You know Amazon, Google, Apple, and Facebook. But what about Skywise, Otonomo, Flatiron, and Metromile? Companies in the former group are well known for their prowess at generating and harnessing vast amounts of data to target the right customers with the right products or offerings. But those in the latter camp—while less well known—have impressive track records of their own when it comes to extracting value from data. These companies have all built businesses that use data to create valuable new offerings.

Most of our research was conducted before the COVID-19 pandemic, which has disrupted the business of companies in almost every industry. Still, in the months and years ahead, digital technologies—a critical part of the societal response and ability to adapt—will become more vital and valuable than before. And companies that can build digital businesses, consequently, will be well positioned over the long term.

But if the ability to leverage data to create value is increasingly important, many companies still have a long way to go in that area. Certainly, many companies leverage data to improve their own operations —for instance, by enhancing offerings and boosting the efficiency of functions such as manufacturing and sales and marketing. But relatively few can harness that information to create entirely new data businesses, whether on their own or within a digital ecosystem . Our extensive analysis of nearly 150 businesses that aim to create value from new data offerings found fewer than 20 efforts that were outright hits. (See “In Search of Data Champions.”)

IN SEARCH OF DATA CHAMPIONS

IN SEARCH OF DATA CHAMPIONS

We cast a wide net in looking for data business pioneers. We studied 146 businesses in 11 industries that create external value from proprietary or aggregated data. These were all commercial entities, including divisions, projects, and new ventures, as well as startups. The ultimate buyer of the offerings varied, including the ecosystem partners themselves and unrelated third-party customers.

We had three criteria for success. First, the effort had to be creating value for customers in the form of data, insights, or a service. Second, the data could not simply be aggregated public information. Rather, it had to be differentiated, by including either proprietary data from the company itself or differentiated data from an ecosystem of providers. Third, the business had to have commercial traction as reflected in factors such as revenue, a robust customer base, or the receipt of significant external funding. Ultimately, just 18 of the businesses we analyzed checked all three boxes.

The reasons: Concerns about risk (including potential reputational damage related to privacy issues), technology hurdles, talent scarcity, and organizational challenges. At the same time, many executives are skeptical of the value creation opportunity in building a data business and, as a result, don’t prioritize it.

We set out to understand how companies can create that value, digging into the business models and strategies of companies on the leading edge in this area. Their efforts highlight the payoff that can come from effectively creating value from data—and reveal the factors that drive success.

Three Leading Data Business Archetypes

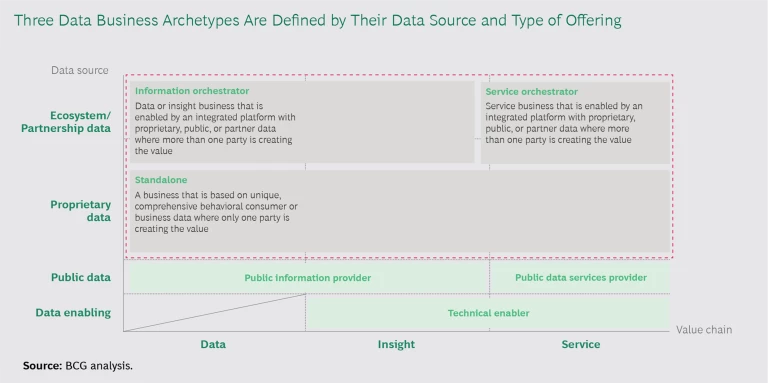

Data businesses are, of course, far from monolithic. It is instructive to assess them on the basis of two factors.

The first is the source of the data. Most frequently, the data comes from multiple players within either a partnership or an ecosystem and can be either proprietary to the group or publicly available. In other cases, the data is proprietary to one company.

The second factor is where in the data value chain the offering sits. The data can be sold outright, sometimes in raw form. In other cases, the business aggregates the data and extracts certain information to create and sell insights. In still other instances, the operation develops a new service that competes directly with a traditional service. A business might, for example, use its data to sell insurance products, competing with traditional insurers, rather than selling the underlying data and insights.

On the basis of these two factors, companies looking to start a data business can pursue one of several archetypes (see the exhibit):

- Standalone. This business offers insight or a service that is based on unique, comprehensive behavioral consumer or business data. One party—not a group of entities—develops and markets the offering. This includes companies such as Metromile and Uptake.

- Information Orchestrator. This type of business provides data or insight enabled by a platform. More than one party collaborates to develop the offering and shares in the value creation, in some cases by combining proprietary, public, and partner data. Companies in this category include Skywise, Otonomo, and Inrix.

- Service Orchestrator. Companies that follow this archetype offer a service enabled by a platform. Much like the information orchestrator, in this archetype more than one party shares in the value creation, potentially through a combination of proprietary, public, and partner data. This includes companies such as Clover Network and Kabbage.

- Public Information Provider. A business like this offers data or insights on the basis of publicly available data, with one party developing and marketing the offering. Companies such as Bloomberg and Statista fall into this category.

- Public Data Services Provider. Businesses in this category create and market a service that is based on publicly available data. Companies in this group include Moody’s and IHS Markit.

- Technical Enabler. This kind of business provides infrastructure and platforms to support all the other archetypes—but does not buy, sell, or create value from data directly. Companies such as Palantir Technologies, Cloudera, and MindSphere fall into this category.

Public information providers and public data services providers have been around for decades and are generally mature, lower-growth businesses. Consequently, in this article we focus on the three, more recent, archetypes. These businesses have gained momentum from the growth of IoT and machine data, as well as the use of the internet.

Uncovering the Secrets of Data Business Success

What drives success within these archetypes? We studied the 18 success stories identified in our research and found some striking commonalities. Certain success factors were observed across all the archetypes, while others were common specifically for information and service orchestrators.

Success Factors Across Archetypes

Regardless of the particulars of a data businesses operation, several critical factors drive success.

Establishing Data Leadership. It may seem obvious, but there is no substitute for high-quality, unique data. Businesses that have data leadership for a given use case can create exponentially greater value for customers in that application compared with businesses that offer more limited information. A company that can collect nearly real-time data on a customer’s location, pulse, blood pressure, and even the surrounding temperature and humidity, for example, has a significant edge over competitors that simply track customer location by the minute. The former can offer personalized in-the-moment offerings, while the latter can create much less targeted products. In addition, companies with a solid data advantage enjoy some protection from rivals that will struggle to replicate their offerings. This is particularly true for standalone businesses with a large or proprietary database.

One airline, for example, has a massive, proprietary database of travelers through its frequent-flyer program. The company has used that data, along with other information, to offer customized insurance products to those travelers. Policyholders receive points for buying, switching, and paying insurance premiums and for daily activities (like walking, exercise, and sleep) that are tracked by wearable devices. Points can be redeemed for purchases such as sports activities, products, and flights.

Targeting a Critical Customer Need. Companies building a data business shouldn’t focus on improvements at the margin. They need to identify the most critical challenges or opportunities facing customers or ecosystem partners and develop offerings that effectively address those issues.

The drug development process in the biopharmaceutical industry provides one such opportunity. With development becoming agile and faster paced, and the value of real-world data increasing, the area is ripe for innovative approaches. Flatiron Health, started as an independent company in 2012 and acquired by Roche as an independent affiliate in 2018, has taken aim at this opportunity. The company cleans, aggregates, deidentifies, and analyzes data from oncology clinics, academic centers, and other sources in the US and then offers insights and services to clinics, researchers, and biopharmaceutical companies. Those insights help accelerate drug development timelines—for instance, by helping companies better understand relationships between treatments and outcomes and identifying patient populations who could benefit from a given treatment in a clinical trial setting.

Building a Creative and Independent Culture. Winning data businesses have an innovative culture that supports the incubation of novel ideas and is effective at evaluating new opportunities. In addition, these businesses often give teams a high degree of autonomy to achieve product market fit. This can help the business avoid the all-too-common mistake of developing products that are based largely on the data the company wants to exploit rather than on what customers actually need.

Independent startups frequently cultivate this type of culture naturally. Kabbage, for example, an independent company started in 2009, analyzes the real-time data of small businesses, including bank accounts, UPS shipping data, accounting-software information, and more. That allows Kabbage to assess a company’s creditworthiness and make a lending decision in minutes. Kabbage now boasts a valuation of more than $1 billion and has extended loans totaling in excess of $8 billion.

Even within a larger company, data businesses can still create an innovative culture. Arity, a wholly owned subsidiary of The Allstate Corporation, aggregates and analyzes data from a variety of sources including mobile phones, onboard diagnostic devices, and sensors within vehicles. The company is connected to more than 20 million drivers and has collected over 225 billion miles of driving data since its creation in 2016. Leveraging that data, Arity provides insights that help customers not only understand the costs associated with risky driving, but how to manage and predict it. Arity’s customers include insurance companies such as Allstate and National General, shared-mobility companies, consumer mobile-app companies such as Life360, and auto manufacturers.

Tapping an Existing Customer Base. A company building a data business has a treasure trove in its existing customer base. Such companies can often cross-sell their new offering to existing customers. Although incumbents have an advantage in this way, startups can strike partnerships with other companies that give them access to an extensive customer base as well.

Metromile took the latter route to build its usage-based car insurance offering. Founded in 2011, the company had a partnership with Uber from 2015 to 2017 that gave Metromile access to the rideshare company’s millions of drivers. That alliance helped the startup gain traction in the market, selling policies that have generated an estimated $100 million in premiums to date.

Cultivating Loyalty Through Tools and Applications. Successful data businesses also understand how to foster customer loyalty. They often bundle the data offering with existing or new custom products, tools, and apps to create “stickiness.” The more products and services customers buy from the company, the less likely they are to switch to a competitor.

Metromile, for example, provides its customers with more than just insurance. The smart driving app used by customers not only gives the company valuable data, but provides feedback to drivers, such as how their speed varies on each trip and how much they spend on fuel. Drivers can use that information to optimize their commute, see where they are parked, be alerted to street sweeping (so that they can move their car in time to avoid a parking ticket), and receive a diagnosis of their car’s running condition.

Success Factors for Information and Service Orchestrators

The success factors outlined above are important for all players. But leading information and service ecosystem orchestrators tend to excel in several other areas as well.

Creating an Attractive Proposition for Potential Partners. Just as important as identifying the right value pool is offering a winning value proposition for each participant in the ecosystem. In some cases, for example, a data business can entice partners by giving them the opportunity to reduce their costs or to share in the profits generated by the ecosystem.

Consider Otonomo, a data services platform startup that aggregates, secures, normalizes, and enriches car-generated data for use by diverse services providers in the mobility ecosystem. The company creates value for OEMs, fleet owners, and third-party customers. OEMs and fleet owners provide data to Otonomo in return for a share of the revenue when the data is licensed to third-party customers. Those customers use Otonomo data to improve offerings such as insurance, smart city services, emergency services, parking apps, mapping, and media measurement. The company has publicly announced five commercial contracts with OEMs and car rental companies.

Selecting the Right Position in the Data Value Chain. Smart orchestrators understand the economics of the data value chain and set their strategy accordingly. In many industries, insights are a higher-margin offering than data, and services yield higher margins than both insights and data. But in some instances, that pattern doesn’t hold.

The business model of one logistics startup in China reflects the specifics of its industry. The company collects data through proprietary hardware embedded in fleet vehicles and provides that information to fleet owners so that they can monitor fuel usage, driver behavior, and theft and can optimize routes. The company had a couple of business model options: it could create a service offering that would have essentially put it in the logistics business, or it could provide the data and insights to logistics companies directly. Given the highly fragmented, low-margin nature of the logistics business, the startup opted for the latter—a more profitable place in the value chain. Today, the company’s hardware tracks hundreds of thousands of vehicles, and more than half of China’s large logistics companies leverage that data.

Breaking Down Silos. Data silos between participants in an ecosystem are a major impediment. The most successful orchestrators understand how to break down those silos, enhancing the quality and quantity of available data, improving the accuracy of algorithm insights, and ultimately opening up new value pools.

Kabbage, for example, maintains more than 2 million live data connections with a variety of banks, e-commerce sites, and other providers that serve potential borrowers. That allows the company to aggregate data so that it can accurately determine the risk of lending to small businesses and offer loans that traditional banks often see as too risky.

Leveraging the Company’s Position. Not every company has what it takes to become an effective ecosystem orchestrator. A company that is just one of hundreds of suppliers to a handful of large, powerful firms, for example, may struggle to carve out a meaningful orchestrator role. But those with a strong brand, access to a large customer base, a well-established platform for seamless customer journeys, and expertise across multiple customer channels have the best chance of success.

Airbus leveraged its central and trusted position as one of just two large passenger aircraft manufacturers when it launched the data platform Skywise with several airlines in 2017. Skywise harnesses data from numerous airline partners to help airlines manage their supply, fuel costs, and maintenance processes. Some 100 airlines with more than 9,000 aircraft now use the Skywise platform, as do more than ten major airline suppliers. Internally, hundreds of projects have been developed on the basis of the Skywise platform, with 15,000 Airbus users leveraging those projects to improve the company’s operational efficiency.

Creating Momentum

Building an innovative data business and creating the ecosystem to support it require a clear roadmap. Companies that want to jump-start their efforts should ask themselves a series of questions in three primary areas.

Value Creation

The first set of questions covers how data can be used to deliver value for ecosystem participants and end customers. Companies in all archetypes should ask:

- What are the biggest challenges facing customers and potential ecosystem players—and how can the data generated by the company or others help address those issues?

- Can the company articulate a clear business case for the offering?

- What are the economics of the target industry? And where exactly in the data value chain—data, insights, or services—should the new offering play?

- What analytics or additional data will be needed to maximize the impact for both customers and ecosystem participants?

Value Capture

With a clear understanding of the value creation opportunity, companies should ask a series of questions related to the business model they will adopt.

Questions for companies considering the standalone archetype include:

- Where in the value chain should the company play—data, insight, or service?

- Can the company go it alone, or does it need partnerships to deliver on its value proposition?

- What is the company’s competitive advantage? Is it, for example, in ownership of proprietary data, analytics leadership, or deep industry insight and expertise?

- What suite of data-based offerings and services will generate the best payoff for customers and create a barrier for copycat products?

Companies that will operate as information and service orchestrators should ask:

- Is the company suited to a central role in the ecosystem? Or will potential participants be concerned that the company orchestrating it stands to reap outsize benefits?

- How should the ecosystem be structured and what role should each participant play?

- Which partners are most valuable for the ecosystem and how should they be enticed to join?

- How will the value be shared among ecosystem participants?

Enablement

The final set of questions relates to the operating model, capabilities, and technology the company needs to execute. Questions for companies in all archetypes include:

- What should the operating model be? This topic will include a determination of which decision rights each partner has and whether the ecosystem should be open (anyone can sign up and become a participant) or closed (the orchestrator decides who can join).

- What organization structure—for example, a division within a large company versus an independent startup—will provide the resources required to build the business while still cultivating an innovative culture?

- What capabilities does the business have today—and which does it need to develop or bring in from the outside, either through hires or partners?

- What is the right technology platform and architecture to support a potentially rapidly scaling business? And is it preferable to build that technology internally or scale the required infrastructure quickly through partnerships?

Companies that think long and hard about each of these questions can create entirely new markets and build high-margin businesses. They might even have a thing or two to teach the Amazons and Googles of the world.