Exactly how the world will reach net zero is unknown, but at a macro level the science and economics define a pretty clear path. Given the magnitude of value at stake during the transition, many leaders are concluding that inaction may be the riskiest strategy of all.

Over the long arc of history, humans don’t have a great track record of accurately predicting and preparing for massive change. An 1876 internal memo from telegraph leader Western Union concluded that the telephone would never be a serious threat. About two months before the Wright Brothers took flight in Kitty Hawk, the New York Times predicted that successful “flying machines” were 1 million to 10 million years away. Just before the modern disruptive changes driven by digital technology swept across the world, Ken Olson, the founder of minicomputer leader Digital Equipment Corporation, argued that there was no reason for any individual to have a home computer.

Could some of today’s business leaders—particularly in North America, but also in other geographies and nearly all industries—be setting themselves up for similar errors and regrets when it comes to climate? We argue “yes,” based on the simple calculus that, given the magnitude of value to be gained or lost, there need be only a moderate probability of a material acceleration toward a decarbonized economy for it to be strategically relevant to most companies’ value creation agendas.

Fortunately, although there is significant micro-level uncertainty about exactly how things will play out—for example, which specific technologies will win or lose in energy storage, electrification, or carbon capture—the path to successful decarbonization at the macro level is predictable. The laws of physics, chemistry, and economics determine it. For that reason, it’s possible for companies to create credible, scientifically consistent forecasts for most profit pools, which they can then use to inform their planning and decision making. In fact, capital markets are already doing just that, and building it into their valuations.

In contrast, playing a game of wait-and-see could easily backfire. Such a strategy might work in more stable competitive environments, but in unstable times, it gives forward-looking competitors more time to position themselves to win. Things may seem to be moving relatively slowly now, but there’s a good chance that the strategic environment around climate will shift, as Hemingway memorably described a character’s personal bankruptcy: “gradually, and then suddenly.” The recent acceleration of investor pressure on companies to give more weight to environmental, social, and governance (ESG) factors in general and to climate considerations in particular is just one example.

The time to act has come. This year’s Value Creators report offers companies context and recommendations for getting started. And although the focus is largely on North America, these perspectives have global relevance.

Momentum Is Building for a Low-Carbon World

Four interrelated forces are coming together to enable and compel action: technology, investor sentiment, regulation, and customer behavior. The data supporting this conclusion is extensive, but in the interest of brevity, we will note some examples that we consider particularly compelling.

Progress in Clean Tech. The recent rapid progress in clean tech isn’t the primary focus of this report, but it can’t be ignored. Several new, green technologies are already cost competitive with their traditional alternatives even without government incentives or a price on carbon emissions. For example, in the power generation sector, the levelized cost of both solar ($29 to $42 per megawatt-hour [MWh]) and wind ($26 to $54 per MWh) is often cheaper than that of gas ($44 to $73 per MWh), which in recent years has been the lowest-cost hydrocarbon option. And Bloomberg NEF estimates that about two-thirds of the global population now lives in a location where renewables are the cheapest source of new power generation.

Just as dramatically, the cost of a lithium-ion battery pack has fallen from more than $1,100 per kilowatt-hour (KWh) in 2010 to less than $150 per KWh in 2020, and is likely to drop below $75 per KWh by 2030. At a battery pack cost of around $100—a milestone forecast to be achieved before 2025—the estimated total cost of ownership for all electric vehicle models in the passenger segment will equal that for internal combustion vehicles in the US. Even in mature industries such as petrochemicals, modern steam crackers emit no more than half the carbon dioxide (CO2) that more dated assets do, with higher efficiency and a lower cost per ton.

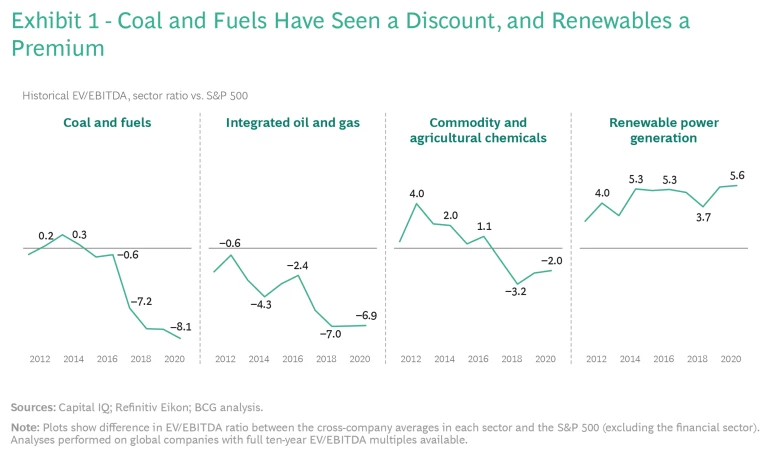

Investor Concerns. Investors, forever motivated by fear and greed, are already pricing climate risks into—and rewarding smart climate moves in—their valuations and behavior. There are many examples across a multitude of industries. In the energy sector, for instance, investors now value profit from coal at a materially different multiple than equivalent profit from renewables. (See Exhibit 1.)

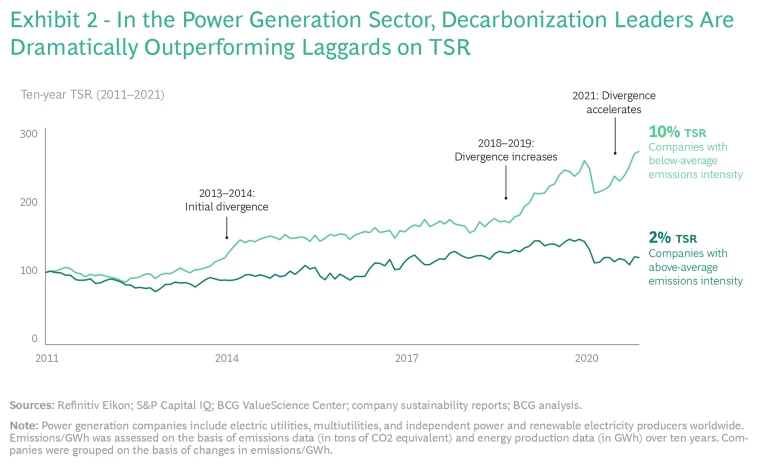

In 2014, we began to see a divergence between the total shareholder returns (TSRs) of companies in the power generation sector that had achieved below-average emissions intensity and those of their above-average rivals. In 2018, that gap began to widen significantly. (See Exhibit 2.)

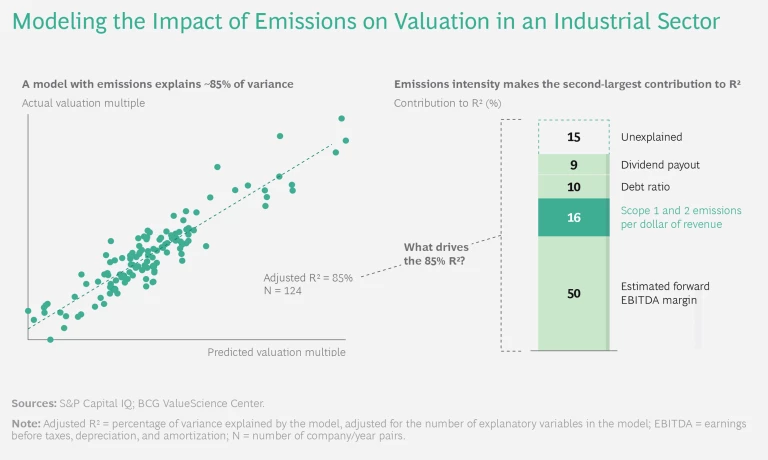

Recent BCG analysis in one industrial sector found a clear link between lower carbon intensity and higher valuations among a peer set of companies with comparable product portfolios but different carbon footprints. (See “Exploring the Relationship Between Carbon Intensity and Valuation.”)

Exploring the Relationship Between Carbon Intensity and Valuation

We found that less-carbon-intensive peers saw higher valuations, all else being equal, than their more-carbon-intensive rivals. (See the exhibit.) In fact, including carbon emissions as a nonfinancial variable improved the model’s predictive power, delivering an R2 of 85%. The carbon effect was statistically significant and increased over time, with the significance of the carbon emissions variable greater for the most recent five years than for the previous five.

The analysis effectively reveals the implicit dollar-per-ton-of-CO2e carbon cost that investors are figuring into the earnings stream. We interpret this carbon penalty as reflecting investors’ concerns about the downside risk to cash flows that is associated with a high-carbon footprint. The precise form of the downside may vary from possible increased expenses related to future regulations, to customer defections to lower-carbon alternatives, to stranded assets in a high-carbon business model.

This valuation effect suggests that incorporating carbon impact into internal resource allocation—including capital allocation choices, R&D project prioritization, and internal transfer pricing—can not only diminish carbon intensity, but also reduce enterprise risk and therefore improve valuation.

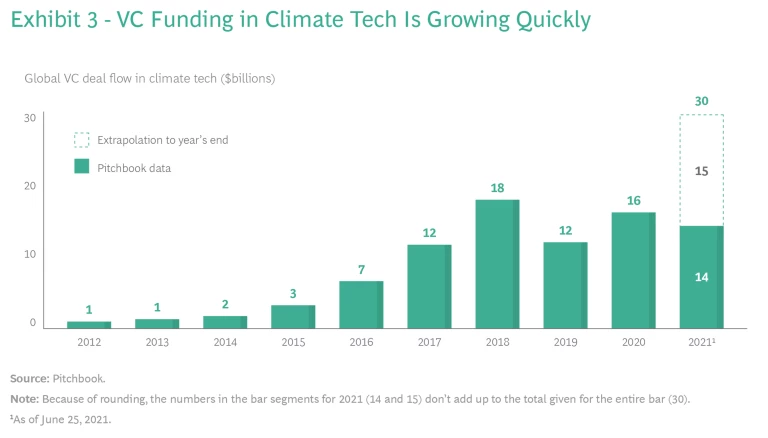

Venture capital firms have poured $86 billion into clean tech over the past ten years and are on track to invest $30 billion in the space in 2021 alone. (See Exhibit 3.) In Q2 of 2021, the average size of Series A deals was double that in the corresponding quarter of the prior year.

Already, 128 investors representing $43 trillion of assets under management—accounting for more than 40% of all assets under management and including BlackRock and State Street—have publicly committed to achieving net-zero emissions across their portfolios by 2050 and a 50% reduction by 2030. Climate activism is on the rise, too. For example, the May 2021 shareholder campaign against ExxonMobil resulted in the election of three new directors with a mandate to focus on climate risks, disclosure, and corporate action.

Pressure from Regulators. Momentum is building among regulators as well. We see myriad moves aimed at encouraging decarbonization either by pricing carbon (explicitly or implicitly) or by requiring greater carbon footprint disclosure. For example, EU members already participate in an emissions trading system, and the current carbon spot price within it is around €60 per ton of CO2. (All references to tons in the report are to metric tons.) Many experts believe that this number will have to rise if the world is to achieve net zero by 2050. To disincentivize offshoring by EU companies and to create a level playing field for European companies, given the EU emissions trading system, the EU plans to introduce a carbon border adjustment mechanism that will tax emissions-intensive materials traded into the EU. Any non-EU producer of an evolving set of products that currently includes iron, steel, cement, aluminum, fertilizer, and electricity will have to pay a price for the emissions linked to its EU sales, regardless of its home country’s regulations.

For its part, China has committed to reach peak emissions by 2030 and to achieve carbon neutrality by 2060. To facilitate the transition, it has instituted a carbon trading market. Meanwhile, global regulators, including the US Securities and Exchange Commission and the European Commission, via its proposed Corporate Sustainability Reporting Directive for companies, are working on mandatory disclosure standards for carbon footprints and material climate risks. Recognizing the risk posed by balkanization of disclosure regimes, many accounting firms and climate policy observers predict that a global standard will emerge, much as the International Financial Reporting Standard (IFRS) did. The IFRS Foundation is currently running a consultation process to set up an International Sustainability Standards Board, and convergence with other standards such as the Sustainability Accounting Standards Board and the Global Reporting Initiative is slowly advancing. As markets wait for regulators to provide clarity, private players (led by the California Public Employees’ Retirement System and global investment firm Carlyle), have come together to adopt their own voluntary—and streamlined—disclosure system.

Consumer Interest. Customer priorities and behavior are beginning to change as well, and suppliers are competing to satisfy them at both the B2C and B2B levels. Increasingly, consumers are demanding green products, with 46% of respondents in a Nielsen study saying that they were willing to forgo their preferred brand in favor of a more eco-friendly alternative. And BCG research finds that the price premiums required to support net-zero products are lower than many people imagine—on the order of 2% .

Since 2019, even without any requirement to disclose their carbon footprints, nearly 300 major global companies—including 17% of the Fortune 500—have pledged to achieve net zero by 2050. To get there, these companies are increasingly evaluating and selecting suppliers and distributors on the basis of their carbon intensity.

As is typical in the early phases of a major change, the momentum of each of these four forces is building independently. But in the real world, they don’t operate individually. Rather, technological progress, regulatory shifts, and investor pressure can change customer behavior, which in turn drives competitive moves that shift investor loyalties or embolden regulators, potentially bringing the system to a tipping point at which change rapidly accelerates. The pandemic response illustrates this kind of rapid, joint disruption, as technology, policy makers, investors, and consumers came together to support the fastest development of a vaccine that the world has ever seen.

The High-Level Path to a Decarbonized Economy Is More Predictable Than Uncertain

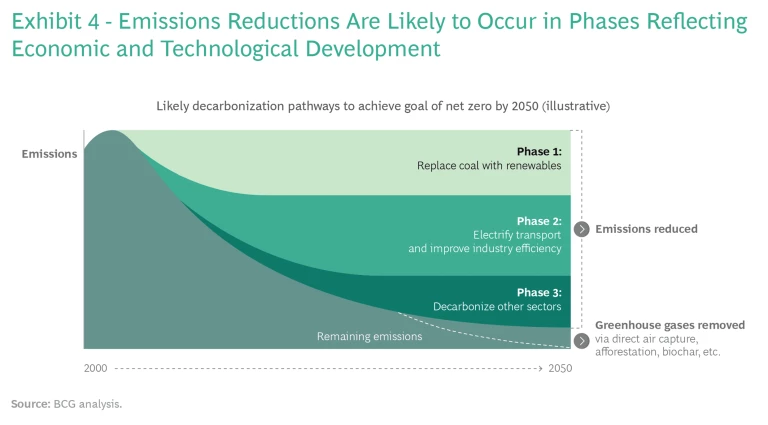

When planning for decarbonization , companies should avoid focusing too early on the long list of micro-uncertainties in the path ahead, as doing so risks derailing climate strategy. The big picture is both more important and more predictable than the individual pixels. It’s impossible to predict the exact timing of things, of course, but the sequence and rough orders of magnitude are pretty clear: physics, chemistry, and economics dictate the high-level path, and the degrees of freedom at the macro level are limited. The degree of difficulty—due either to the complexity of the problems or to the maturity of the critical technologies—defines three broad phases of emissions reduction. (See Exhibit 4.)

Replace coal with renewables. Setting aside the obvious step of investing in energy efficiency, physics and chemistry dictate that the first phase of the decarbonization process must be to replace coal with renewable power generation. The emissions reduction benefits of shifting from internal combustion engines to electric ones, for example, are essentially nullified if utilities burn coal to generate the electricity that powers electric vehicles. The transition from coal is already well underway in North America, driven by a combination of regulation, competition from lower-cost natural gas, and technological advances in renewables. After decades during which coal accounted for roughly half of the US generation mix, its market share today is less than 20%. This first phase of decarbonization is important not only for its climate impact, but also for its value as a cautionary tale. Despite a lot of rhetoric about “clean coal,” the economics never worked. From 2010 to 2020, driven by environmental pressures and cheaper alternatives, coal production dropped by 60%, and five of the ten largest-volume coal producers filed for bankruptcy. Too few coal companies recognized the risk early enough to pivot strategically. A BCG analysis of coal company earnings call transcripts between 2010 and 2020 estimates that more than 85% of diversification mentions during this period involved areas closer to the core, such as metallurgical coal and natural gas. Only 5% of diversification mentions went farther afield into areas such as lithium and copper. Other regions are moving away from coal more slowly than the US is. In Asia, where new coal plants are still being built today, the transition away from coal will take longer, and financial institutions are actively working to speed up the decommissioning process.

Electrify transport and improve industry efficiency. In the US, completely eliminating coal gets the economy only about a quarter of the way to net zero. The next phase of emissions reductions, which could account for another 30% to 40%, concentrates on displacing most oil and easy gas applications, principally by electrifying passenger transportation, decarbonizing building systems, and continuing to improve industrial energy efficiency. This phase, which has already begun, requires a lot of dispersed investments, mostly using existing technologies, along with a material change in the infrastructure of energy distribution. Technologies associated with this phase are maturing and coming down the cost curve rapidly. Some segments of electric passenger vehicles, for example, are forecast to have a lower total cost of ownership than gasoline-powered vehicles in select regions by 2022 or 2023 . Other technologies—such as electric heat pumps, distributed solar, and high-efficiency lighting—are already economical investments for many use cases and have the potential to help curb energy demand. Even without regulatory imposition of a price on carbon, many more-efficient technologies for industrial applications already have a positive ROI. With an appropriate price on carbon in place, the rest will follow suit.

In this phase, regulation, global trade schemes, and business model innovation all become increasingly important ways to tilt the incentives toward accelerated adoption. A carbon pricing scheme could obviously play a big role in this phase, but more targeted regulatory examples are already in play, including fleet efficiency standards for passenger vehicles and tax breaks for electric vehicles. Europe’s border adjustment tax offers an example of how to implement local carbon regulation without putting local producers at a competitive disadvantage. Business model innovation around financing continues to advance, but examples such as Tesla’s Solar City lease options for rooftop solar are a harbinger of what’s to come as the balance changes between upfront capital investments and lower-cost ongoing energy consumption across the economy.

Decarbonize other sectors. The final 30% to 40% of emitted carbon is the hardest to abate. Cement, steel, plastics, shipping, aviation, chemicals, and agriculture are among the biggest sources of these emissions. To get to net zero by 2050, the world needs R&D investments today that make sense economically and can scale up rapidly. To succeed in this undertaking, we must venture into uncharted waters and bet on human ingenuity. New technologies and approaches are necessary. A comprehensive discussion of technologies and their states of maturity is beyond the scope of this paper. But companies and investors—seeing both necessity and opportunity—are putting capital into possible solutions. Consumer goods companies are investing in new technologies to help them reach recycled content goals. And many venture capitalists, including Bill Gates’ Breakthrough Energy Ventures, see this phase as both existentially important and a potential source of massive wealth creation. For example, Breakthrough’s Catalyst Program aims to accelerate the commercial viability of critical emerging technologies—such as green hydrogen and sustainable aviation fuel—in hard-to-abate sectors. In the first half of 2021, according to Climate Tech VC, about half of VC money went into the mobility sector, followed by the consumer and energy sectors; however, the latter two sectors represent more than half of the deal count—not a surprise, given their smaller average investment sizes. In the face of these challenges, corporations that play “wait and see” run the risk of meeting the same fate as most coal companies.

A Few Simple First Steps

Although it’s easy to justify inaction on grounds of uncertainty, almost every company can take several simple and sensible first steps toward devising a value creation plan that embraces the opportunities, risk, and social responsibilities that a decarbonizing economy presents.

Assume that decarbonization will happen more quickly than you expect. Suspend disbelief for a moment, and play out the path to net zero outlined above. If we get to net zero by 2050, what must have happened? What role did regulators play in encouraging it? And how did your current business fare in that environment? Keep that scenario in mind as you evaluate various strategic alternatives.

Assume that your carbon footprint will be transparent to the world and priced at the social cost of carbon; then assess the competitive implications. How would different carbon price scenarios—say, $50, $70, or $100 per ton—applied directly to your internal operations (Scope 1 emissions), directly to your energy suppliers (Scope 2), and indirectly to your downstream and upstream value chain ecosystem (Scope 3) affect your competitive position relative to traditional and nontraditional rivals? How would they affect your customers’, investors’, and employees’ perceptions and pressure, your bottom line, and your portfolio strategy? Ensure that your price and volume forecasts in each scenario take into account the carbon price, and how much of it you can pass on to customers. And be sure to investigate—and model the impact of—how you can gain competitive advantage through climate-related differentiation.

Bucket the implications into three categories—operational, capital, and growth—and develop plans. Operationally, what are the major drivers of your Scope 1, 2, and 3 emissions? Which emissions are easiest to mitigate? Where might you achieve competitive advantage, and what would it cost? What thorny challenges may require working with suppliers, customers, and even rivals? In terms of capital, should you consider any portfolio moves (acquisitions and divestitures) to navigate shifting profit pools? Which units will need extra capital to achieve decarbonization? And where will you need to manage a declining business, treating legacy as legacy? With regard to growth, where can you make your own luck? Is there a chance to “sell shovels in a gold rush”? What new green offerings or businesses can you envision in areas where you have or could develop a right to win?

Build capabilities to monitor, experiment, and scale rapidly. A successful transition requires investments in people, processes, and capabilities. New talent with specialized skills or domain knowledge may be essential to envision and engineer the changes needed to win in a decarbonized world. Some of your moves will be no-regret, but many are likely to be conditional. It’s critical for your leadership team to be aligned on the overall vision and the specific developments that will trigger key actions. If such alignment is lacking up front, it will be impossible to move rapidly from pilot to scale when a critical opportunity arises. It’s also important to develop a sensing system to ensure access to timely intelligence on key triggers, so that you can make smart, careful bets that keep you in the game. In addition, you should embrace opportunities to exert influence and engage your wider ecosystem (investors, employees, governments, and communities) to accelerate the speed and scale needed to amplify climate impact. To stay on track, you must build climate—perhaps via an internal carbon-pricing mechanism—into your investment decision-making process. And you must set up an effective governance and performance management system with clear accountability, incentives, and data systems that provide ready and transparent access to all critical metrics.

The best course of action will depend on where you sit. If you operate a coal plant in a location where wind power is affordably available, you’re already in the endgame. If you distribute airline fuel—a category of energy for which alternatives are only starting to emerge—you have more time to plan and position your company, and you can chart its course to be part of the solution.

Even in the hardest-hit sectors, this approach can create competitive advantage relative to rivals. For example, coal companies that acted early—before the sector’s future was completely clear—were rewarded. Thus, Nacco Industries, the seventh-largest coal producer in North America in 2010, expanded its focus to various noncoal segments, including limestone in 1994 and lithium in 2019. In 2020, it registered the highest ten-year TSR among companies in the coal-producing segment.

None of this is easy, but leaders must play the hand they’re dealt. In the words of the great philosopher, Dean Koontz, “We are not born to wait. We are born to do.”

The authors would like to thank Jean-Marc Goguikian, Govinda Avasarala, Amy Hurwitz, Ryan Jones, and Jahnvi Vaidya for their help with the research—and Joseph Majkut of the Center for Strategic and International Studies for his thoughtful counsel.