W

hen Soviet premier Nikita Khrushchev barked “We will bury you!” in 1956, it was not considered an empty threat. It was seen as a real existential threat to capitalism and the American way of life. Many Western intellectuals believed that planned economies might indeed outperform free markets, whose inherent shortcomings—such as volatile economic cycles, lower investment rates, and the inefficiencies of competition—put capitalism at a relative

Of course, reality turned out very differently, and we can see clearly today why planned economies almost invariably fail. They suppress diversity, initiative, innovation, and the adaptive capacity necessary for survival in an unpredictable environment. This lesson from history reveals an important insight: not only are there inherent limits to human intervention in a complex system—such as the economy—but we have difficulty seeing those limits before the fact.

The same lesson applies to businesses operating in today’s rapidly changing and unpredictable global environment. We have argued that businesses, like forests or oceans or ant colonies, are complex adaptive systems (CASs), in which local behaviors and events can cascade and reshape the entire

To succeed over the long run, business leaders must not rely only on the traditional “mechanical” approach to management, which seeks to direct a company toward desired outcomes by engineering processes and controlling the behavior of its various components. They must also learn a “biological” approach, which acknowledges the uncertainty and complexity of business problems and so addresses them indirectly.

In a complex adaptive system, local events and interactions among heterogeneous agents (in the business context, employees and units) cascade and reshape the entire system in a process called emergence. Those agents then respond to the system’s new structure in a feedback process that drives further changes to the system. The system continually evolves in hard-to-predict ways through this ongoing cycle of emergence and feedback.

To see how this dynamic applies to businesses, consider corporate culture. Culture is an emergent outcome of the behaviors and interactions of employees—their actions and words, and the way they treat one another—rather than what leaders and managers declare it to be. Executives are able to influence culture only indirectly by setting an example, providing incentives, and selecting and amplifying the right behaviors. Unlike factory production, which can be engineered and scaled up or down through hierarchical directives, culture cannot be directly controlled by managers.

For example, companies with a culture hostile to diversity have difficulty changing it precisely because this hostility usually arises not from a single controllable source but from the implicit assumptions, expectations, and behaviors of all employees. Plausible direct interventions such as compulsory diversity training and affirmative action programs tend to be ineffective—some research has shown that they can even retard progress. These top-down initiatives tend to fail because rules and compulsion frustrate employees’ need for autonomy and provoke negative reactions that undermine the attainment of the initial goal. The dynamics of complex systems can thus cripple mechanical interventions.

Managers instinctively prioritize predictable business problems and look for ways to “engineer” solutions to them.

There is for sure a growing understanding of the importance of complexity in business. Nevertheless, managerial instinct is still often mechanical and deterministic: managers instinctively prioritize predictable business problems and look for ways to “engineer” solutions to them. As a result, planning and optimizing are still the dominant paradigms of business strategy. For example, many CEOs and boards of directors view their objective as increasing total shareholder return (TSR), and they aim to do so through direct and controllable measures such as financial engineering and cost cutting. But making TSR an explicit priority and pulling the obvious levers of value creation can actually be counterproductive.

A case in point is Valeant Pharmaceuticals. Valeant’s strategy to drive shareholder value was to pull the levers that would increase profits in a direct and predictable fashion. For example, Valeant took advantage of lower tax rates abroad, tightly managed costs, and raised prices aggressively. It also minimized spending on R&D, preferring instead to acquire drugs developed elsewhere. These levers had an immediate positive effect on Valeant’s bottom line—indeed, Valeant was one of the best-performing pharmaceutical companies in the early 2010s. However, they ultimately impoverished Valeant’s long-term growth opportunities and alienated stakeholders in the broader ecosystem. The direct cause of Valeant’s collapse, in which the company lost more than 95% of shareholder value, was an alleged accounting fraud involving a specialty pharmacy booking fake sales. However, the more fundamental problem was that the mechanical pursuit of TSR growth did not actually create sustainable long-term value. Valeant is now under new management and has adopted a very different management philosophy, with a mission stressing patient health, a more prudent pricing and access strategy, and increased investment in R&D.

Although a mechanical approach works well in situations with high stability and low complexity, such as a production factory, it has a number of characteristics that make it ill-suited to CASs. For instance, it assumes linear interactions and straightforward cause-and-effect relationships while ignoring higher-order effects, and it suppresses adaptive learning by minimizing tinkering and deviations from prescribed processes. Mechanical management is becoming less and less effective in today’s business conditions, in which global competition and rapidly advancing technologies make both companies and their business environments more complex and less predictable.

Balancing the Mechanical and the Biological

Balancing the Mechanical and the Biological

We do not claim that biological thinking is a magic bullet. It goes without saying that some business problems are more amenable to mechanical approaches than others.

How should managers strike the right balance between the mechanical and the biological? It’s helpful to think of the two approaches as different bands in the electromagnetic spectrum. We are used to looking at the world through visible light. But it’s not that x-ray, infrared, and UV spectra are “wrong” or that the visible spectrum is “right”—they provide different ways of looking at the world, and they are each appropriate in different circumstances. We understand the world best when we know when to apply each perspective.

As companies and the environment both become more complex, managers will increasingly need a meta-management skill: the ability to understand the appropriate approach given the particulars of a situation. Applying the wrong managerial approach can negate the value of good thinking and execution downstream.

Here is a heuristic: biological management is most useful under conditions of high unpredictability and high complexity. These conditions are characterized by numerous and heterogeneous agents, nonlinear interactions, rapid cycles of emergence and feedback, and a high degree of co-evolution between business and the environment. Innovation and new business development are examples of activities that may benefit from biological management. It’s impossible to know before the fact which combination of people produces the best outcomes or what products best fit the market; managers should seek to create variance, tinker, and continue to receive feedback from the market until they find success.

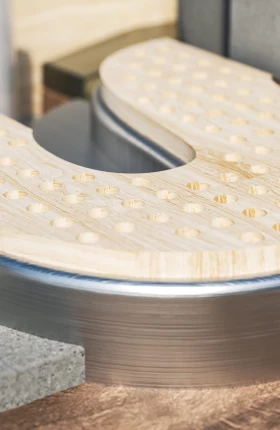

Mechanical management is most suitable for relatively stable and predictable environments. In departments like accounting, payroll, and legal, for example, traditional managerial approaches such as process optimization and efficiency maximization work well. In addition, environments that a manager can control precisely—a factory that has limited interactions with outside stakeholders, for instance—tend to reward mechanical management. It is for this reason that planning, process design, and lean methods all pay dividends in manufacturing. Ultimately, sound management must find the right mix between mechanistic and biological, adaptive thinking.

Pointing out the flaws of traditional management is not enough. Businesses need a pragmatic alternative. Instead of focusing just on the parts of businesses that are easily intelligible and predictable, leaders should start by acknowledging the inherent complexity of running businesses and taking the implications seriously.

To “manage” complex adaptive systems, companies must overcome several fundamental challenges. First, they must be able to understand and exploit the link between local behaviors and macro-outcomes and use the right leverage points to allow global change to emerge from local actions. They must also manage the conflict of interest between the system’s multiple levels. They must be able to maintain robustness in a changing environment as well as avoid being pulled into unfavorable basins of attraction (that is, conditions that are difficult to escape). Finally, companies must adjust their approaches in response to changing circumstances.

We propose six practices that address these challenges; taken together, they constitute a biological approach to management. The practices apply as much to businesses as they do to other complex adaptive systems, such as fisheries and cities.

1. Understand and exploit the link between local behaviors and macro-outcomes. It is no surprise that the process of emergence in a complex adaptive system cannot be described precisely. It is for this reason that the outcomes of these systems are nearly impossible to predict—and that the mechanical management of them is therefore often unwise. For instance, no degree of micromanagement of researchers’ behaviors can guarantee higher productivity in R&D departments. Controlling lower-level processes, no matter how precisely, cannot guarantee innovation.

Nevertheless, this does not imply that there are no useful links to be exploited between local behaviors and macro-outcomes. Rather, it implies that business leaders should look for these links using the right statistical approaches. For example, although we cannot predict the weather in New York a year from now—even if we have the most accurate meteorological measurements possible—we can still be confident that we should bring a coat if we are going there in January. Likewise, venture capitalists and startup accelerators know that they cannot predict the success of particular companies they fund; instead, they seek to take advantage of the law of large numbers by managing a portfolio of numerous

Another important business example of such a link between macro and micro scales is the experience curve, which connects the cumulative production of a good with its unit cost of production. Typically, each time cumulative volume doubles, the unit cost of producing a good decreases by

How can business managers learn to identify such links? First, they should use the right tools. Agent-based modeling and other local interaction models, for instance, can produce rich insights about, for instance, how behaviors propagate and how small changes can have a large impact. Second, they should learn to look at their problems through a statistical lens. As is true of the climate, venture investment outcomes, and the experience curve, most of what we can say about complex systems is statistical and inductive rather than deterministic.

2. Find and use the right leverage point in the system. In systems without complexity, such as a mechanical watch, the point of highest influence is usually clear; changes propagate predictably from the beginning of a causal chain. In complex adaptive systems, the right approach for intervention is rarely obvious because of feedback loops, nonlinear relationships and nonobvious cause-and-effect relationships. For example, the reintroduction of wolves into Yellowstone National Park set off a cascade of ecological changes—not only increasing the ecosystem’s diversity but also restoring willow and aspen populations, thereby stabilizing riverbanks and modifying river flow. Surprises and unpredictable outcomes are the norm when intervening in a complex system.

How, then, should executives think about interventions in complex businesses? They should start by tinkering with varying degrees of directness. Business interventions exist on a spectrum of very direct to very indirect; the right level can be discovered only through experimentation. Take again, for example, the challenge of enhancing corporate diversity. The most direct intervention might be to set a hiring quota. However, there are many other less direct approaches, from shifting the pool of candidates, to addressing inherent bias in HR processes, to reducing the role of subjective judgment, to redefining the concept of diversity. Typically, indirect interventions—those that change the mindset, context, and assumptions informing particular actions—prove to be more effective because they touch the deeper, more persistent drivers of behavior. Moreover, tinkering at multiple levels of directness generally beats pure deduction in identifying such measures.

Therefore, finding the right leverage point often requires expanding the scope of problem solving beyond the direct and obvious level. Consider, for example, how Intel came to dominate the microprocessor market by starting from the right leverage point. Before the 1990s, computers were defined by their brand, software, and specs—no one thought that the brand of a microprocessor made much difference. Intel’s marketers naturally focused on their direct clients—the design engineers at computer manufacturers. Their challenge was that as the microprocessor market matured, microprocessors started to become commoditized and the adoption of new products slowed significantly. In 1989, Andy Grove, then chairman of Intel, let his technical assistant run a marketing experiment with a $500,000 budget: instead of marketing to design engineers, Intel would target consumers

3. Manage conflicting interests between levels or agents. A fundamental challenge of managing complex adaptive systems is that they often consist of multiple levels, whose interests can conflict. Employees, businesses, and the players in broader business ecosystems all have separate interests. Business leaders must strike an equitable balance between levels.

To do so, they should follow two principles: first, they should establish mutualism, reciprocity, and fairness in the interactions among agents and between levels. For example, an ecosystem orchestrator should ensure that all participants receive an equitable share of the value the ecosystem creates. Second, they must make sure that the higher system levels provide real feedback to lower levels and allow for local adjustment and failure. Put simply, there must be mechanisms to amplify desirable outcomes and diminish undesirable ones.

In human CASs, transparency and fairness of institutions make trust and collaboration possible. Elinor Ostrom, for example, studied the conditions under which fisheries are able to self-organize in order to avoid the Tragedy of the Commons (a situation in which stakeholders overexploit shared resources, to the detriment of everyone involved). Her conclusion was that trust, reciprocity, and transparency were some of the pillars of groups that successfully self-organize.

One of the surprising features of complex adaptive systems is that local failures are costly in the short run but essential for the viability of the larger system in the long run. In nature, periodic local forest fires temporarily harm ecosystem productivity but help avoid catastrophic fires that damage the ecosystem over a much longer timespan. There are clear analogues in business: companies that keep failing businesses alive can avoid short-term pain, but they ultimately lose vitality because of increasing complexity, loss of focus, and resource misallocation. The tension between CAS levels is never resolved if local failures are prevented.

One of the surprising features of complex adaptive systems is that local failures are costly in the short run but essential for the viability of the larger system in the long run.

The Japanese media company Recruit exemplifies how companies can grow sustainably by building healthy ecosystems. Recruit, one of the most successful large companies in Japan, had a CAGR of close to 20% from 2011 through 2016 in a sluggish economy. This growth has been driven by the cultivation of various ecosystems (in areas as diverse as tourism, dining, and used car sales) in which the company serves as an orchestrator, promoting the long-term success of multicompany ecosystems rather than just its own P&L.

For example, Recruit created an ecosystem of small businesses by offering an iPad-based POS system called AirREGI free of charge. Through AirREGI, small businesses are able to access outside service providers and developers in areas such as advertising, accounting, work force management, procurement, payment processing, and even cutting-edge recommendation engines powered by machine learning. The initiative grew explosively, reaching a hundred thousand businesses in its first year, partly because Recruit was willing to postpone monetization in order to maximize the value of participating in the ecosystem. For instance, Recruit sacrificed some immediate profits by opening up the AirREGI ecosystem to third-party providers—even where it had its own competing services or the capability to build them. By doing so, Recruit not only promoted ecosystem health but also enhanced the vitality of its own teams by exposing them to external competition and collaboration.

4. Maintain robustness in a changing environment. One of the most important challenges in managing a large, complex business is making it robust in the face of shocks. In a complex adaptive system such as a business, which evolves constantly along with the environment, it is impossible to enumerate all possible sources of risk. Instead of addressing each individual risk, then, managers must instill heterogeneity, redundancy, and modularity—properties that enable systems to withstand and adapt to shocks.

The human immune system is an excellent example of a system with such properties: it has a diverse set of antibodies and responses to address myriad potential attacks, three layers of defense, and loose boundaries between levels, which confine infections to one part of the body. If any of these features were missing, people would not survive for long except in a sterile environment. These principles apply just as much to businesses. Moves such as building financial buffers, investing in diverse people and initiatives, and building in redundancy for critical functions all help ensure long-run survival.

These basic properties of robustness are important in complex adaptive systems because complexity can amplify the potential impact of shocks. Interactions within the system are nonlinear, so small perturbations can compound to large, destabilizing transitions as they are propagated throughout the system. The recent bankruptcy of Westinghouse is a case in point. The downfall stemmed directly from the acquisition of CB&I Stone & Webster, a nuclear construction contractor. The inherent complexity of the nuclear construction business amplified liabilities involved in the acquisition, which grew to more than $9 billion. The seemingly innocuous $229 million acquisition turned out to be an equivalent of betting the house. Westinghouse went bankrupt because it was not properly insulated—both its modularity and redundancy were compromised.

5. Avoid unfavorable basins of attraction. Complex systems often have configurations or situations toward which they move naturally. These so-called basins of attraction can be favorable or unfavorable, but they have a reinforcing feedback cycle, so they cannot be escaped through small perturbations. CASs are therefore at risk of stagnation and collapse when they fall into an unfavorable basin.

In business, a prototypical unfavorable basin of attraction is the success trap, which successful companies can fall into when they focus on exploiting known, validated opportunities (their “success formula”) and lose the ability to take risks, explore, and create new growth opportunities. Our research has shown that this is a measurable risk plaguing large, established companies—in fact, seven out of ten companies that fall into this trap fail to escape it in five years. Large companies are the most vulnerable because their momentum makes it difficult for them to take sharp turns. They can run into unfavorable basins even knowing that they lie ahead.

To stay out of unfavorable basins of attraction, companies must develop the habit of nurturing variety in behaviors and encouraging actions with unpredictable but potentially large payoffs. It is not enough to promote tolerance of failures—instead, companies should actively foster initiatives with a high likelihood of failure. Intrapreneurship programs, self-disruption units, and minimum failure rates are all rarely used but potentially effective ways to promote new innovation initiatives. Most businesses are entrenched in a mechanical worldview—managers want to be able to explain their endeavors, employees want to avoid failure, and investors want to see consistent returns—so they tend to tolerate insufficient variance. It requires an especially strong push toward risky initiatives to get companies out of the success trap.

Amazon, despite enormous size and success, continues to epitomize this approach. It starts from the top: Jeff Bezos, in his April 2016 letter to shareholders, declared that Amazon is “the best place in the world to fail.” He explained that a company should take bets that are 90% likely to fail, as long as the potential payoffs are high enough. For example, Amazon Marketplace was an outcome of persistence after two successive failures—Auctions and zShops. The willingness to continue taking big swings despite strikeouts has allowed Amazon to hit home runs in many disparate areas, not just in online retail with Marketplace, Prime, and FBA, but in completely new endeavors such as AWS, Kindle, and Alexa.

6. Adapt approaches in response to changing circumstances. One of the traps of mechanical management is the tendency to seek universal and permanent solutions to complex problems. Processes and procedures are alluring, especially in large organizations, because they seem to be ways to tame complexity by dividing problems into simple tasks that can then be managed separately and predictably repeated. The problem is that the world is more complex than these static universal processes acknowledge—and even if they work for a while, they inevitably become stale and outdated as the environment changes.

In a complex world, there is no universal formula for problem solving. So what should managers do? Their best bet is to iteratively conduct small, low-cost experiments that can then be scaled up or down on the basis of their relative success. Scott Cook, the founder of Intuit, emphasizes that teams should make decisions by running experiments quickly and cheaply, rather than basing them on intuition or

This mode of problem solving through constant experimentation needs the right organizational enablers. Individual teams require the autonomy to run experiments with minimal hierarchical direction, because worthwhile ideas and initiatives often spring from individuals closest to the front line. Moreover, they need to be empowered to take full advantage of the experimental learnings. At Intuit, teams running experiments often have embedded data scientists to help them draw rigorous conclusions from their trials. Finally, teams require a culture that prioritizes learning over immediate profitability or efficiency. Experiments are not valuable unless there is a legitimate chance of failure, so businesses must help teams and individuals become bold enough to attempt such risky experiments.

Haier, the Chinese white goods giant, embodies this ethos of constant experimentation. Haier’s philosopher-CEO Zhang Ruimin wanted an open, entrepreneurial, and continuously evolving organizational structure. His answer was to recast the entire company as an innovation platform for small, autonomous teams. Ruimin successively disintermediated and decentralized the company by transferring responsibility to small, self-managed units called zi zhu jing ying ti (ZZJYTs, or independent operating units). The company now consists of more than 2,000 ZZJYTs. These units are essentially autonomous experiments: they have their own P&L responsibility, and they must be validated by real, external customers and research partners in order to scale up.

These interventions illustrate how biological management can work in practice. However, the crux of biological management is not the interventions themselves but the worldview upstream to them—something we call biological thinking.

Biological thinking matters for several important reasons: First, in complex adaptive systems, there is no single formula or framework that always works. In fact, the very defiance of formulaic problem solving is what makes CAS management so challenging initially. It’s not possible to articulate before the fact how best to intervene in a given situation.

Second, actions that work in CASs do not make sense except in light of biological thinking. Mechanical management remains alluring precisely because it relies on a familiar and shared protocol for sense making: it focuses on measurable outcomes such as efficiency and profitability; it makes initiatives easy to explain; and it gives managers a sense of control. Biological management stops being counterintuitive only when business leaders adopt a new managerial worldview.

Third, managing businesses successfully in today’s environment involves new goals rather than just new problem-solving tools. In other words, businesses need a new what as well as a new how: for instance, surviving, in addition to winning; maximizing value for others, as well as for oneself; and prioritizing learning, as well as optimizing short-term performance. These new goals can be embraced only when businesses adopt biological thinking.

Managing businesses successfully in today’s environment involves new goals rather than just new problem-solving tools.

Therefore, instead of focusing on developing specific techniques or actions, managers should master the principles of biological thinking:

- Pragmatism, Rather Than Intellectualism. In an old business joke, a strategist says of a new idea, “It might work in practice, but does it work in theory?” The reality is that managers also tend to want narratives and explanations. It is tempting to reject ideas that one cannot explain. Nevertheless, the lack of an obvious explanation does not imply that something does not work (or vice versa). Managers must acknowledge that things often work before we can explain why.

- Resilience, Rather Than Efficiency. It’s hard to argue against efficiency. What few managers recognize, though, is that it often trades off against resilience. Like excessive dieting, trimming too much fat can in fact be harmful to companies. The difficulty is that the benefits of efficiency are often immediate and visible, while its risks are latent and invisible. To balance the calculus, companies must make resilience an explicit priority.

- Experimentation, Rather Than Deduction. Paul Graham once claimed that “the best startups almost have to start as side projects.” That’s because when it comes to innovating, no one knows what will work. Great ideas, in particular, are often outliers that experts may have good reasons for rejecting. Biological management therefore demands getting your hands dirty and tinkering more often than it demands analyzing and theorizing.

- Indirect, Rather Than Direct, Approaches. In her influential analysis of system leverage points, Donella Meadows pointed out that the most powerful leverage points in complex systems are all indirect, whereas the obvious leverage points like subsidies, taxes, and standards tend to be relatively ineffective. It’s an idea that most business executives intuitively understand but hesitate to put into practice. Acting on structure, goals, mindset, and other contextual drivers may seem unacceptably “soft,” but these levers are often more effective than direct levers in the long run.

- Holism, Rather Than Reductionism. On the surface, reduction is a natural step in the problem-solving process. It makes problems more tractable and allows for division of labor. It works in engineerable systems, in which subcomponents interact minimally or linearly. But reduction often fails in complex systems because the crux of their behavior lies in the relationship between parts rather than in the parts themselves. The whole is not the sum of its parts.

- Plurality, Rather Than Universality. Heterogeneity is the basic ingredient through which adaptation and therefore renewal and growth become possible. Innovation in cities scales superlinearly, not because their inhabitants are efficient and coordinated, but because their plural, competing viewpoints provide for constant growth and

rejuvenation.7 7 The process by which heterogeneous agents compete and renew the entire system is what the economist Joseph Schumpeter called “creative destruction.” Likewise, companies can achieve vitality not through dogma or universal solutions but by nurturing plurality.

We have an innate need to understand and see simple, explainable patterns, even in a sea of complexity. But this desire can misguide us. Biological management is necessary because the world is not always orderly or easily explainable.

The biological approach makes management messy, iterative, and even counterintuitive and harder to articulate. Nevertheless, it is also a boon: it allows managers to tinker, to experiment, and to find solutions amid complexity. Biological management also draws on the initiative and diversity of people and liberates them from being mere instruments in mechanical processes—it is thus ultimately a more humanistic approach to management.