The coronavirus crisis has caused unprecedented disruption to businesses and economies around the world, forcing companies to respond on accelerated timescales. Even prior to the pandemic, business environments around the world were changing faster than ever before, and outperformance was fading faster than it used to . Business leaders are therefore understandably focused on increasing the agility of their organizations.

Yet while companies worry about fast and unforeseen changes, there are also many important slow-moving social, political, and ecological changes to navigate, too. These include the impact of climate change, increasing inequality, the rise of China as an economic superpower, the development of Africa, and the growing importance of AI—all of which could have a significant impact on businesses in the long term. Even the COVID-19 outbreak presents a number of slower-moving challenges, such as shifts in attitudes and consumer behavior that will persist into the postcrisis future .

In other words, companies need to think and operate on multiple timescales —both faster and slower. But navigating slow changes is not necessarily as easy as it might appear. Even when a slow phenomenon is well understood and highly predictable, as in the case of demographic change, it can nevertheless be challenging for companies to navigate. Why do companies falter in preparing for slow changes? What do the ones who successfully navigate slow change do differently? We looked into how companies responded to demographic change to find out more.

Demographic Aging: Slow Poison for Growth

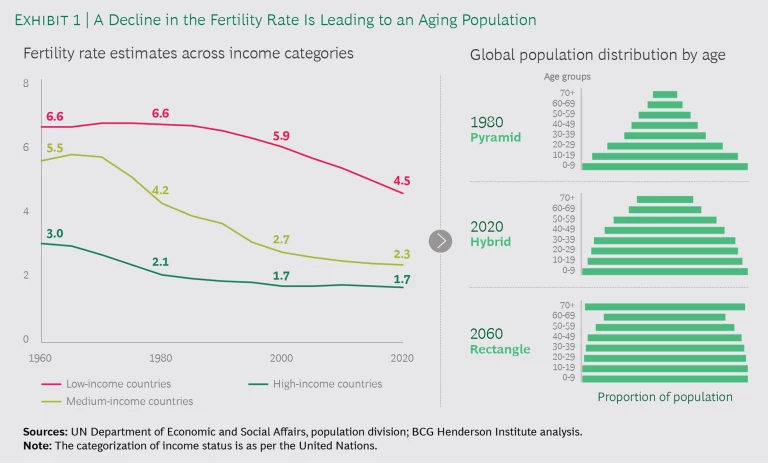

Fertility rates are decreasing in almost all countries in the world. As a result, population growth has slowed, and some countries—including Germany, Italy, Japan, and Portugal—have already experienced population decline. Fertility decline, combined with increasing life expectancy, is leading to population aging. The age distribution of the world population is moving from a pyramid shape to a rectangle. (See Exhibit 1.) While this trend is now visible worldwide, it started earlier in wealthier countries, which are already experiencing its effects on economic growth.

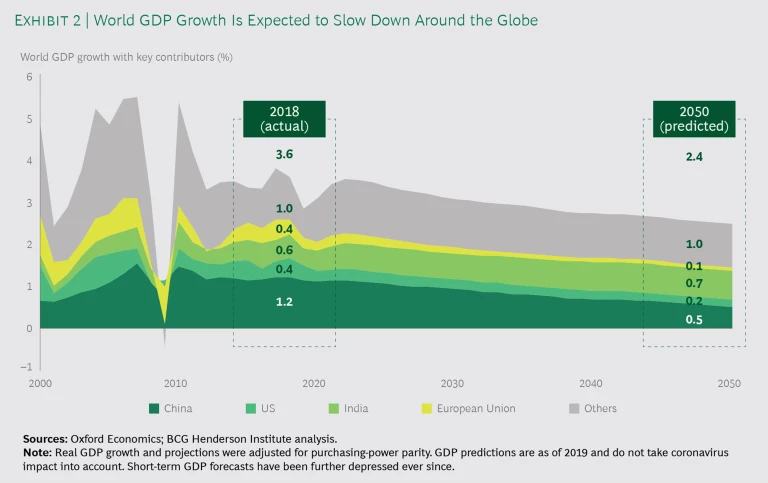

Economic growth in the long run is driven by two factors: growth in the labor force and growth in labor productivity. Growth in the labor force contributed about 30% of economic growth in the US from 1960 to 2010. However, retirement of the post–World War II boomer generation and the subsequent decline in fertility rate have depressed labor force growth. The impact on economic growth is already visible: according to Oxford Economics, the 20-year average GDP growth rate has already declined from above 3% before 2007 to 2.2% in 2018 and is expected to stabilize around 1.75% to 2% during the next 20 years. The same story is playing out at different speeds and with different time frames in all major economies.

Economists forecast steady decline in world GDP growth from about 3.6% in 2018 to 2.4% in the next 30 years. (See Exhibit 2.) A long-term decline in economic growth will likely lead to a long-term decline in shareholder returns—even though the past decade has, paradoxically, seen record-breaking market returns. This disconnect between high market returns and depressed economic growth in developed economies is driven by temporary factors, such as increased debt and low interest rates fueling growth in P/E ratios, which cannot continue forever. A demographically driven decline in GDP growth in major growth markets, such as China (which helped many companies compensate for sluggish domestic growth), and the rise of protectionism around the world will make this kind of market outperformance less likely to occur in the future. However, investor expectations, which tend to be heavily influenced by past performance, may continue to be high in the near to medium term, though they must eventually decline. As a result, it is crucial for business leaders to find the right strategy for growth in an impending lower-growth environment.

Japan: A Test Case for Adjusting to Population Aging

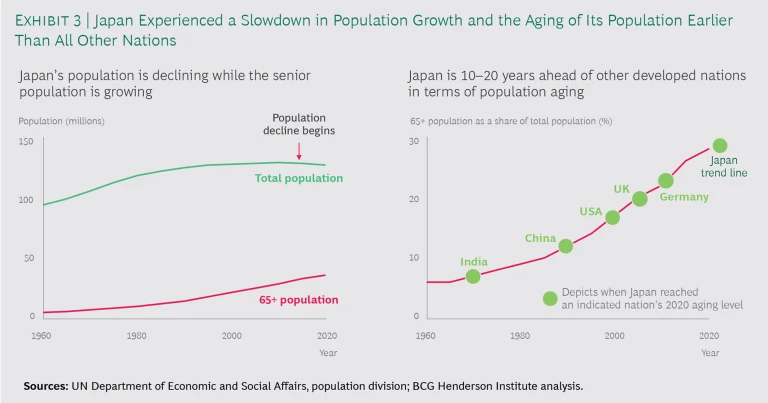

Fertility rate decline and societal aging started in Japan 10 to 20 years before other developed economies and impacted both labor force and consumption; both have been more or less stagnant for the past 20 years. (See Exhibit 3.) This has contributed to a sustained period of low economic growth and returns for Japanese companies.

Japanese businesses and policymakers were well aware of the impending demographic pressures and their likely impact from early on. The 50-year population predictions made by the cabinet office of the Japanese government in 1999 have, so far, been more than 99% accurate. In 1996, in his very first press conference as prime minister, Ryutaro Hashimoto identified demographic change as the greatest threat to Japan’s economy: “…from this demographic change alone, it is clear that we have to reform the system of the country. Otherwise, the reality is that the country will stop functioning.”

The basic strategies for businesses to combat a demographics-led slowdown focus on two core issues: stagnation in consumption and a shortage of labor.

On the demand side, one option for Japanese corporations was to circumvent low domestic consumption by moving into higher-growth international markets. The other was to refocus on specific segments in the domestic market, which actually benefited from the demographic shift. Diaper, personal hygiene, and household cleaning products manufacturer Unicharm is a perfect example of a company that made both these strategies the cornerstone of its growth plan. In its 2001 annual report, the company announced that it had targeted two business opportunities: to develop its business in Asia and in the domestic adult incontinence sector.

Anticipating the growth slowdown in Japan, Unicharm started expanding into foreign markets as early as 1984, when it entered the Taiwanese market via a joint venture. After building presence in multiple Asian markets in the late 1980s and 1990s, the company dramatically accelerated its business expansion in Asia in the early 2000s and established itself as a market leader in its key product segments in such fast-growing markets as Thailand, Indonesia, and Vietnam. Foreign markets now contribute an impressive 60% of the company’s revenues. This simple strategy has been adopted by other companies as well. Twelve out of the 14 Japanese large-cap companies that achieved annual shareholder returns of more than 10% for the period 1995 to 2018 earn more than 40% of their revenues from foreign markets. In contrast to these early movers, the majority of Japanese companies did not move aggressively to capture foreign markets, in spite of facing declining consumption growth in the 1990s. As late as 2002, only 13% of listed Japanese companies reported income from foreign countries—a number that almost tripled, to 38%, by 2018.

Even with aggregate stagnation in consumption, there were specific areas of domestic consumption growth. A good example is the diaper market in Japan. While adult diapers constitute only 15% of the total diaper market worldwide, they constitute more than 50% of the Japanese diaper market, driven by an aged population. Unicharm realized the potential of the incontinence market early and introduced its first diaper brand for adults in 1987. While customers with significant incontinence issues always required adult diapers, those with minor incontinence often avoided purchasing them due to lack of knowledge about products and social stigma associated with using them. With a differentiated product line that offered diapers designed for three different levels of incontinence, Unicharm actively expanded its market by educating customers. As of 2018, Unicharm was the market leader, with a share of more than 50% in the adult diaper market. P&G, the global leader in the total diaper market, did not focus on this high-growth segment and failed to capture significant share. As a result, P&G exited the Japanese adult incontinence market in 2007.

On the supply side, utilizing readily available and lower-cost labor in foreign countries became a much-discussed potential strategy in the 1980s to combat high local wages and tight labor markets. While many Japanese manufacturers started establishing production facilities in low-cost economies, they were very cautious in moving significant amount of production overseas. By 1992, when General Motors had moved 40%, and IBM had moved 46%, of production outside the US, only 20% of Toyota’s and 8% of Hitachi’s production had moved offshore. Even as late as 2005, when 63% of Japanese manufacturers had foreign production facilities, only 20% of the production in these companies was performed offshore. This has contributed to 2.5 million unfilled job openings in Japan, a number that is growing by 6% per year.

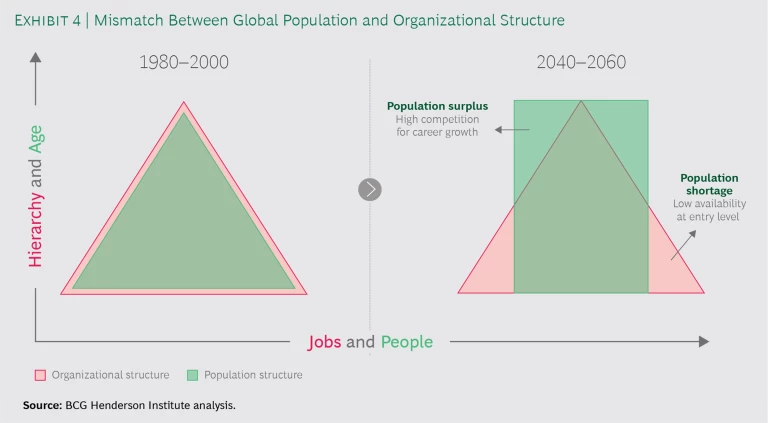

Population aging leads not only to labor shortages but also to changes in the age mix of the labor force. As previously noted, the global population structure is moving from a pyramid shape to a rectangle. (See Exhibit 4.) However, hierarchical organizational structures largely remain pyramid shaped, creating a shortage of young workers for entry-level jobs and a surplus of older workers. This leads to high competition for young talent and limited prospects for getting senior managerial roles. Although few companies have seriously tried to tackle this challenge, some success stories include such companies as retail giant AEON and furniture retailer Nitori, which try to make nonmanagerial jobs more feasible for older workers by using tools to simplify physically strenuous work and providing special facilities, such as resting places. Other companies are moving away from traditional rigid and hierarchical organizational structures to allow for more flexible career paths. For instance, SB Technology has introduced grade skips, and software company Line has opted to compensate its engineers with differential salaries based on technical expertise. However, such examples are rare among a sea of companies that have not changed their organizational setups significantly.

Why Do Companies Fail to Adapt to Slow Changes?

This brings us to the core question: why do the majority of companies fail to adapt to slow changes? Three types of organizational failures weaken a company’s ability to deal with slow changes.

Failure to See. When evaluating future choices, we use discount rates to adjust future outcomes to present value, so that they can be compared and strategic choices can be made. In certain contexts, individuals and organizations tend to apply hyperbolic discounting. This is a phenomenon where discount rates increase with longer timescales. Because the present is clear, while the future is often hazy, there is a bias toward maximizing the present at the cost of the future. Slow-moving changes can have a significant long-term impact, but future scenarios may be hard to predict or imagine. This pushes many business leaders to focus on optimizing current business models rather than imagining new ones. In 2007, for instance, P&G saw adult incontinence as a niche market, significant only in the unique market structure in Japan. Hence, the company sold its Japanese adult diaper brand to concentrate on products with more global appeal. But P&G failed to visualize the potential of the adult incontinence market not only in Japan but also in the rapidly aging economies of Europe and North America, and it had to change course some years later. In 2014, the company launched a new adult diaper brand in order to avoid losing out on the growing market in the US.

Slow changes can give rise to a perception that there is plenty of time to deal with them. However, this illusion of time can prove dangerous because dealing with slow changes may require immediately embarking on long-term investments. For instance, establishing yourself in a foreign market is an expensive and time-consuming strategy. Many companies in Japan delayed the process of expanding abroad during a high-growth period in the 1970s and 1980s. As a result, after the slump of the late 1980s, they were too busy firefighting in their domestic markets to seize overseas opportunities.

It is important to note that our Japan example deals with the unusual situation of very predictable long-term change. The challenges discussed here are further exacerbated with phenomena that are much less predictable, such as the rise of service robots and the impact of climate change. Uncertainty creates further barriers to imagining and preparing for the future.

Failure to Care. Another key factor that contributes to hyperbolic discounting is the incentive structure for business leaders, which is primarily focused on achieving success on a timescale of one to five years because of both market pressures and career promotion cycles. Slow changes, by their nature, have minimal impact on short timescales. Hence, they have a high tendency to get overlooked, especially if the strategy to deal with them involves significant investments that don’t reap immediate rewards or penalties for leaders but will impact their successors. Many companies have scenario-planning exercises, but it’s hard to act against a future possibility if it involves siphoning funds from a sure-bet current business, especially in a company that is run on short-term financial metrics.

Failure to Act. There is a tendency of mature and successful organizations to continue on their current trajectory due to organizational inertia. MIT Sloan professor Donald Sull states that organizational inertia stems from a company’s inability to change its routines, relationships, values and, most important, strategic frame—the set of assumptions that determine how managers view and think about their businesses.

The failure of Japanese companies to move sufficient production offshore despite opening foreign factories can be ascribed to such organizational inertia. Relationships and processes established with domestic vendors, as well as relationships with employees and local communities, stopped companies from downsizing Japanese factories, in spite of the writing on the wall. False beliefs, such as assuming that precision or quality manufacturing is impossible in foreign countries, only reinforced this inertia.

In extreme cases, companies end up actively reinforcing narratives that rationalize sticking to the status quo. This phenomenon is exacerbated by the ostrich effect—a bias against receiving or acknowledging information that can point to a contrary view of the future.

How to Avoid Such Failures?

Companies can take five actions to make sure they respond adequately to slow-moving change.

Visualize. Clear visualization of the future and quantitative exploration of options help dispel hyperbolic discounting.

AN ILLUSTRATION OF THE POWER OF VISUALIZATION

AN ILLUSTRATION OF THE POWER OF VISUALIZATION

A classic experiment in hyperbolic discounting asked participants to choose between receiving $50 today or $70 in a year. Scientists then ran another experiment with a more explicit articulation of the same choices: $50 today and $0 in a year or $0 today and $70 in a year. A significantly higher number of participants chose the delayed reward with the more explicit articulation. The fewest participants opted for the delayed options when they were asked to choose between $50 today or $70 at some unspecified later time.

It is important to visualize not only the future environment but also the potential response of competitors. Unicharm’s analysis rightly identified the impending growth slowdown in Japan and the consumption boom in other Asian markets. But the company also anticipated competition from global fast-moving consumer goods giants, which would eventually act on similar analyses. Assuming that these companies would focus on the largest markets, such as China and India, Unicharm decided initially to invest heavily in relatively smaller high-growth markets, such as Indonesia, Thailand, and Vietnam in order to attain market leadership.

Align incentives. Central to the success of any long-term strategy is leadership’s vision and commitment. Hence, it is critical for company leaders to have a stake in its long-term future. Takahisa Takahara, the son of Unicharm founder Keiichiro Takahara, joined the company in 1991 and held various management positions before becoming its president in 2001—a position that he still occupies today. His long history in the company and extended leadership tenure supported his visionary leadership style and allowed him to focus on finding the next source of long-term growth.

This long-term perspective is reinforced by the fact that Unicharm is a family company, albeit a public one. Our research shows that family companies tend to take a more prudent and long-term view, presumably because, for them, the force of market pressures is balanced by long-term incentives.

Create urgency. Slow changes are often treated as nonurgent, which exacerbates organizational inertia. Creating a sense of urgency is, therefore, a necessary antidote. In 1999, Jeff Bezos, the founder and CEO of Amazon, pulled 300 of the company’s employees into a room and announced that Amazon was dying. This was a surprise to the employees, who had just seen their company produce spectacular growth. Bezos had identified the digitization of goods and services as a slow change that would have a massive impact on the business in the coming decades, because he believed that books, music, and videos—the three major contributors to Amazon’s sales at the time—would be easily digitizable. Bezos created a sense of urgency to both digitize and rapidly diversify into other product categories. In the three core categories, Amazon became the disruptor itself, with the introduction a decade later of the Kindle ecosystem, Amazon prime music, and Amazon Prime Video. And diversification decreased the risk of this transition.

In addition to scenario planning, urgency toward slow changes can be triggered by two other sources: threat of action from competitors and shifting demands from customers. Unicharm’s urgent need to enter the markets in Indonesia, Thailand, and Vietnam was driven by the fear of losing out to global giants, such as P&G. The company’s focus on expanding in the adult incontinency market was driven by declining domestic demand for their baby and childcare products.

Exercises can be constructed to exploit these two sources of fear and to drive companies to take timely actions. A maverick scan involves evaluating the investments being made by venture funds and disruptors in your markets or in adjacent ones. In the exercise, you need to understand the essence of the bets made by these mavericks against your business model and the consequences for you if these bets are correct. This helps you understand the conditions for these bets to work and your best strategy in this scenario. While most maverick strategies are risky, an improved ability to predict when they can work helps you self-disrupt or build your defenses in a timely manner.

Another useful exercise is to understand customers in emerging niches who are not direct targets of your core offering. The purpose of this exercise is to form a strategy for a scenario in which this customer segment is the only one that you have to cater to. For instance, adult diapers were seen as a niche health care product catering to customers with severe incontinence issues. However, by understanding customers with minor incontinence issues, Unicharm was able to imagine, build, and dominate a new, attractive market segment. New signals from new, potential, or existing customers can help drive up urgency within an organization a lot more effectively than internal change advocates can.

Commit resources. Slow-moving changes are often well known. Most companies today have a climate action group. Most leadership teams are aware of growing markets for the elderly, the rise of AI, and greater health consciousness in society. Still, only a small proportion of companies have gone beyond token actions against these trends. A key reason underlying why many Japanese companies could not do what Unicharm did was their discomfort in shifting resources away from existing, successful businesses.

After declaring their intention to move into Asian markets, Unicharm was ready to dedicate the resources required to succeed. The company moved some of its top executives to lead foreign businesses. The head of sales, one of the top five leaders of the company, became the head of Chinese business, and the deputy head of sales led the Indonesian business. Unicharm invested heavily to acquire local companies to build a sales network and market share in new markets. The R&D resources of the company were focused on building low-cost products customized for each new foreign market. The manufacturing footprint was shifted to low-cost economies, and the supply chain headquarters was moved from Tokyo to Shanghai in order to support Asian markets. It is important to note that all of these investments came at the cost of reduced resource allocation to the Japanese market, which still contributed more than 85% of the company’s revenues in 2000. Since then, Unicharm has seen about 9% year-over-year revenue growth, with almost 75% of the growth contributed by foreign markets—which, in total, now account for 60% of Unicharm’s revenues.

Develop action bias. Companies that focus on heavily exploiting existing competitive advantages find it hard to change themselves. Companies that are biased toward experimentation and exploring new options tend to suffer less organizational inertia. The real reason why Amazon could respond to Jeff Bezos’s call for urgency is because the organization is perpetually in motion—a trait that Bezos has famously popularized as the “Day 1 mindset.” Whether through incremental changes (adding new product categories and automating warehouses, for example) or quantum leaps (adding new verticals, such as AWS and Kindle), the company is always changing—and thus has never fallen into the comfort zone of a fixed routine. As Bezos has said, “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.” Such vitality in companies is essential to deal with fast changes. It also improves their ability to implement strategy to combat slow changes.

In a rapidly changing, technology-fueled world, leaders need to become attuned to a faster pace of change. But they must also attend to the significant challenges and opportunities presented by slower change. They need to become multi-clock-speed organizations.