Given the imperative for value creation in today’s private equity marketplace, no PE firm can afford to neglect deploying digitization in its portfolio companies. This is especially true since—as BCG’s research and analysis have found—PE-owned companies, on the whole, tend to lag behind their non-PE-owned peers in digital maturity, possessing fewer digital strengths and less-developed digital capabilities and efforts.

Yet the fact that PE-owned companies are generally not found in the ranks of digital champions—that is, best-in-class digital leaders--—comes with some good news: PE firms have the opportunity to unlock a great deal of unrealized value in their portfolio companies by joining those ranks.

How Digital Champions Create Value

A study BCG conducted last year showed that digital champions outperformed peers across several dimensions:

- Executives from 78% of digital champions surveyed by BCG said that their companies enjoy a competitive advantage over peers, benefiting from offerings such as new digital services and products.

- 62% of digital champions achieved faster time to market than their industry peers—by using, for example, digital marketing, sales, and personalization.

- 60% realized a superior cost position, often by deploying future-ready tech functions, digital platforms, and DevOps approaches.

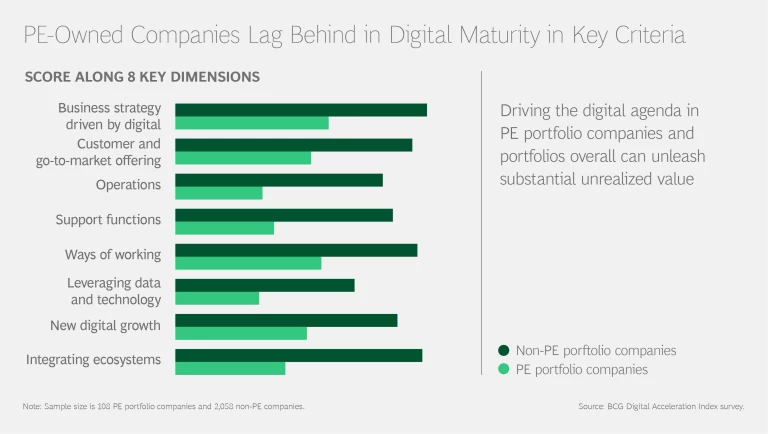

Using a survey with more than 100 data points, BCG has conducted outside-in assessments of the digital maturity of PE portfolio companies. Using 8 key criteria from BCG’s Digital Acceleration Index (DAI) , BCG’s analysis then compared the results with the averages from their respective industries.

In rating PE-owned companies against their non-PE-owned peers, the assessment criteria were:

- Having a business strategy driven by digital

- Digitizing the customer offering and go-to-market approach

- Optimizing operations with digital technologies and analytics

- Digitizing support functions

- Changing ways of working to focus on business value, such as agile

- Drawing on data and technology

- Achieving new digital growth from new digital products and services or from incubating startups

- Integrating ecosystems

PE-Owned Firms Lag in Digital Maturity

BCG has identified several PE-owned companies—in the consumer fashion industry, for example—that have achieved new digital growth by using omnichannel capabilities to address customer needs. But BCG’s findings in its assessment suggest that, on the whole, PE portfolio companies lag behind their industry averages on all 8 DAI criteria.

The assessments also revealed that:

- Company size does not drive the differences between PE portfolio companies and non-PE-owned firms.

- There is no clear difference in digital maturity between US and European PE-owned firms.

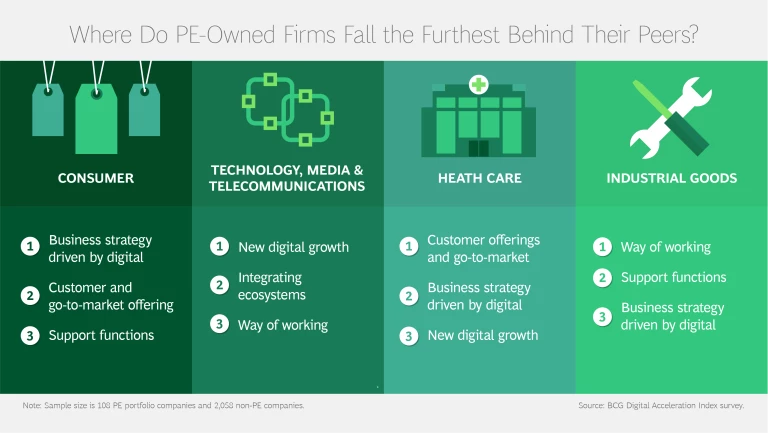

- Differences in digital maturity between PE- and non-PE-owned firms vary across industries. The gap is smallest in the consumer goods and the technology, media, and telecommunications industries. These industries are more focused than others on digital business models, go-to-market strategies, and product offerings. The difference is somewhat larger in health care and particularly large in industrial goods.

Another key finding is that PE-owned firms that lag farthest behind in vision—that is, that score lowest for having a business strategy driven by digital—are also laggards along every other criterion from the DAI.

Steps to Take Now to Close the Gap

Responding to the following three imperatives helps PE firms maximize the return from their investments in digital and boost revenue growth, improve profitability, and increase multiples at their portfolio companies.

Start with the equity story and the role digital will play

Before identifying which digital value levers you want to pull, clarify the role of digital in your company’s overall value-creation and equity story.

Such clarification must include a thorough assessment of industry-specific digital trends, including the risk of digital disruption your company is facing. It should also identify your digital opportunities as well as the starting point of the portfolio company.

At BCG, we typically see two primary vectors of digital value-creation as part of the equity story: increasing a company’s efficiency through digitizing core processes, and finding new growth by building new businesses.

Prioritize and sequence the use of digital value-creation levers

After devising the overall value-creation plan, you must choose which digital levers to pull, and in what sequence, by using three criteria:

- Return on investment

- Time to impact

- Fit with overall equity story

Quick wins, such as those achieved from digitizing back-office support functions and getting bottom-line increases, will be achievable within 6 months. But it will likely take 2 to 3 years before business-building digital initiatives yield measurable top-line growth and other positive outcomes.

Consequently, it is imperative that your deal team find the right mixture of digital initiatives—both short-term and long-term—as part of your portfolio company’s overall value creation agenda.

Define the role digital value creation will play in your operating model

To define value-creation plans that will maximize returns and offer the most effective governance support to portfolio companies, PE firms must also be clear about the role that digital will play in their own operating models. This role can typically be understood by asking three questions:

- What digital resources do I need at the fund level?

- How can I ensure that digital assessment becomes part of every due diligence effort and every value-creation plan?

- How can I offer the most up-to-date and effective support to my portfolio companies across industry sectors?

Ongoing Steps for PE Firms

When planning for the implementation period, it is important to note that the digital transformation of processes and entire businesses takes time. While some results can be realized quickly, a full digital transformation may take several years, depending on the company’s starting point.

However the always-changing digital landscape takes shape down the road, PE firms can be sure that digital tools and technology will remain essential to competitive advantage and to optimizing top-and bottom-line performance for the companies in which they invest.

Meanwhile, the untapped value in today’s PE-owned firms presents opportunities right now for PE investors to create significant value for their portfolio companies, their own investors, and themselves. BCG’s tools for digital value creation can help PE firms start taking advantage of these opportunities immediately.