What challenges does the future hold for a fast-evolving sector that has undergone decades of change in the past 18 months?

For the health care sector, COVID-19 delivered decades of change in a year and a half, highlighting the inertia that has been a significant barrier to widespread adoption of many available solutions. While many of the resulting changes were positive, the pandemic also laid bare the shortcomings of the health care infrastructure in many countries, revealed the tenuous state of health care staffing, underscored the disproportionately great health-related hurdles that patients from disadvantaged backgrounds face, and demonstrated the visible need for reliable, real-time data to spur fast action.

Many of the biggest changes are undoubtedly here to stay. Winners and losers across the sectors will be determined by how companies react to the shifts underway. Already, we see a divide opening in all four health care segments—providers, payers, biopharma, and medtech—between the players that are embracing the new reality and those that are trying to maintain or return to pre-pandemic business as usual. Those eager to adapt are experiencing a robust rebound in their core businesses and operations and discovering new opportunities to grow. Those holding out for a return to 2019 are enduring continued operational challenges and lower levels of productive activity. They are at risk of falling farther behind.

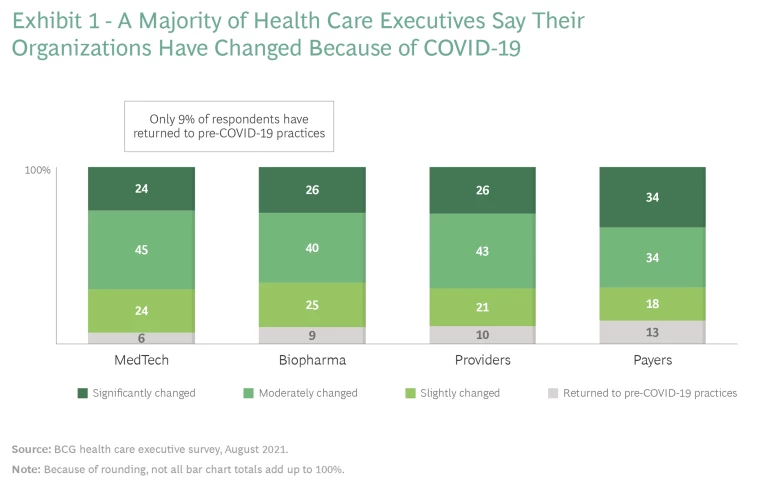

The new reality is not business as usual. Our latest research found that two-thirds or more of health care executives believe that their organization has significantly or moderately changed as a result of COVID-19. (See Exhibit 1.) Moreover, about three-quarters believe that the health care system (and their segment within it) will change more over the next three to five years. Here are five big challenges that successful organizations will need to tackle in this fast-evolving sector.

Digital Engagement Is Now Imperative

Digital engagement is here to stay. Consumers, doctors, and health care executives all say so. Although telehealth usage has fallen slightly from its peak in 2020, it remains 11 times higher than it was before the pandemic began. Two-thirds of providers believe that use of virtual consultations will accelerate over the next one to three years. More than 30% of providers say that patients’ use of digital and diagnostic tools is common now, compared with only 17% that held this view before the pandemic.

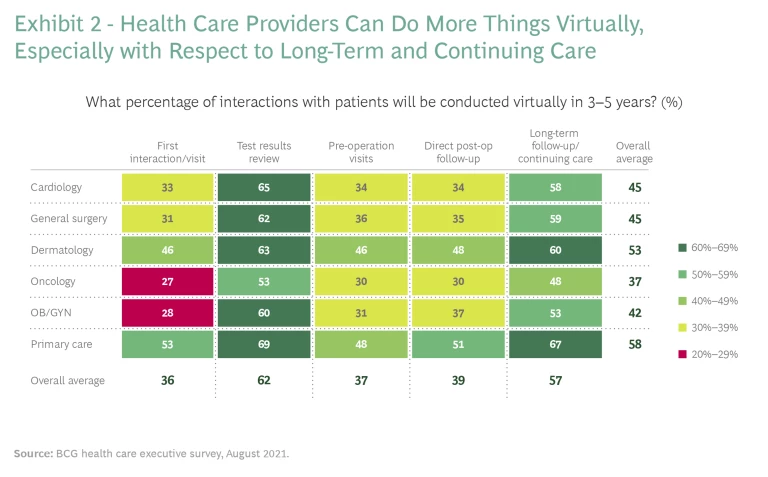

More and more care journeys today start with digital interaction as the front door—and for certain specialties and treatments, virtual engagement will be a common option at most or all points of care. For example, according to our research, many providers believe that up to 60% of patient interactions for primary care will be conducted virtually in three to five years. (See Exhibit 2.) Some specialties will continue to require physical interactions, but companies that do not have the ability to engage digitally will lose patients, customers, and partners.

Still, while the benefits are clear, managing these new forms of engagement is hard. Expanding digital delivery requires providers to do more than just invest in digital platforms and technical infrastructure: it also mandates that they fundamentally change their operating model. Enhanced patient access, more flexible and on-demand scheduling, new clinician working and compensation models, and the ability to maintain quality and outcomes in the virtual environment are just a few of the shifts that providers must contemplate.

Patients Want Care in Their Community and Home

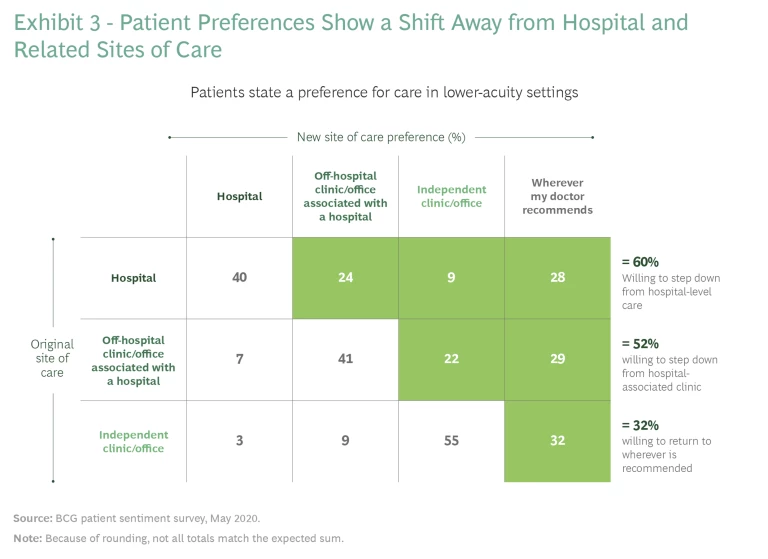

Patients are exhibiting a shift in preference away from hospitals and hospital-related sites of care. (See Exhibit 3.) Our most recent patient sentiment survey found that 60% of patients are willing to transition from hospital-level care, 52% are willing to transition from hospital-associated clinics, and 32% are willing to go to whatever site their physician recommends for care. Almost 30% of providers say that use of remote monitoring for patients is a common practice today, compared with only 12% who said it was common before the pandemic. Three-quarters of providers believe that use of remote monitoring will accelerate over the next two to three years.

Physicians, providers, and others must follow patients’ shifting preferences toward various care settings that are closer to home and community, the next frontier in care delivery. More than 40% of executives expect to see an increase in procedures performed in outpatient ambulatory settings, and more than 60% expect to see more care delivered in nonclinical settings (such as the home). We project that as much as of one-third of all hospital volume could move into ambulatory, home, and virtual-visit settings over the next ten years. Solutions are already expanding to cover more mobile patients and more points of care—including diagnostics, urgent care, primary care, specialty care, and post-acute care.

Further impetus for these shifts will come from policy momentum to maintain telehealth access and promote reimbursement parity. During the pandemic, the US Center of Medicare Services (CMS) increased the number of diagnosis codes eligible for telehealth reimbursement by 80%, and US private insurers eliminated co-pays for virtual care during the crisis. CMS recently added remote therapeutic monitoring codes to the 2022 Physician Fee Schedule, suggesting that the changes in reimbursement policy for digital health are likely to become permanent. Almost 30 states and the District of Columbia have passed parity laws for telemedicine.

That said, national and regional differences persist as legal, regulatory, and reimbursement frameworks have reached different stages of evolution around the world. The pace of telehealth adoption will probably be fastest in geographies such as the US, the UK, Australia, Denmark, Switzerland, and Spain, where digital consultations are an established part of the health systems. In contrast, data and privacy restrictions in markets such as Germany, Austria, France, and the Netherlands could hamper uptake in those countries.

As the delivery of care shifts, providers must create delivery ecosystems that integrate both digital and in-person modalities. Providing a cohesive care experience across the patient journey will require providers to partner more seamlessly with other stakeholders. One big must-do for providers is to determine the right number and level of partnerships to establish with pharma, medtech, and insurance players to provide a cohesive patient experience and deliver the best outcomes while maintaining competitive advantage.

As patient care takes place in more diverse venues and becomes increasingly virtual, biopharma and medtech companies need to understand implications of these changes for diagnosis, medication adherence, product design, R&D, and commercialization . In our most recent provider survey, three-quarters of physicians said that they would prefer to maintain or further increase the amount of virtual (versus face-to-face) engagements with pharma reps that they became accustomed to during the pandemic. They see virtual engagement with pharma companies as efficient and effective. Doctors are also looking for new models of cooperation with the pharma industry. Two of the four most effective communication channels for physicians are now virtual: training webinars and virtual speaker programs. Physicians continue to have high levels of interest in medical information and scientific data, and more are interested in learning how biopharma companies can support patient care with digital tools and engagement.

Medtech companies have an opportunity to define their strategies and their role in the patient journey more clearly, and then optimize their production and distribution accordingly. Like biopharma firms, medtech companies will need to invest in culture, training, and technology to support new multichannel sales and marketing models, since they will have fewer opportunities for in-person sales. Early adopters of omnichannel sales approaches in medtech have enjoyed strong results. The main focus in medtech continues to be on developing innovative and differentiated products, services, and solutions for a wider variety of care settings. Many subsectors are experiencing a continuing shift from hardware innovation to digital and software features and ecosystems (such as remote access), as well as to service offerings. Some companies are actively positioning themselves as partners of choice for other players in a multisite, omnichannel care delivery model.

Payers have a critical role to play as enablers and facilitators of the shift in care settings. They can also play a role in facilitating more home and community care settings. Many companies are accelerating their adoption of digital technologies and altering benefit designs in ways that offer preferential cost sharing for—or even mandate the use of—telehealth as a first step. Two-thirds of insurance executives believe that COVID-19 has had a positive effect on virtual and telephonic engagements, and nine of ten expect members’ digital engagement to increase over the next one to three years. More payers are partnering with other organizations to share data and enable improved mobile and cloud experiences. As many payers integrate themselves with the delivery system, they increasingly become direct facilitators of in-home, remote, and ambulatory services, often via the creation of virtual platforms and ecosystems to link patient journeys.

Science and Technology Accelerate

As the available therapeutic arsenal rapidly expands, players throughout the sector must adjust their practices to keep pace with the advances. New and advanced treatment technologies, such as RNA , CAR-T , and cell and gene therapy are gaining widespread traction. The successful development and delivery of two mRNA COVID-19 vaccines in less than a year will accelerate a wave of RNA innovation. We expect to see significant use of mRNA technology against other viruses, now that mRNA technology has been validated through the administration of hundreds of millions of doses. We also expect researchers to significantly accelerate the use of mRNA as a therapeutic modality in oncology and rare diseases and in other acute and chronic diseases.

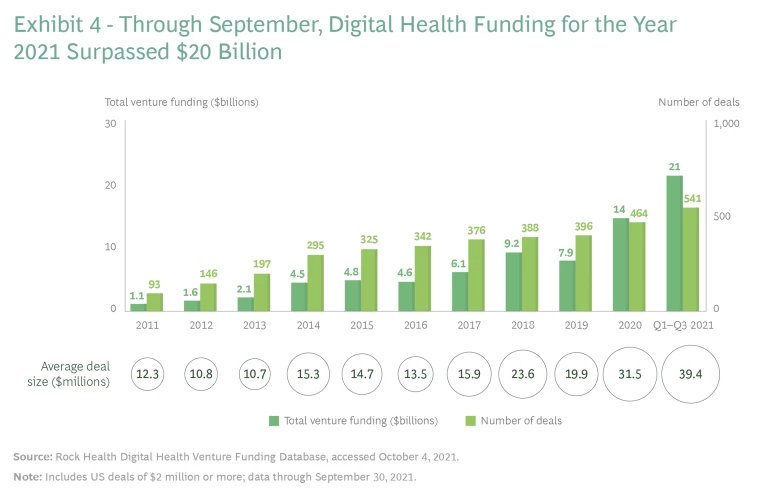

In recent years we have seen strong growth in the funding of digital ventures, and the emergence of COVID-19 led to a marked acceleration in such funding. Venture funding in health care surpassed $20 billion in September 2021, with three more months left in the year, and the average size of funding deals increased as well—to $39 million in 2021, a 147% jump from $15.9 million in 2017. (See Exhibit 4.)

As the speed of scientific innovation accelerates, everyone involved in the development, delivery, regulation, and reimbursement of care must become more agile. The pandemic represents an inflection point for the use of real-world evidence, both in R&D and in clinical trial design and deployment. One application garnering increased interest is the use of real-world evidence to serve as synthetic control arms (SCAs), dramatically changing the historical approach to clinical development testing. SCAs have the potential to reduce the number of patients required in traditional control arms, especially active-comparator or standard-of-care arms, thereby decreasing study costs, accelerating the speed to result, and boosting the overall attractiveness of clinical trial participation for prospective patients.

We also expect additional real-world data and evidence to deliver more informed engagement among providers and patients, payers, regulators, and pharmaceutical companies, yielding better outcomes at lower cost. Drivers include greater availability of real-world evidence, including data from electronic health records, social media platforms, and wearables; the availability of powerful computing tools and technologies to mine and analyze data in an iterative and self-improving fashion; and a growing number of partnerships and initiatives among regulators and private-sector players.

Winning the Battle for Talent

In the past year or two, a lot has changed in the ways people work and think about work. In response, organizations need to recast how they recruit, train, retain, and make themselves attractive to talent.

In a June 2021 survey by Future Forum of more than 10,000 knowledge workers from six countries, 21% of respondents said that they are likely to move to a new company in the next year, and 56% said that they are open to looking at new positions. Flexibility ranked second as a factor in job satisfaction, behind only compensation.

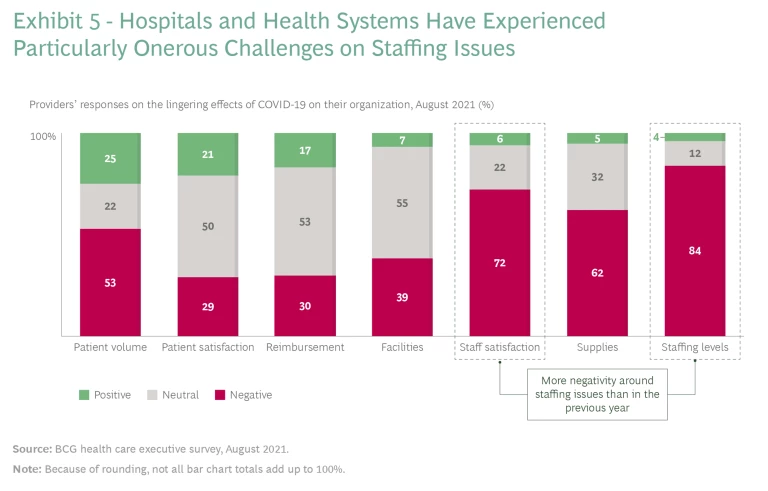

Hospitals and health systems have experienced particularly difficult staffing issues. Workforce challenges (such as burnout and labor cost inflation) are compounding the enormous burdens that providers face. Providers need to reimagine how care is delivered, make major digital investments, and address unrelenting pressures related to workforce affordability. Many of these issues were big concerns before COVID-19, and they are all the more acutely felt now. In our 2021 survey of health care executives, 72% of providers said that COVID-19 has had lingering negative effects on staff satisfaction, and 84% said that it has had lingering negative effects on staffing levels. (See Exhibit 5.) This isn’t just a management issue. Staffing can have measurable impact on care quality: in 2020, hospital-associated infections increased significantly, after declining steadily for years.

Digitization, more virtual care, and more varied care settings present staffing and organization challenges for pharma, medtech, and insurance companies, which must transition toward more bionic ways of working at time when talent—especially technical talent—is in short supply. The combination of a shifting skills mix, new ways of working, and new care delivery models for entirely new treatments will be a major test for most management teams and HR functions. For example, the design, manufacture, and delivery of cell therapies are likely to require advanced scientific and digital and analytics knowledge at every stage of the treatment chain. The right culture—one that breaks data silos, democratizes data, and centralizes its availability for use across the organization—is a prerequisite for success.

Aside from recruiting and training, part of the staffing solution lies in automating or eliminating low-value tasks (such as performing manual data entry or completing tasks that call for a lower-than-licensed level of skill) so that the available staff can focus on higher-value activities. Our research indicates that organizations in all segments should give due weight to the following principles as they rethink how they organize and do business:

- People can collaborate effectively from remote locations on an increasing number of activities.

- Even where remote work isn’t possible, organizations should intentionally integrate digital tools and supporting automation to restore employees’ “joy of work” and tighten their focus on value.

- It’s not all about working remotely: flexibility is important, too, as is in-person connection with others.

Prioritizing Health Equity

To achieve step-change improvements in health outcomes, organizations must put dollars and leadership energy toward health equity. The pandemic highlighted long-standing gaps in equitable access to health care. The COVID-19 death rate in the US among Black people is more than twice that of whites, and more than 85% of the difference is attributable to greater risk exposure and less access to testing.

These disparities present an additional threat: underserved populations may not be able to access and benefit from the new therapies. Addressing this challenge requires greater emphasis on the social determinants of health and the formulation of government policies to help protect vulnerable populations. As we wrote recently about digital therapeutics , companies need to rethink their approach to product development, from idea and design to realization and commercialization. Doing so means taking into account how members of various demographic groups might use a particular product in their daily lives and testing potential solutions with individuals who are currently living with disease.

In recent months, major companies, such as Walmart, Target, CVS/Caremark, and UnitedHealth Group, and government agencies, such as the US Department of Health and Human Services and CMS, have announced major investments in initiatives to reduce inequities in health care access. US News & World Report, which publishes an annual ranking of US hospitals, announced in June 2021 that in the face of widespread and persistent health disparities, it is developing a portfolio of health equity measures that it will publish along with its rankings. Digital health and technology-based efforts that leverage artificial intelligence and machine learning are avoiding past mistakes by embedding health equity thinking into algorithm design from the start. These are necessary steps, but there is much more to do.

Big Questions to Ponder

Taken together, it’s a lot for both clinicians and health care executives to digest. The five challenges that we have identified signal that the foundation of scientific discovery, the channels of care delivery, and the modes of patient engagement are undergoing radical change at the same time. And they are doing so in an environment in which making real improvements in equitable access and patient outcomes is imperative. Organizations that fail to adapt rapidly are at risk of becoming obsolete—sooner rather than later.

In deciding how to move forward, industry leaders need to ask themselves some big questions. Here are a few to consider:

- As scientific and technological innovations accelerate, what diagnostics and therapeutics that don’t exist today will become possible? What expensive or rare interventions will become commonplace? What will the patient journeys of the future look like?

- In increasingly crowded digital channels, how will organizations cut through the noise? What entities in the ecosystem will emerge as trusted voices? How can health equity be protected and advanced?

- What are the implications for hospitals and institutions of the shift in care into the home and community? How will the workforce adapt? How will patient-physician and patient-caregiver relationships evolve?

- As care sites, modalities, and channels proliferate, how will the health care system achieve integration and harmonization? Which organizations have the best opportunity to create new operating and talent models that will distinguish them from the rest?

The familiar adage that the more things change, the more they stay the same does not apply to health care. For the sector as a whole and for its individual segments, the changes are likely to be extensive, material, and permanent. The sooner companies in all segments begin planning for and implementing new operating, supply chain, and customer engagement models—with strong emphasis on digital interactions at all levels—the greater their advantage will be as the new reality takes hold.