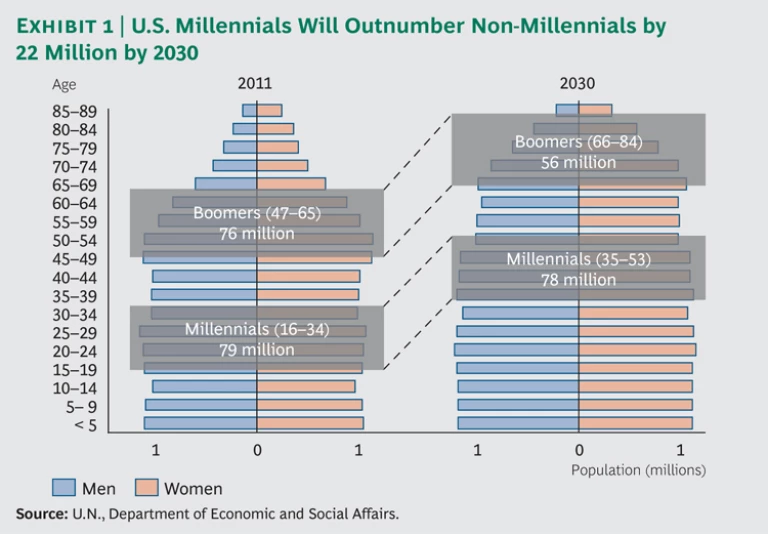

Move aside, U.S. baby boomers. The Millennial generation is bigger than you and growing in influence. (See Exhibit 1.) Now numbering 79 million (compared with the boomers’ 76 million), U.S. Millennials—people between the ages of 16 and 34—have been the subject of abundant analysis and commentary, mostly revolving around their avid use of technology, changing media-consumption habits, and entry into the workforce. Less has been written about Millennials as consumers. How do they interact with brands? Where do they eat and shop? How do they make buying decisions, and what factors influence their opinions and choices? Is it true that Millennials consume less than previous generations? On average, U.S. Millennials already shell out and influence the expenditure of hundreds of billions of dollars annually—an amount that will only increase as they mature into their peak earning and spending years.

Millennials’ expectations are different from those of previous generations, and companies will need to rethink their brands, business models, and marketing accordingly. Yet our research shows that many executives who make product and service decisions for their companies have negative or dismissive attitudes toward Millennials. Clearly, companies will have to understand, accept, and embrace the characteristics and values of this generation if they are to create and market relevant products and services that resonate with them and meet their needs.

Although the youngest members of the Millennial generation are still economically dependent on Mom and Dad, older Millennials are beginning to enter their peak spending years. While they are not yet set in their ways, they are forming preferences, exhibiting tendencies, and influencing one another’s opinions and behaviors. This generation engages with brands, channels, and service models in new ways limited only by the rate of technological advancement and innovation.

To better understand this generation, The Boston Consulting Group, along with Barkley and Service Management Group, surveyed 4,000 Millennials (ages 16 to 34) and 1,000 non-Millennials (ages 35 to 74) in the United States. A key goal of this research was to identify how behaviors and attitudes differ between the two groups and determine which of those differences are truly generational characteristics of Millennials—and not merely qualities associated with youth in general. We extended the broadly accepted definition of “Millennial” a few years beyond the upper end of the age range in order to capture the pivotal years during which Millennials transition to the next stage of life. This allowed us to gain greater insights into which of their attitudes and behaviors might change later in life and how.

The first of two reports, this overview of Millennial consumers explores who they are today and what they think of themselves and the world around them. We’ll also examine the six different segments of U.S. Millennials that our research revealed. In our second report, we’ll delve deeper into the industry sectors and categories that the survey addressed, such as how the members of this generation shop for apparel and groceries, where they eat out, how they travel, and their favorite brands relative to non-Millennials.

The Risk of Stereotyping

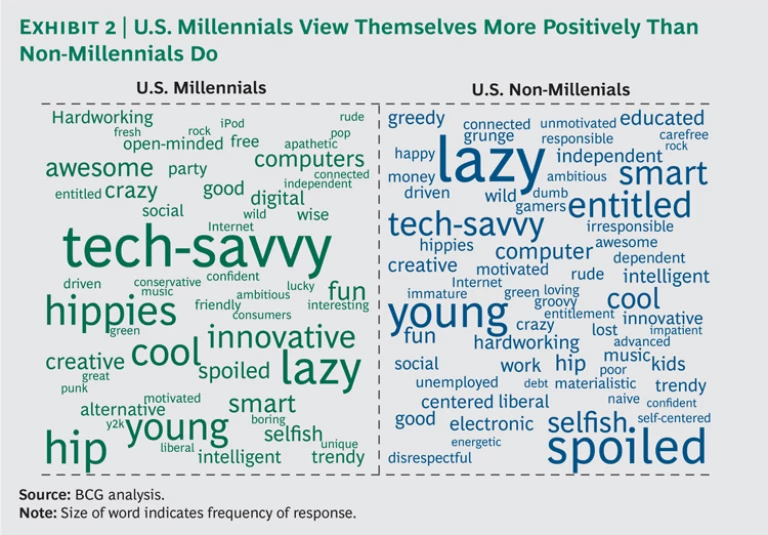

Our survey asked U.S. Millennials and non-Millennials which words best describe the Millennial generation. While Millennials’ perceptions of themselves are generally favorable, non-Millennials tend to view them far less kindly, often referring to them as “spoiled,” “lazy,” or “entitled.” (See Exhibit 2.) These perceptions may be coloring how executives view the Millennial consumer, preventing companies from understanding and fully addressing the product and service needs of this generation—and establishing strong brand relationships.

We found a generation engaged in consuming and influencing, one that embraces business and government and believes that such institutions can bring about global change, one that is generally optimistic, and one that has often-unexpected attitudes and behaviors. Those companies that truly “get” the Millennials and engage with them appropriately have an opportunity to differentiate themselves in the marketplace and forge long-term relationships with their customers.

Our research did confirm one stereotype: U.S. Millennials are extremely comfortable with technology. They are “digital natives,” meaning that they’ve largely grown up with technology and social media, using these new tools as a natural, integral part of life and work. Millennials consider themselves fast adopters of new technologies and applications, and they are far more likely than non-Millennials to be the very first or among the first to try a new technology. They also tend to own multiple devices such as smartphones, tablets, and gaming systems. More U.S. Millennials than non-Millennials reported using MP3 players (72 percent versus 44 percent), gaming platforms (67 percent versus 41 percent), and smartphones (59 percent versus 33 percent), while more non-Millennials reported using desktop computers at home (80 percent versus 63 percent) and basic cell phones (66 percent versus 46 percent). As a result, U.S. Millennials are much more likely to multitask while online, constantly moving across platforms—mobile, social, PC, and gaming.

Both groups spend roughly the same amount of time online, but Millennials are more likely to use the Internet as a platform to broadcast their thoughts and experiences and to contribute user-generated content. They are far more engaged in activities such as rating products and services (60 percent versus 46 percent of non-Millennials) and uploading videos, images, and blog entries to the Web (60 percent versus 29 percent).

It’s no surprise that U.S. Millennials spend less time reading printed books and watching TV. Only 26 percent watch TV for 20 hours or more per week (compared with 49 percent of non-Millennials), and when they do watch, they’re more likely to do so on their computers through services such as Hulu (42 percent versus 18 percent).

Generational Attitudes and Behaviors

Beyond Millennials’ widely recognized affinity for technology, our research identified a variety of unique behaviors and attitudes that these individuals are likely to bring to their next life stages.

“I want it fast, and I want it now.” U.S. Millennials are all about instant gratification. They put a premium on speed, ease, efficiency, and convenience in all their transactions. For example, Millennials shop for groceries at convenience stores twice as often as non-Millennials. They also value getting through the line quickly in so-called fast-casual restaurants (upscale fast-food chains without table service, such as Chipotle) (81 percent versus 71 percent) and care relatively less about “friendly” service. This preference for efficiency is even reflected in how they participate in causes. Of Millennials who make direct donations (34 percent), almost half donate through their mobile devices (15 percent), compared with only 5 percent of non-Millennials. To meet the expectations of this generation, companies will need to rethink their existing customer-service models. These consumers are always in a hurry, and it’s critical to determine how you can get them to spend time developing a relationship with your brand.

“I trust my friends more than ‘corporate mouthpieces’.” For this generation, the definition of “expert”—a person with the credibility to recommend brands, products, and services—has shifted from someone with professional or academic credentials to potentially anyone with firsthand experience, ideally a peer or close friend. U.S. Millennials also tend to seek multiple sources of information, especially from noncorporate channels, and they’re likely to consult their friends before making purchase decisions. For example, more Millennials than non-Millennials reported using a mobile device to read user reviews and to research products while shopping (50 percent versus 21 percent). “Crowd sourcing”— tapping into the collective intelligence of the public or one’s peer group—has become particularly popular. The reach and accessibility of social media have amplified the voice of individual consumers. Now anyone can become an expert. Messages that resonate are quickly spread and reinforced through user reviews and other online forums. Given this new reality, companies must monitor what is being said about their brands and participate in the conversation, especially since Millennials are much more likely than non-Millennials to explore brands on social networks (53 percent versus 37 percent). It may also be time to reevaluate whether current brand endorsers are credible and effective with this audience, because while the right brand advocates can be very influential, the wrong ones can be detrimental.

“I’m a social creature—both online and offline.” Although both generations value personal connections, U.S. Millennials use technology to connect with a greater number of people, more frequently, and in real time. Millennials use social-media platforms more than non-Millennials (79 percent versus 59 percent), and they maintain significantly larger networks: 46 percent have 200 or more “friends” on Facebook, compared with 19 percent of non-Millennials. Millennials feel that they are missing out when they’re not up to date with social-media chatter, and they feel validated when the community “likes” their posts. When it comes to making purchases, Millennials are far more likely than non-Millennials to favor brands that have Facebook pages and mobile websites (33 percent versus 17 percent). They overwhelmingly agree (47 percent versus 28 percent) that their lives feel richer when they’re connected to people through social media.

This desire for connection and shared experience also extends offline. Millennials are much more likely than non-Millennials to engage in group activities—especially with people outside their immediate family. They dine, shop, and travel with friends and coworkers, to whom they look for validation that they’ve made the right decisions. This can be good news for retailers and restaurants, since groups of consumers tend to spend more money than people who are by themselves. Smart companies are using location-based shopping services such as Foursquare and Shopkick to capitalize on this trend.

“I can make the world a better place.” The generation that was taught to recycle in kindergarten wants to be good to the planet and believes that collective action can make a difference. Millennials believe that working for causes is an integral part of life, and they are drawn to big issues. Instead of making one-off charitable donations in cash or in kind, they’re more likely to integrate their causes into daily life by buying products that support sustainable farming or “fair trade” principles, or by joining large movements that aim to solve social or environmental problems. Our survey found that Millennials, more than non-Millennials, prefer to actively engage in a cause campaign by encouraging others to support it (30 percent versus 22 percent) or by participating in fundraising events (27 percent versus 16 percent).

U.S. Millennials are receptive to cause marketing and are more likely than non-Millennials to purchase items associated with a particular cause (37 percent versus 30 percent). Millennials expect companies to care about social issues and will reward those that partner with the right causes. Recent examples of successful campaigns are Nike’s Livestrong campaign and the Nike(Red) “Lace Up, Save Lives” campaign to fight HIV/AIDS in Africa. Despite this affinity for causes, the great wave of volunteerism that was generally expected of this generation has not materialized. Millennials are only slightly more likely than non-Millennials to volunteer their time (31 percent versus 26 percent), a difference that is likely a function of more free time rather than a greater commitment to social issues. Indeed, the word “slacktivism” was coined to describe the sort of engagement in a cause that requires little personal effort.

Other key Millennial beliefs and attitudes that our survey revealed were a general egocentrism beyond what would be expected of young people, a global viewpoint, and overall tech-savviness. We also discovered two attitudes that appear to be more life-stage specific: a tendency to live in the moment and to make decisions at the last minute, as well as a desire to leverage the resources of large entities—such as government—to change the world rather than to act alone.

Not Your Typical Millennial: Disparate Personalities

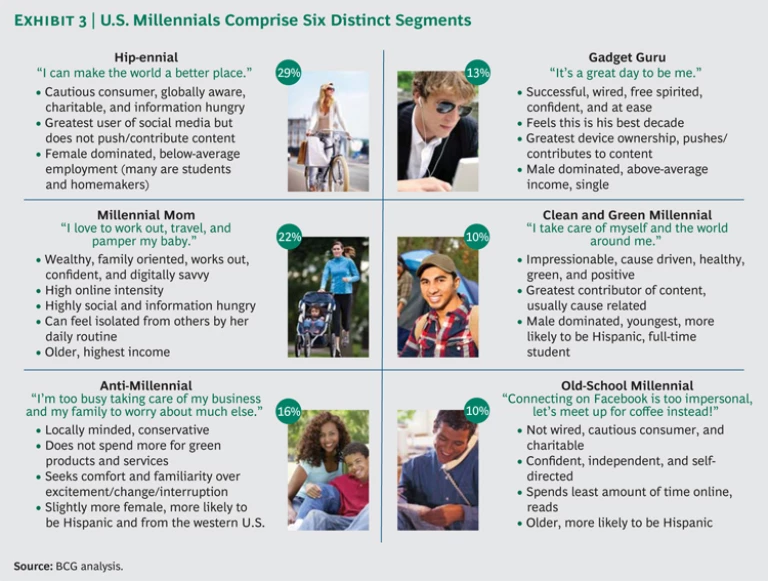

Despite these shared beliefs and attitudes, U.S. Millennials are by no means homogeneous. On the basis of their responses to questions about technology, cause marketing, media habits, and general outlook on life, we identified six distinct segments within the Millennial population: Hip-ennial, Millennial Mom, Anti-Millennial, Gadget Guru, Clean and Green Millennial, and Old-School Millennial. (See Exhibit 3.) Each one exhibits Millennial traits in varying degrees and combinations.

For instance, Marcus typifies the Clean and Green Millennial. He’s a 27-year-old graduate student with his own blog on the benefits of green living. He spends a lot of time online updating his blog and uploading articles and studies that support his opinions. He is a healthy eater and sees himself as an expert on green products, often taking time out of his day to rate environmentally friendly products and services. Charity work matters to him. He not only volunteers his own time, but also encourages his friends and families to support his causes.

Another example is Amy, a 28-year-old Millennial Mom and brand manager at Procter & Gamble. The Internet is her go-to source for daily information. She relies on online publications and social media to keep current on digital-marketing trends. When planning the week’s dinners, she finds new recipes and menu ideas online, and she shops Amazon Mom for deals on diapers and baby formula. She cares about staying in shape and exercises at least three times a week—often using her Wii Fit—and uploads data from her Fitbit. She uses Google Maps on her iPhone to find her way around and dreams of visiting foreign countries with her family one day.

Understanding and recognizing these distinct segments and their nuances is essential for companies that hope to develop effective product offerings, marketing campaigns, channel strategies, and messaging. A one-size-fits-all effort will fail to connect with every Millennial segment.

Staying on Top of the Trendsetters

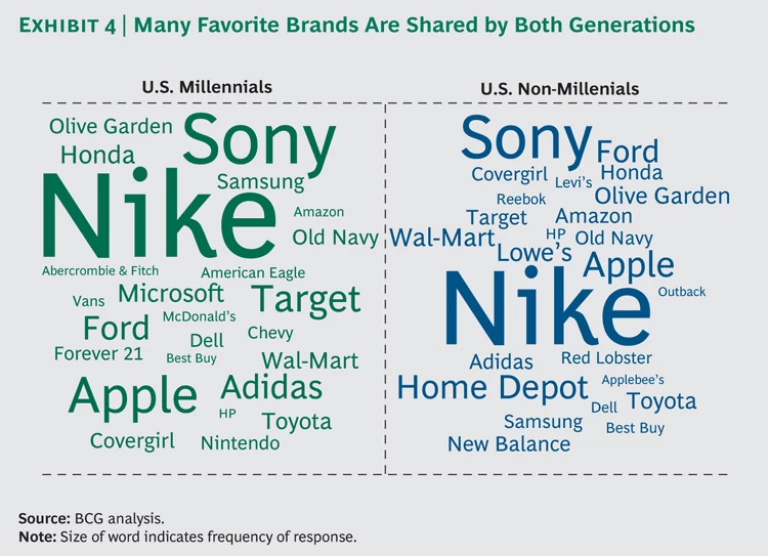

So what does all this mean for companies and their brands? For some, a fundamental reinvention may be in order. For instance, brands that target teenagers, college students, or young adults may have to be rethought for each successive generation. In other cases, companies may need to figure out how to introduce their brands to Millennials at the appropriate life stage. And for others still, reaching Millennials may simply require more relevant and resonant marketing messages. Some brands—such as Nike and Sony—are favorites among U.S. Millennials and non-Millennials alike and must try to remain so. Others, such as Target and Apple, appear to have a particular edge with Millennials. (See Exhibit 4.)

Mindful of the value and opportunities that Millennials present, forward-looking companies are planning ahead and taking action. In the area of marketing, content and delivery platforms already reflect the Millennial influence. Companies in the financial services and travel industries are beginning to rethink their business models and offerings, particularly where capital investment is involved. American Express, for instance, has already set up a digital-payment platform as an alternative to traditional credit cards to attract the under-35 demographic.

Amex has also partnered with Facebook, Twitter, and Foursquare to move beyond its older, more affluent customer base. Many companies are setting up Millennial advisory boards, changing their organization structures, and creating new in-house groups to focus on Millennials. Other businesses are reevaluating their service models, retail formats, and delivery channels in light of the needs and interests of this generation. And companies that must maintain their core while refreshing their franchise are experimenting with entirely new brands or lines of business.

Non-Millennial executives should examine their own attitudes toward the Millennials. Companies that fail to understand and embrace the needs and characteristics of this generation will have a hard time developing well-targeted, appealing products and services. Some may argue that the peak spending years of the Millennials are far enough in the future that companies can take their time in developing products and services that will appeal to them. But we believe that staying on top of Millennial trends is critical because they will ultimately influence today’s big spenders, the 35- to 74-year-old non-Millennials. Millennial attitudes in such areas as media consumption, social-media usage, advocacy and cause marketing, marketing messages, and shopping technology are leading indicators of future trends. Companies that pay attention today can gain valuable insights into tomorrow’s opportunities—and get a head start on capturing a larger share of the Millennial wallet.

Acknowledgments

The authors would like to thank Dominic Field, Catherine Roche, Kate Sayre, Miki Tsusaka, Steve Knox, Kate Manfred, Carrie Perzanowski, Neal Rich, Lainie Decker, Sean Bramble, and especially Cheryl Uynicky.