At a glance

The global pandemic has been ongoing for 15 months as of June 2021 and has heavily influenced nearly every aspect of our world. It has been one of the most disruptive periods in modern times, and Sweden and other Nordic countries are no exceptions. While consumer behavior is always evolving, the extreme changes seen during the pandemic have altered the business world significantly.

In May 2021, BCG surveyed 1,000 consumers in Sweden, Norway, and Finland, respectively, to learn more about their behavioral changes, consumption patterns, and preferences during the pandemic, as well as what they anticipate once restrictions are lifted. While some things are reverting back to normal, we see a number of expected permanent shifts in consumer behavior.

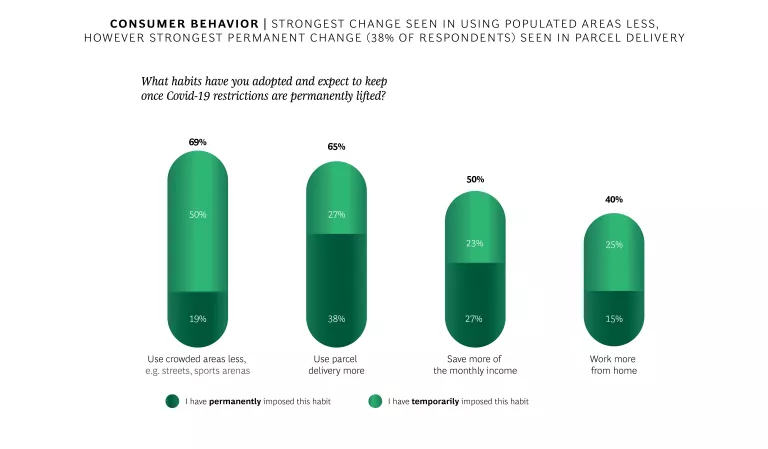

First, the pandemic has accelerated the ongoing shift from stores to online, particularly with unlocking a new set of first time users. Health concerns and working from home have led more people to discover the convenience of online shopping, with 10% making their first online purchase during the pandemic. Many consumers believe at least part of this shift will be permanent, with 38% of consumers expecting to permanently increase their use of parcel delivery. This is especially true for categories where online penetration has historically been low such as Food & Groceries. The share of consumers that buy food and groceries online once a week or at least several times per week is expected to stay 17% higher compared to pre-pandemic levels.

Second, with the accelerating shift towards online channels, store networks in their current format need to change. Traffic is expected to permanently decline, altering the business case for physical stores. The pandemic has forever redefined the role of the physical store and retailers need to re-think their footprint, reshape the layout and purpose of some stores, and close down others. Our sentiment survey shows that 69% of Swedish consumers have used crowded areas less often during the pandemic, of which 19% expect this decline to be permanent. This is in line with consumers stating that they have visited stores 6% less frequent across product categories compared to before the pandemic. Moreover, consumers state that they will look to stores to find inspiration and to socialize while shopping, and retailers can thus evolve their store format to showcase the full experience of products and services to cater to these preferences. All in all, the survey results indicate that more purchases will be done online, while stores are expected to function as a place for browsing and finding inspiration.

Third, the opening of society will likely unleash a wave of suppressed spending. Stakes are high in the short-term but there will also be long-lasting shifts in consumer spending in the long term. The pandemic has caused around 40% of consumers to cut back on spending, especially in discretionary categories such as travel, restaurants, and other entertainment, and instead save more (50% state that they have increased their monthly savings). There is now a clear desire among consumers to increase consumption across almost all categories once restrictions are lifted. This is especially true for self-indulgent categories such as Vacation/Leisure Travel, where 70% of respondents expect to travel more or much more once restrictions are lifted. Interestingly enough, at the same time 27% of consumers expect to keep their new higher levels of monthly savings compared to before the pandemic, indicating an optimistic outlook among Swedish consumers. Same patterns can be seen in Norway and Finland (with 28% expecting to save more in both countries).

Finally, sustainability has even further anchored its position as a key priority among consumers. The importance of sustainability has increased across categories from already high levels, with the largest shift seen in the younger age groups (45% of respondents in the 18-22 age group believe the importance of sustainability has increased during Covid). Many also believe that these priorities will remain after the pandemic and lead to a permanent growth in demand for sustainable products.

Pandemic to further accelerate fast moving shift to online

Significant increase of home parcel delivery

While Swedish consumers and the economy were undergoing digitization long before 2020, the pandemic has rapidly increased the pace. Swedish consumers made large leaps to online shopping and parcel delivery, with 65% of Swedes indicating that they have used parcel delivery more since COVID-19 started, and 38% in this group believe this new habit to continue permanently after the pandemic ends. These patterns are shared across age groups, with people aged 23-35 and 36-55 indicating the strongest permanent shift (44% and 47% of respondents, respectively). Unsurprisingly, these are the age groups that also stated being most affected by the work from home trend.

The results indicate that 40% of respondents are working more from home, and 15% believe they will continue doing so even after the government lifts all COVID-19 restrictions. The most significant permanent change in working from home has been in metropolitan areas (21% of respondents), compared to medium-sized cities (16%) and small-sized cities (12%), likely correlated with the type of work being performed allowing for a remote setup (e.g. office work) and the need for commuting with public transport.

Comparing Nordic neighbours

Comparing Nordic neighbours

“We are investing in a new digital platform where e-commerce will be the core of our business, the big hub in all channels. This means that the customer will be able to start their purchase in one channel and end it in a completely different one. Customers will be able to shop with us on their own terms. And it also creates the conditions for us to be with the customer before, during and after purchase”

—Niclas Eriksson, Chief Executive Officer at Elgiganten.1 1 Så krossar Elgiganten motståndet: ”E-handeln blir kärnan i allt”, E-handel Press Release, August 29, 2020,Så krossar Elgiganten motståndet: ”E-handeln blir kärnan i allt” (ehandel.se)

Underpenetrated categories show the largest shift

The e-commerce increase differs somewhat between categories. Online penetration in categories like clothing was already high before the pandemic, however, many Swedish consumers have now also discovered the ease and convenience of online shopping in other categories. It can thus be argued that the pandemic has somewhat leveled the field in online penetration across categories, with higher impact in 2020 on less mature e-commerce categories. One clear example being the previously underpenetrated category of Food & Groceries.

Online growth further fueled by first-time users

The behavior shifts imposed by the COVID-19 pandemic also led to many making their first-time online purchase. 10% of respondents in our survey state they shopped online for the first time during the pandemic, primarily due to health reasons or restrictions. Approximately 70% of people aged 18-55 who had never shopped online before have now done so. The pandemic has clearly pushed groups with previously lower online penetration into new behaviors. Looking again at Food & Groceries, we see that people in the oldest age group (ages 56-80) increased their shopping the most (24% increase), compared to those in younger age groups (11% increase).

“Already in the spring of 2020, many people created new habits and started shopping for food online because it was both safe and convenient. We do not yet see any signs that this is slowing down, but we are sure that it will continue even in the aftermath of the pandemic.”

— Johan Lagercrantz, CEO MatHem.3 3 MatHem slår rekord i nya kunder när trycket på e-handelfortsätter, My News Desk, November 17, 2020, https://www.mynewsdesk.com/se/mathem/news/mathem-slaar-rekord-i-nya-kunder-naer-trycket-paa-e-handel-fortsaetter-415225

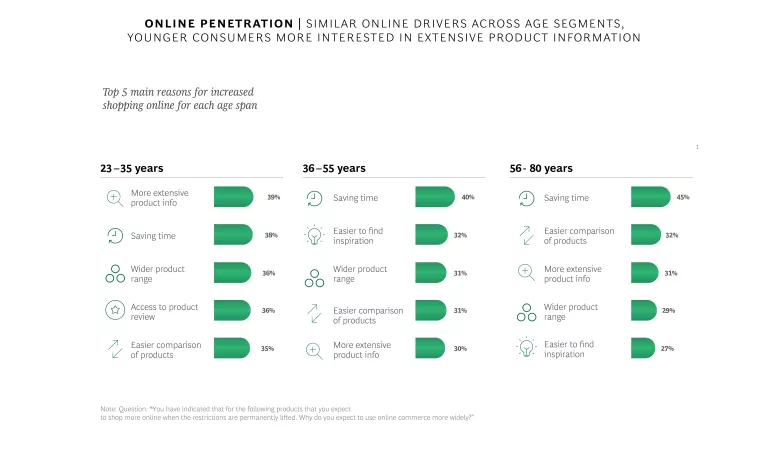

Saving time and accessing product information key e-commerce drivers

Consumers of all age groups in Sweden said saving time was a primary motivator leading them to shop online. The pattern was most evident among older age groups, whereas more extensive product information was the most important criteria for younger age groups. Other important motivators across all age groups were a broader product range and easier product comparison, giving a strong indication of the most important areas for e-commerce players to excel in order to stay competitive.

Since time savings emerged as the most important factor for the older generation, it’s evident that convenience is what’s needed to appeal to this target group. For the younger generations on the other hand, many other benefits are viewed to be highly important. Younger people seem to be more interested in product information than the older generation; doing research before a purchase is important to ensure that products provide good value-for-money. Thus, to target this consumer group, it’s important for any e-commerce offering to include extensive product information and, where applicable, allow for leaving product reviews.

Stores recovering but to a new reality

A tough year for stores in Sweden

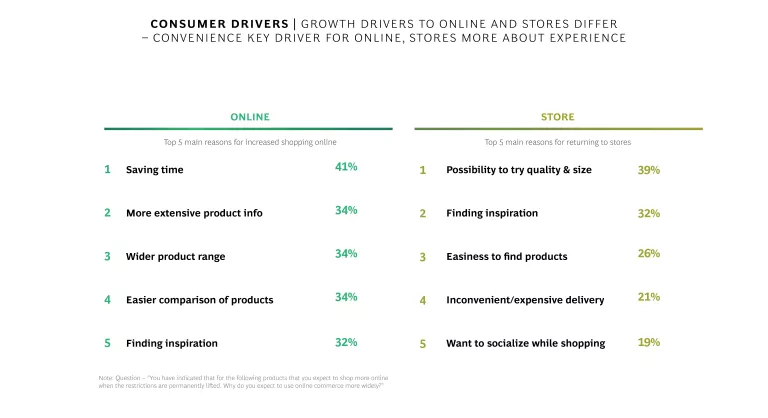

Unsurprisingly, the pandemic has led to unforeseen challenges for physical stores. Health concerns and work from home has kept people from the city centers and dramatically reduced store traffic. The shift is driven by more than just concerns over the pandemic; key reasons that were stated for not visiting stores included that it’s time consuming; a less exhaustive product range compared to online; and ultimately that it’s not as easy to compare prices and reviews (e.g. due to lack of easily accessible peer reviews).

Consumers returning but to a new reality

There is however some light at the end of the tunnel for physical stores. Our survey shows that in-person shopping is expected to increase by 7% from today’s levels, across product categories, once restrictions are lifted, as consumers are longing to assess quality in-person and find inspiration. Some in-store traffic will, however, be forever lost to e-commerce, particularly in categories such as Food & Groceries, Clothing, Shoes & Accessories, and Home Renovation Products. This calls for some tough choices where retailers need to review their store footprint, potentially shutting down some stores, and rethink the layout of remaining stores to cater to new behaviors.

Inspiration-driven showrooms and flagship stores

To align with these trends, future stores can take on roles such as driving brand awareness, enhancing consumer perceptions, and providing personal and tailored advice. Our survey shows that consumers see stores as a venue for inspiration (32% of respondents indicate that this is a main reason for returning to stores), and also look to stores to provide opportunities to try and feel quality and size (39% of respondents) or to socialize while shopping (19% of respondents). It will thus be key for retailers to evolve and innovate their store format and purpose, for instance through investing in selected flagship- and experience stores in premium locations and rely less on a large network of standardized stores.

Stores as complementors of e-commerce

As online shopping grows there are also opportunities to conveniently connect the online and offline experience where stores can play a critical role in fulfillment. As consumers are looking to save as much time as possible, the store can act as an e-commerce complement through in-store pick-up of online orders (click and collect) and by allowing fast delivery through leveraging in-store inventory. The future purpose of the store will thus have a stronger link to supporting omni-channel shopping delivery through increased consumer convenience and fulfillment speed.

Vaccination a key driver in return-to-store

The growth of vaccinations is expected to play a key role in leading hesitant Swedes back into stores. When our survey was conducted in May 2021, 30% of Swedish consumers said they expect to visit stores more often after they have gotten the vaccine. In the other Nordic countries, more consumers expect to visit stores roughly as often as before the vaccine, with 62% of Norwegian consumers and 78% of Finnish consumers indicating they will do so. Consequently, fewer consumers in Norway and Finland expect to visit stores more often once they get the vaccine. This implies that vaccination is a more significant key driver for return-to-store in Sweden than it is in other Nordic countries.

A suppressed need to treat yourself

Across all ages and income levels, approximately 40% of Swedish households stated that they had reduced their overall consumption compared to before COVID-19. The Swedish retail sector is still facing a significant sales drop compared to its pre-COVID levels, but it is making a comeback. As of April 2021, the retail trade index rose 7.2% compared to April 2020, with retail sales in durables increasing by 10.9% and retail sales in consumables rising by 3.3%.

Taking a broader view, the whole Swedish economy is clearly on the rebound. The Economic Tendency Indicator, which characterizes consumer and business sentiment regarding the country's economy, climbed from 113.5 in May to 119.3 in June, the highest in its 25-year history. The confidence indicator for the retail trade fell 4.0 points due to weaker sales expectations over the next quarter, but it still points to a stronger situation than usual.

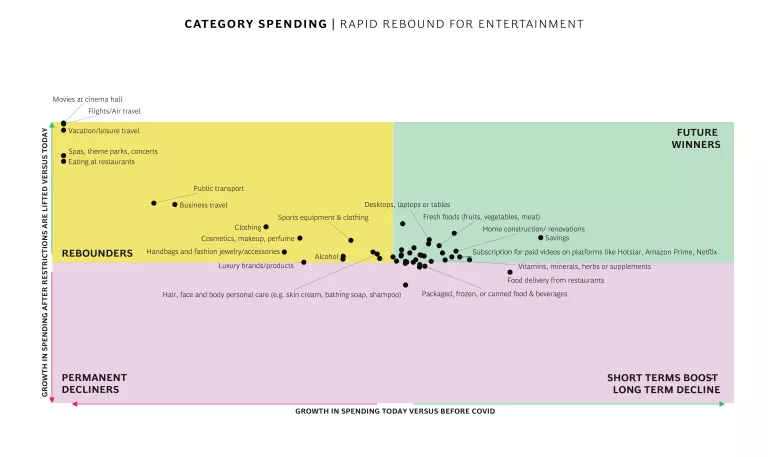

As Swedish consumers now resume spending, the pattern differs between categories. Broadly we see one group that has benefitted from spending patterns during the pandemic, now coming out as clear winners with retained high spending, while others that have suffered from the pandemic are making a strong comeback.

Permanent shift creating ‘future winners’

The new behaviors imposed by the pandemic have led to a boost for several product categories such as work from home equipment, home renovation, and fresh food. The overall reduction in spending has also led to an increase in consumer saving.

With Swedish society opening up again, these are clear ‘future winner’ categories where higher consumption boosted by the pandemic is expected to remain elevated even after restrictions are lifted. Spending increases within fresh foods, health, and home renovation are here to stay, with around 20% of consumers having increased their spend in these categories during the pandemic, and 95% expecting to spend at higher levels than before the pandemic. Interestingly enough, consumers also expect to maintain a higher rate of savings, somewhat contradictory to the overall wish to increase consumption. This speaks to consumers “wanting to have it all,” but also of a positive outlook of the future.

Comparing the Swedish responses to Finland and Norway, it is evident that new spending patterns are not unique to Sweden. Finland displays much of the same trends as Sweden, with Future Winner categories also including fresh foods, health, and home renovation. Norwegians on the other hand, seem to have a more pessimistic outlook on their spending, saying that 50% of the 50 categories surveyed will see a decrease in spend vs. today. Out of those categories, approximately half have already experienced a decrease compared to before the pandemic. The overall spending sentiment thus seems to be higher in Sweden and Finland, while Norwegians are more cautious about the future.

Return of old patterns creating ‘rebounder’ categories

Not surprisingly, categories related to entertainment (such as travel, cinema, air travel and restaurants) have seen the largest decline during the pandemic, driven both by restrictions and an overall reduction in consumption. There are now clear indications that these categories will rebound strongly as Sweden opens up, leading to a wave in more self-indulgent consumption. The most significant growth will occur in restaurants, vacation/leisure travel, spas, theme parks, concerts, and cinema halls as consumers start to return when restrictions are lifted. Consumption in these categories is expected to increase by as much as 65-70% once restrictions are lifted. Public transportation is also expected to rebound sharply, as face-to-face meetings make a comeback, in addition to clothing, cosmetics, and personal care products.

To capture the growth coming from these ‘rebounder’ categories, consumer companies must be prepared for a rapid return in consumer demand and get ready to cater to new customer preferences. While many businesses in these sectors and their employees have suffered a great deal during the pandemic, and are not out of the woods yet, players that have had the opportunity to invest in new capabilities will now reap the benefits and face a stronger outlook vs. their peers. Across these industries, new investments will likely be required to stay competitive in a potentially rapid comeback.

One example of an organization that has invested in new capabilities is the Stockholm-based amusement park Gröna Lund

Sustainability even further top of mind

If sustainability wasn’t already top of mind for everyone, it for sure is now. During the pandemic, Swedish consumers have started to take a closer look at where their products come from and are seeking more sustainable choices. 32% of respondents believe the importance of sustainability has increased during COVID-19. An even larger number (45%) have started to buy more sustainable products - of which 29% believe that habit to be permanent.

This goes hand in hand with a recent global BCG consumer survey, The Pandemic is Heightening Environmental Awareness, that showed that 70% of survey participants said they were more aware that human activity threatens the climate compared to before the pandemic. The global survey also found that 90% were equally or more concerned about environmental issues compared to the start of COVID-19.

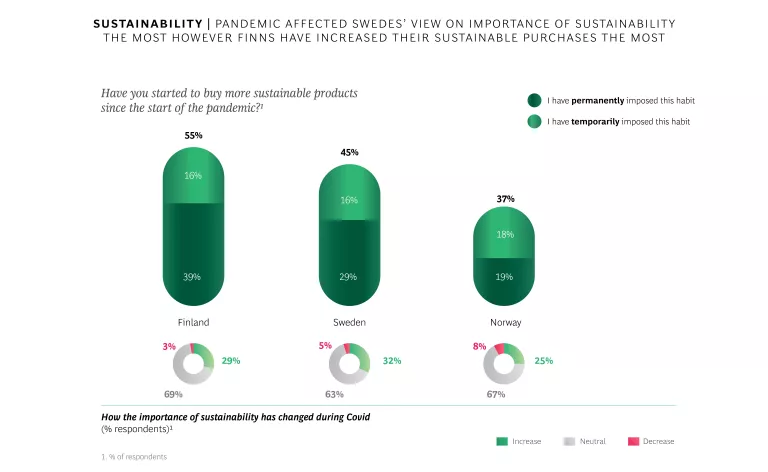

Compared to our Nordic neighbors, the pandemic has affected Swedes' view on the importance of sustainability the most with 32% increase in Sweden compared to 29% in Finland and 25% in Norway.

However - looking at what impact this has on purchasing patterns, the Finns have seen the largest acceleration in actually buying more sustainable products (+55%) compared to Swedes (+45%) and Norwegians (+37%).

Indifferent of starting point we can see that the perceived importance of sustainability and actual purchase of sustainable products are making big positive shifts. This is expected to have a large impact overall - but especially in Finland and Sweden where around half of the respondents are buying more sustainable products.

The desire for sustainability true for all products and demographic groups

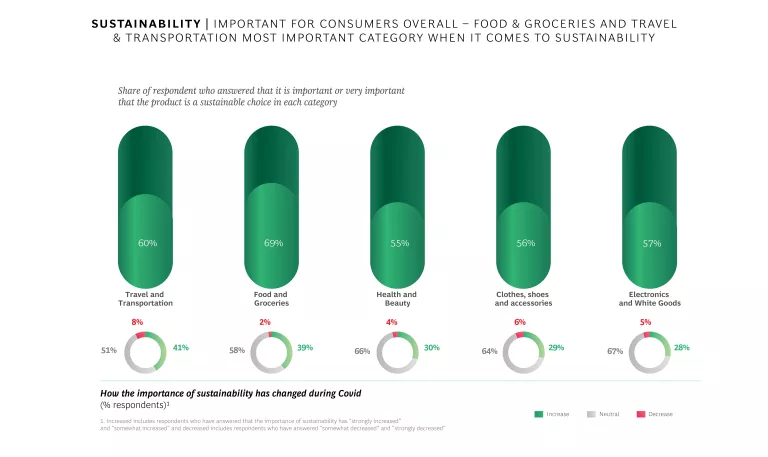

Swedish consumers demonstrated the increased importance of sustainability across all product segments, ages, and income levels. The most significant increase in sustainability importance appears in Travel and Transportation and Food & Groceries, where 60% and 69%, respectively, said sustainability is important or very important. Other categories where sustainability was more important included Health and Beauty (55%); Clothes, shoes, and accessories (56%); and Electronics and White Goods (57%).

Across product categories, the share of consumers that see sustainability as important is evenly spread across income- and age groups and varies between 55-65%. This shows that sustainability is not directly correlated to economy nor age. The only distinct difference between age spans is when it comes to how much the importance of sustainability has increased during Covid. Our survey shows that the importance of sustainability has increased more for consumers in the younger age spans (45% of respondents indicating an increase of importance) than for consumers in the older age spans (25% of respondents indicating an increase of importance) during COVID-19 across all categories except for travel.

Summary: Priorities to win in post-pandemic Sweden

While Swedes anticipate a return close to pre-pandemic life by the end of 2021, our survey shows that many changes in consumer sentiment and spending will remain permanent even after restrictions are lifted. It is imperative for businesses to adjust now, in order to adapt to new consumer behaviors and ride the post-COVID-19 wave of consumption.

Capture your fair share of the consumption rebound

The largest positive shift in consumption will be in the ‘rebounder’ categories. As stated previously, these businesses need to be on their toes in order to capture their fair share of the value as the rebound will likely be rapid.

We have identified three areas where retailers can position themselves to win in the short-term:

- Gear up your inbound supply chain, logistics, and fulfillment to be fully ready to deliver once the consumption rebound really takes off

- Drive demand and brand awareness through investing in intelligent digital marketing efforts, unlocking personalization and customization at scale

- While investing to capture the rebound, stay agile through scenario planning, ensuring responsiveness in a still-evolving future with a high degree of uncertainty

Convenience and scalable low-cost operations will be key for e-commerce

With the boost in e-commerce due to the pandemic, retailers need to create a strong value proposition and drive scale in e-commerce in order to reach long-term profitability. These players should strive to increase consumer convenience, online operations, and marketing to deliver a frictionless retail experience.

We see three important factors to drive higher e-commerce growth:

- Strengthen the strategic play between online and offline, fully integrating the two channels to capture different shopping missions for the same consumer and to offer a seamless retail experience

- With time savings and convenience as top priorities for 41% of survey respondents, ensure convenience and address any pain points in the consumer journey through smooth check-outs, relevant content, and fast last-mile delivery

- As online competition remains fierce, double-down on analytics for more effective customer acquisition through e.g. digital marketing to drive attraction and hyper-personalization to ensure retention

Evolving store purpose and format will be key for the offline channel

Changing consumer behavior brings a clear need to rethink store format and purpose in the post-pandemic world. Physical store networks must be optimized and re-defined to help drive both online and offline sales, not only at point-of-sale, but also to support building brand awareness, legitimacy, and credibility in order to attract new customers while at the same time engaging loyal fans.

We see three important moves for retailers to set up stores up for success in the future:

- Rethink the number and sizes of current physical stores, potentially close down some of them, and reduce space in others

- Re-evaluate the purpose of the store, and redesign the layout and offer to create a full experience rather than focus on only driving transactions

- Remodel stores to also serve as fulfillment hubs, by for instance enhancing supply chain efficiency, and upgrading network logistics & technology investments

Sustainability at the core

As seen in our survey, the pandemic has made sustainability a new baseline and hygiene factor for doing business. The heightened need to focus on environmental awareness clearly shows that consumer product companies need to invest in their sustainability roadmap to ensure long-term survival. The fact that 45% of respondents are purchasing more sustainable options since the start of the pandemic offers an opportunity for businesses to deepen their relationship with increasingly sustainability-minded consumers.

We see three important actions to take advantage of the increased importance of sustainability:

- Understand the starting point through a 360° scan of core operations giving an holistic view on each and every part of the ESG footprint (Environmental, Social and Corporate Governance) to prevent any unwanted surprises

- Invest in building a clear and compelling sustainability message closely integrated with your brand to avoid having sustainability communication fall short or be perceived as shallow by consumers

- Accelerate supply chain innovation to continuously monitor and analyze data on how goods are produced, what delivery routes are chosen, and more – and then use this as a selling point in communication

“In times of social distancing, it is crucial to challenge the conventional ways and find new solutions to offer the customer both safety and flexibility. We have launched many new shopping and delivery alternatives during the past years and are today offering a unique mix of stores, e-commerce on our own, and third-party channels - all of which are accompanied by several flexible delivery options. I am very happy to see that we are now further improving the interplay between our online and physical stores with even faster deliveries.”

— Stine Trygg-Hauger, Chief Commercial Officer at Clas Ohlson.8 8 Clas Ohlson introduces faster Click & Collect – now only 30 minutes from order to delivery, Clas Ohlson, October 14, 2020, https://about.clasohlson.com/en/media-press/press-releases/2020/clas-ohlson-introduces-faster-click--collect--now-only-30-minutes-from-order-to-delivery/

Closing remarks

After having seen a tough period of lower spending during the pandemic, our consumer sentiment survey clearly shows that brighter times are ahead. Consumer spending in most categories is expected to go back to pre-pandemic levels and lead to a much-needed recovery for several segments that have suffered deeply.

However, the pandemic has changed us at our core. Our findings show that some changed behaviors are only temporary, while others are here to stay. As society reopens in the coming months, we will learn what this new normal will look like. However, it will be more important than ever for consumer companies to be agile and flexible in finding their new role if they are to succeed in making it into the group of post-pandemic winners.