This is the second article in a series exploring the implications of CI functions in a wide variety of consumer-facing industries. The first piece in the series, “ The Introverted Corporation ,” was published in April 2016. In future articles, we will discuss how to integrate CI functions into business decisions and core processes, inhibitors to the function’s development, seat-at-the-table issues, and the new CI talent blueprint

Despite their best intentions to focus on customers’ needs, many companies spend more time looking inward. If you are not convinced of your organization’s internal focus, try this experiment: In your next internal meeting, divide a piece of paper in two. On the left side, record each mention of an internal topic, such as financial or operational performance, plans, metrics, organization, employees, or culture. On the right side, record each discussion of an external topic, such as competition, technology, innovation, purpose, testing, social media conversations, or customers’ behaviors, needs, and wants. If your “introverted” score is higher than your “extroverted” score, keep reading.

Consumer-facing companies in developed economies have experienced little or no growth since the global recession of 2008 and 2009. As a result, CEOs, business unit (BU) leaders, chief marketing officers (CMOs), and executive teams are looking outward, trying to spur growth by turning to new sources of customer information. These include “implicit” data such as biometrics, “structured” batches of big data such as online behavior, and “unstructured” data such as social media and call center conversations.

The Customer Insight Series

- The Introverted Corporation

- Why Companies Can’t Turn Customer Insights Into Growth

- Building a Better Insight Capacity

- How Customer Insight Can be a Powerful Business Partner

- Measuring the ROI of Customer Insight

In addition, these companies are experimenting with predictive methods for anticipating customers’ behavior, and they are evolving customer insight (CI) functions that can provide more relevant recommendations and ongoing execution support.

Integrating a CI function into a company’s core processes and decision making has proved to be extremely difficult. Our research has found that most companies struggle to make CI more than just a traditional market research operation. Those that succeed in elevating CI to a strategic position do so only with the commitment of their top executives.

Rewiring Your CI Function

Companies face rapidly changing technology and consumer behavior. The shopping habits of millennials, for example, are far different from those of older generations. Mobile apps are generating large volumes of new data from sources such as online behavior patterns, social media, user reviews, geolocation data, and mobile payments. Shopping is now integrated into daily activities, before and after traditional retail hours. Consumers’ demands for information, newness, and interactions with brands are increasing, as is the ability of brands and retailers to anticipate the needs of individual customers. As a result, sectors that once were predictable and stable—and that once could have survived a more internal focus—have become more volatile and uncertain. (See “ The Introverted Corporation ,” BCG Perspectives, April 2016.)

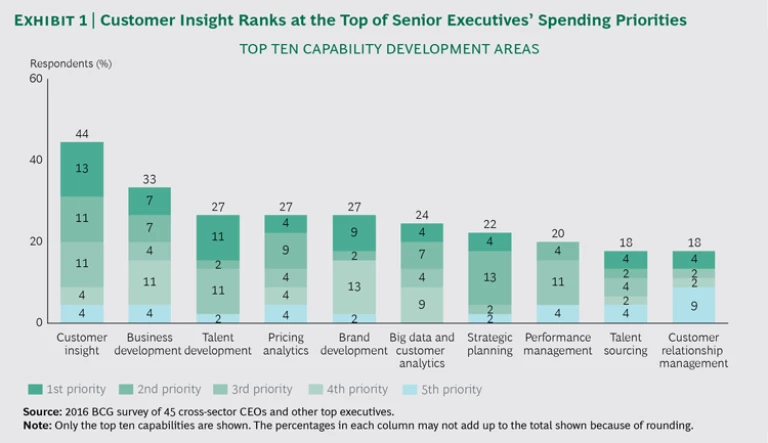

In this environment, companies must rewrite—indeed, rewire—their CI capabilities and teams. In a 2016 survey by The Boston Consulting Group, 45 CEOs, presidents, BU leaders, and chief operating officers (COOs) in a variety of sectors said that they consider customer and growth objectives to be the top priorities for their companies, followed by operational excellence, shareholder value creation, and customer experience. More than 75% of the senior executives overall—and 100% from companies with more than $5 billion in annual revenue—thought CI was critical to accelerating growth. When asked what capabilities their companies needed to develop, respondents cited CI and business development as the top two; advanced analytics was also an important focus, represented in three of the top ten categories. (See Exhibit 1.)

Surprisingly, many CI organizations have a long way to go. In fact, they have barely evolved in the years since BCG’s seminal benchmarking study. (See The Consumer’s Voice—Can Your Company Hear It? BCG report, November 2009.) In late 2015, BCG’s Center for Customer Insight, in partnership with Cambiar and the Yale School of Management’s Center for Customer Insights, updated and expanded the original study. The new study included more than 640 respondents from more than 90 cross-sector enterprises.

More than 60% of the participating companies reported annual revenue of at least $5 billion, and about 70% operate globally. Respondents included a balanced mix of senior executives, insights and analytics practitioners, and senior business line partners. They were evenly split between corporate and BU positions.

The Four Stages of CI Maturity

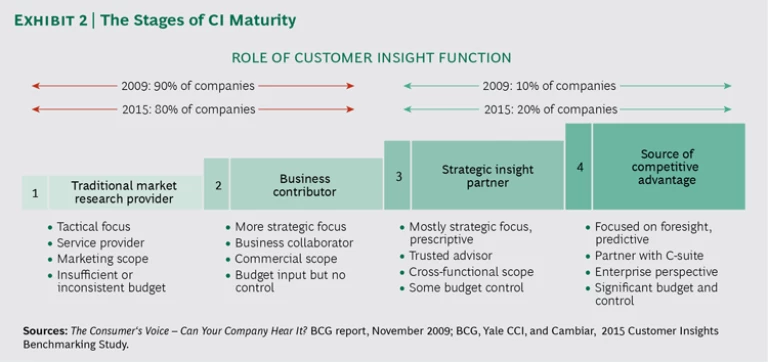

The pattern of maturation that we identified in 2009 is still relevant for CI groups and for emerging commercial big data and customer analytics organizations. Such groups move through four main developmental stages. (See Exhibit 2.) (Visit insightsassessment.bcg.com to evaluate the maturity of a CI function.)

1. Traditional Market Research Provider. At this stage, CI functions are mostly tactical and research oriented, focused on uncovering trends of sales of existing products and services, largely in existing channels and geographic locations. The group works on a project basis to produce data in response to line managers’ requests. It is limited in budget, head count, and scope of influence within the organization, and it receives limited senior executive support. The function’s communications concentrate on studies or project results that target a narrow audience, such as the managers who commissioned the research.

2. Business Contributor. For a CI function at this stage, research tends to have a real-time focus on short-term innovations such as packaging, form and flavor extensions, pricing, and promotions. The group concentrates on translating customer insights into business recommendations . Studies build on one another to start to form bodies of work and broad perspectives.

A function at this stage typically has active support from the most senior marketer in the company as well as greater access to senior and BU leaders. However, business leaders generally set priorities. Significant parts of the CI budget may exist outside the funtion’s control, and the group’s representation on the executive team and its exposure to the board are limited.

3. Strategic Insight Partner. At this stage, senior executives believe customer insights should guide most commercial business decisions. The CI function is a strategic partner and trusted advisor to the line. In addition to specialized research skills, CI team members demonstrate critical thinking, a willingness to challenge ideas, economic and strategic understanding, and business judgment. An executive team member—who is not the chief marketer—champions strategic research, and the CI team works with line management to translate customer knowledge into key business decisions. Together, the CI team and line managers form the beginning of a learning organization that becomes increasingly capable of anticipating customers’ needs.

The function’s strategic or real-time research focuses on product and service improvements and short-term innovations but also includes experimentation with new data sources and research methodologies. Results are communicated across the organization, not just to the function commissioning the work. A group at this stage will have more generalists and strategists, and its leaders will frequently come from nontraditional CI recruiting pools, such as consulting firms or another industry.

4. Source of Competitive Advantage. This stage remains elusive for almost all companies. At this level, a CI function is focused on new-to-the-world innovation, foresight, and predictive inquiry. CI is used in business decisions and core processes beyond market decisions, including research priorities, new-product development, strategic planning, M&A and portfolio strategy, employee engagement, and company branding.

At this level, the CI team exerts the greatest control over the CI budget. As one CI vice president we surveyed remarked, “We’re aiming for 100% budget control….We want to have visibility of the total spend and the ability to trade off against higher value and higher impact uses.”

A function at this stage provides feedback on relevant trends, offering an independent perspective on high-priority topics and customer populations and specializing in innovative methodologies. Functional leaders play executive roles, such as head of strategy, analytics, or marketing, and they often report directly to the CEO.

One senior marketer we surveyed said that for the team to reach stage 4 it must be “truly embedded” with business decision makers, seen as a “thought leader” rather than only a “project executor or data provider,” and capable of providing “world-class strategy and guidance that’s actionable to solve business issues.”

Stages 3 and 4 Are the Goal

In 2009, we found that 10% of the companies represented in our survey had CI functions in the third and fourth stages. Despite 2015 participants’ talk of “vision,” “transformation,” “restructuring,” and long “journeys”—and despite rising expectations—the pace of change has been glacial. Our 2015 benchmarking found that only 20% of companies are at stages 3 and 4. The study did not reveal cases in which a new CI group leapfrogged stages.

Even when companies adopt new functions and capabilities that incorporate stage 3 elements—such as advanced analytics, digital, or social media monitoring—these groups seem to be analogous to traditional market research groups: they lack executive support, report low in the company hierarchy, have limited interaction with the line, are constrained by small budgets and little budgetary control, are unmeasured in terms of return on investment, and offer narrow career paths to team members.

Our 2015 benchmarking revealed that companies with CI functions that reach stage 3 or 4 often do well on externally verifiable outcomes, such as customer loyalty and growth rates. Generally, companies with such functions are more likely to recognize CI’s effectiveness in business decisions and to measure the return on CI investments. Specifically, executives we surveyed in companies with stage 3 functions were significantly more likely (by 15 percentage points) than executives in companies with less mature CI functions to think that these groups materially contribute to financial performance, that they put their companies and BUs on faster growth trajectories (by 9 percentage points), and that they enhance their companies’ competitive advantage (by 20 percentage points).

All senior executives we surveyed whose CI functions had achieved stage 4 agreed that CI puts companies and BUs on faster growth trajectories; 50% said that CI was “very critical” to growth. Fifty percent of stage 3 and 67% of stage 4 companies try to measure the ROI of CI investments, and they report significantly higher satisfaction—83% to 88%—with CI’s ROI.

In companies with stage 3 or 4 functions, CI practitioners and business line partners are much more closely aligned on the impact, value, and importance of CI. As companies progress through the stages, CI practitioners and business line managers become increasingly satisfied with their relationship. By stage 4, the satisfaction rate is 89%. About 90% of the executives in our study agreed that by stage 3 line leaders pull CI into business decisions more than CI pushes its way in. As the line invites CI in, business partners’ satisfaction with CI’s contributions to business decisions increases, jumping to 90% overall in stage 4. In stages 3 and 4, line partners recognize CI’s value in identifying critical business issues before a study and then collaborating with the business on the scope and objectives.

Given these results, executive teams should explicitly reevaluate the ROI for CI functions that are mostly backward looking, descriptive, tactical, or confined to marketing.

Executive Support Is Critical to CI Maturity

A function’s progress to stages 3 and 4 must be pulled by the CEO and senior executives as much as or more than it is pushed by CI practitioners. Although CEOs often think that their CI functions should be doing more to capture value from external information, they and their executive teams must first look inward to examine their support for these groups. Seventy-three percent of the senior executives we surveyed said the CI function had the support of the CEO, while 40% said it was supported by the president or BU head, and 49% said the CMO supported it. However, CI practitioners and their nonexecutive business counterparts had a different perspective. Only 30% said that the president or BU leader actively supported the function, and only 19% to 32% said that the CEO did.

Part of this disconnect may be the result of changes in CI reporting functions and resource allocations since 2009 as well as the misconception at the top that the CI functional transformation has been completed or that the function is the purview of the CMO. Indeed, more companies in our 2015 study seemed to be shifting CI reporting away from the CEO and presidents and toward the CMO; the number reporting to the chief strategy officer has stayed the same. During the same period, the number of CI functions reporting to the BU leader or BU senior marketer dropped significantly in favor of centralized reporting, driven by CMO and marketing function transformations. In addition, chief information and chief technical officers saw increases in CI reporting driven by commercial big data and customer analytics.

In stage 3 CI functions, the leader has routine access to the executive team through advisory status or standing content sessions. One of the unique characteristics of stage 4 groups is the leader’s full-fledged membership on the executive team.

How to Get Going

Executive teams can take several steps to begin the process of reaching higher levels of CI maturity:

- Conduct a diagnostic. Interview stakeholders, quantitatively benchmark against peers, and observe the “life” of an insight through the parts of the organization and the processes in which it is identified, amplified, gains influence, and has impact—or is dampened and dies out.

- Attend one or two facilitated creative workshops with the executive team. Apply practical creativity techniques to achieve shared self-awareness; identify “magic points,” in which the CI function delivers on executives’ aspirations, and “tragic points,” in which CI falls short of its potential.

- Craft an action plan. Develop a strategy for changing executives’ individual and collective action.

Companies serious about attaining the highest stages of CI maturity should set a target of no more than 24 months. Longer initiatives do not signal a sufficient commitment to change and may get bogged down, leading to distraction and change fatigue.

Companies whose CEOs and executives are not committed to a fundamentally different CI operating model should not undertake the hard work of CI transformation. In companies with CEOs who do support the transition, however, senior executives should be updated regularly on the progress with regular reports from a steering or strategy committee. They should create an “activist” project management structure that ensures functional transformation through transparency, a “single source of the truth,” a focus on results instead of the completion of activities, accountability, accelerated decision making, and interventions when change initiatives are off track.

Companies should prioritize three types of cross-functional initiatives and identify executive sponsors and day-to-day leaders for each.

- Funding the Journey. Initiatives in this category fund the transformation and the external support it requires by closing performance gaps. Examples include consolidating market research suppliers; reviewing supplier pricing and terms; cutting or reallocating tactical, backward-looking, descriptive, low-ROI project spending; and attacking duplicative expenses and teams.

- Winning in the Medium Term. These initiatives, which require more lead time, are the building blocks of the functional strategy. Examples include building knowledge management systems; measuring the return on CI spending; developing learning agendas for executive teams and boards; experimenting with data sources and methodologies; and enabling CI to use strategic planning and budget tools.

- Organizing for Growth. Initiatives of this type enable the function to execute and sustain the transformation. Examples include expanding roles for the most talented employees; reworking job specifications, forming executive recruiting partnerships, and targeting new talent pools; developing career paths; developing rotation programs for future leaders; establishing functional training and development programs; and tying functional compensation to performance.

Developing a truly external orientation is a struggle for many companies. Taking a hard look at the maturity of the CI function may be a good place to start. But a CI function that’s treated simply as a provider of traditional market research can’t become a strategic player on its own. The effort to tap this overlooked source of competitive advantage must begin at the highest levels of the organization, with executives setting the tone for the process. By measuring, interpreting, and applying knowledge from customer experiences, and using this information to fuel decisions, companies can elevate their CI function—and their own position in the marketplace.