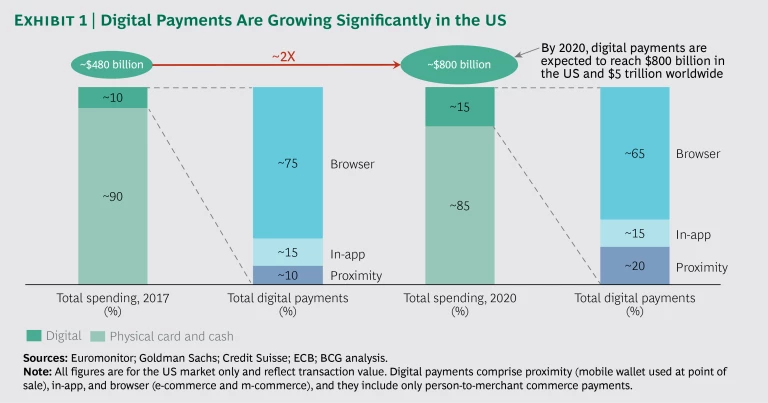

Few topics in retail banking have generated as much attention as digital payments—transactions that don’t involve physical cards or cash. The emergence of payment systems that are designed to function seamlessly with mobile devices, in-app methods, or browsers has prompted wide-ranging innovation from banks, digital giants, and fintechs. The volume of digital payments is soaring and by 2020 is likely to approach $5 trillion worldwide and $800 billion in the United States.

That growth brings new opportunities and risks for retail banks. Banks that fail to keep pace with market leaders in digital payments will lose share to nonbanks—and any reduction in payment interactions will have a ripple effect on the rest of the business, since payments often serve as the primary relationship gateway between banks and customers. Consequently, ceding ground in the payments arena can result in lower revenues elsewhere. This shift is already hurting banks in China and India, which are rapidly losing ground to the leading fintechs.

To combat this threat, banks need to redesign and personalize the payments experience, collaborate strategically to keep pace with the digital giants, and substantially improve their approach to protecting and monetizing data.

The Impact of Digital in Payments

Smartphones are now ubiquitous worldwide, and consumers use them for a multitude of daily transactions, from buying groceries to paying for public transport. With NFC payment terminals now commonplace, more and more consumers prefer to conduct contactless transactions, through phones in close proximity to the terminal. And as digital user interfaces have improved for apps and websites, consumers are finding it easy to forgo cash when paying for a wide range of goods and services. The result is rapid growth in digital payments. In the US, for example, digital payments are likely to increase from 10% of total payment volume in 2017 to 15% in 2020. (See Exhibit 1.)

The continuing move to digital payments will powerfully affect retail banks because payments remain central to their customer relationships. Although continued low interest rates, reduced transaction fees, and margin pressures have made the business more challenging, payment-related revenue (including revenue from accounts, noncard payments, debit cards, and credit cards) still accounts for a third of banks’ top line. As transaction volume for digital payments in large and small amounts continues to grow, the payment provider stands front and center to the customer.

Nonbank providers have jumped at this opportunity. Many of them now play a mainstream role in storing value or enabling exchange. This crowded space includes digital giants such as Apple and Google, fintechs such as PayPal and TransferWise, and merchants such as Amazon and Starbucks. Companies like WeChat and Grab, which began as nonfinancial service providers, have amassed so many users that they now offer payment services to support their wider e-commerce ambitions.

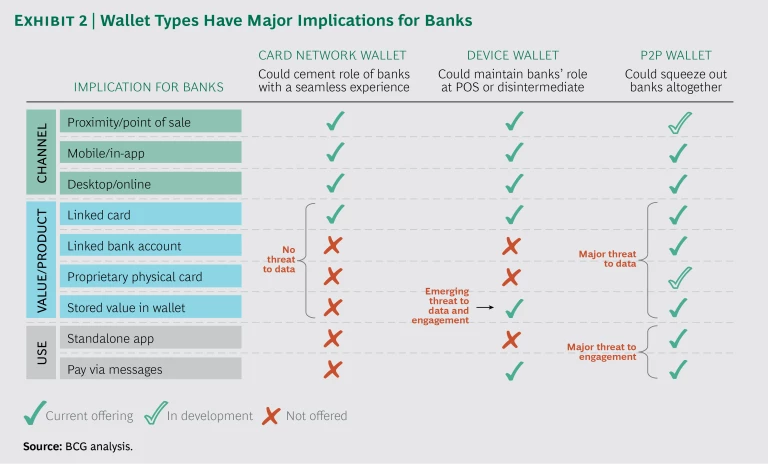

Three types of digital wallets—the devices that allow people to perform electronic transactions—will be on the front line of the battle for users. Visa, MasterCard, and American Express offer different flavors of card network wallets that largely preserve the status quo for issuers, while offering consumers a better experience than manual cards can. Device wallets, from the digital giants, can hold multiple cards and may eventually provide independent value storage (as with Apple Cash) or link directly to the customer’s bank account. Fintechs such as PayPal/Venmo and Paytm are offering P2P wallets, which completely remove banks from the consumer interface by performing direct account-to-account transfers. (See Exhibit 2.)

Although no dominant wallet type has yet emerged, banks have much to be concerned about. Customers are adopting device wallets at a growth rate equivalent to that of WhatsApp and similar social disruptors. With improved infrastructure for near-field communication, device wallets will gain further momentum. The digital giants can exploit their control of these devices to offer a seamless omnichannel experience across point-of-sale, in-app, and browser channels, giving device wallets an inherent advantage over competing payment types.

P2P (person-to-person) wallets are spreading rapidly, too, especially among younger consumers who appreciate their social aspect. In China, fintechs already manage more than 60% of all online payments. Taking advantage of that scale, they’ve quickly developed offerings in mainstream financial services, many of which focus on delivering a superior customer experience. To compete, banks’ payment offerings must be intuitive, engaging, and highly relevant to customers’ specific needs.

Device wallets and P2P wallets threaten the primacy of banks in two ways. First, they pose a threat to data by reducing the number of bank transactions, leaving banks with less data on their customers and less value stored in customer accounts. Second, they pose a threat to engagement by deterring customers from deepening their relationship with the bank. Primary customers rely on a bank for deposits, checking, and other core banking services; as a result, they generate up to 15 times as much value as casual customers do—so this second threat is especially serious.

Some banks, especially those that have a first-mover advantage or collaborate effectively, are thriving in the digital payment arena. Introduced just over two years ago, DNB bank’s Vipps P2P payment app is so popular that half of Norway’s consumers now use it. Singapore’s PayNow—a joint effort of the country’s major banks—attracted more than 500,000 users, a tenth of the adult population, in its first month. Beyond these examples, however, most bank-led efforts have failed to gain traction.

How Banks Can Respond

To improve their payment offerings and provide a more engaging customer experience, banks need to build on their core strengths, focusing on four imperatives.

Create a frictionless payment experience. To discourage customer defection to nonbank providers, banks must make signing up for and using payment products as frictionless and seamless as possible. Such a result requires reimagining and redesigning the payment journey.

To date, most banks have focused their redesigns on winning new account and credit card customers. Leading banks have doubled their conversion rates and increased their Net Promoter Scores by more than 15% by rethinking the application and setup process for credit cards. In our experience, however, this process is a relatively minor factor in customer satisfaction and operating cost. Customers care more about learning how to get the most out of their new card, redeeming reward points, paying bills, upgrading cards, resolving instances of fraud, and changing account settings—all of which involve multiple interactions.

To make their offerings more appealing, banks must pay greater attention to these aspects of the customer experience. Addressing them end-to-end can also deliver substantial cost savings, particularly through deployment of smart processing technologies. Tools such as machine learning and robotics can achieve savings of 25% to 35% in addressable back-office operating expenses, while also improving customer satisfaction. Banks can then reinvest these savings in the front-end experience.

Personalize and reward payments. Most banks underexploit the data available to them. For years banks have used data to generate leads, but new technology enables them to personalize rewards, features, service levels, and fees to encourage cross-selling and customer acquisition. Banks can now use advanced analytics to personalize the right offer in the right channel at the right time.

In practice, this means tailoring contact, rewards, and pricing to customers on virtually a one-to-one basis. The potential gains are substantial, as some players have boosted revenue by 15% and reduced churn by 10%. China’s Ant Financial, the financial services affiliate of Alibaba, has used scenario-based finance methods to bundle in-house financial services and provide personalized merchant-funded offers.

Banks can also fight back against competition from digital wallets with redesigned transaction and payment products that motivate customers to make banks their primary providers. Many banks already explicitly tier the rewards they offer on their products to attract customers and seal the resulting relationship. These programs reward such relationship-enhancing behaviors as larger and more frequent transactions, bill payment, contactless payments, and the addition of complementary products.

Collaborate to offer a credible response to third parties. As nonbanks pose an increasingly serious threat, banks are becoming more open to collaborating with other banks on industry-wide solutions. Many banks now recognize that control of the smartphone interface makes it easier for the digital giants to provide a seamless omnichannel experience. To counter that threat, banks must develop a new, much simpler standard for digital payments—particularly for the browser, where keying in a 16-digit card number is a major pain point. Otherwise, they risk ceding this space to nonbanks altogether.

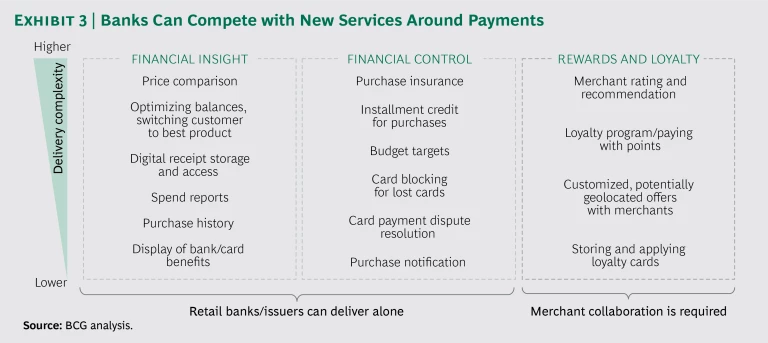

In the near term, individual banks can be pragmatic and work with the digital giants’ device wallets, as this will increase their card transaction volume. But they need to do more to get their cards to the top of third-party wallets. Besides establishing strategic partnerships, banks must differentiate on the basis of services they provide around the payment. In particular, banks can carve out differentiation in the areas of financial insight and financial control. Such offerings route customers back to the bank’s channels, creating new avenues for retaining and deepening the customer relationship. (See Exhibit 3.) For example, customers may want to switch cards on and off, redeem rewards, address a transaction dispute directly within the app, or switch or upgrade products easily. Separately, banks must deploy strategies via marketing, rewards, or integrated features to ensure that their cards are “top of the third-party wallet.” An example of a mutually beneficial collaboration is the one between JPMorgan Chase and PayPal, which enables Chase cardholders to easily add their Chase cards to PayPal accounts, see a digital representation of a Chase card in the PayPal interface, and redeem Chase reward points in the PayPal network.

Protect and monetize data. Banks sit on vast troves of data that they can use to understand customer behavior and to identify commercial opportunities. Better use of data can deliver substantial back-end improvements, particularly with regard to fraud, underwriting, operations, and IT. Despite spending $2 billion on data and analytics, the large retail and commercial banks in BCG’s data and analytics maturity assessment survey have so far generated relatively little commercial return on their investment.

Banks now need to assess all sources of data and identify new use cases to monetize. Some banks have developed new products or services from their data, demonstrating that new business models can emerge from superior data and analytics practices. For example, BBVA has created PayStats, an application programming interface for delivering anonymized and aggregated transaction data from BBVA cards and point-of-sale terminals. Third-party businesses can purchase this data from BBVA for business intelligence use in analyzing consumer habits and developing their own commercial opportunities.

The consumer payments sector is at a tipping point. Yet far too few retail banks are thinking strategically about payments as a source of competitive advantage. To remain relevant, these banks must redefine the payments experience, build personalized connections with customers, collaborate pragmatically with other banks and nonbanks, and realize new data-driven financial benefits. By moving swiftly and strategically—and building on their core strengths—they can offer a competitive and compelling payment experience and safeguard their primary customer relationships.