Artificial intelligence (AI) is a hot topic in business technology, and industrial companies have taken notice. By deploying the right combination of AI technologies , producers can boost efficiency, improve flexibility, accelerate processes, and even enable self-optimizing operations. A BCG analysis found that use of AI can reduce producers’ conversion costs by up to 20%, with up to 70% of the cost reduction resulting from higher workforce productivity. Producers can generate additional sales by using AI to develop and produce innovative products tailored to specific customers and to deliver these with a much shorter lead-time. AI is thus integral to the factory of the future, in which technology will enhance the flexibility of plant structures and processes. (See The Factory of the Future , BCG Focus, December 2016.)

Not surprisingly, companies around the world and across industries are exploring the possibility of applying AI in their operations. Yet some executives remain skeptical that AI can deliver its promised benefits. To better understand the opportunities and challenges, The Boston Consulting Group recently examined expectations for AI and the status of AI adoption in industrial operations.

BCG’s study focused on the results of a global survey of more than 1,000 executives and managers from a multitude of producing industries. (See the sidebar.) Overall, we found that producers expect AI to become a crucial lever for improving productivity. But implementation has not kept pace with expectations, in large part because many companies lack the four key enablers of AI: a strategy (including a comprehensive roadmap), a governance model for implementation, relevant employee competencies, and a supporting IT infrastructure.

About the Study

In February and March 2018, BCG conducted an online survey of companies in order to assess their progress in adopting AI in industrial operations, which we defined as producers’ core transformation processes, including production and related functions such as maintenance, product quality, and logistics. The survey also covered engineering and supply chain management.

The survey’s participants consisted of executives and production and technology managers from 1,096 global companies representing a broad array of producing industries: automotive, consumer goods, energy, engineered products, health care, process industries, transportation and logistics, and technology. The participants were based in Austria, Canada, China, France, Germany, India, Japan, Mexico, Poland, Singapore, the UK, and the US.

The survey sought to evaluate survey participants’ views of the relevance of AI in operations today and in 2030, to assess the current state of AI adoption, to understand companies’ future plans, and to identify major challenges. The survey also delved into the relevance and adoption levels of specific AI use cases in operations and the benefits that participants expect to gain from them.

The survey revealed that transportation and logistics, automotive, and technology companies are at the forefront of AI adoption, while process industries (such as chemicals) lag behind. Companies in the US, China, and India have taken an impressive lead in adoption over their counterparts in such countries as Japan, France, and Germany. The differences in speed of AI adoption across countries reflect different expectations regarding AI’s benefits.

While companies in emerging nations such as China tend to be enthusiastic about these benefits, those in many industrialized nations, such as Germany, have a more conservative view. Because German companies have also fallen behind in developing detailed plans for AI adoption, their status as laggards is likely to persist. Within Germany, the automotive industry is among the most advanced in its adoption of AI technology, while the process industries have considerably farther to go.

The survey results indicate that industrial producers must significantly ramp up their implementation efforts if they are to achieve their ambitions for AI. Technology alone will not make it happen. To tap into the full potential of AI, companies must consider at an organizational level all of the necessary enablers.

AI Will Transform Operations

AI gives computers and machines the ability to perform tasks in a smart way. It helps producers decide on the best sequence of actions to achieve goals, and it enables them to remotely manage operations in real time. (See the sidebar.)

The Basics of AI in Operations

Many uses of AI in operations apply machine learning—a family of algorithms used in data mining and data science. Rather than following static, preset rules or instructions, these algorithms learn by analyzing data and then using the insights to generate predictions or train predictive models.

AI technologies have a number of applications in operations:

- Machine Vision. Sensing the production environment through visual, x-ray, or laser signals—for example, using a camera to classify parts and products

- Speech Recognition. Processing speech and other acoustic signals—for example, using a virtual assistant similar to Alexa or Siri to process comments from operators about quality issues

- Natural-Language Processing. Parsing text and interpreting its most probable meaning—for example, creating summaries from different performance reports

- Information Processing. Extracting knowledge from unstructured text and retrieving answers to queries—for example, by searching in production-related text reports

- Learning from Data. Predicting or classifying values on the basis of empirical production-related data—for example, using historical data generated by machines and processes to predict events

- Planning and Exploring. Choosing a sequence of actions that maximizes a specified goal—for example, enabling an automated guided vehicle (AGV) to identify its best next movement

- Speech Generation. Communicating with humans via written text or acoustic speech—for example, reading instructions aloud

- Handling and Control. Manipulating physical objects—for example, enabling robots to pick unsorted parts from a storage bin without requiring specific training

- Navigation and Movement. Maneuvering through physical environments—for example, enabling an AGV to move and optimize its routes autonomously within a factory

Many industry leaders expect AI to transform processes along the value chain from end to end, including engineering, procurement, supply chain management, industrial operations (production and related functions), marketing, sales, and customer service. In a recent study, executives of industrial companies cited operations as the company area likely to be most affected by AI. (See Reshaping Business with Artificial Intelligence , a report by BCG and MIT Sloan Management Review, Fall 2017.)

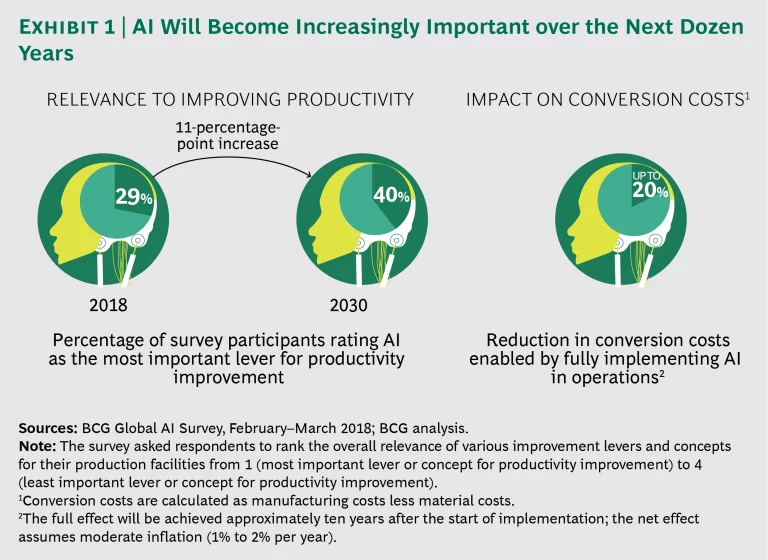

AI augments, rather than replaces, existing levers that producers apply to continuously improve productivity. It is among the main technological building blocks of Industry 4.0. (See Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries , BCG Focus, April 2015.) Moreover, producers can use AI to enhance traditional efficiency levers, such as automation and lean management. (See When Lean Meets Industry 4.0: The Next Level of Operational Excellence , BCG Focus, December 2017.) For example, by identifying root causes of quality issues and thus helping to eliminate defects, AI supports lean-management efforts to reduce waste. Indeed, 40% of our study participants expect AI to become a very important driver of productivity improvement in 2030, versus 29% who consider it to be very important for productivity improvement today. (See Exhibit 1.)

AI adoption will significantly alter the composition of the workforce, lowering conversion costs as it reduces the need for manual activities in production processes. For example, tasks related to quality control that today require intensive human involvement will be highly automated and have extensive AI support. But even as existing jobs are eliminated, new job opportunities requiring skills complementary to AI will arise. Overall, survey participants showed a slight bias toward expecting that AI’s net effect will be a reduction in the total workforce.

Expectations varied significantly from one country to another, however. For example, survey respondents from Chinese companies believe that AI adoption will significantly reduce their total workforce (reflecting the substitution of technology for low-skilled workers), whereas those from German companies expect small, if any, reductions in their more highly skilled workforce.

The Use Cases for AI

AI represents a paradigm shift for the factory. Today’s factory automates processes and machinery through a rules-based approach, and today’s robotics programming addresses a fixed set of scenarios. In contrast, the factory of the future will use AI support to automate processes and machinery to respond to unfamiliar or unexpected situations by making smart decisions. As a result, technical systems will be more flexible and adaptable. For example, under a rules-based approach, a robot cannot identify and select needed parts from a bin of unsorted parts, because it lacks the detailed programming necessary to cope with the myriad possible orientations of the parts. In contrast, an AI-supported robot can pick desired parts from an unsorted mass, regardless of their orientation.

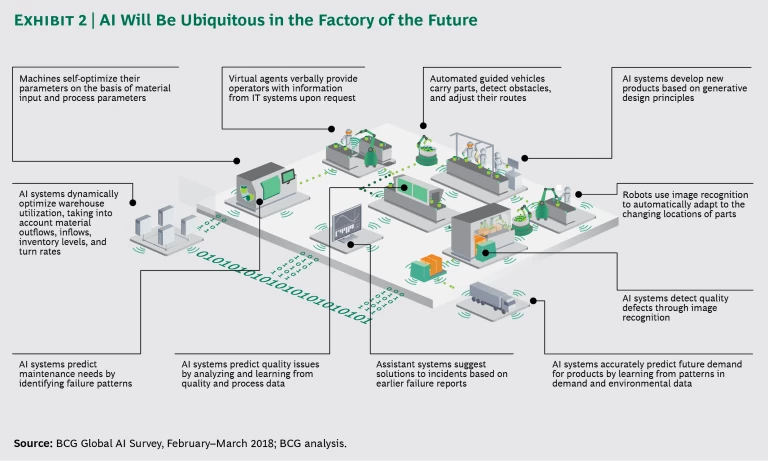

Various AI use cases involve improving productivity across major areas of operations, both outside and inside the factory walls. Among survey participants, 37% rated production as the area of factory operations in which AI is the most important lever for productivity improvement, while 25% rated quality highest and 12% chose logistics. Consistent with those findings, companies regard the most important AI use cases to be self-optimizing machines, detection of quality defects, and prediction of efficiency losses. Although individual companies will find different use cases especially valuable, producers can achieve full benefits only by applying AI and integrating data pools across functions, and with suppliers and customers.

Outside the Factory. Outside the factory walls, engineering and supply chain management are the most important operational areas in which to apply AI:

- Engineering. Producers can use AI to promote R&D efforts that optimize designs, improve responsiveness to customer demand and expectations, and simplify production. AI supports generative product design, in which algorithms explore all possible design solutions on the basis of defined goals and constraints. Through iterative testing and learning, AI algorithms optimize designs and suggest solutions that may appear unconventional to the human mind. Some aerospace companies are using generative design to develop aircraft parts with completely new designs, such as bionic structures that provide the same functionality as conventional designs but weigh significantly less.

- Supply Chain Management. Demand forecasting is a key topic for applying AI within supply chain management. By better anticipating changes in demand, companies can efficiently adjust production programs and improve factory utilization. AI supports forecasting of customer demand by analyzing and learning from data related to product launches, media information, and weather conditions. Some companies use machine-learning algorithms to identify demand patterns by consolidating data from warehousing and enterprise resource planning (ERP) systems with customer insights.

Inside the Factory. Inside the factory walls, AI will bring various benefits to production and to such support functions as maintenance, quality, and logistics:

- Production. Our study covered the full range of production environments, including continuous processes (such as those for producing chemicals and building materials) and discrete production (such as assembly tasks). In all environments, producers will use AI to reduce cost and increase speed, thereby boosting productivity. They will also use it to improve flexibility and cope with the complexity of production—for example, in manufacturing customer-specific products. AI will enable machines and units to become self-optimized systems that adjust their parameters in real time by continuously analyzing and learning from current and historical data. Already, some steel producers are using AI to enable furnaces to autonomously optimize their settings. AI analyzes the material composition of iron intake and identifies the lowest temperature for stable process conditions, thereby reducing overall energy consumption. In another important use case in production, robots enhanced with intelligent image-recognition capabilities will be able to pick up unsorted parts in undefined locations, such as from a bin or a conveyor belt. First applications are already available in, for example, the automotive industry.

- Maintenance. Producers will use AI to reduce equipment breakdowns and increase asset utilization. AI supports predictive maintenance—for example, avoiding breakdowns by replacing worn parts on the basis of their actual condition. AI will continuously analyze and learn from data that machines and units (for example, sensor data and product mix) generate. This technology will especially benefit process industries, where breakdowns lead to lost sales. For example, some oil refineries have implemented machine-learning models that estimate the remaining time before equipment failures. The models consider more than 1,000 variables related to material input, material output, process parameters, and weather conditions.

- Quality. Producers can use AI to help detect quality issues as early as possible. Vision systems use image-recognition technology to identify defects and deviations in product features. Because these systems can learn continuously, their performance improves over time. Automotive suppliers have started to use vision systems with machine-learning algorithms to identify parts that have quality problems, including defects not contained in the data set used to train the algorithm. AI can also continuously analyze and learn from data generated by machines and the production environment. For example, AI can compare drilling-machine settings with material properties and behavior to predict the risk that drilling will exceed tolerance levels.

- Logistics. Our study focused on in-plant logistics and warehousing, rather than on logistics along the external supply chain. AI will enable autonomous movement and efficient supply of material within the plant, which is essential to managing the growing complexity that comes with making multiple product variants and customer-tailored products. Self-driving vehicles that transport items within the plant and warehouse will use AI to sense obstacles and adjust the vehicles’ course to achieve the optimal route. Producers of health care equipment have begun using self-driving vehicles in their repair centers. Without relying on guidance from magnetic strips or conveyors, the vehicles can stop if they encounter obstacles and then autonomously determine the best route. Machine learning algorithms will use logistics data—such as data on outflow and inflow of material, inventory levels, and turn rates of parts—to enable warehouses to self-optimize their operations. For example, an algorithm could recommend moving low-demand parts to more remote locations and moving high-demand parts to nearby areas for faster access.

Some AI use cases apply to more than one area of operations. For example, virtual agents that are capable of language generation and processing (similar to Apple’s Siri and Amazon’s Alexa) will give operators context-specific information that emanates from IT systems. Some companies are already using pick-by-voice systems to handle picking, packaging, receiving, and replenishment operations. In these applications, a voice system connected to the bill of material in the ERP system directs an operator to the correct bin.

AI systems will suggest solutions to incidents (such as machine breakdowns, quality deviations, and performance losses) on the basis of incident reports (for example, photographs and written reports), which they continuously analyze and learn from. Aircraft manufacturers have implemented a self-learning algorithm that uses incident reports to identify patterns in production problems, and then matches current incidents with similar past incidents and proposes solutions.

Among study participants, expectations that each of the use cases mentioned above will become very important by 2030 ranged from 81% to 88%, but belief that the capability had already been fully implemented in multiple areas of production was quite low (6% to 8%). Exhibit 2 provides an overview of the use cases that survey participants ranked as most important for the factory of the future.

The Gap Between Ambition and Reality

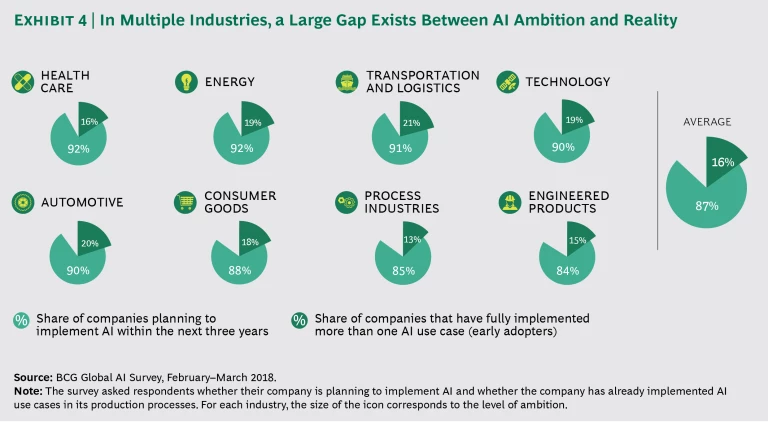

Many companies plan to implement AI soon, but our study found that those in China, India, and Singapore, on average, have the greatest ambitions for near-term implementation of AI in production. Among the discrete industries surveyed, health care and energy are the most ambitious in the near term; process industries and engineered products tend to be less so.

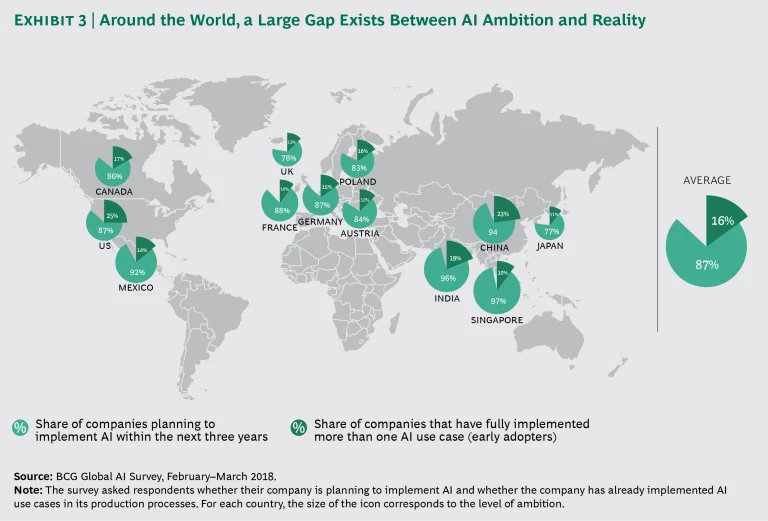

Most companies that took part in our study said that they regard AI as increasingly important. However, their investments, planning, and implementation do not yet match their ambitions. Although 87% of study participants said they plan to implement AI in production within the next three years, only 28% have established a comprehensive implementation roadmap. The remaining 72% of companies lack detailed plans: 32% are testing selected use cases, 27% have only preliminary ideas, and 13% have deprioritized AI or not yet considered it.

The limited degree of implementation reflects a shortfall in comprehensive planning, revealing a large gap between ambition and reality. In the past, only about 50% of companies have achieved their targets when implementing AI use cases. It is therefore not surprising that only about 16% of companies have fully implemented more than one AI use case in multiple plant areas today—an accomplishment that, under the definitions we use, qualifies them as early adopters. For the 12 countries included in our study, percentages of early-adopting companies are highest in the US (25%), China (23%), and India (19%), and lowest in Japan (11%), Singapore (10%), and France (10%). (See Exhibit 3.) Among the German companies surveyed, only 15% are early adopters.

The high level of adoption among US companies likely reflects the widespread availability of AI technology there. Even so, China has overtaken the US in AI funding, and last year it accounted for nearly half of the global investment in AI startups. Also in 2017, China’s State Council issued a Next-Generation Artificial Intelligence Development Plan setting out a three-stage development strategy for achieving AI preeminence by 2030; and the municipal government of Tianjin, near Beijing, has announced a $5 billion fund to support the AI industry. Other emerging nations, such as India, similarly regard AI adoption as essential to keeping their producing industries internationally competitive and have made large investments in AI. In contrast, some industrialized nations, such as Japan, remain focused on conventional levers (for example, lean manufacturing) that promoted their competitiveness in the past.

Among the eight industries that our study focused on, transportation and logistics (21%), and automotive (20%) have the highest share of companies that are early adopters, while engineered products (15%) and process industries (13%) lag behind. (See Exhibit 4.) These differences reflect the industries’ different starting points and affinities for digitization. It is not surprising that automotive and technology companies are among the most advanced. Other industries have yet to learn many of the digital tactics that have become integral parts of those industries’ value chain over the years.

The number of people that a company employs also affects its AI implementation. Small businesses are less likely than large businesses to be early adopters—perhaps because smaller companies tend to have smaller budgets and fewer capabilities to dedicate to AI adoption. Although recent advances in technology and the decreasing costs of data storage and data processing will lower the threshold for funding investments in AI, the overall capability gap is likely to persist.

Closing the Gap

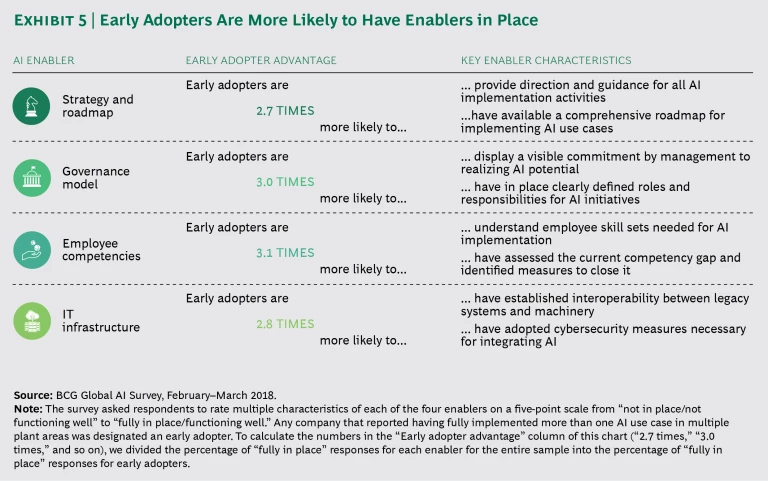

Four enablers are critical to the successful implementation of AI in operations: strategy and roadmap, governance model, employee competencies, and IT infrastructure. Early adopters have made significantly greater progress than laggard companies have toward making the AI enablers fully functional. (See Exhibit 5.)

Strategy and Roadmap. In order to provide direction and guidance for all of its AI implementation activities, a company needs to have a clear strategy. The AI strategy should focus on the most valuable use cases—those that address the company’s specific business needs and challenges—and align them with the company’s overall digital strategy. A company also needs a clear implementation roadmap that establishes business cases and measurable targets for investments. Survey participants rated having a clear AI strategy for operations as the most important enabler.

Governance Model. A visible commitment by management is critical to realizing potential improvement. Top management should use structured communications to ensure a clear understanding of AI within the organization. The company should establish clear roles and responsibilities for AI implementation and devise a clear organizational structure. Efficient collaboration and communication across the relevant functions are essential to overcoming cultural resistance to applying AI.

Employee Competencies. To adopt AI—and digitization in general—a company must have employees with strong skills in programming, data management, and analytics, among other competencies. A company should have a clear idea of the skill sets it requires and should assess the gaps between those needs and the skills its employees currently possess.

For topics such as understanding the basics of AI in operations, employees can gain the needed skills through training programs, either within or outside the company. For topics that require a more formal IT-related course of study, such as advanced analytics, the company must hire new types of workers, including data scientists.

Among study participants, 93% reported not having sufficient competencies available within their company to implement AI in operations. More than one in four (29%) said their company had increased the number of employees dedicated to AI, and nearly half (47%) expected the number to increase in the years ahead.

IT Infrastructure. The interoperability of legacy IT systems and machinery equipment, promoted by application programming interfaces and network standards, is crucial to the success of AI implementation. Cybersecurity is another important concern of practitioners working with AI and Industry 4.0 generally.

In implementing AI, a company should consider adopting an agile work mode that enables it to adjust its strategy and roadmap as its requirements change. In applying AI technology, the company should take a fail-fast, minimum-viable-product approach, in which it tests new ideas on a small scale and then refines them in rapid iterations before committing to a full-scale rollout. Early adopters are more likely than laggards to employ this agile working mode.

Getting Started

The study’s findings point to the need for action by both industrial companies and producers of industrial machinery and automation. (See the sidebar.)

Implications for the Machinery and Automation Sector

As suppliers to all other types of industrial companies, machinery and automation producers will play a major role in realizing the potential of AI technology and in meeting the demand for AI-supported applications in the factory. AI will enable machinery and automation producers to develop new revenue-generating business models, such as “machinery as a service.” To tap into this market, such producers should enhance their equipment and gather data to experiment with AI technology.

Across all industries, survey participants cited self-optimizing machines as being an extremely important AI use case. Machinery and automation producers can offer industrial companies equipment that uses machine-learning techniques to analyze parameters in real time and optimize processes.

Survey participants also regard machine vision systems as growing in importance. Machinery producers can directly integrate machine vision into their mechanical systems. Although the underlying AI technology is available from well-known vendors, machinery producers should consider developing their own AI solutions in order to avoid having to depend on particular vendors.

As a first step toward developing AI-supported analytics and self-optimizing machines, machinery and automation producers should strive for full transparency regarding the performance of their equipment. This will enable users to advance on the AI journey from sensing machine parameters to acting on and continuously learning from the data. Sensing and action entail the monitoring of process parameters such as temperature, torque, and vibration in order to gain insights into the condition of machines and the quality of parts produced. Ultimately, transparency provides the foundation for self-regulating systems. In addition, machinery and automation producers must be able to assure customers that data accessed from their machines will remain secure and confidential.

To catch up in the race to implement AI, industrial companies should adopt a structured, three-step approach:

Assess the status quo. A company should start by evaluating its pain points and AI maturity, and then it should benchmark its current state against that of its peers or against the industry average. Because robust IT infrastructure is essential for AI implementation, the company must assess the current state of its operations IT. One prerequisite to conducting a shop-floor assessment is to have a repository of assessment topics and benchmarks available on mobile devices.

Establish the enablers. The company should develop a comprehensive list of AI use cases to address the pain points identified during the health check. All stakeholders should meet in workshops to discuss the use cases in depth and to determine which ones to prioritize for implementation. In assessing the financial and nonfinancial benefits of the prioritized use cases, the company should calculate the business cases for investment. Input from AI experts who have experience in quantifying the benefits and required investments can be extremely valuable at this stage. After identifying the priority use cases, the company can develop a target picture for AI in operations and create a roadmap for implementation.

The company’s governance model should clearly delineate roles and responsibilities for AI implementation and should establish a coherent organizational structure. The company also needs to compare the qualifications of its current workforce with those needed to implement its AI use cases, and determine how to close the gaps. In addition, it should define the IT requirements for use case implementation and develop a second governance model for effective and efficient data management. Data scientists and IT specialists with AI expertise should participate in defining the requirements.

Test and scale up solutions. The company should test AI uses cases in specific parts of the plant. To accelerate the process, it should initiate its first pilot programs at the same time that it is defining a vision and establishing enablers. The objective of each pilot should be to quickly develop a minimum viable solution and then, through agile development methods, to improve the pilot’s design over multiple iterations. By interacting with the pilots, employees can experience the touch and feel of AI use cases. To facilitate pilots, the company must have access to technology tools that enable rapid impact, such as sensors for asset monitoring and smart glasses. The company should scale up solutions that it has tested successfully in pilots. Finally, to achieve the full potential of AI implementation, the company should implement integrated solutions at full scale.

Our study demonstrates that AI is on the verge of becoming the most important lever for enhancing operational productivity. But many companies have failed to recognize that capturing the benefits of AI requires more than investing in technology. A clearly articulated strategy is an essential starting point—but even that is not sufficient. A company must put appropriate governance and supporting infrastructure in place, and it must reconfigure and retrain its workforce. Producers that have not yet adopted a holistic perspective on AI implementation should quickly raise their game in order to catch up to early adopters.