“Cure the disease that has not yet happened”

—Chinese saying

In business transformations , there are plausible reasons to believe that time is an essential factor. Companies that change early may get a first-mover advantage, acting ahead of their competitors and potential disruptors. Besides, business organizations are complex systems, which often decline much faster than they grow , an asymmetry that has been called the Seneca effect. Considering that transformations take time, moving preemptively may be the best way to prevent obsolescence and collapse.

Nevertheless, leaders may be reluctant to change their companies when they are in a comfortable position. And they may understandably feel little urgency to change when current performance indicators are still healthy. Transformations are costly, monopolize management attention, and may create distraction or instability, leading many to follow the adage, “If it ain’t broke, don’t fix it.”

So, should business leaders engage in transformation preemptively or wait for a degradation of performance to trigger change? To answer this, we leveraged our evidence-based approach to transformation .

We analyzed hundreds of

transformations involving restructuring

costs launched between 2010 and 2014 by large listed US

Preemptive change does indeed generate significantly higher long-term value than reactive change, and it does so faster and more reliably.

The Value of Preemptive Transformation

Because each company’s circumstances are unique, we studied relative financial performance to identify preemption, rather than making qualitative timing judgments. If a company embarks on a transformation when it is outperforming its industry (as measured by TSR over the past year), the transformation can be described as preemptive. On the other hand, a transformation is categorized as reactive if it is launched while the firm is underperforming its industry on the basis of TSR.

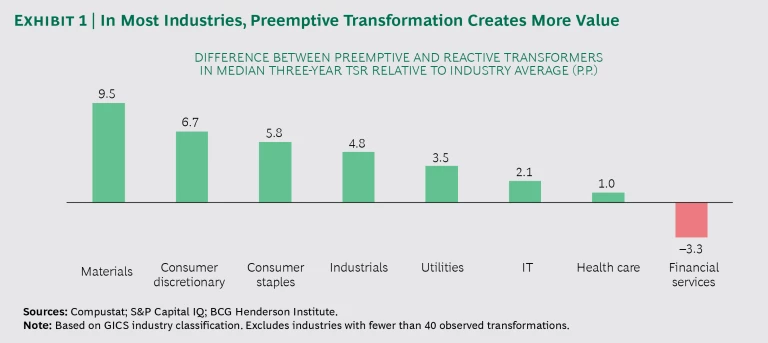

Our analysis shows that in the three years following the start of a transformation, preemptive transformers have an annualized TSR that is 3 percentage points higher than that of reactive transformers. Outperformance following a preemptive transformation is true not only in aggregate but across most industries, except financial services. (See Exhibit 1.) (In the period of our analysis, the financial sector was still recovering from the crisis and the subsequent regulatory changes, which may have caused anomalies.)

Is this outperformance explained simply by the tendency of high-performing firms to continue outperforming? In fact, for companies that do not transform, there is no observable link between past and future long-term TSR. A small “momentum effect,” where previously outperforming companies continue to outperform, is observable on shorter time frames (up to one year). But, consistent with financial literature, we find that this effect disappears on longer time

As Giuseppe Tomasi di Lampedusa famously wrote in The Leopard, “If we want things to stay as they are, things will have to change.” Our findings suggest that in order to maintain outperformance, companies should pursue preemptive transformation rather than relying on performance momentum to sustain itself.

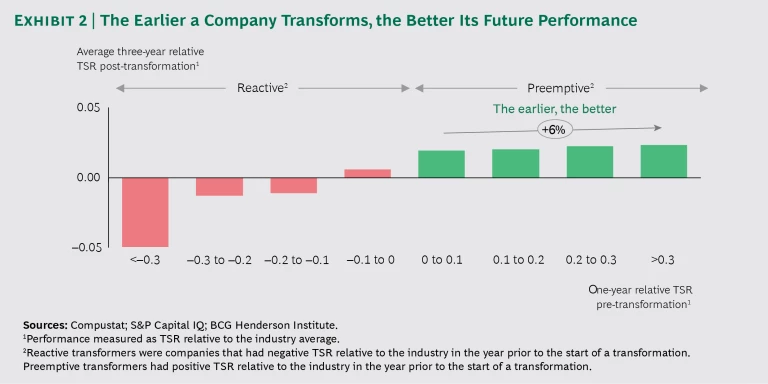

Furthermore, the preemption premium is continuous: the higher the relative performance of a company when it initiates change, the higher its long-term relative performance. In other words, the earlier a transformation is initiated, the better. (See Exhibit 2.)

In spite of this pattern, preemptive transformations are less common: in a given year, only 15% of outperforming companies embark on transformation, while 20% of underperforming and 25% of severely underperforming companies (the bottom decile of firm performance) do.

There are exceptions. When Jack Ma founded Alibaba, in 1999, internet penetration in China was less than 1%. Growth in that area was expected, but no one could predict its precise course. So, early on, Alibaba took an experimental approach, in which leaders constantly reevaluated their vision and, when necessary, restructured the company accordingly.

In 2011, Alibaba’s online marketplace Taobao had captured more than 80% of the digital Chinese consumer market. Even though Taobao was highly successful, Alibaba decided to split it into three independent businesses in order to participate in three possible futures for e-commerce: one for consumer-to-consumer transactions (Taobao), one for business-to-consumer transactions (Tmall), and one for product search (Etao). The restructuring resulted in two successful mass-market businesses and one strong niche market.

Alibaba frequently reshuffles its more than 20 business units, so Taobao is just one example of many preemptive restructurings implemented as Alibaba grew from an 18-employee startup into a Fortune Global 500 company in less than 20 years.

Secondary Benefits of Preemption

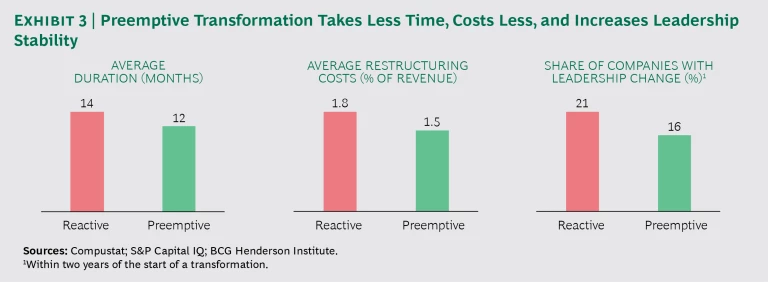

In addition to having better financial performance, preemptive transformations offer three secondary benefits. (See Exhibit 3.) First, they take less time: preemptive transformations result in consecutive restructuring costs for an average of only 12 months, compared with 14 months for reactive ones. Second (and perhaps partly because of the shorter duration), they are less costly. The costs of restructuring in preemptive transformations total 1.5% of yearly revenues, on average, compared with 1.8% for reactive

By combining the lower average cost with the superior returns, we estimate the ROI of preemptive transformation to be approximately 50% higher than that of reactive

Finally, preemptive change is associated with increased leadership stability. The share of companies experiencing a CEO change in the two years following the start of the transformation is significantly lower in the case of preemption (16% versus 21%).

Preemption as the Primary Success Factor in Transformation

How can leaders successfully implement preemptive transformation? In our previous study on evidence-based transformation , which focused on reactive moves designed to restore financial performance after a decline, we identified several factors that boost the odds of success:

- Above-average capital expenditure

- Above-average R&D spending

- Long-term strategic orientation (as measured by a proprietary natural language processing analysis of corporate communications)

- Leadership change

- Above-average restructuring costs and a formal transformation initiative

Our analysis confirms that these success factors also apply to preemptive transformations. But a more fundamental question is whether and how timing affects that recipe for success. To answer that question, we used gradient boosting, a machine-learning technique based on decision tree models that measures how well each factor discriminates between successful and unsuccessful transformation

In preemptive transformations, R&D expenditure and capex are the next-most-decisive factors, reflecting a need to properly understand and invest in the future. In reactive transformations, leadership change is the second-most-important success factor—perhaps because companies that have already allowed performance to decline need to refresh their leadership and culture in order to accelerate change.

Microsoft illustrates how preemptive transformation with heavy investment in the future allows a company to sustain performance. After a few years of stagnating performance in 2009–2012, the software company managed to create strong momentum in 2012–2014 (36% annualized TSR). Rather than resting on its success, Microsoft changed its CEO and restructured again preemptively in 2014, which enabled it to preserve its momentum and continue to strongly outperform. The transformation aimed to orient the company to the new dominance of mobile and cloud , even though these trends had not yet damaged the bottom line. In March 2018, Microsoft announced yet another restructuring amid strong performance . For the first time, Microsoft will not have a division devoted to personal computer operating systems. Again, the company is trying to adapt preemptively to the ongoing technology changes and an evolving competitive environment.

Six Steps to Successful Preemptive Change

Faced with a need to adapt to changes in their business, technology, or competitive environment, companies should transform early, before financial performance has started to decline. How can leaders turn around the successful company?

Constantly explore. To be able to transform preemptively, leaders need to anticipate change by continually exploring new options. The observation of biological systems teaches us that it is optimal for companies to begin searching well before they exhaust their current sources of profit, and that firms should use a mix of “big steps” to move to uncharted terrain and “small steps” to uncover adjacent options at low cost. This requires balancing short-term tactical moves with a long-term aspiration, and investing enough in the future, especially in digital technology and R&D.

Create a sense of urgency. When a company is doing well, danger lies in self-satisfaction. Leaders shouldn’t wait for an actual crisis to mobilize. Creating a sense of urgency is the best way for leaders to preempt the risk of complacency. Using scenarios, studying maverick challengers, surveying dissatisfied customers or noncustomers, and other exercises can help management envision new risks and opportunities, and test the resilience and adaptability of the current business model in a changing environment.

Watch out for early-warning signals. Most financial metrics, such as earnings, profits, or cash flow, are backward looking. Detecting the need for change requires a variety of early-warning signals for phenomena that have not yet affected the bottom line. Forward-looking metrics such as vitality can help assess a company’s readiness for the future.

Create transformation capabilities. Moving quickly against risks and opportunities is essential. This requires building permanent transformation capabilities and strengthening the adaptability of the organization. In particular, leadership teams should balance the right mix of fresh ideas and experience to foster innovation and ensure that new ideas are constantly explored and entertained.

Control the narrative. Preemptive change may generate frictions with stakeholders who believe that prudence and continuity are the best policies. Leaders should take control of the investor narrative and actively manage investor expectations in order to make preemptive transformation feasible. Defining and conveying the purpose of the company, and relating change efforts to that purpose, can also help energize and recruit employees and middle management for change efforts, which may otherwise be perceived as threatening. Indeed, a reliance on reactive approaches has caused transformation to become associated with painful, defensive, and remedial change efforts, whereas preemptive transformation is more likely to be focused on innovation and growth from the outset.

Choose the right approaches to change. Companies tend to drive change with a monolithic, linear project-management mindset. But there is no universal form of change. In reality, a complex business transformation comprises multiple types of change . Each form requires a different mindset and different change management mechanisms. While the transformation may be run as a comprehensive program under a consolidated agenda, leaders should de-average and sequence the different forms of change. In particular, preemptive change is more likely to rely on adaptive or visionary models of change, rather than heavy-handed, top-down approaches.