In light of this year’s world-changing events, US consumers are taking a fresh look at life insurance. For many, there is a heightened awareness of the value of protecting loved ones. And there is also a growing interest in the steps they can take to safeguard their own physical health. That interest was already evident before COVID-19 became a health crisis, but it is likely to become even more pronounced now.

This personal health push provides an opportunity for the life insurance industry. What if life insurers—typically focused on mortality—could “flip the frame” to disease prevention and longevity? What if they became partners in the effort to live the longest, healthiest life possible?

We began talking with executives about this idea early in 2020. With the growing availability of consumer health data and people’s increased reliance on digital sources of information, we thought there might be a chance for life insurers to step into a new role. Wellness, in our view, is a chance for life insurers to improve their performance by doing something good for their customers.

A Route to Increased Engagement

The business for which life insurance carriers are best known—financial protection—doesn’t provide much opportunity for interacting with customers. There just aren’t a lot of reasons for customers to contact their life insurance carriers over the course of a year. Life insurers typically don’t provide vital information to their customers on a regular basis or offer services to improve customers’ everyday lives. It’s more that the policies are there if they’re ever needed.

From a business perspective, this lack of ongoing engagement is problematic. It limits insurers’ ability to identify new ways of helping customers and to engender loyalty. Indeed, attrition is an increasing problem in life insurance. Approximately 57% of US adults carry a life insurance policy today, whether group or individual—down six percentage points from 2011. And only 34% of millennials own individual life insurance policies. That’s a very low number in a key customer cohort.

Wellness is a chance for life insurers to improve their performance by doing something good for their customers.

Life insurers know they will be more successful if they can provide easily accessible, high-value solutions that go beyond their traditional products. This explains why some are expanding beyond pure protection into other aspects of wellness. The biggest expansion to date has been in financial wellness—an emerging area of insurance that includes financial counseling, financial literacy tools, and retirement planning.

There is also an undeniable logic to life insurers expanding into physical wellness. Obviously, a long, physically healthy and financially successful life is what both end customers and life insurers want. The question is whether life insurers can credibly contribute to the pursuit of those goals.

The Elements of a Wellness Strategy Are Falling into Place

The window into physical wellness is opening in part because of the availability of personal health-related data. Examples of these new data sources include:

- Health Activity Data. This information is captured daily through fitness and diet-tracking apps and wearables. It provides continuous, real-time insights into people’s wellness—insights that can reinforce healthy habits.

- Medical Records. These contain data collected by doctors, labs, and hospitals. Congress, some big consumer technology companies, and the US public itself have been pushing to simplify access to this data, which is vital for the management of medical conditions.

- Genetic Tests. These include everything from 23andMe’s partial snapshots to whole-genome mapping. Genome data can provide a variety of insights, including an individual’s optimal diet, necessary medications, and disease risks.

Of course, the availability of all this data won’t be of much value unless people see insurers as potentially helping them to achieve better health. And, in fact, they do see insurers that way.

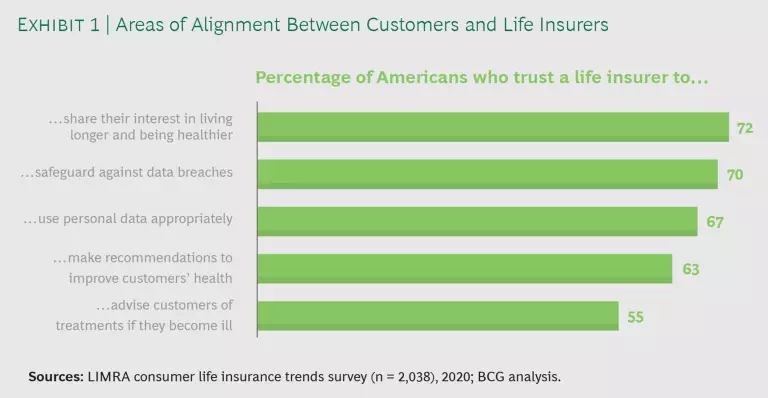

In a survey that BCG and the insurance association LIMRA conducted in February, most US consumers said they would trust the health and wellness suggestions made by life insurance carriers. (See Exhibit 1.) Clearly, life insurers and consumers have a shared interest—increased longevity. This creates an opening for a higher level of engagement through wellness and could allow carriers to form stronger relationships with their end customers.

What a Wellness Offering Might Look Like

It’s still very early for wellness-led innovation among life insurers. But some early examples hint at the potential. Consider Swiss Re’s partnership with the independent app developer Sharecare. Sharecare’s most popular product, RealAge, gives people a “fitness and wellness age” that they can compare with their chronological age. Around the world, 43 million people have completed RealAge assessments, learning (for example) that while their chronological age may be 55, their fitness age is 45—or vice versa. RealAge then provides tools and advice to help them improve their fitness.

This is exactly the kind of offering that could help a life insurer engage with customers and nudge them toward better health and wellness behaviors.

Another example is the AI-based lifestyle questionnaire that Sproutt, a digital life insurance broker, uses to generate longevity recommendations for users. The company provides incentives by offering discounted life insurance to healthier users.

Life insurance companies could even subsidize the cost of a Peloton exercise subscription service or provide an app to help people eat more healthily. It’s a matter of finding solutions to the quest for better health and longevity—which would also increase life insurers’ own success.

The Three Preconditions of a Wellness Strategy

There are three preconditions to unlocking value through wellness data: increased customer engagement, the development of wellness capabilities, and the mobilization of insurance distribution networks.

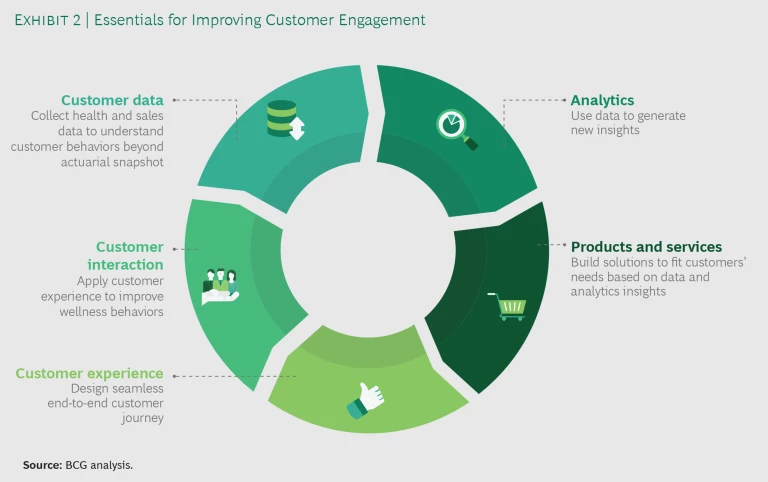

Customer Engagement. In order to create a product or service that their end customers will value, life insurers need to understand those customers better than they do today. This will require a greater focus on end-customer priorities. Exhibit 2 shows the elements of customer engagement. Insurers may start with any one of these activities, depending on their approach to wellness. The activities are mutually reinforcing, and insurers that are serious about the effort will eventually undertake all of them simultaneously.

Improving customer engagement won’t be easy. Today, most life insurers are focused on supporting the advisors who distribute their products—on optimizing those relationships. To this priority, they will have to add a new one: the customer experience. Life insurance carriers will need to provide their wellness offering in a way that adds value and that, as one insurance executive put it, is “seamless, so that it feels like no work at all” for the end customer.

Wellness Capabilities. As a brand-new area for life insurers, wellness will require some completely new capabilities—new processes, new tools, new skills, new talent. Conceivably, some of these capabilities can be built internally. But not all of them. In the area of talent, for example, it’s likely that life insurers will have to tap some outside resources to get the expertise they need in health, wellness, and digital engagement. Moreover, the carriers we’ve spoken with are keenly aware of the economic risks of a wellness play—including the upfront investment required, the uncertainty about end-customer acceptance, and the as-yet unproven business benefits.

In order to create a product or service that their end customers will value, life insurers need to understand those customers better than they do today.

Taking all this into account, life insurers may be better off partnering with a company that already has a wellness offering or the strong prospect of one. It could be a company in the health care or wellness industry. Or it could be a digital giant with expertise in the area of customer experience.

Mobilizing the Distribution Network. Life insurers that choose to pursue wellness should leverage their existing distribution networks. Their advisors and agents could use this product line extension both to secure new business and to limit the churn in their existing customer base. There are two main things that carriers must do to make advisors feel comfortable with a wellness offering:

- Keep the products simple. Advisors will be the ones receiving the calls (and the complaints) in the event that end customers are confused by the offering. In our conversations with advisors, they’ve made it clear that they would want to avoid the extra work created by such calls. Advisors also feel that a simple offering—simple to buy and with self-evident benefits—will have a better chance of being used and of being seen to add value to a carrier’s policies.

- Communicate and train. Advisors need to know what type of benefits are being marketed to their clients. Nothing could be worse for the advisor-carrier relationship than for the advisor to feel sidelined. “I wouldn’t want to be left in the dark,” one independent agent told us. “The more I’m aware, the better I’ll be able to use the solution as a tool.”

Not every life insurance advisor is going to feel comfortable making wellness a part of the sales pitch. Much depends on the business model. Advisors who have relatively few touchpoints with their clients—perhaps only once a year during an annual policy review—may not be the ideal conduit for these new services. That may likewise be the case with advisors focused exclusively on term insurance or reliant on heaped commissions, in which the majority of a commission is paid in the first year. In contrast, advisors who are more focused on retention and long-term client relationships are a better fit. They may be the ones to mobilize in a wellness push.

There is no question that the life insurance industry must evolve to meet changing customer needs. Purchases of core life insurance products have stagnated and life insurers have struggled to find new customers. But carriers still have giant customer bases and growth potential—if they can find the right next move and the way to make it. The aligned interests of carriers and customers with respect to wellness and longevity create an intriguing opportunity.

These are the key questions to think about:

- How can holistic wellness be integrated into carriers’ long-term strategies?

- How can carriers identify the most valuable offerings?

- What is the nature of the economic opportunity and how can it be captured?

- What capabilities must carriers add to develop the most promising extensions?

The journey will be different for every carrier—which is why it’s impossible to provide a map and milestones. We do think that customer engagement, the development of new capabilities, and the mobilization of distribution networks will be crucial to any life insurer that wants to consider this extension to its value proposition.

Staying healthy—physically, mentally, financially—was a preoccupation in the US even before the country was hit by the worst health and economic crisis in generations. People’s interest in taking care of themselves isn’t going to fade anytime soon. For life insurers looking to extend their value proposition to consumers, blending protection with health maximization and prevention may well be the right move at the right time.

This article is a summary version of a report published by LIMRA, which can be downloaded

here

.