Airlines are difficult businesses to run. They are capital and labor intensive, they have complex operations and thin margins, and they encounter plenty of unpredictability. Big factors affecting results, such as fuel prices, weather, and macroeconomic shifts, are beyond management’s control. For all these reasons, companies focus intently on controlling costs, especially labor costs—the second largest expense category (after fuel) for most airlines.

While airlines concentrate on compensation, often using restructurings and consolidations to reduce headcount, wages, and benefits, a big opportunity to increase productivity typically goes unrealized and unaddressed. Improvements in the management of crews—the pilots and flight attendants who work every flight—can reduce labor-related costs, increase efficiency, and improve customer service.

At US mainline (nonregional) carriers, the total number of industry employees remained essentially flat from 2009 to 2014, as airlines took advantage of growth and consolidation to achieve economies of scale with their workforces. Over the same period, however, the number of pilots and flight attendants increased by about 5%. Generally speaking, crew costs are more difficult to scale because every flight requires a given number of cockpit and cabin crew members. Companies need to look for ways to maximize crew productivity.

The Crew Conundrum

The impact of crew management extends well beyond costs, although the costs themselves are substantial. Good crew management is critical to flight operations: missed flight connections by crews and lack of reserve crews are two of the largest controllable sources of delays and cancellations. Moreover, crew management affects employee morale and has a huge impact on customer service and satisfaction.

Managing crews is complex; airlines have many moving parts. The process involves multiple stakeholders, both inside the company (operations, finance, and HR, for example) and outside (labor unions, governments, and regulators). Many trade-offs are made, often based on imperfect information about the full consequences of any given decision. And the precise challenge facing each airline is unique: legacy and low-cost carriers each have very different considerations and constraints, as do regional and global carriers, and regulatory requirements vary by jurisdiction. Because of the complexity of the task, management’s efforts often end up compartmentalized, fragmented, or uncoordinated, and many opportunities are missed.

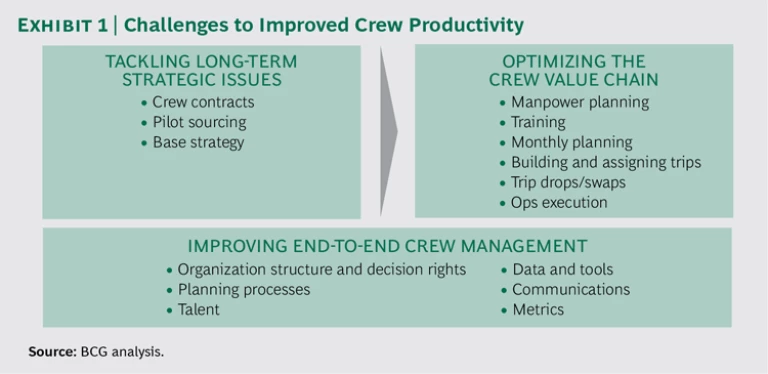

In our experience, which spans all types of airlines in the Americas, Europe, and Asia-Pacific, companies can improve crew productivity through a comprehensive approach that involves tackling long-term strategic issues, optimizing the crew value chain, and improving end-to-end crew management. (See Exhibit 1.)

Tackling Long-Term Strategic Challenges

For many carriers, contracts with labor unions govern all aspects of crew management, and managers often assume that the fundamentals are therefore fixed and cannot be improved. Our experience with multiple legacy and low-cost airlines shows that this is not the case.

Airlines often apply stricter constraints than those set by union contracts, creating self-imposed rules that can be more restrictive than the contract prescribes—for example, setting fewer flying hours than the bargaining agreement allows. It is also possible to restructure work rules through negotiation, moving toward arrangements that can deliver benefits to all parties, such as reduced costs and more efficient operations for the company, better quality of life for crew members, and higher levels of customer satisfaction.

While strategic changes are rarely easy and often take years to fully implement, they can deliver enormous value. One large Asia-Pacific carrier was able to move from a guaranteed-hours model to one that encourages crews to fly more hours for more pay, substantially reducing the need for reserves and cutting crew costs by 20%.

Companies need not wait for contract negotiations to make changes. We have found that they can unlock significant value through initiatives that do not involve major renegotiations, such as introducing part-time work arrangements on a voluntary basis. Or they can add a hybrid reserve mechanism, under which some reserve crews are given a combination of assigned flights and reserve days. This arrangement increases predictability for both the company and its reserve crew members, while ensuring a better match between flying needs and available resources.

Such initiatives usually require strategic thinking outside the complicated box of day-to-day crew management. They also take time and require careful planning and coordination with crew members and their representatives. They can be implemented in sequence with other changes, such as a new business model, a major expansion, or the introduction of a new fleet.

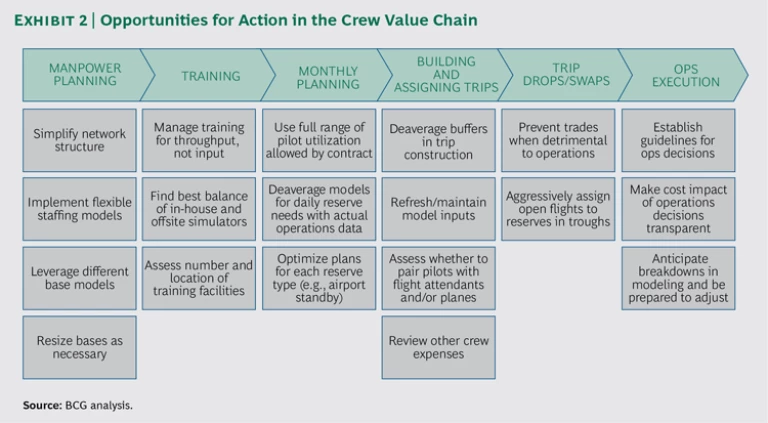

Optimizing the Crew Value Chain

At each point in the crew value chain (which includes planning, training, trip assignment, and execution), there are multiple levers that airlines can pull to solve specific problems. (See Exhibit 2.) But it can be a big challenge to understand the relationships among the various links and the ways in which actions in one area can affect operations and costs in others.

Address the entire value chain. Airlines that don’t take an end-to-end view of crew management can easily find themselves in the corporate equivalent of whack-a-mole. For example, setting pilot utilization at a low level during a trough can be a good way to spread the workload across the available workforce and avoid ending up with more reserve crews than needed (which would result in the additional costs associated with high guaranteed pay). But it can also prompt crew members who are assigned light schedules to pick up open trips to compensate for lost pay, leaving reserves underused. If this cause-and-effect relationship is not modeled accurately, it can lead to inefficiencies in reserve usage that erase the savings from the revised utilization model.

It starts with effective planning. Crew planning needs to be tackled in a comprehensive manner. Addressing any one crew-related issue can affect multiple points on the value chain. For instance, there can be a number of reasons why an airline has excess crew reserves, including too many crews based in the wrong locations, seasonal travel demands, or poor day-by-day alignment of reserve needs and available personnel. Only by understanding the reasons for the excess, and by looking at every part of the value chain, can airlines determine how best to address such issues.

One North American low-cost carrier found that it needed extra reserves because line pilots could decide anytime, even at the last minute, to take time off on days when they’d already been assigned a trip. Once the airline understood the costs that arose from this uncertainty, it offered pilots incentives to make their time-off decisions further in advance so the airline could plan its resources accordingly. Everyone benefited: the airline lowered its costs through better planning and reduced reserves, while pilots received extra compensation from the incentives.

The right talent and tools are key. Models such as the ones used to optimize crew pairings are highly complex, and many problems can undermine their performance. Airlines need people with both analytical skills and deep operational knowledge to build and maintain these models, which involve many sources of data and multiple variables. And these experts need access to detailed data on the performance of the crew pairings they construct—data that often resides in a different corporate department or function, which inhibits ready access. Trade-offs are an inevitable part of the modeling process, and it’s impossible, of course, to achieve 100% efficiency. But a thorough analysis of trade-offs between costs and on-time performance (OTP) enabled one US-based global carrier, which had estimated the cost of inefficiencies in crew pairings at about $50 million annually, to achieve double-digit savings without affecting OTP.

The impact goes beyond costs. How airlines develop and apply scheduling and utilization models can have a big effect on crew satisfaction and, by extension, customer service. But the impact of various moves is often difficult to assess, since each crew group can be affected differently. Airlines rightly search for scenarios in which everyone benefits, and although these can be easy to overlook and difficult to construct, it is worth the effort to find them.

A good example is changing a crew’s home base, such as when a postmerger consolidation involves a base closure or when crews are redistributed among existing bases. This can be disruptive to those crew members who must now commute longer distances or even move their homes to be closer to work. But combining such a change with an approach like virtual domiciles, which allow pilots to start trips from places other than their home base, can be an attractive option.

One global airline we worked with needed to restructure its staffing strategies across almost a dozen bases. Using a carefully designed, multistep process that allowed the vast majority of crew moves to be voluntary rather than mandatory, the company was able to reduce costs by millions of dollars and increase operational flexibility. The restructuring also gave crew members more career opportunities and, for many, increased the proportion of shorter trips in their schedules.

Complexity mandates an adaptive approach. In some cases, changes to crew scheduling or utilization can be so complex that their ramifications are all but impossible to foresee. Implementing new models progressively—while monitoring for unintended effects and adjusting as necessary—becomes the next-best option. Moreover, crew needs are a moving target: no airline can hope to develop and adhere to a fixed 12-month plan; circumstances inevitably will change. Nor can an airline focus only on short-term needs. The best bet, in our experience, is a 12- to 18-month plan—covering the full crew value chain (including hiring and training)—that allows for contingencies, is revisited monthly in close cooperation with all the relevant teams, and employs a wide range of tools to adapt to changes.

Improving End-to-End Crew Management

At the typical airline, the different tasks and responsibilities of flight crews are overseen in different functions or departments within the organization. It can be hard for any single executive to get a clear picture of the entire value chain (over which even the COO often does not have full or direct oversight). This puts a premium on end-to-end management and highlights the importance of several structural, planning, and communications considerations.

Organization Structure and Decision Rights. Lines of responsibility need to be clear. For example, is crew planning part of flight operations, is it a separate group, or is it linked to network operations? Both the structure and the decision rights—who ultimately decides and who participates, for example—need to be well-understood to get the best results in a timely and coordinated way. Feedback loops are crucial.

Planning Processes. How do all the relevant departments and teams come together to ensure that each understands its interdependencies with the others? How often do meetings take place? Which departments are involved? Who sets the agenda? Who attends? And who is informed later of the decisions made?

Talent. Teams need strong analytical capabilities, but they can also benefit from the addition of dedicated resources with actual line experience to help design and run models and plans that lead to greater efficiency (adjusting flight times to facilitate crew connections, for example). Introducing such dedicated resources can have a high return on investment, especially when combined with a strong test-and-learn culture that encourages employees to continually look for ways to improve operations.

Data and Tools. Many airlines use generic software, especially for manpower planning. The process is frequently error-prone and does not allow for appropriate scenario analysis. Airlines need reliable, agile tools that can be customized as necessary, as well as easily accessible operations data so that plan performance can be accurately assessed.

Communication. Employees value up-front and open communication. While crews are often seen as an obstacle to change, pilot and flight attendant satisfaction can be a powerful motivational lever, and a strong dialogue with crews and their representatives is crucial to finding mutually beneficial opportunities.

Metrics. What are the five to ten key metrics the COO should see every month? These need to go deeper than simply scheduled hours to include such factors as fully allocated cost per block hour, soft time, reserve utilization, and crew-driven flight delays and cancellations.

While the three broad levers described above apply to all airlines, their relative importance and the ways to apply them are entirely situation-specific. A comprehensive assessment of a company’s circumstances and opportunities, combined with a strategic perspective on what can be achieved, is the essential first step. Optimizing crew management can be a long and difficult journey. It requires experimentation, monitoring, adjustment as necessary—and persistence. Our experience shows that while the journey is challenging, the rewards—not just lower costs, but also improved productivity, crew satisfaction, operational integrity, and customer service—make it worth the effort.