Banks today are under pressure on multiple fronts across the globe. Customers increasingly demand that their financial services providers offer the kind of user-friendly, frictionless experiences they are used to receiving from a host of consumer companies. Traditional and new competitors alike are investing to grab market share. Regulatory scrutiny continues and margins remain under pressure. Meanwhile, many banks find too much of their resources are consumed by inefficient processes that fail to deliver customer value. To meet these challenges, banks will need more than incremental improvement. Rather, a comprehensive transformation of the operating model is required.

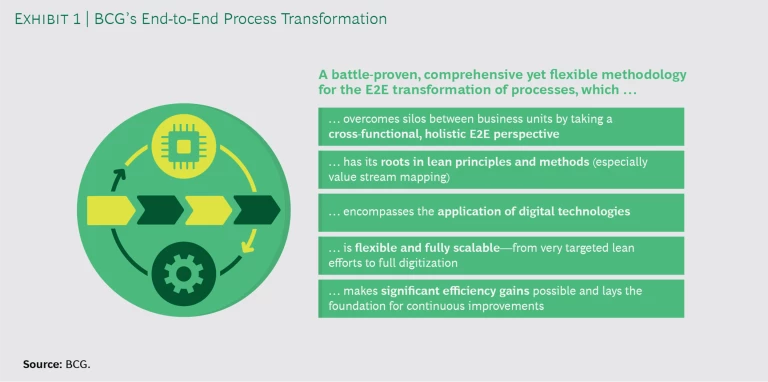

BCG’s End-to-End Process Transformation (E2E PT) is a powerful methodology that reliably enables banks to transform either individual processes or their entire operating model. (See Exhibit 1.) Combining “classical” process optimization methods and the advantages of digital technologies, E2E PT unlocks maximum potential, delivering significant efficiency gains, a more satisfactory customer experience, and hence, greater competitiveness. (See the sidebar “Applying E2E Process Transformation.”) The methodology engages employees along the relevant parts of the value chain in both opportunity development and solution design, helping to create a more empowered and engaged workforce.

Applying E2E Process Transformation

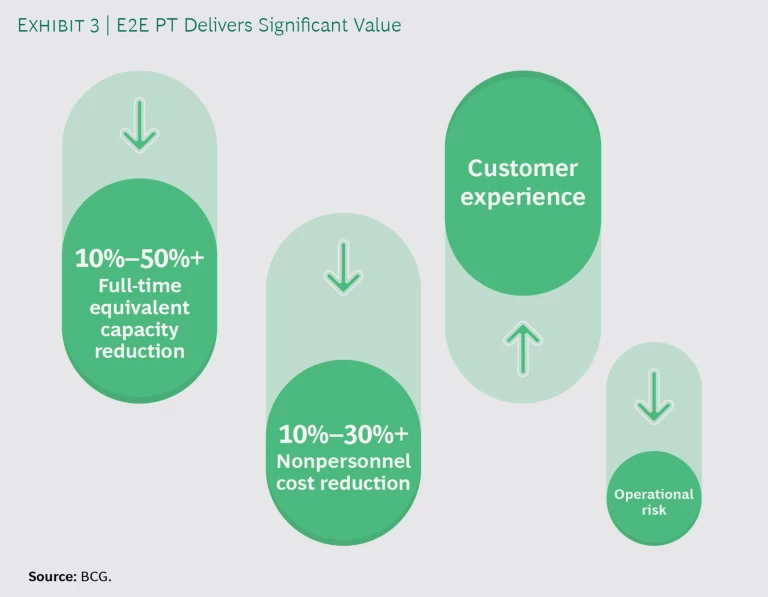

The example of a leading European bank shows how E2E PT can create leaner, more customer-focused processes. The bank’s costs had been increasing faster than those of its peers for a number of years. As part of an organization-wide cost-reduction and operating-model redesign program, BCG was engaged to support E2E optimization of several processes. An integrated team from the client worked hand in hand with BCG to develop the concept for a fundamental redesign and digitization, which incorporated more advanced processes such as the management of sales and customer service through third parties connected to the bank via APIs. The target design for one core business process implied a 40% release of full-time equivalent (FTE) capacity along with substantial nonpersonnel cost savings.

In another case, a bank’s corporate-clients division faced numerous operational constraints, including lack of standardization and a low level of automation in loan processing, which kept it from realizing an ambitious growth strategy. Working with a cross-functional client team, BCG redesigned and optimized the process end-to-end, including the relationship manager support model. The redesign eliminated waste and resulted in faster revenue growth. Relationship managers had 30% more time to devote to selling after their other activities were streamlined. New metrics enabled leaders to manage the business E2E for the first time.

A holistic E2E approach produces dramatic results when the goals are more technologically demanding as well. Another BCG client, a universal bank in a fast-growing economy, wanted to create a lean process mindset supported by machine learning, which would provide a more scalable platform to support its growth. BCG worked with this client to create an E2E process architecture supported by robotics and artificial intelligence and established a center of excellence to continuously identify, deploy, and improve processes. The project resulted in substantial improvements in efficiency, including reduction of manual data entry by 80% and reduction of processing time by 60%. In addition, complaints went down 20% and the client was able to reduce full-time employee capacity in the areas included in the project by 20%.

FIRST, DEFINE YOUR AMBITION

While some banks already know what process or processes they want to tackle first, others will want to start with a high-level assessment of all relevant business divisions—for example, retail banking—and then pick a pilot process to optimize. Whichever approach your organization decides to take, a successful transformation always begins with defining your ambition: the strategic goal that will serve as an inspiration for solution design. What is the business profile your organization aims to achieve? What specific processes are critical to your competitiveness, and do any of these need to be overhauled? For example, is it crucial to reduce the time it takes for your customers to open an account or secure an unconditional loan approval? As you consider the answers to these types of questions, always keep customers’ needs and expectations well in mind.

ESSENTIAL ELEMENTS OF E2E PT

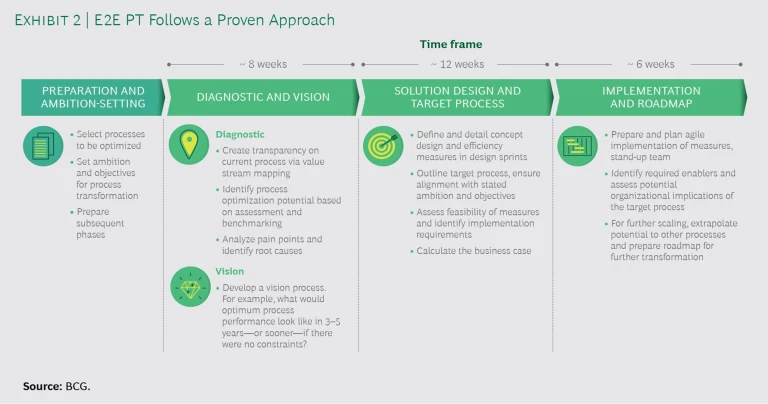

The core methodology of E2E PT is proven and fully scalable, and organized in three steps: diagnostic and vision, solution design and target process, and implementation and roadmap. (See Exhibit 2.)

Diagnostic and Vision. Start by gaining a clear understanding of your current E2E process: not as it’s documented but as it’s actually applied, day to day. A process documentation rarely describes reality accurately and cannot be used to identify problems that occur in practice, because the E2E process is typically much more complicated than it appears on paper; often, employees work through the same process in a variety of ways. A thorough diagnostic includes a comprehensive, end-to-end baselining of capacity as well as key metrics such as volumes, revenue, and direct cost. Ideally, benchmarking your E2E process versus your competitors’ can be leveraged to generate a preliminary set of opportunity areas.

Value stream mapping (VSM) is a core element of the diagnostic step, providing transparency into the process as it currently exists, including pain points. VSM uses interactive, cross-functional workshops with employees involved in the process day-to-day to understand how current E2E processes are applied in practice, mapping activity and information flows. VSM visualizes the current path of the customer through the process, highlighting inefficiencies and pain points.

Working collaboratively across functions, VSM helps prioritize opportunities for additional deep dives to uncover the root causes of the inefficiencies. By creating transparency across every step of the process, it helps you to overcome siloed thinking and develop a common E2E understanding, facilitating collaborative idea generation and building momentum for the entire optimization effort.

In addition to VSM that leverages knowledge of the people involved in executing the process, process mining quickly and automatically analyzes how a process and its variants are actually executed, adding a data-driven lens to the diagnostic. Software tools can help to determine how much time individual process steps and activities demand from employees.

At the same time that you are working to understanding the current process, it is important to storyboard the future-state vision. This is not meant to be an actual, detailed solution. To the contrary, the objective here is to be aspirational, setting aside any implementation or budget constraints; to lift workshop participants out of the thicket of daily execution and forestall incremental thinking; to radically reimagine what a specific process could be like if it was created from scratch, and how this change would transform the customer experience and the operating model.

How, for example, do you envision a more user-friendly, seamless E2E customer experience? Does it include an almost completely self-service experience, akin to Amazon’s 1-Click Ordering, in which the customer can obtain, say, a credit approval instantaneously? Digital exemplars and zero-based principles, which aim to redirect resources and employees to higher-value areas, can help you spark more creative thinking as you develop your vision, tracing a route to greater productivity. Only an aspirational vision can ensure that the actual solution is designed with a sufficiently high level of ambition.

Solution Design and Target Process. Once you have established your vision, it can serve as your North Star as you design a near- to midterm target process that can be achieved quickly via an agile implementation. Crafting your solution design is about identifying the best way to remedy a pain point at its root while progressing toward your vision. Often, the remedy will include a classic lever; sometimes, digital tools or automation offer the best way to achieve efficiency and create a satisfactory client experience; in other cases, the full benefits of digitization or automation can be realized only after a process has been substantially improved with classic levers. The key levers are:

- Simplification in areas including data requirements, documents and forms, process steps, decision rights, and even products

- Standardization, such as codifying the way customers are informed of the documents or pieces of information they need to bring to a meeting

- Differentiation, including setting up fast-track processes for simple cases and focusing resources on complex cases where they are most needed

- Redesign, such as moving activities out of branches to a centralized team, rethinking which data elements are actually needed for a process and at what stage in the process they are best collected

- Data analytics and artificial intelligence, which could include creating credit-decision engines that enable a faster and more streamlined customer experience

- Smart processing, such as robotic process automation, machine learning, optical and intelligent character or voice recognition

- Automation, for example, creating straight-through processing for high-volume sub-processes

Our integrated approach to process optimization not only ensures that your solution adheres as closely as possible to your vision, but in so doing, enables you to create maximum value. Key outputs in the solution design phase are a target process, a set of prioritized capabilities to achieve that process functionality, a high-level business case, and a roadmap for implementation. Prioritization of capabilities is based on improvement potential; time criticality; dependencies between measures; strategic relevance for the bank or its business units; and feasibility, given IT capacities and capabilities.

Implementation and Roadmap. As important as it is to achieve alignment between ambition and process transformation, it is equally so to secure agreement from senior leadership on the target process, its efficiency implications, and the resources needed to achieve it. Since E2E PT is cross-functional by design, it often challenges established structures and ways of working within the organization. To be successful, these changes must be called out and agreed upon before a team is tasked with implementation. Senior leadership must then commit to realizing the efficiency gains that will be reflected in its budgets. Finally, it is critical that sufficient resources with adequate capabilities are allocated to the implementation; this includes the involvement of staff from project management and IT, but also sufficient contribution from the line units affected by the change. As much as possible, there should be carry-over from the design to the implementation teams in order to guarantee continuity between target process and implementation.

Once agreement has been achieved on these points, you can prepare a roadmap and begin implementation. To achieve the best results, agility is a must; develop design sprints around each initiative using agile elements such as timeboxing with cross-functional E2E teams and strict product/output orientation. During implementation, make sure you adhere to your ambition and the agreed-upon target process. There will be challenges: not all details will be foreseen in the solution design, and not all solutions will be easy to implement. It is critical that the implementation teams stay true to the desired outcome and get the necessary leadership support. Daily alignment in standups, continuous improvement via retrospectives, and effective use of meetings ensure that the transformation remains aligned with your objectives, stays on-schedule, and takes new developments into account.

WHAT MAKES E2E PT SUCCESSFUL?

As stated earlier, it is a prerequisite to have a clear and bold ambition for the processes encompassed by the transformation. Senior executives across all relevant business and support functions must be aligned with this ambition and how the transformation project is to be governed. Critical to achieving alignment is evaluating the bank’s efficiency and performance at achieving customer satisfaction; this creates a common understanding of how the specific process or processes rank against operational and digital best practices and agreement on any changes those processes require. But driving that understanding down into the organization from the leadership level is also essential to making the transformation a success.

With a shared ambition established, apply your E2E approach systematically, breaking down silos between business units to establish a unified approach across the value chain. Focus on interfaces between different functions, analyzing them holistically rather than sequentially through all phases of optimization, and apply this holistic view to any trade-off decisions. Throughout the transformation, be disciplined in tracking benefits achieved to ensure the organization remains engaged and focused on creating sustainable value.

In executing process transformation, deploy one shared methodology and approach. Utilize the full set of tools—from classic optimization to full digitalization, depending on applicability and payback profile—to unlock efficiencies and cost savings to the highest degree possible. And, ensure you have process optimization teams in place that combine skills in methodology with relevant tools and an understanding of the business. By bringing these capabilities together, E2E PT creates substantial value for companies that adopt it. (See Exhibit 3.)

As you move toward scaling process transformation more broadly across the organization, there will be additional matters to consider. To ensure pace of change is sustainable and that you continue to reap the advantages of E2E transformation—at scale—you will need to create a governance structure that institutionalizes end-to-end process ownership throughout the organization. In addition to strong governance, we recommend setting up a process optimization/digitization core team to compile knowledge, own and further develop the methodology, and coordinate the transformation under the direction of the governance leadership.

Lastly, E2E transformation requires an approach to continuous improvement that can be driven by line management. Without engaging line management and the full production workforce, introduction of new processes will erode productivity. The production workforce needs to learn new tools and techniques to maintain, identify, and implement solutions and continuously improve. Simply embedding new digital tools inside human-centric processes generates new forms of inefficiency, which will necessitate yet another round of optimization.

Digital technologies will evolve, the possibilities they create will continue to grow, and customer needs and behaviors will continue to change. E2E PT is critical for banks that want to benefit from these shifts and can lay the foundation for a fully digital and customer-centric organization and operating model. At the same time, it is important to be ready to rethink and adjust your methodology as the environment changes, bringing new demands and opportunities.

E2E Process Transformation has proven successful in a number of industries, including banking. The idea of the digital factory has been talked about in manufacturing for years and institutionalized E2E PT is very much part of that strategic discussion. But the competitive advantage that an E2E transformation offers may be even more attractive for banks, with their often acute concerns about narrowing profit margins and customer demands for a smoother, more intuitive online experience.

As competition intensifies, end-to-end optimization will no longer merely be advisable—it will be imperative. BCG’s proven E2E Process Transformation methodology enables you to achieve it.