is now up to governments to follow through with a combination of public education, greater investments in green infrastructure, and smart incentives—and for companies to provide eco-friendly products and services that meet consumers’ needs and expectations.

This publication would not have been possible without the contributions of our BCG colleagues Maya El Hachem, Deepti Tyagi, Benjamin Deschietere, Daniel Tanuri, Yassin El Khourouj, Faisal Hamady, Hassan Elhaj, Javier Doblas, Georges El Hitti, Ingmar Schaefer, Shriram Ramesh, and Mohamed Alaa. We also thank Gaurav Bajpai, Aakash Jain, and Kavya Sharma of BCG’s Omnia Survey Operations and Analytics team and Jorge de Esteban, Benedikt Fässler, and Miriam Benedi of its Knowledge Management team. We are also grateful to Belinda Gallaugher, Varvara Egorvova, and Leili Naguib for marketing support, Pete Engardio for writing assistance, and Katherine Andrews, Kim Friedman, Abby Garland, Gina Goldstein, and Shannon Nardi for editing, design, and production.