The slideshow and accompanying text showcase findings from the ninth annual study by BCG and IRI of US growth leaders in the consumer packaged goods industry.

The COVID-19 pandemic has upended markets and dramatically reshaped consumption habits. Few industries remain unaffected by these profound changes. In 2020, consumer packaged goods (CPG) was no exception.

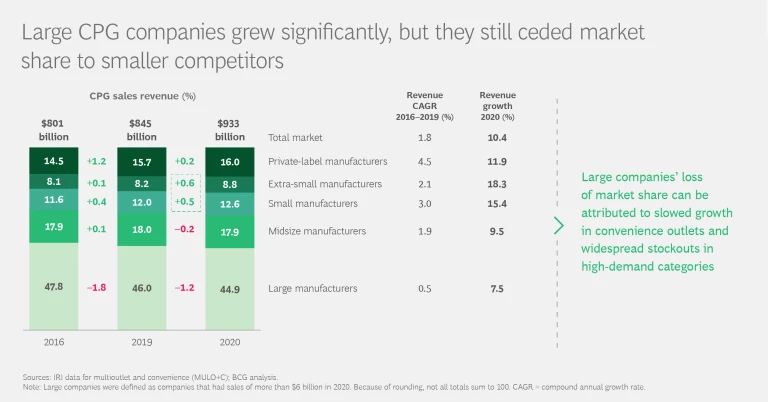

Following a modest 1.8% compound annual growth rate from 2016 through 2019, the industry grew last year by an impressive 10.4%. Large and midsize companies saw revenue gains of 7.5% and 9.5%, respectively. Small companies excelled with 15.4% growth, while extra-small companies fared even better, averaging an 18.3% revenue increase across the board. Private-label brands grew by 11.9%, and they gained market share, though at a lower rate than in years past.

Growth in 2020 was driven meaningfully by volume, which not only shot up by 6.4% industrywide but also overtook price/mix for the first time in more than ten years. (Price/mix is a metric that’s calculated using like-for-like pricing and product mix to determine a change in the absolute price.) Price/mix reached a decade-high annual gain of 3.7%.

Volume grew primarily because of elevated consumer demand during the pandemic, with the biggest spikes coming in March 2020, when shoppers rushed to the physical and digital aisles and prepared to face lockdowns.

Not all gains will be sustainable for the CPG industry, given that it will certainly face a postpandemic correction.

SOME NEW LEADERS EMERGE

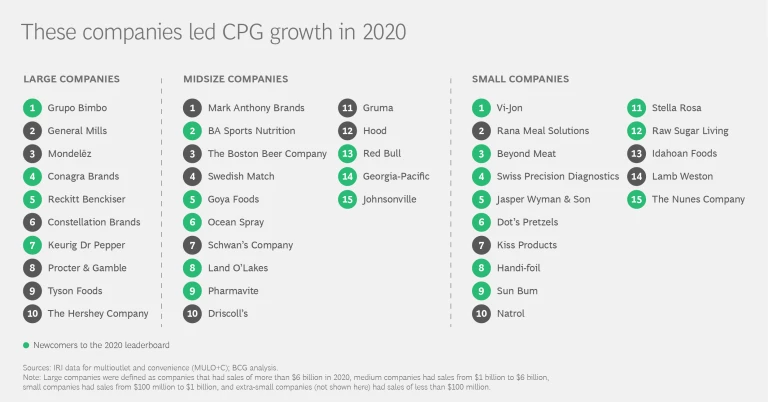

In 2019, our eighth annual study had no new entrants in the top-ten lists of small and midsize companies, and only one newcomer joined the list of large leaders.

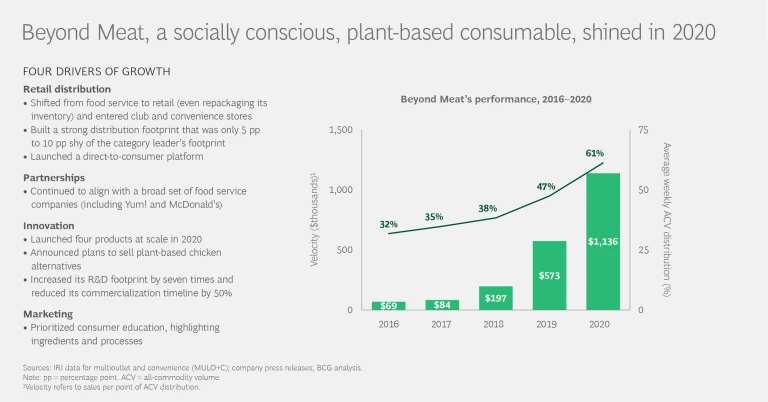

The 2020 study is a different story. While many large and midsize companies are returning leaders from recent years, 60% of the small leaderboard is made up of new entrants that could meet pandemic-specific demands.

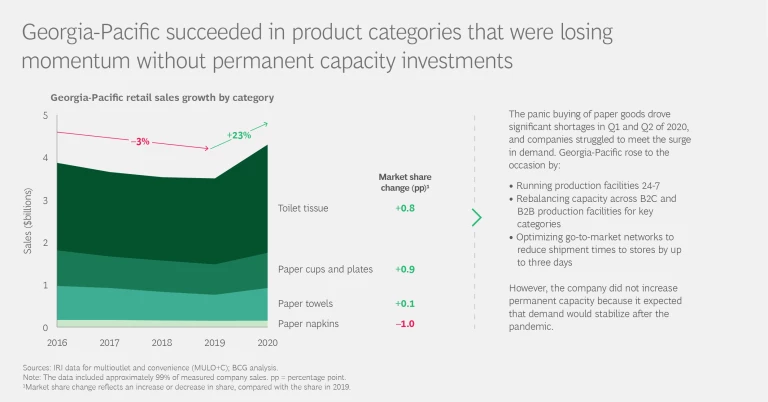

Grupo Bimbo topped this year’s list of large growth leaders, followed by General Mills, Mondelēz, and Conagra Brands. The most attractive categories were ready-to-consume foods (including bakery goods, frozen meals, and candy), cleaning materials, paper products, and home-care items.

Because of the increasing popularity of its White Claw brand, brewing giant Mark Anthony Brands held its position as the number-one growth leader among midsize companies. Alcohol, tobacco, and shelf-stable food and beverage options remained popular consumer choices, and they account for the more than 20% sales growth delivered by 14 of the top 15 midsize companies.

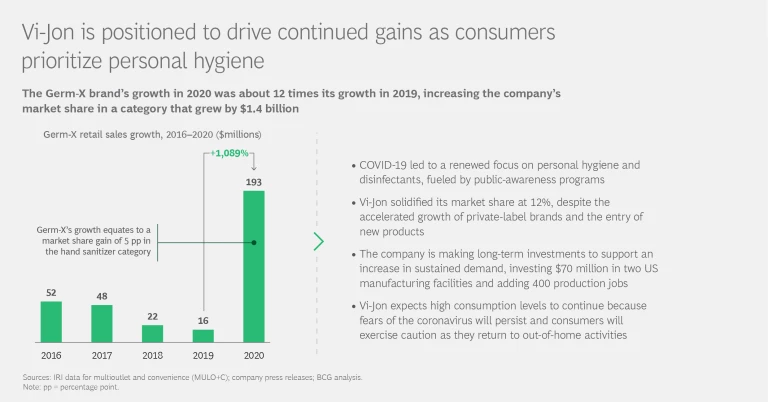

Vi-Jon is 2020’s fastest-growing small company—it experienced more than 450% year-over-year sales growth—thanks largely to its Germ-X hand sanitizer. Meanwhile, 6 of the top 15 small CPG companies more than doubled their revenues, fueled by pandemic-driven demand for easy-to-prepare and frozen foods, health products, and at-home cosmetics.

MAINTAINING MOMENTUM

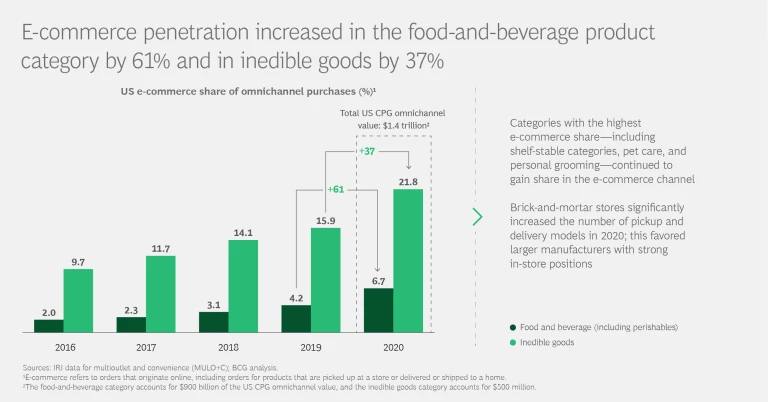

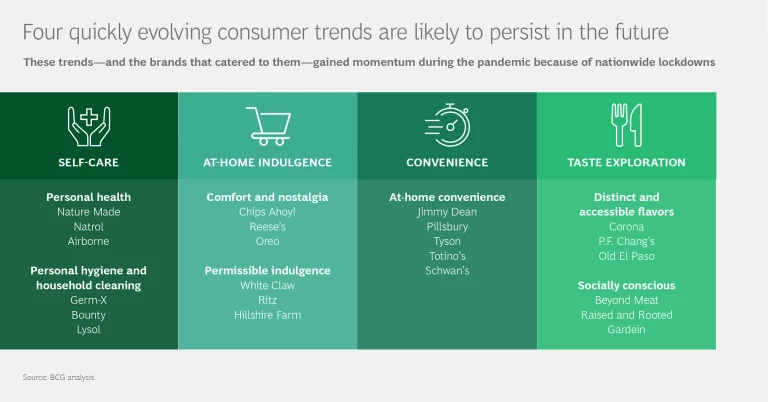

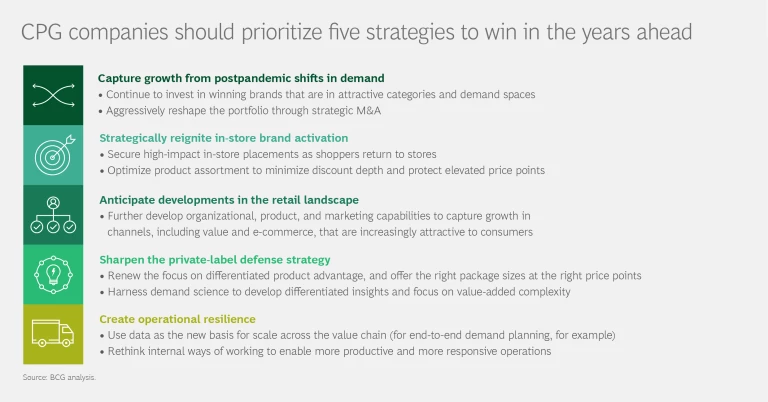

The pandemic bump may be coming to an end, but CPG companies must recognize that certain trends, including the move toward e-commerce and newly solidified consumer habits, are here to stay. As CPG companies look to lap last year’s strong performance, they should consider the following strategies to continue on a trajectory of growth in 2021 and beyond:

- Capture growth from postpandemic shifts in demand. Continue to invest in winning brands that are in attractive categories and demand spaces. At the same time, aggressively reshape the portfolio through strategic M&A.

- Strategically reignite in-store brand activation. As shoppers return to stores, secure high-impact in-store placements—but also optimize product assortment to minimize discount depth and protect elevated price points.

- Anticipate developments in the retail landscape. Evolve organizational, product, and marketing capabilities to capture growth in channels, such as value and e-commerce, that are increasingly attractive to consumers.

- Sharpen the private-label defense strategy. Renew the focus on differentiated product advantage, and offer the right package sizes at the right price points. Harness demand science to develop differentiated insights and focus on value-added complexity.

- Create operational resilience. Use data as the new basis for scale across the value chain (for end-to-end demand planning, for example). Rethink internal ways of working to enable more productive and more responsive operations.