Digital technology began reshaping retail banking years ago but has been much slower to shake up corporate banking. Secretly, some corporate bankers might have even hoped they would be spared major disruption. But those hopes, never realistic, have been dashed. Digital disruption has finally come to corporate banking—with a vengeance. Bankers now find themselves under substantial pressure to act.

The disruption started with new competition from digitally nimble fintechs offering novel standalone solutions such as low-cost international transfers or supply chain financing solutions, followed by an accelerating wave of digital innovations—most notably involving platforms, artificial intelligence (AI), and blockchain—as well as product and service enhancements developed in response to clients’ changing expectations. The financial stakes are high for corporate banks. Over the next five years, we expect these new digital platforms and channels will attract 30% of traditional corporate banking revenue.

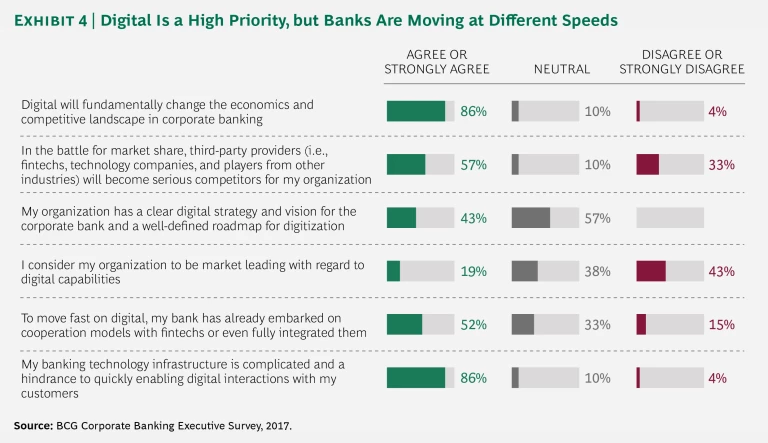

To keep up with these developments, corporate banks need to undertake front-to-back digital transformations. Only those that adeptly manage this extraordinarily challenging transition will survive and thrive. To their credit, corporate bankers are waking up to these challenges. In BCG’s qualitative 2017 Corporate Banking Executive Survey, which gauged global corporate banking executives’ views on digitization, a large majority of respondents (86%) said that digital will change both the competitive landscape and the economics of the business. However, less than half (43%) stated that they have an explicit digital strategy.

Corporate banks need to undertake front-to-back digital transformations.

In the first wave of digital adoption, many corporate banks launched numerous uncoordinated digital initiatives. Now it’s time for the second wave: banks need to develop a clear vision of how the corporate banking industry will evolve, formulate a comprehensive strategy for their own banks, and then plot their digital initiatives accordingly. If leaders don’t cultivate a coherent view upfront, they risk pursuing a collection of ad hoc digital initiatives that ultimately fail to give their banks the best chance for success. By developing a guiding vision, they can establish initiatives focused on four priorities:

- Reinvent the customer journey. Learn what matters most during critical points in the journey (and how such concerns vary among different customer segments) to improve the experience.

- Discover the power of data. Use data analytics to understand customers better, identify business opportunities, and reduce costs.

- Redefine the operating model. Alter the corporate banking relationship model to better account for customer needs and be open to collaboration.

- Build a digitally driven organization. Clearly articulate that the digital transformation is a strategic priority and then support that strategy with appropriate funding, talent recruitment, openness to new agile ways of working, and a willingness to take risks.

Corporate Banks Struggle to Create Value

Corporate banks’ digital-transformation challenges—complexity, legacy IT systems, cultural resistance, and substantial required investments—are complicated by their declining profitability. In 2017, BCG’s Corporate Banking Performance Bench-marking Survey assessed approximately 200 corporate banking divisions that serve small businesses, midmarket companies, and large corporations. Results of the benchmarking survey showed that a significant share of corporate banks have shrinking profits, particularly in the midmarket and large business segments.

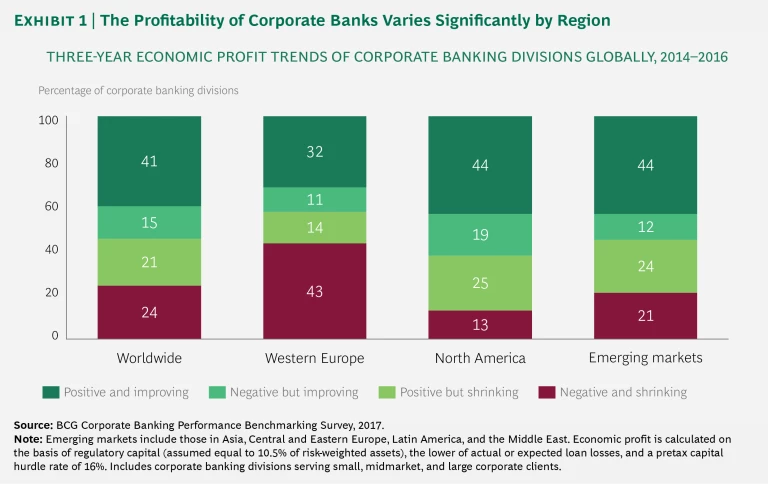

Overall, the survey found that 45% of corporate banking divisions worldwide showed declining profits. (See Exhibit 1.)

This picture varied by region, however. In Western Europe, 57% of corporate banking divisions reported a drop, while only 38% of divisions in North America suffered a decline. The difference in profitability shown in the survey reflects the varying rates of growth in the regions—in Western Europe, growth rates are still comparatively low, while in North America, they have accelerated and loan losses have fallen below their historical averages. Corporate banks in the emerging markets were more evenly divided between those whose profits are improving profits and those whose profits are declining.

By comparison, BCG’s previous Corporate Banking Performance Benchmarking Survey, which covered the years 2013 through 2015, found that profits were improving in a higher share of corporate banking divisions in Western Europe compared with North America.

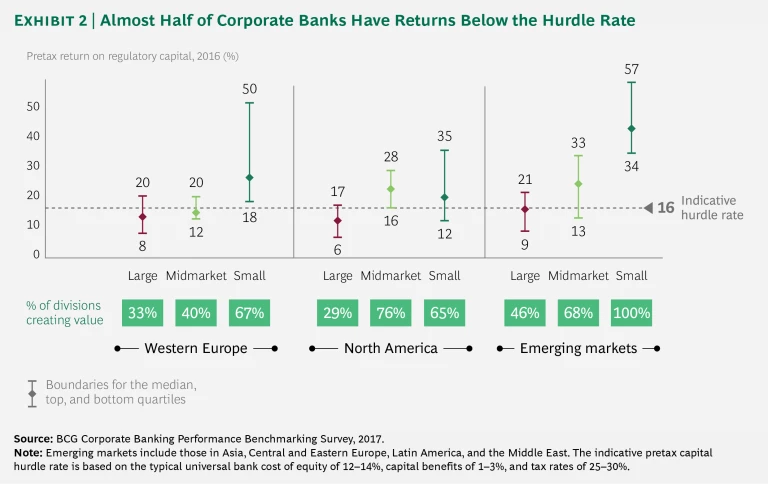

Moreover, according to our recent survey, nearly one-half of corporate banking divisions had returns on capital that were below the hurdle rate, even though they were operating in a mostly benign macroeconomic environment.

Across regions, the challenge has been especially difficult for large corporate divisions: the median pretax returns of these larger divisions fell below the hurdle rate of 16%. (See Exhibit 2.)

Midmarket divisions fared much better in North America as well as in the emerging markets, where economic outlooks are improving and loan losses are declining. Meanwhile, midmarket divisions in Western European countries are still struggling with relatively higher loan losses and lower revenue generation.

Generally, the small-business banking divisions are performing the best; these smaller divisions have their loan losses under control, and they have a much stronger focus on nonlending products.

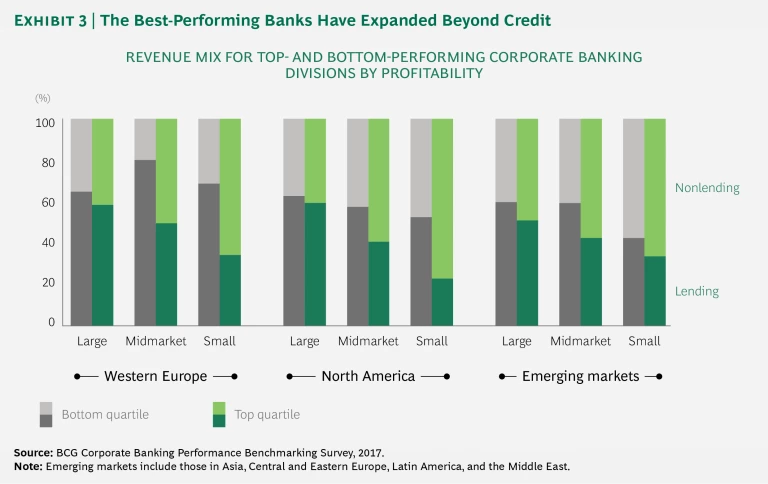

Overall, banks that fell in the top quartile have pretax returns on regulatory capital that are more than 10 percentage points higher than the returns of players in the bottom quartile, in every segment and every region. What accounts for this performance disparity among banks in the same region and even in the same segment? Our analysis identified four recurring themes among the leading corporate banking divisions:

- A Focus on Nonlending Products. Banks that focus on credit often end up with very low pretax returns on capital because of potential loan losses and increasing capital costs. It’s a recurring truth that the best-performing banks do well at selling nonlending products and tend to focus on capital-light banking services such as transaction banking, deposit products, and investment banking. (See Exhibit 3.)

- Careful Management of Lending Margins. Leading players focus on targeting clients intelligently, creating good pricing systems, avoiding unnecessary discounting and revenue loss, and giving the sales force an incentive to price products correctly. These banks also care-

fully balance risk and reward tradeoffs, leading to much higher lending margins and providing a sufficient buffer against any future losses. - An Investment in the Sales Force. Top-performing banks invest heavily in train-ing and developing the sales force, giving employees ample professional opportunities and recognition when they hit targets in areas such as revenue, client acquisition, and price realization. And they equip them with digital tools such as mobile apps with customer information or real-time pricing to plan their days better, reduce administrative work, and target the right clients with the right products at the right price.

- A Willingness to Spend Where It Matters. Top-quartile banks successfully tread a fine line between revenue and cost growth. They don’t necessarily have low cost-to-income ratios, but they aren’t afraid to spend money where it counts—often by freeing up funds from nondifferentiating activities. For example, spending on product capabilities that attract more customers could produce valuable results. Indeed, banks with better cross-sell ratios and revenue generation than their competitors often have higher cost-to-income ratios.

The Digital Imperative

The four success factors listed previously will never go out of style, but leading banks also need to digitize their enterprises in order to lower costs, improve customer service, and maintain their competitive advantage. In fact, many industry leaders are achieving better-than-average results because they have already embarked on digitization. According to our executive survey, most corporate banking executives (86%) agree that digitization will fundamentally change the competitive landscape and the economics of corporate banking business models. A variety of forces make the switch to digital inevitable, such as:

- Corporate clients are rapidly digitizing their operations and ways of working, and they expect to interact with banks accordingly.

- Powerful new digital tools are constantly emerging—think robotics, big data, AI, and blockchain—but only digitally enabled enterprises can put them to use.

- Digitization creates its own momentum. The more digitization begins to break up the traditional banking value chain, the more points of attack emerge for new players and new business models.

- Fintech firms are awash with funding and talent, accelerating change and innovation and placing substantial competitive pressure on banks.

While there is wide agreement that digitization will change the competitive landscape for corporate banking, executives in our survey were much more divided on exactly where the competitive threats are coming from, and many reported that they are unprepared for battle. (See Exhibit 4.) Less than half (43%) indicated that their organization has a clear digital strategy and vision for the corporate bank as well as a well-defined roadmap for digitization. Only 19% believe their organization has market-leading digital capabilities.

This lack of readiness is worrisome for digital laggards because the digital transformation is already well under way among industry leaders. In particular, small and medium-sized enterprises (SMEs) and midmarket firms are swiftly adopting highly standardized products and expect instant credit decisions. Change is also coming rapidly to the large-cap segment as platforms and aggregators increasingly disrupt exclusive advisory relationships between corporate banks and their large clients, which will put further pressure on already thin margins.

Over the next five years, we estimate that, in some segments, digital providers and channels (including banks’ own digital channels) will capture at least 30% of corporate banking revenues. Large-scale, balance-sheet-based lending may remain immune, but that business won’t be enough to cover capital costs for most banks. Banks that don’t digitize fully or fast enough may find themselves in a downward spiral in terms of market share, revenues, and profits as newcomers and more nimble banks swoop in and take away customers while using their profits to continue to innovate.

Although digitization is an imperative, corporate banks must be careful about how they approach the challenge. To start, leaders need to develop a specific vision for how the corporate banking business will evolve and what role their bank will play in this new digital environment. They should identify the exact capabilities they will need and decide where to invest. If leading banks don’t create a coherent view from the get-go, they risk pursuing various uncoordinated digital initiatives that don’t put them in the best position for success.

Potential Paths Forward

Today, most corporate banks have essentially the same business model, but we believe that the future will bring a more diverse set of options. We see several potential paths that executives should consider as they position their organizations.

One is to continue to concentrate on offering their own products and services. For many banks, this will be a tempting option because it seems closest to the status quo. But the resources and capabilities necessary to pursue this path are significant. It will require a full-scale digital transformation of every aspect of the current business—and that’s just initially. To be successful, banks will need a strong value proposition across all products, services, and sectors and will also need to run operations very effectively and efficiently. Such a transformation will take substantial and ongoing investment in digital, the kind that only a handful of banks can maintain.

Another path is for a bank to leverage an element of its existing business that it excels at—certain industries, for example—and create a digital ecosystem to serve that segment completely. This option involves collaborating with partners to become more interlinked with their clients’ value chains beyond financial services—for instance, combining supply chain finance with logistics support or offering accounting services to customers. Although such a model is promising, in reality we would expect a limited number of viable ecosystems.

Yet another path is to invest in the development of a highly efficient digital platform where corporate customers can access a vast array of solutions from the bank as well as from other banks and third parties. This open-banking direction leverages banks’ client franchises while creating more flexibility in the depth of the value chain and in their cost bases. Once again, however, the specific supporting value proposition needs to be well defined.

The consequences of surrendering client access should never be taken lightly.

Finally, a corporate bank might conclude that its strengths are related mainly to its products and services, so instead of managing corporate customer relationships directly, it would rather supply its products and services to other banks and third-party platforms. This is a legitimate direction to take, but the consequences of surrendering client access should not be taken lightly.

Market Evidence: The Asian Example

Overall, the digitization of corporate banking is moving much more rapidly in Asia than in the West for a number of reasons:

- Asian consumers are more deeply immersed in a digital environment than customers in the West.

- SMEs are underserved by traditional banks and offer huge opportunities for new corporate banking players.

- Tech giants and large e-commerce platforms are driving innovation and have been investing heavily in cutting-edge solutions.

Exploring how banks have digitized in Asia can help us understand what future business models in corporate banking might look like in other parts of the world.

For banks in emerging markets, the following examples show how their institutions might leapfrog trends and competitors in developed markets. For banks in developed markets, the examples illustrate how they might consolidate financial and nonfinancial services.

Our first example is the world’s largest fintech, a Chinese firm valued at about $60 billion. The company is part of the ecosystem of a huge Chinese B2B e-commerce site and is using its unique access to small companies to disintermediate financial institutions by offering loans (with a total exposure of over $100 billion) and a money market fund (one of the largest globally). Its ambition is to become a financial marketplace inside and outside China; to this end, it has gone on an international shopping spree to expand its offerings.

Meanwhile, a former delivery company has built an integrated financial ecosystem in China, providing a variety of services including logistics support, online payments, and financial services (such as wealth management, credit cards, and supply chain finance). As the orchestrator of this ecosystem, the company has a huge amount of data (in particular, transaction data) that it can use to identify and develop new value-added services.

In yet another example, a Chinese peer-to-peer lender has become the largest direct wealth management platform in China with assets under management of more than $75 billion. It has become popular by offering individual investors direct access to previously inaccessible investments, such as real estate and infrastructure projects. It also provides its services directly to institutions, challenging long-established business models.

Several Asian banks are partnering with a supply chain financial services platform in China. Using the purchase, sales, stock, and financial data that the platform collects from their clients, various banks offer credit financing via the platform.

These examples, while illustrative, do not present a comprehensive portrait of the possibilities associated with the rise of digital. Indeed, the most creative companies may formulate completely original business models that have yet to be seen. Being first—or at least among the first—to develop a truly innovative path and being prepared for competitors from nontraditional backgrounds is part of the current challenge.

A Roadmap for the Future

Every corporate bank’s digitization journey will be unique, with challenges specific to each institution. But most successful digital-transformation programs are built on four pillars:

- Reinventing the customer journey

- Discovering the power of data

- Redefining the operating model

- Building a digitally driven organization

Reinventing the Customer Journey

In an age of one-click ordering and instant approvals, clients are less tolerant of nontransparent processes that stretch on for weeks. To adapt, banks must reinvent and digitize the entire customer journey. This usually starts with streamlining and compressing the onboarding and lending processes; this not only sets the right tone for the new relationship but frees up the sales force to focus on more value-added activities. To reinvent the customer journey, banks must be willing to focus time and resources on three key areas:

- Client Centricity. Customer expectations are defined by beacons such as Amazon and Google. With that in mind, corporate banks need to rethink processes from a client perspective to deliver an outstanding digital experience across the entire customer journey. They need to put customers at the center of all design decisions.

- Innovative Technology. Corporate banks need to think beyond the boundaries of their own industry and adopt cutting-edge technologies, such as robotics and AI, and replace legacy infrastructure with modern data-centric tech platforms.

- End-to-End Process Optimization. To keep costs down while improving the customer journey, corporate banks need to automate wherever possible. This automation will standardize and streamline processes, add speed and agility, and eliminate waste.

This reinvention isn’t sci-fi—it’s already happening in the real world, as we illustrated before. But there are also examples in developed markets: for instance, a large US bank is a leader in using an online platform to re-invent the traditional SME lending experience. It offers short-term credit through an easy application process that includes competitive rates, clear terms, and rapid decision making (as soon as next-day funding). This new program dramatically reduces cycle and work time for its employees while providing a markedly enhanced experience for customers.

Discovering the Power of Data

Corporate banks have a major advantage over fintechs and other potential competitors that most don’t exploit well enough. They have huge amounts of data that could be put to use in myriad ways. Unlocking this data is critical to their digital transformation and competitive vigor. Data mining can help banks reinvent themselves as partners that offer highly tailored solutions to their clients, rather than suppliers trying to push products that might not match customer needs. They can leverage data to improve performance in several vital areas:

Unlocking client data is critical to banks’ digital transformation and competitive vigor.

- Client Targeting. Use new data sources and predictive analytics to prioritize leads and identify potential connections to future clients.

- Share of Wallet. Discover new business opportunities with existing clients using granular cluster analysis (that is, compare the product mix of each individual client with that client’s peer averages to find opportunities to deepen the relationship).

- Retention. Proactively identify clients at risk of attrition using behavioral analysis (on the basis of data such as recent trans-

action types and billing volume) and generate individual customer action plans for relationship managers (RMs) to implement. - Pricing. Spot clients that are underpaying for services and products—resulting from, for example, aggressive discounting—and initiate repricing efforts.

- Risk Management. Shorten cycle times for new loans and more accurately anticipate defaults by using advanced analytics to parse transaction data both in credit applications and in credit surveillance processes.

Redefining the Operating Model

The spectrum of new customer relationship models will extend from the “bionic”—a human RM empowered with digital tools to engage more effectively across the client life cycle—to the virtual, a relationship that eliminates the human RM and instead connects the client directly with the bank’s platform. Wherever the bank exists on this spectrum within each segment, it will need a set of integrated capabilities to bring the relationship model to life and serve the customer seamlessly.

To support these new approaches to customer relationships, banks should have an operating model that cost-effectively delivers products and services across channels and can keep up with fast-changing customer needs and the latest innovations. One efficient way of staying in step with innovation is to employ an operating model that allows for collaboration. Top players are already capitalizing on their fintech partnerships and internal incubators, launching attractive new services, reaching underserved segments, and differentiating the client experience—all at competitive price points and lower operating costs.

Building a Digitally Driven Organization

The fourth pillar of a digital-transformation program is tackling organizational and cultural change. Infusing a digital mindset into a traditional banking culture can be challenging, and the need to manage two cultures during the transition can exacerbate the situation. Success depends on engaged senior leadership that is committed to radically changing the bank. Digital transformation must be a clearly articulated strategic priority, supported by appropriate funding, talent recruitment, openness to new agile ways of working, and a willingness to take risks.

Although fintechs pose a competitive threat, their market presence is a reality that corporate banks cannot deny or ignore. Instead, they should look to harvest best practices from fintechs and should team up with them when appropriate to incorporate step-change ways of working and interacting with customers. Collaborating with fintechs in this manner may help corporate banks evolve their own cultures and ingrain new ways of thinking about the customer experience as well as the need for faster reaction times.

Digital is forcing sweeping changes in corporate banking, and institutions will need to adapt or see their competitiveness and market share steadily spiral down over the next few years. In the past, banks have focused on launching various digital initiatives, but now it’s time to develop a more coherent digital strategy to decide where to play and how to invest. None of the potential paths are easy and—regardless of the direction—any digital transformation will need analysis from a strategic perspective as well as probing and exploring. Hence the initial positioning of the organization and a realistic assessment of its capabilities are essential. Digital examples in Asia show what these new forms of banking can look like and how these transformations can open the door to a wide variety of fresh possibilities, new revenue streams, and competitive advantages.