Payments players are used to operating in an instant and real-time world, but few could have anticipated the crushing speed of the pandemic or its devastating toll. Amid the extraordinary dislocations, the payments industry demonstrated its adaptability, springing quickly to serve as a crisis response copartner for individuals and businesses, assist in distributing government stimulus payments, and help customers, merchants, and corporate clients transact in contactless ways.

Still, with economic life disrupted by social distancing and lockdowns, most payments businesses will see revenue growth dip in the near term—although the impacts will vary according to the value proposition, portfolio composition, and market position of individual players. Our modeling suggests that from 2019 to 2024 global payments revenues will likely increase by about 1% to 4%, depending on the speed of the economic recovery. Under a quick-rebound scenario, that growth range would be roughly half the rate of the prior five years. Once the recovery is underway, however, prospects in the medium term and beyond remain buoyant. Our forecasts suggest that payments revenues globally could soar to $1.8 trillion by 2024, from $1.5 trillion in 2019, lifted by the continued transition away from cash, sustained strong growth in e-commerce and electronic transactions, and greater innovation.

Once the economic recovery is underway, prospects in the medium term and beyond remain buoyant.

Incumbents will need to work harder to capture this growth, however. The payments space is becoming more crowded, with an expanding array of nontraditional players jostling with banks and payments service providers to become the issuer, provider, processor, or partner of choice. Shifts that were already happening before the pandemic will force established institutions to pick up the pace of digitization, gain economies of scale, and manage risk in new ways—all while continuing to innovate. The growth winners in the postcrisis period will be those that use this time before the recovery to reset and rebalance.

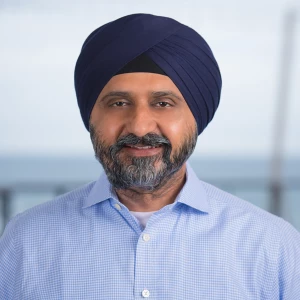

These are among the findings of BCG’s 18th annual analysis of payments businesses worldwide. Our coverage draws from BCG’s proprietary global payments model, using data from SWIFT, a global provider of secure financial messaging services. First, the report outlines recent developments in the payments market around the world and on a regional basis. The next chapters then explore how retail and wholesale payments providers can best respond to the disruptions caused by the pandemic and fast-forward to growth. Finally, in our concluding chapter, we note key challenges impacting the industry and five imperatives to win in the future.